2020 was a huge year for the hedge fund industry, where overall performance was positive after 9 months of COVID-19 and managers re-asserted their value as a key portfolio diversifier during turbulent times.

Q4 2020 hedge fund letters, conferences and more

With this in mind, Citco, a leading provider of asset servicing solutions to the global alternative investment industry--with over $1 trillion in assets under administration--is pleased to share its 2020 "Year in Review" hedge fund report.

The report captures proprietary data amalgamated from the company's hedge fund clientele and provides insights into:

- 2020 performance breakdowns by strategy

- 2020 performance breakdowns by AuM

- Trade volume patterns throughout the year

- Trade volumes by asset class

- Investor flow patterns by fiscal quarter

- And more

Executive Summary

Needless to say, 2020 turned out to be an exceptionally unusual year, but one where hedge funds went from strength to relative strength as the year progressed.

Facing higher trade volumes at first and several marked spikes throughout the year, investor flows – based on funds administered by Citco Funds Services companies (‘Citco’) – resulted in a net positive year. At $17.8Bn, this could be considered a relatively small number, but one that shows the resilience of the alternative investment sector in exceptional circumstances.

As 2020 turned out to be the year of outsourcing, our services played a large part in the sector’s resilience. We saw significant adoption of our Treasury Services - with Collateral, Trade Matching and OTC Settlements all growing at a significant rate during the challenges posed by remote working.

One thing is for certain, we were here for our clients throughout the challenging year that was - and will be here for them no matter what 2021 brings.

Overview Of Data

Performance Data

We have considered funds for which we deliver daily PNL/NAV reporting. We only include returns for those strategies where we believe we have sufficient daily service delivery on that strategy.

Treasury

Data on payments volumes are constituted by all dispatched payments including Letter of Acceptances (LOAs). Excludes all payments to investors/limited partners.

Performance Of Hedge Funds In 2020

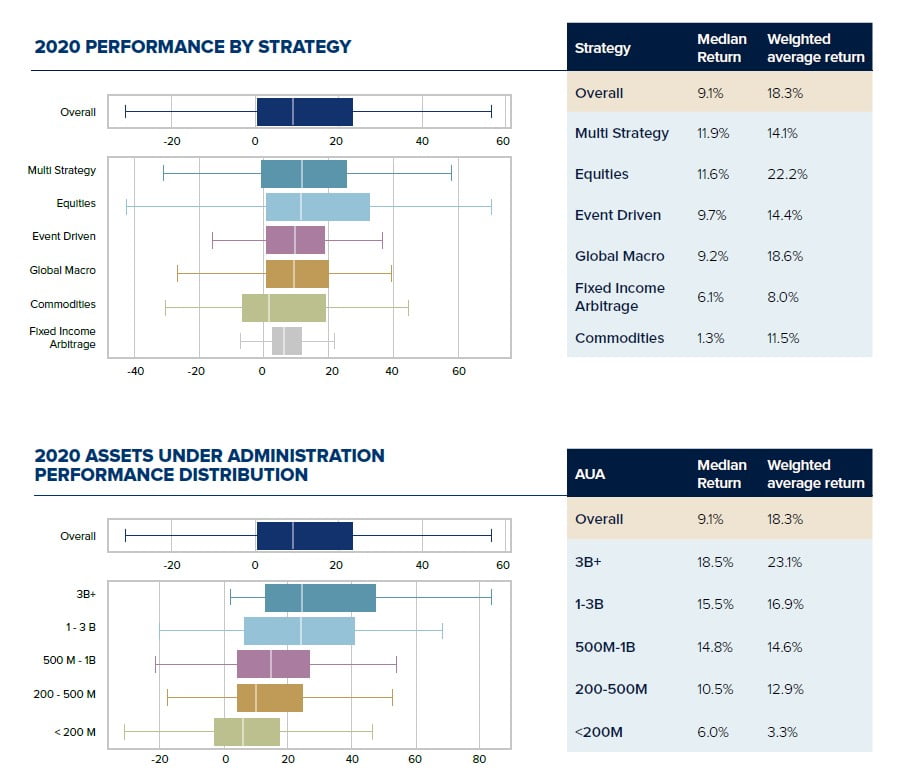

In the aftermath of market volatility in late Q1 2020, the markets as well as hedge fund performance recovered well and continued its trajectory throughout the year.

It was a good year overall for hedge funds, with all strategies and AuA categories delivering positive returns. Equity was the best performing strategy with a weighted average return of 22.2% for the year; Fixed Income Arbitrate was the worst, while still delivering a return of 8%.

The dispersion in returns between the top performers [90th percentile] and bottom performers [10th percentile] was 57.5% for the year.

The key takeaway for fund performance last year was that size matters – larger funds performed better. This shows in multiple metrics: funds in $3bn+ category had the best weighted average return of 23.1%; in addition, the positive difference between weighted average return and median return in most categories signifies larger funds performed better in each of these categories.

Trade Volumes

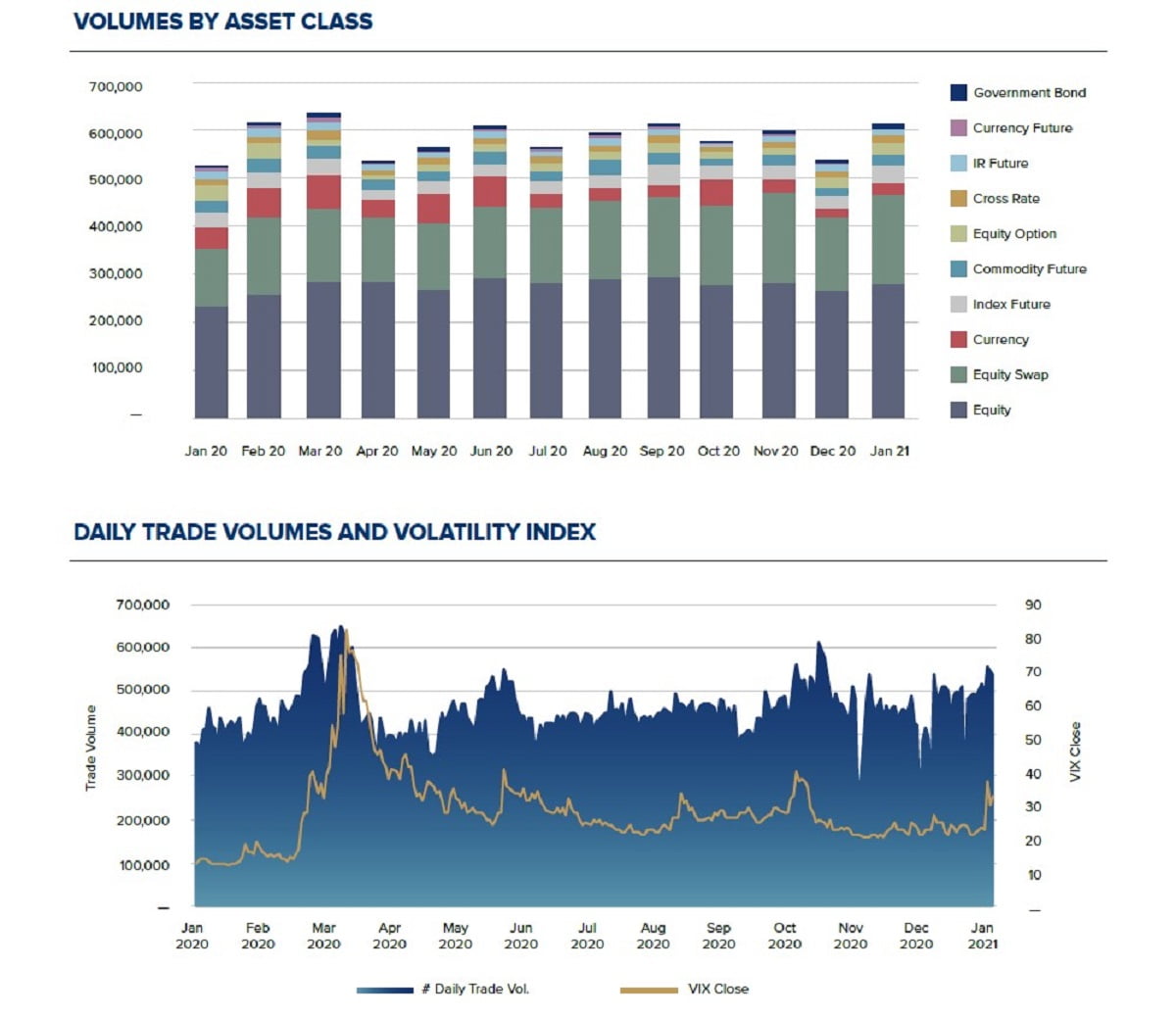

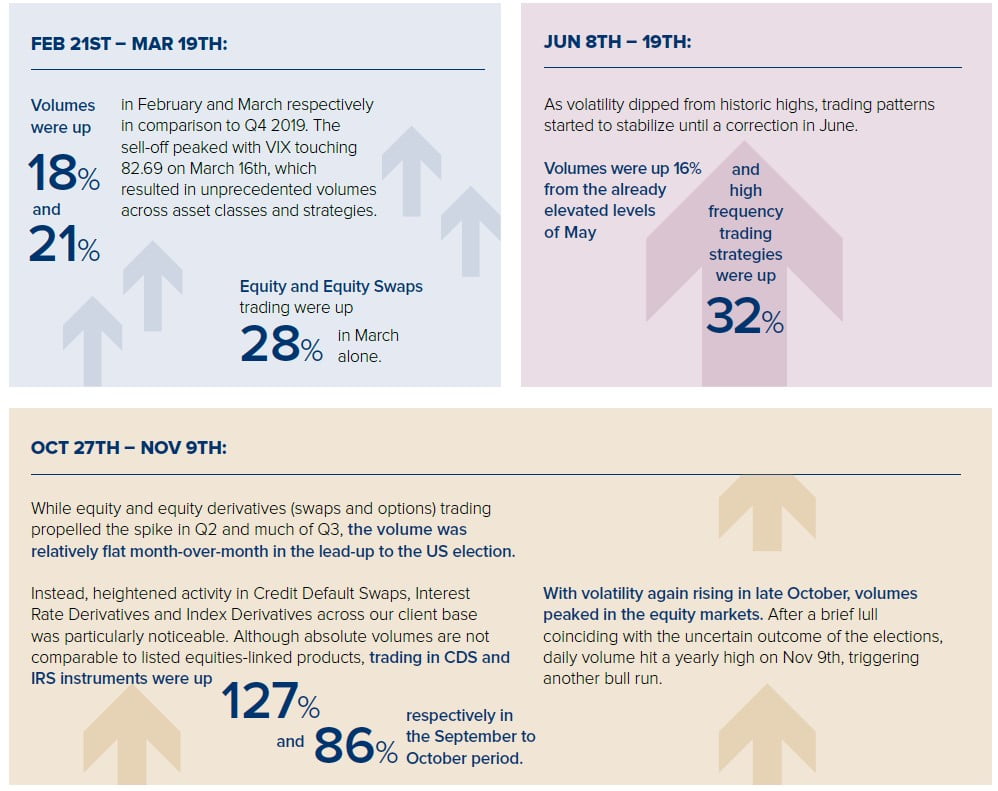

The year began with relatively higher volumes, continuing the bull run from Q4 2019. Looking back at the past year, there are three noticeable groups of trading sessions that were exceptional:

As expected, these trading sessions have a strong correlation to the volatility in the equity markets.

The sharp rise in VIX in the last week of January 2021 coincided with daily volumes touching the highs of March, June and October 2020. Overall, other than during specific events and triggers in the market, Equity and Equity Swap volumes were the most favored asset classes.

Citco’s scalable and flexible trade ingestion architecture has equally been up to the challenge, with trade STP rates above 97% throughout this period.

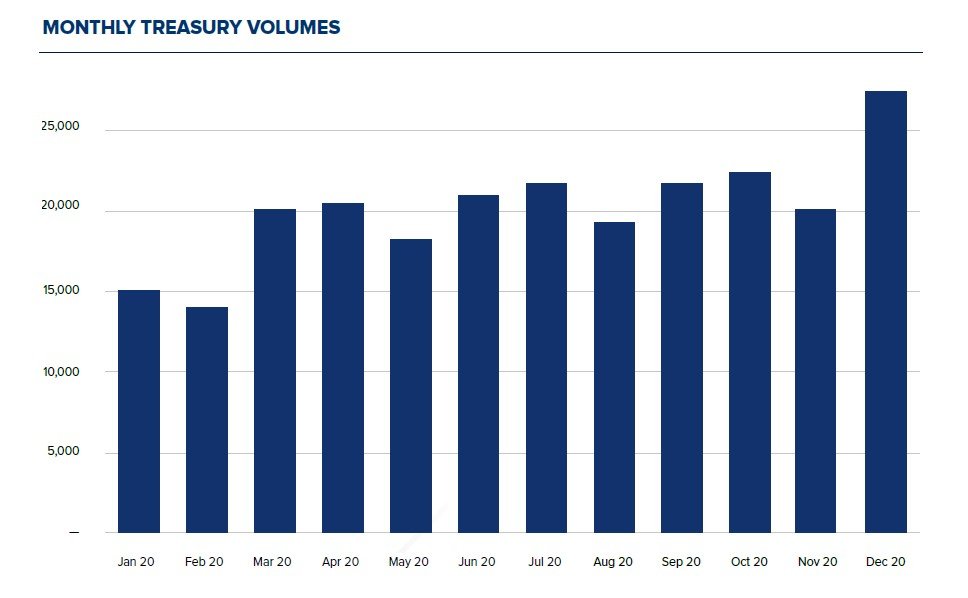

Treasury

2020 turned out to be the year of outsourcing. While Citco Treasury Services saw significant client adoption throughout the year – Collateral, Trade Matching and OTC Settlements all grew at an incredible rate.

Working from home presented many challenges, and clients responded by leveraging Citco’s best in class offerings. This trend has continued into 2021, where we are seeing new funds launch with smaller operational footprints and mature funds moving middle office functions to their administrator in order to focus internally on higher value tasks.

Investor Flows

2020 will certainly be remembered as a monumental year across all facets of life. For the alternatives industry, it was an opportunity to demonstrate the value of the asset class as part of a diversified portfolio.

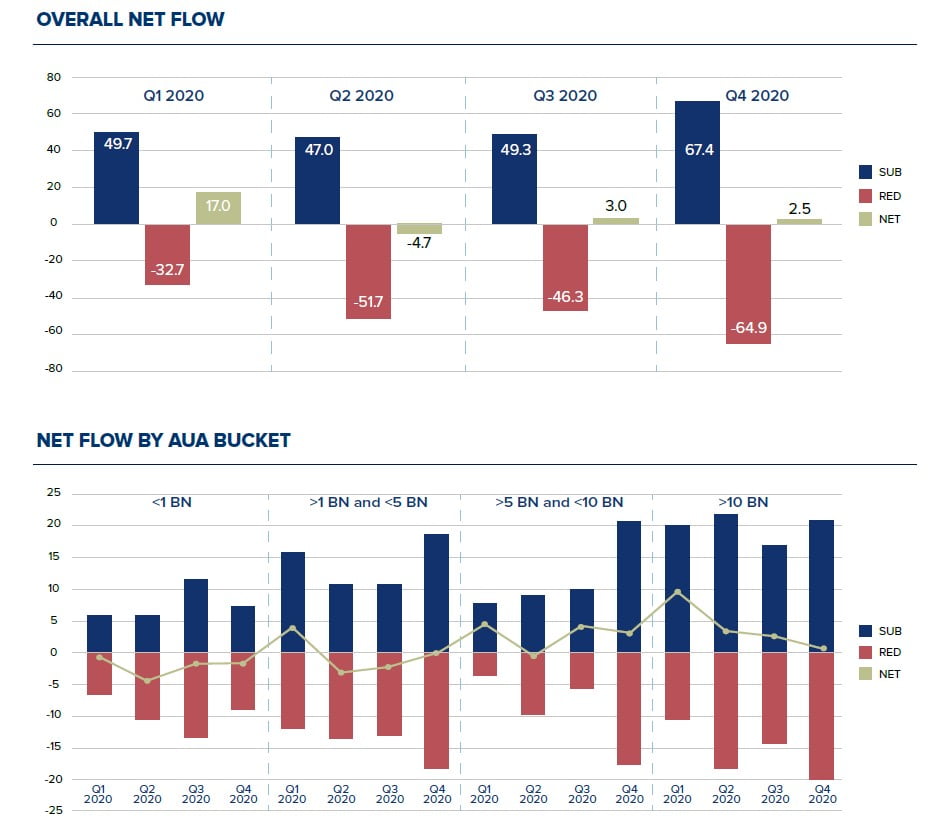

Investors and allocators have been voting with their feet for many years, with muted capital growth and shrinking allocations causing them to consider other exposures. However, based on the capital flows in and out of Citco administered funds, 2020 was a net positive year with investors buoying assets under management – with total net inflows of $17.8Bn.

Relative to the overall industry – and even Citco’s total AuA of $1.4Trn, this could be considered a small number; however, it illustrates both the resilience and resurgence of alternatives in the modern investment landscape.

The bulk of inflows went to the larger asset managers running more than $5Bn with funds under $5Bn actually seeing net outflows over the year.

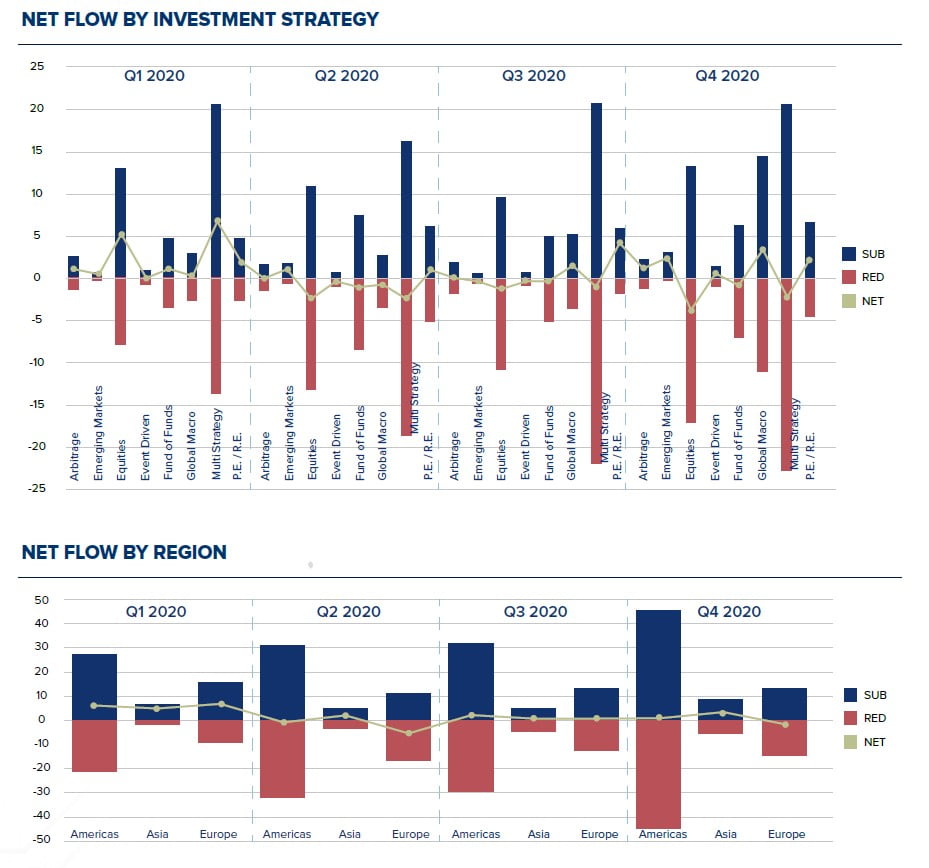

Global Macro and Emerging Markets strategies were on the comeback trail, accounting for a sizable chunk of overall flows. Funds of Funds were stable for the year, arresting a multi-year decline in allocations. Investments in hybrid private equity style investment structures continued apace as the popularity and availability of these products continues to grow.

Asian funds saw the most material increases overall, especially impressive relative to their asset size, whilst European based funds struggled to attract meaningful new capital.