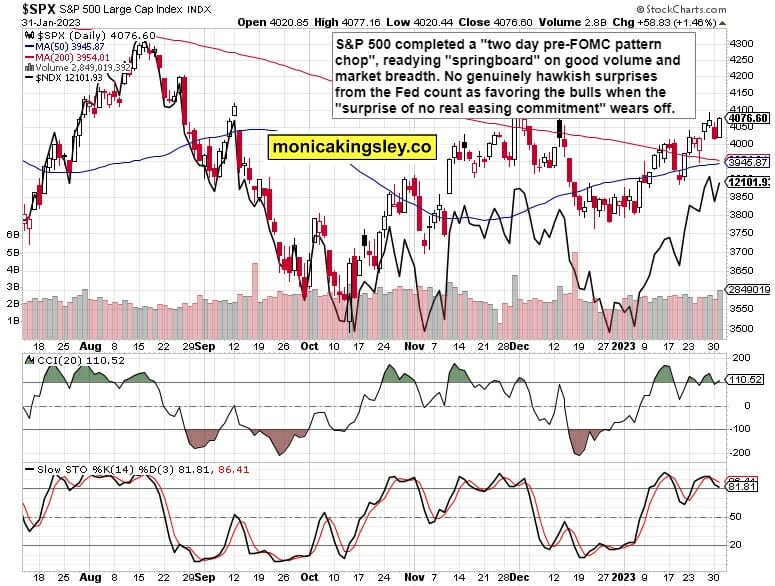

S&P 500 perfomed to the bulls‘ liking most definitely as is apparent from today‘s rich chart section. While I‘m looking for an eventual bullish resolution to today‘s FOMC, my medium-term view is of no smoothest sailing ahead for the bulls – still grinding higher, and also my daily intermarket observation confirms that.

Follow my Twitter feed for live coverage well before the Fed die is cast today!

Q4 2022 hedge fund letters, conferences and more

Reiterating that the "springboard" lives on, let me quote from yesterday‘s key analysis:

(…) Markets had been running on the best case scenario where nothing could go wrong – Fed pivoting, soft landing, inflation down, job market resilience, credit quality, consumer strong and earnings (with revenue, margins and guidance) not suffering. It isn‘t turning out that way, and will increasingly less turn out so.

In such an environment, tomorrow‘s FOMC merely not showing dovish face while reiterating prior positions, is to be perceived as hawkish even if it doesn‘t turn more hawkish than it was already.

This is what provides for all the "selling before the news" unfolding – a tad deeper than the "springboard" setup.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 has first 4,063, then higher rather than lower 4,040s a key support – likely to hold in the FOMC aftermath. See captions for detailed fundamental / narrative reaction outlook.

Credit Markets

Nice daily risk-on reversal in bonds – volume is leaning optimistic, and bonds don‘t look expecting a Fed curveball. The same for USD.

Crude Oil

Crude oil is relatively struggling, and my prior thoughts about this 2023 laggard being good enough just as part of a wider commodities long portfolio, remain true. $82.50 remains the key „point of control“ to beat, and then there‘s the tough $86 – 88 zone. Long road ahead.

Copper

Copper reversed nicely, but pay attention to the levels given in the chart. If the hawkish takeaway from FOMC prevails, real assets (high beta – think copper, silver) would be really hurt in the aftermath.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.