In terms of challenges, there were few as unexpected and damaging as COVID was for businesses. Industry was booming and many risks were made with the expectation of that continuing. COVID-19 and the pandemic it causes not only posed challenges never before seen, it disrupted every industry completely.

All of a sudden thousands of workers were left completely without a job. Those that had a job likely went remote, an alternative that was highly underdeveloped at the time. If workers were able to make it into the office, new safety restrictions made it a much more challenging process. And that’s all without even mentioning the customers or patrons themselves.

People, now scared to go out, aren’t spending their money. Suddenly businesses have a highly reduced revenue stream. On top of that, the spaces they’re renting out all of a sudden have dramatically decreased in value. Truly the ways in which COVID affected business are near endless. It was only natural then that the government took steps to slow the bleeding.

The Employee Retention Credit Program

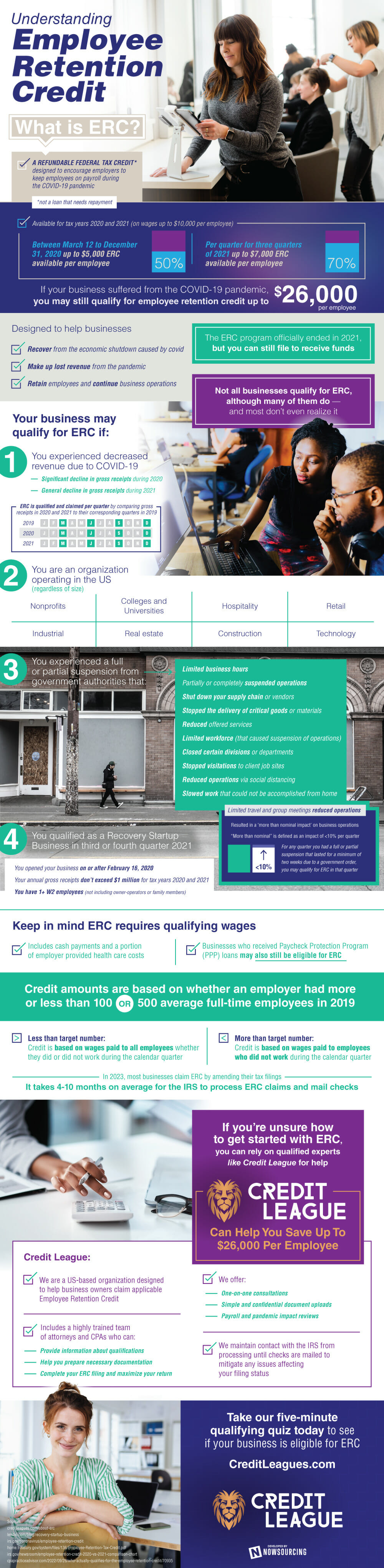

There were countless bits of legislation proposed and passed in this effort. Legislation that many of which are still relevant today. The Employee Retention Credit program is exactly one of those pieces of legislation. The credit this program created was a refundable federal tax credit. It wasn’t offered to every business, but instead was an incentive for businesses to keep employees onboard and paid.

The program was in effect during 2020 and 2021. Each year a different amount was offered by the credit, totally to $26,000 per employee. Officially speaking, the program ended in 2021. Yet many of the businesses that managed to keep their employees paid had no idea about the program. Others opted for more popular programs such as the Paycheck Protection Program. Both of these groups may still be eligible for the credit, even today.

In determining eligibility, there are four key factors, meeting any of them could mean qualification. The first is if COVID reduced the revenue stream of the business. This is determined through a quartile evaluation through both 2020 and 2021. The second is if the business is a qualifying organization. These consist of things like nonprofits, universities, hospitality, retail, real estate, and construction.

The third factor is if the business qualified as a Recovery Startup Business in 2021. In other words did the business open late and did it make under one million in revenue? Finally the fourth factor is if the business was suspended or limited by the government. This can mean limited hours, disrupted supply chain, stopped visitations, or general stopped or slowed operations.

A business meeting any of these four conditions can help to qualify it for the Employee Retention Credit. In terms of actually obtaining the credit, the process is luckily fairly simple. The first step is making sure all wages and benefits are reported and qualified during the pandemic. This means cash payments, health care, payroll, everything. The second step is understanding which type of business is being applied with.

For any business with under a target number of employees (100 or 500), the credit is awarded to all employees. For those with over the target, the credit is based on the wages of employees who did not work exclusively. Again the intent of the program was to promote keeping employees paid, even when they could not work.

After all of this is determined and done, the actual process is quite simply a tax amendment. This can take anywhere from four to 10 months to be processed. Although it’s important to start the process now because the funding from the credit won’t last forever. If any step of this process seems unclear, there are also lots of resources available.

Hiring any organization of experts for taxes or credits is the easiest avenue. There are lots of businesses looking to help businesses maximize credits exactly like these. Applying for and obtaining a credit like this should not be a time-intensive process. Making strides to make it as simple a process as possible can be helpful for businesses that are overwhelmed even today.

Ultimately, COVID made a lot of things very challenging, especially for small business owners. The government did a lot of bad and a lot of good in attempting to alleviate the issues everyone experienced. This simple credit is an example of good. Yet the onus is on businesses today to learn about and utilize it before it’s too late. It was hard to pay employees properly during the pandemic, why not be rewarded for that?