You can always use some professional tax tips when it comes to saving taxes. Some financial decisions, like filing your income tax, should be diplomatic indeed. With effective tax planning, you can save significantly in the current and upcoming fiscal years. Moreover, strategic planning maximizes disposable funds at retirement.

Other benefits of meticulous tax planning include reduced cost of funding education for your children and mitigating real estate taxes. Ultimately, we all love cherishing a better cash flow to fulfill our financial goals. This explains why professional tax planning turns out to be the cornerstone of finance management.

Q1 2023 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

New laws and updates to file returns in 2023

Several legislative changes have transformed the tax paradigm in the US in the last few years. Some of these include:

- The CARES Act

- The Consolidated Appropriations Act

- The American Rescue Plan Act

- The Inflation Reduction Act

- The SECURE Act

Drawing insights from these changes, we have updated the latest tax tips below for your convenience.

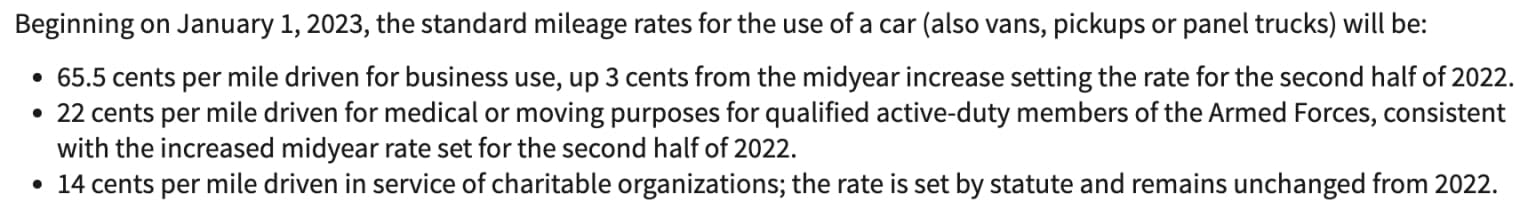

1. Changes in the standard business mileage rate

The standard business mileage rate has been changed with the new rate in place since January 1. The revised rate, at 65.5 cents per mile, is higher than the second half of 2022 by 3 cents. If you remember, the rate underwent another 4-cent increment in the first half of last year. This rate is applicable even to electric and hybrid cars.

2. Child tax credit

Back in 2022, the government reduced the dependent care tax credit and child tax credit. The American Rescue Plan (2021) temporarily boosted both these tax credits. However, the modified tax breaks are no longer valid in 2023.

In 2021, the enhanced credit for child tax implied that individuals with kids aged between 6 years and 17 years would be entitled to get a tax credit. The maximum amount would be $3,000. The amount was even higher for children aged below six years, at $3,600. In 2022, the authorities reduced this amount to just $2,000 for a dependent child aged under 16.

3. Earned Income Tax Credit

There have been some changes in the Earned Income Tax Credit starting in 2021, which will also be applicable in 2023. A greater number of working families and workers having investment income can benefit from the credit. Based on the number of kids in your family and the filing status, it ranges from $600 to $7,430 in the 2023 tax year. The investment income limit has also been increased from $10,300 in 2022 to $11,000 in 2023.

4. The Clean Vehicles Credit

Under the Internal Revenue Code Section 30D, the tax authorities have enhanced the Clean Vehicles Credit to $7,500. If you have purchased electric vehicles after 16th August 2022, make sure that the final assembly takes place in the US. Besides, you need to adhere to further restrictions for vehicles purchased in 2023.

Tax tips in 2023 to make maximum savings

Looking to get your tax planning right for 2023? Here are some professional tax tips that’ll ensure you won’t have to shell out more than what you absolutely need to.

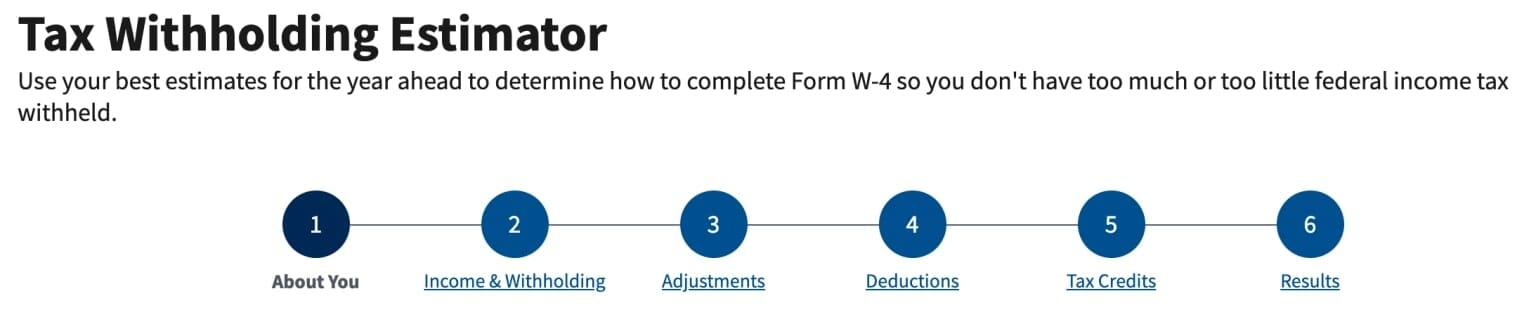

1. Check tax withholding issues

The ‘pay as you go’ income tax model in the US prompts your recruiter to withhold funds while processing your paycheck. Freelancers need to fork out the taxes on a quarterly basis. You might face a penalty if you fail to pay the taxes at the right time throughout the year.

Your recruiter would use the W-4 form to determine how much they deducted from your paycheck. This tax form states the estimated tax deductions and the filing status. As the end of the financial year approaches, review the form along with the withheld amount to make an informed decision while filing your returns.

Many people use the Tax Withholding Estimator tool of the IRS to calculate the current withholdings. This tool also lets you estimate the tentative returns. Submit the updated W-4 forms at any time to your employer. The company should institute the necessary changes before the first payroll period commences.

2. Consider your paycheck withholdings

A careful evaluation of your paycheck withholds can help you maximize tax savings. In 2022, the average tax refund was around $3,039, which comes to roughly $250 per month. Compared to 2021, this return was higher by more than 7%. Therefore, consider your paycheck withholdings as you talk to your accountant.

However, if you end up withholding very little tax, you might end up facing a penalty. It’s possible to change the withholdings on payroll tax at any time.

3. Increase contributions to your retirement account

Why not make the most of tax deduction opportunities by contributing to your retirement account? Typically, contributing to 401(k) or 403(b) can reduce your taxable income. Here are three tax tips and strategies that you can deploy to minimize your tax load.

- Business owners or self-employed people should go for a simple IRA or SEP.

- If you are above 50, pay an additional $1,000 to IRA or $7,500 to 401(k) or 403(b).

- If you want to make tax-free retirement withdrawals, make Roth or Roth IRA contributions to a 401(k).

4. Focus on your health savings account (HSA)

Has your employer put you on a high-deductible health plan (HDHP)? Well, before you file taxes in 2023, check out whether or not you have access to an HSA. This can help you save on medical expenses you are shelling out from your pocket.

There are three tax advantages to these expenses.

- The deductions on payroll HSA take place before taxation

- The growth is exempted from tax

- There’s no tax on the amount withdrawn for qualified medical expenses

5. Benefit from your flexible spending account (FSA)

Professional accountants recommend opening a flexible spending account to maximize your income tax savings in 2023. Expenses like prescribed medicines or elder care can curtail your tax burden since they are paid for through your employer. The IRS has introduced a plethora of changes to help employees reap maximum tax benefits each year. In case you fail to make the most of these advantages, you end up losing money by paying taxes.

6. Contribute to your college savings

The 529 Plan can help you save on your income tax in two ways. You need to use your after-taxation income to contribute to this plan. Besides, the earnings from this plan are exempted from tax. Besides, the government doesn’t impose a tax on the amount you use for educational expenses. The contributions you make to the 529 Plan may be eligible for state income tax deductions.

One can also use the funds to manage secondary and elementary school expenses and apprenticeship programs or undergo training through religious schools or home-schooling.

7. Get tax credits for energy-efficient homes

Why not enjoy a greener home and bank on the tax incentives? The American Recovery and Reinvestment Act (2009) warrants a three-fold tax credit for homeowners to boost energy efficiency. Compared to deductions, the impact of tax credits is much more visible on your tax bill. Tax deductions simply minimize your taxable income. On the other hand, tax credits help in slashing the amount of tax a homeowner owes to the government.

If you installed a geothermal heat pump, solar energy system, or wind turbine before 1st January 2023, you can get as much as 26% of the cost back. Remember, the tax credit is likely to fall to 22% in 2024.

The cost of getting a solar energy system in California is around $14,000. So, if you installed it in 2022, you can save $3,666 on your tax.

Besides, installing Energy Star-certified boilers and furnaces can also fetch you tax credits.

8. Defer your payments and bonuses

Well, deferring your year-end payments from your employer isn’t that easy. However, if you are in a situation to negotiate with your company banking on your goodwill, postponing your bonuses can help you save tax. If the situation works out, try to receive these payments in January.

Contracts and freelancers should try and delay their payments till December. It’s only in January that you get paid. Remember, you are postponing the payments so that you benefit from lower income tax burdens. In the first place, you should determine the year in which it would be better for you to earn that amount.

9. Don’t overlook your charitable contributions

People under high tax brackets often consider charitable contributions a viable strategy to reduce their tax burdens. So, if you provide financial assistance to NGOs or charitable groups, make sure to transfer the amount before the financial year ends. You can deduct these donations up to 50% of your taxable income.

However, not all types of donations are eligible for tax benefits. Have a look at the database listing the IRS’s tax-exempted list of organizations at the outset. Besides, valid non-profit groups should have their tax identification numbers. Once you verify these credentials, you can proceed to make your charitable contributions.

10. Take advantage of all tax deductions and credits

Apart from the accounts listed above, here are some other tax tips, deductions and credits.

- If you have taken a property loan, the interest on your mortgage would be eligible for tax exemption. Whether you go for a standard or itemized deduction, your tax accountant can help.

- Take advantage of child tax credit (CTC) norms in case you have a dependent at your home aged under 18. Your tax professional should be able to guide you on the applicable clauses.

- Purchasing EVs can help you save tax, but make sure to get an eligible car. In case you purchased an EV last year, check out whether it’s good enough to fetch you further tax savings.

11. Combine your medical costs

Taxpayers can significantly save tax on the medical expenses they incurred during the past year. Make sure to combine all these expenses into a single year before filing your taxes. According to the IRS, you can deduct medical expenses that exceed your AGI by 7.5%.

This explains why established tax accountants recommend grouping all your medical expenses in a single financial year. Don’t overlook the bills you pay during hospital visits, preventive care, surgeries, prescription medicines, dental care, hearing aids, and glasses. Also include the transportation costs involved in your transits and costs incurred to seek mental healthcare.

If you find that you are nearing the 7.5% mark, try to make the maximum number of medical expenses by December. So, if you plan to take a new pair of glasses or fix your teeth, get it done by the previous year-end. However, if you are not nearing the 7.5% mark, postpone the non-urgent medical expenses until January 2024. This way, you can save taxes in the next financial year.

Conclusion

Now that you are better poised to save taxes, talk to your accountant and plan your expenses tactically. There are plenty of other avenues where you can save income tax. As a high-income individual, diversify your investments to benefit from tax exemption schemes. Many Americans consider investing in tax-saving mutual funds to reduce their tax burdens.

Likewise, timing your losses and gains from business can also help you manage your tax burden. Wealth management can turn out to be a challenging pursuit without professional assistance and meticulous tax tips. Consider looping in an experienced tax accountant while you plan your expenses to maximize your tax savings.

The post 2023 Tax Tips From a Retired Tax Accountant appeared first on Due.