Should you buy the headline momentum?

With bank-failure hysteria upending nearly all assets except the PMs, silver has benefited from the fear. And while basic accounting highlights how these issues are about short-term liquidity and not long-term solvency, investors continue to ride the momentum.

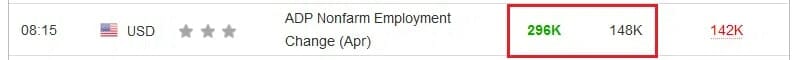

Yet, while the financial sector anxiety distracts the crowd from the Fed’s inflation problem, ignoring the issue won’t make it disappear. For example, ADP released its private payroll report on May 3. And while the data doesn’t correlate well with U.S. nonfarm payrolls (released today), the metric came in at 296,000, well above the consensus estimate of 148,000.

Please see below:

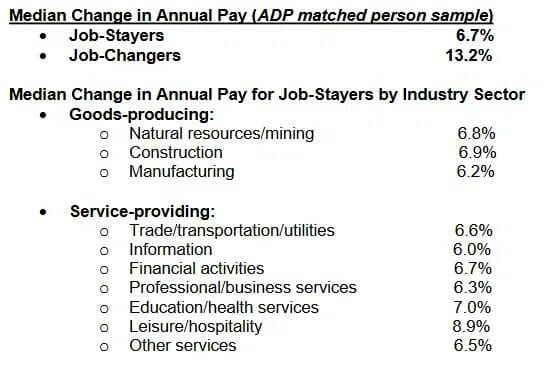

More importantly, the release highlights how wage inflation is far from a level that aligns with 2% output inflation.

Please see below:

To explain, the table above shows how the median change in annual pay for job-stayers and job-switchers was 6.7% and 13.2% in April. Moreover, every sector is still experiencing wage increases of 6% or more.

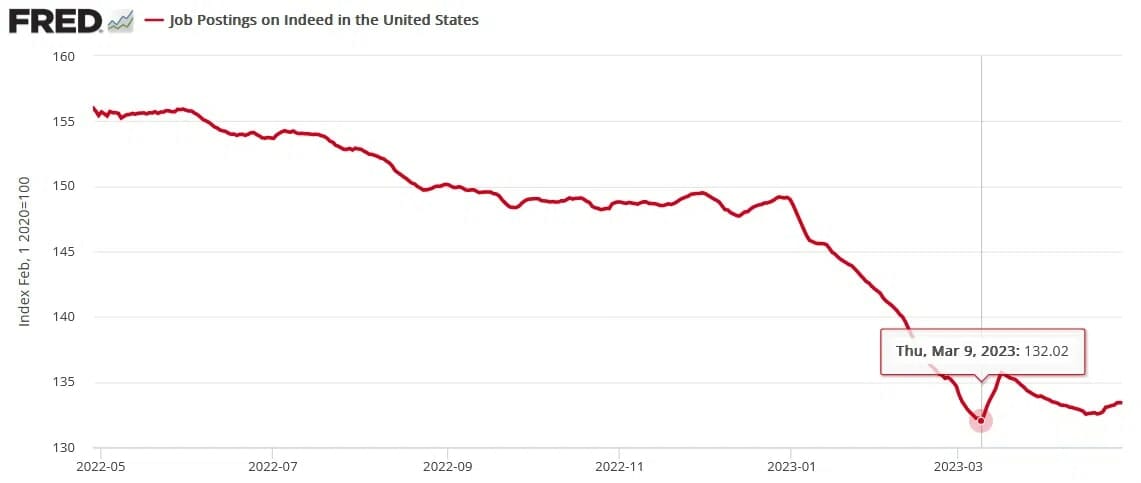

To that point, while the crowd frets over the bank uncertainty, job postings on Indeed increased last week (updated on May 2). Therefore, it’s another sign that demand is much stronger than the narrative suggests.

Please see below:

To explain, despite the material decline at the start of 2023, Indeed’s data bottomed on Mar. 9 and moved higher last week. And while the drop in JOLTS garnered plenty of media attention, the latter follows the former, highlighting why the crowds’ QE dreams are increasingly premature.

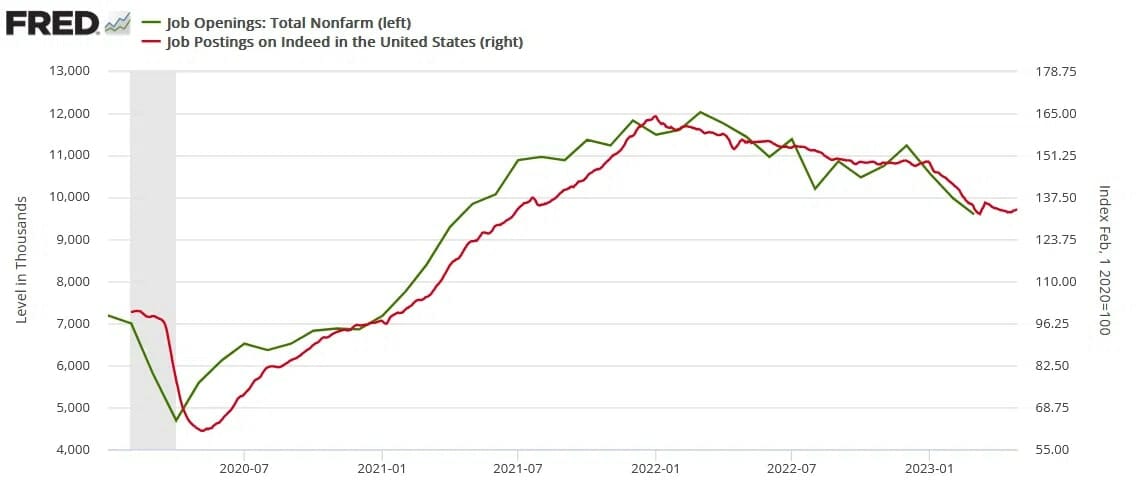

Please see below:

To explain, the green line above tracks JOLTS, while the red line above tracks Indeed’s job postings. If you analyze the relationship, you can see that JOLTS follows with a lag. But, with Indeed’s metric stabilizing and now rising, the JOLTS outlook is bullish in the months ahead.

In addition, job postings on Indeed are still 33.4% above their pre-pandemic trend, while JOLTS are still 37.1% above their pre-pandemic trend. Consequently, the crowd is submerged in wishful thinking, and silver has benefited from the sentiment shift. As such, when the fundamentals become fashionable again, the PMs’ bear markets should resume.

A Confidence Game

The Conference Board released its U.S. Consumer Confidence Index on Apr. 25. And while expectations remain weak, the current realities are much different.

Please see below:

To explain, the second bullet point shows that fewer respondents labeled business conditions “bad” in April versus March. More importantly, the third and fourth bullet points show that more respondents believe jobs are “plentiful,” while less believe jobs are “hard to get.” Therefore, the strength of the U.S. labor market signals more hawkish policy from a data-dependent Powell.

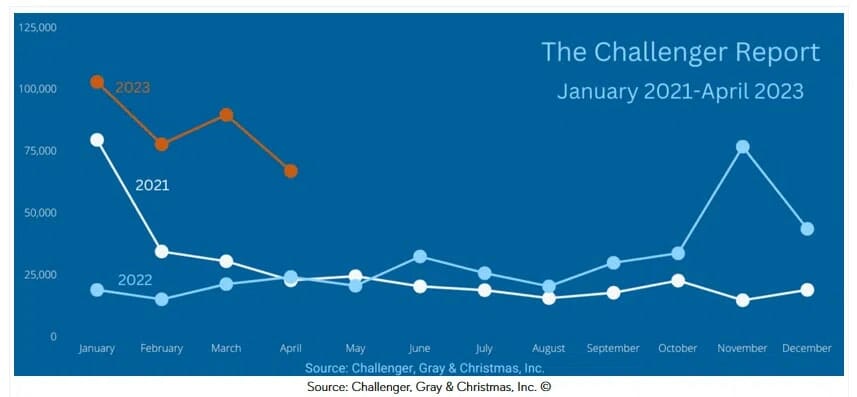

Furthermore, Challenger, Gray & Christmas released its job cuts report on May. 4. An excerpt read:

“U.S.-based employers announced 66,995 cuts in April, a 176% increase from the 24,286 cuts announced in April 2022. It fell 25% from the 89,703 cuts announced in March.”

Thus, while one would assume that a banking crisis would capsize employment, there were fewer layoffs in April than in March.

Please see below:

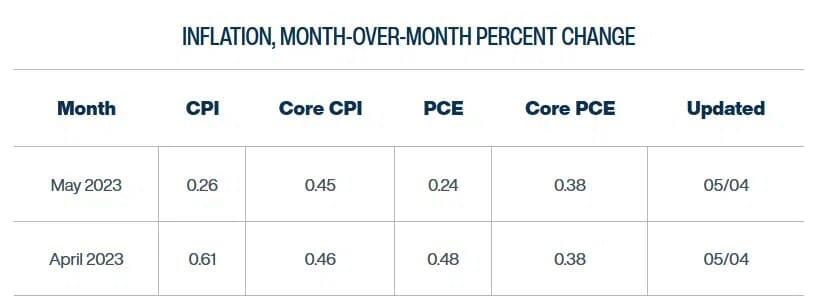

Finally, while base effects have reduced the year-over-year (YoY) headline Consumer Price Index (CPI), those benefits end in June. And with the Cleveland Fed still expecting hot core CPI prints, demand destruction awaits us.

Please see below:

To explain, the Cleveland Fed expects the headline CPI to come in at 0.61% and 0.26% month-over-month (MoM) in April and May. Now, while volatile commodity prices reduce the accuracy of its headline CPI projections, its core CPI estimates have been relatively precise.

Therefore, with 0.46% and 0.45% MoM expected in April and May, a continuation will make the YoY numbers look troublesome when the base effects end in June.

Overall, while the regional bank and debt ceiling drama uplift the PMs, these are short-term phenomena that don’t impact the economic cycle. In reality, persistent inflation will force the Fed’s hand, just like it did in 2021/2022. And if Powell relents, he will foster the worst-case economic scenario — a repeat of the 1970s. As a result, while gold, silver and mining stocks assume a new bull market has begun, the fundamentals signal the exact opposite.

Overall, the crowd remains immensely confident, which is a positive sign, not a negative one. When the permabulls count their chickens before they hatch, we’re often near an inflection point. Consequently, we believe more pain will confront the PMs, as the risk-reward is heavily skewed to the downside.

Do you think the data supports rate cuts and/or QE?

Alex Demolitor

Precious Metals Strategist