The latest issue of ‘The Globe‘, Eurizon monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “The three ingredients of a virtuous scenario”.

Scenario

The decline of inflation accelerated in the US, while economic activity is still proving resilient. A combination that points to an end to the monetary restriction, albeit not in the immediate term.

In order to confirm the virtuous baseline scenario, investors will monitor three developments.

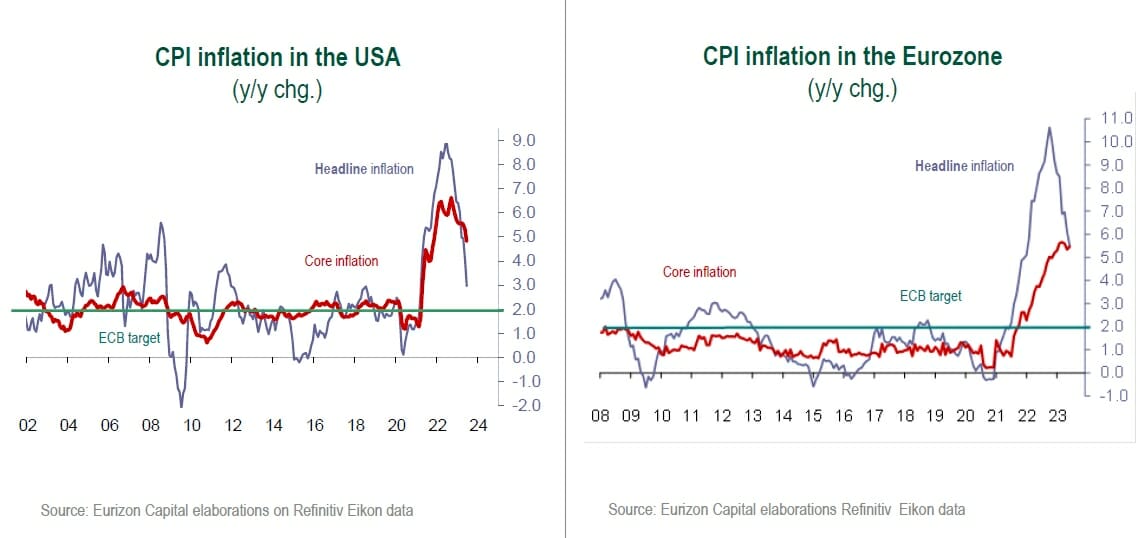

Inflation will have to be confirmed on the decline, especially for what concerns the core components, and disinflation, now evident in the US, will have to accelerate in the Eurozone.

The Central Banks will have to stop hiking rates, announcing the end of the inflation emergency. This will be likely in the autumn, for the Fed as well as for the ECB.

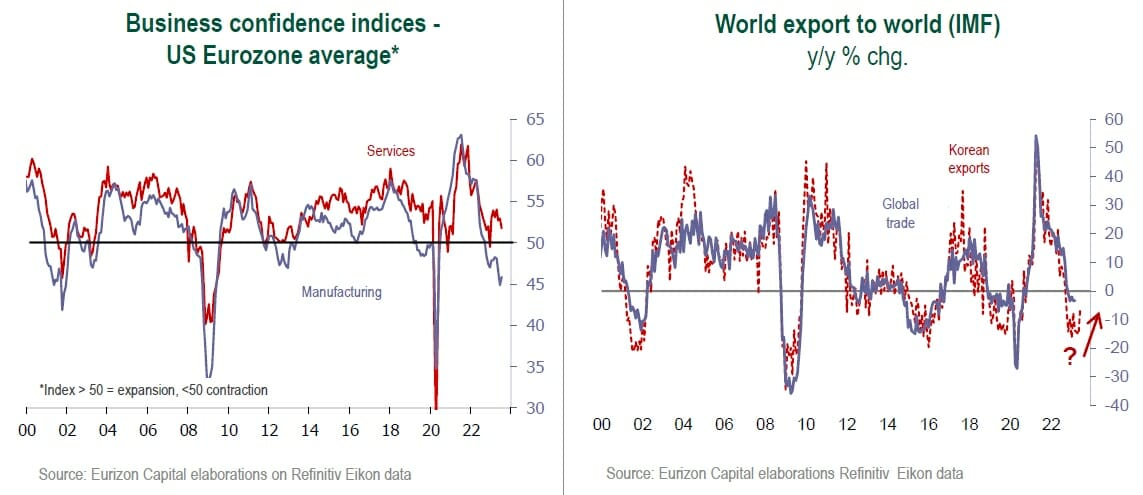

Lastly, economic activity will have to be confirmed in expansionary territory. The ideal development would be a stabilization of manufacturing activity, that has slowed sharply over the pasts few months, to balance the likely moderation of activity in the services sector, tied to still sustained domestic demand.

Among risk scenarios, the possibility of inflation flaring up again seems rather remote, whereas a sharper than expected slowdown of economic activity cannot be ruled out, as the full impact of the monetary restriction is yet to materialize.

The reacceleration of growth in China, where the impact of reopenings has been modest, was confirmed to be slower than expected.

Macro Economy

- The decline of inflation accelerated in the US, anticipating a moderation in the Eurozone as well, in a still positive phase for economic activity.

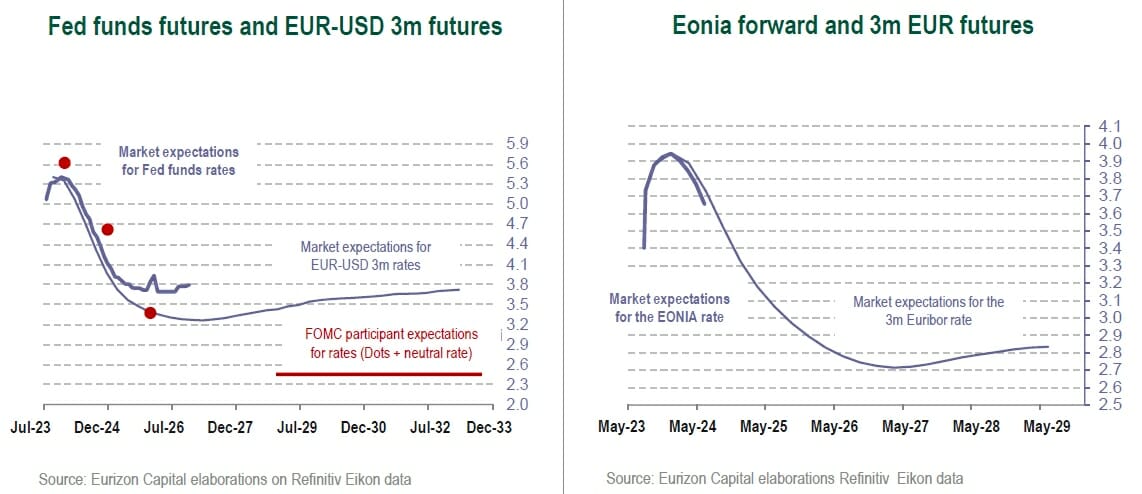

- The Fed and the ECB are not yet ready to announce the end of the rate hike cycle but could do so in the autumn. The market expects rates to drop in 2024.

Asset Allocation

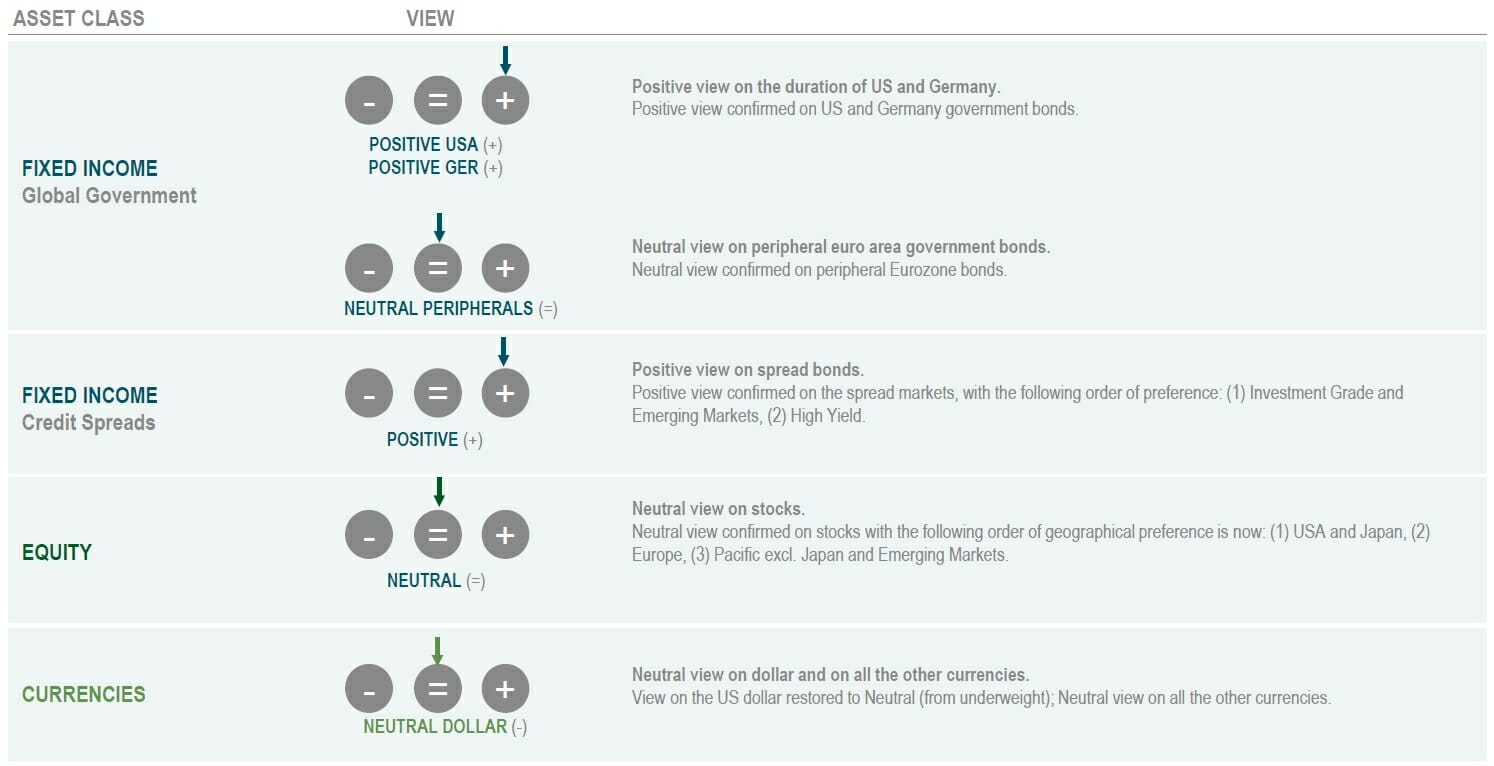

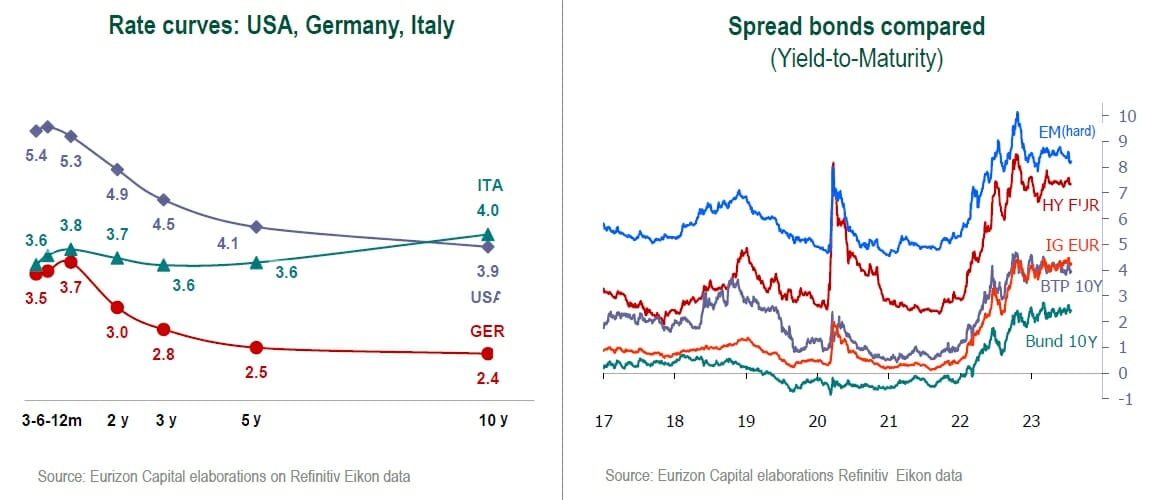

- The combination of high rates on the short-medium end of the curve, and expectations for the macro slowdown to continue afford appeal to core bond markets.

- Risk assets offer appealing valuations but could prove volatile in waiting for the Central Banks to complete their tightening action.

Fixed Income

- Overweighting view confirmed on US and German government bonds, that offer appealing yield-to-maturity and can offer protection in case of a macro slowdown.

- Among bond spreads, our preference still goes to Investment Grade and Emerging Market bonds, whereas our view on High Yield bonds and Italian government bonds remains Neutral.

Equity

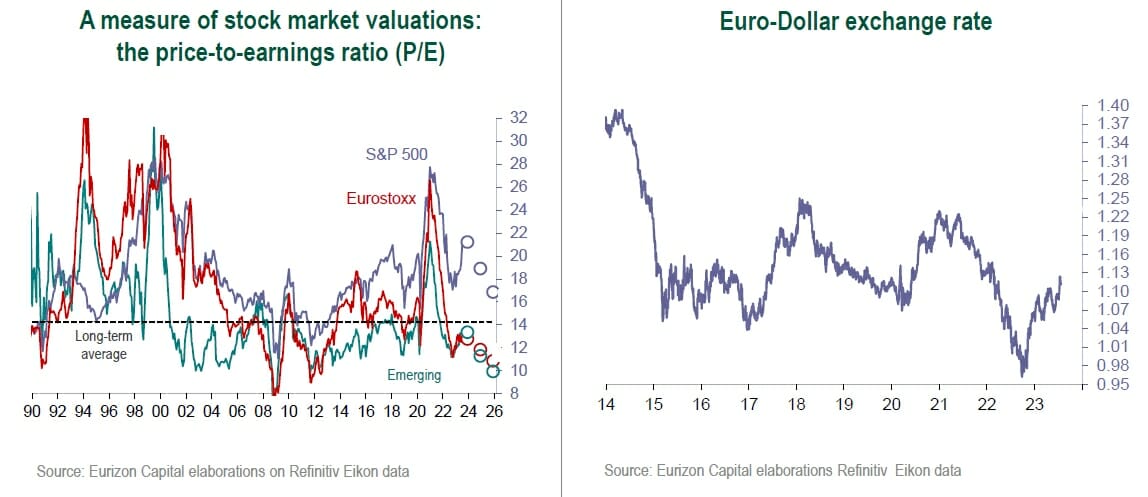

- Stock market valuations are historically appealing, but the completion of the monetary restriction and the risk of a macro slowdown may be a source of volatility.

- By geographical region, our relative preference goes to the USA and Japan.

Currencies

- After dropping swiftly in July, the dollar may put its downswing on hold in waiting to assess the Fed and ECB decisions; however, the medium-term trend leans towards a weaker dollar.

Investment View

The baseline combines inflation on the decline but still above target, and resilient economic despite the monetary restriction, due to which the Central Banks are in no rush to announce the end of the rate hike cycle. Positive view on US and German government bonds and on bond spreads, as opposed to a still Neutral view on stocks, that could prove volatile in waiting to assess the risk of a macro slowdown and the winding up of monetary restriction.

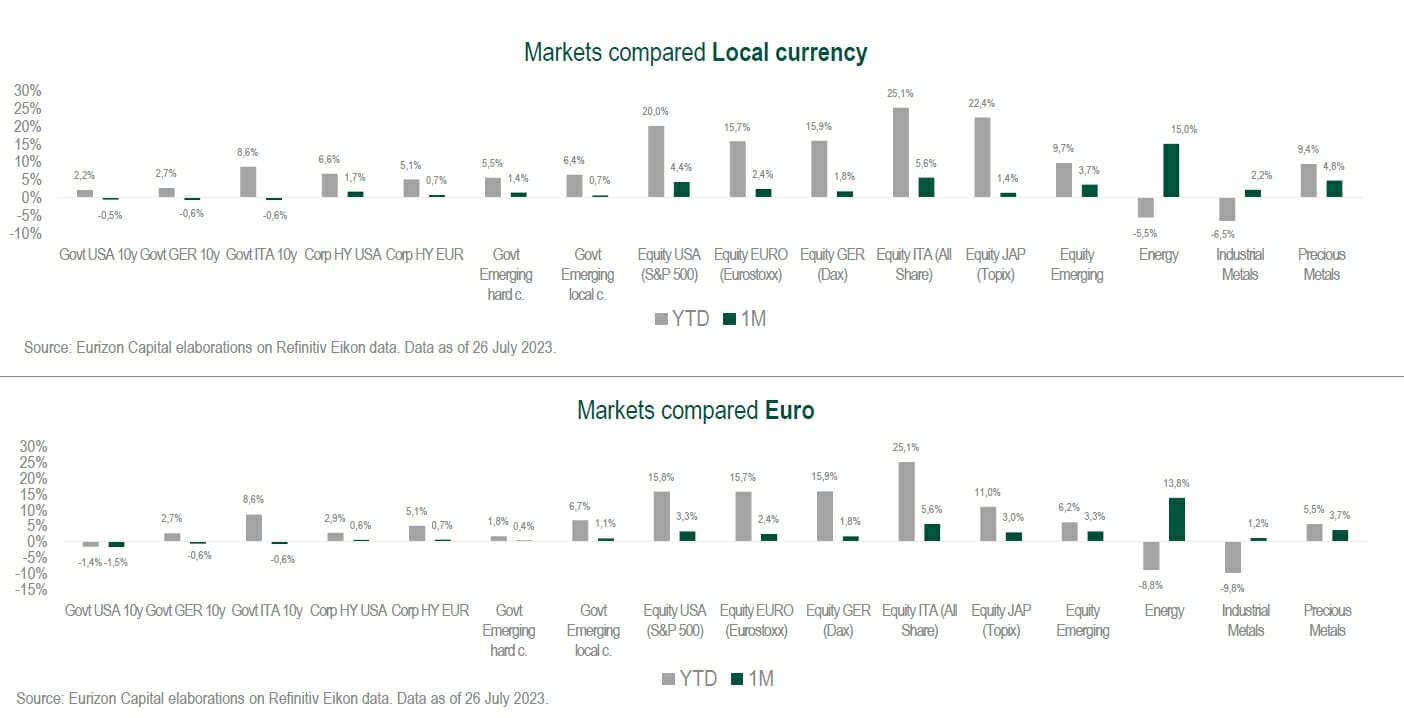

Asset Classes Compared

Government bond rates rose in the first half of July, marching March highs, but dropped following the release of US inflation data, that came in lower than expected. The US and German curves remain markedly inverted. Spreads were little changed in the Eurozone, but dropped in the corporate Investment Grade, High Yield, and Emerging market segments. The stock markets reported gains, led by the US index. Dollar on the decline to 1.12 against the euro.

Theme Of The Month: The Three Ingredients Of A Virtuous Scenario

In the first half of the year the markets embraced a virtuous scenario, namely a soft landing of the economy, following the inflationary post-Covid turbulences.

The “soft landing” scenario risks becoming trite due to excessive repetition. In essence, a virtuous scenario is the one in which the inflationary hot economy phase ends without giving way to the opposite turbulence, i.e. a recession (hard landing).

Events are evolving in this direction, although in order to embrace the “no hot economy –no hard landing” scenario there are three aspects to monitor.

First of all, inflation must complete its return to a low and stable level. In the US, where year-on-year headline inflation dropped to 3% in June, the process is well under way. Core inflation, at 4.8% y/y, is still high but is tracking the decline of the more energy-dependent items on the downside.

Most importantly, disinflation will have to accelerate in the Eurozone, where inflation is at 5.5% y/y, down from the peak marked in October (10.6%), but still too high in terms of the core component in particular, that is still not showing clear signals of reversing.

The second aspect to watch in the next few months concerns the Central Banks, that will have to declare the end of the inflation emergency, ending their rate hike cycles.

As regards the Fed, the markets expect it to pause after the July rate increase. However, it is also likely to keep its tones hawkish for some time, leaving the door open for potential new hikes in the event of the inflation downtrend slowing.

The market is pricing in one final 25 basis points ECB hike in the autumn, after which rates should stay stable. In this case as well, the ECB will be in no rush to announce the end of the restriction and will keep its options open to raise rates again if needed.

Understandably, in conditions of still positive economic growth, the Central Banks will not want to be too hasty in declaring the fight against inflation as won. Better to overshoot now than to risk adverse surprises at a later stage. However, the baseline scenario is an end to the monetary restriction phase in the autumn both in the US and in the Eurozone.

At that point, 2024 would be a year in which interest rates drop, within the context of a post-inflation normalization process.

The third aspect to monitor for a virtuous scenario, the most important and probably the most debated, is the resilience of economic activity.

Consensus forecasts at the beginning of the year pointed to 2023 as a macro slowdown year, without ruling out the risk of a recession. By contrast, economic activity surprised on the upside, despite the strong monetary restriction implemented by the Central Banks.

However, a hard landing of the economy as a delayed effect of the rate hikes remains the main risk scenario. To rule out this outcome, it will be essential for industrial activity to stabilize after slowing sharply over the past few months, in turn a consequence of the production excesses in the post-Covid boom.

At the same time, a moderation of activity is desirable in the services sector, in the form of weaker domestic demand, still too strong at present and responsible for the fact that the decline of inflation has been slow to date.

This ideal passing of the baton between the manufacturing and services sectors will be the main element to watch, and if successful may guarantee that the economic cycle continues at a sustainable pace, both in the USA and in the Eurozone.

In a context in which the hot economy of 2022 is overcome and a soft landing is achieved in the form of a sustainable pace of growth, nonetheless without ruling out the risk of a hard landing, interest rates hold appeal at current levels.

Fed fund rates at 5.0-5.5%, and EBC rates at 4.0-4.5% should be seen as emergency levels from which a post-inflation normalization phase will begin in 2024, with futures on rates currently pricing in targets of 3.0-3.5% in the US and 2.5-3.0% in the Eurozone in mid-2025.

Based on these expectations, current short-term and medium-term bond rates should be considered as an opportunity, with rates on the longer maturities offering excellent insurance against the risk of a sharper slowdown than expected (in which case rates would drop more rapidly than estimated at present).

Among corporate bonds, Investment Grades offer an appealing risk-return profile with high yield-to-maturity and spreads that are already pricing in a certain degree of economic slowdown. High Yield bonds are more at risk of volatility.

Emerging country bonds are appealing, as the local Central Banks have room to accommodate a potential slowdown of the economy.

The stock markets were the main beneficiaries of the soft-landing picture drawn to date by inflation and economic activity data.

Symmetrically compared to last year, the stock markets rose facing the headwind of slowing earnings on expectations for an extension of the economic cycle and the impending end of the rate hike cycle. As a result, absolute valuations (price-to-earnings ratio, P/E) seem less appealing now especially for the US stock market.

In a medium-term perspective, stock market valuations should not be considered as rich, and are still consistent with medium-term return in line with historical averages. Any hitch or delay affecting one of the three aspects described above (delays in the decline of inflation, still hawkish Central Banks, weakening macro data), however, could reignite volatility on markets that are pricing in a virtuous scenario.

The soft-landing scenario has affected the dollar negatively, both because the Fed will be the first to end its rate hike cycle, and because the clearing of uncertainty works against the demand for currencies perceived as safe havens. If the soft-landing scenario is confirmed, the dollar could drop further, although in the near term, after stopping just short of 1.13 against the euro, it could take a breather.