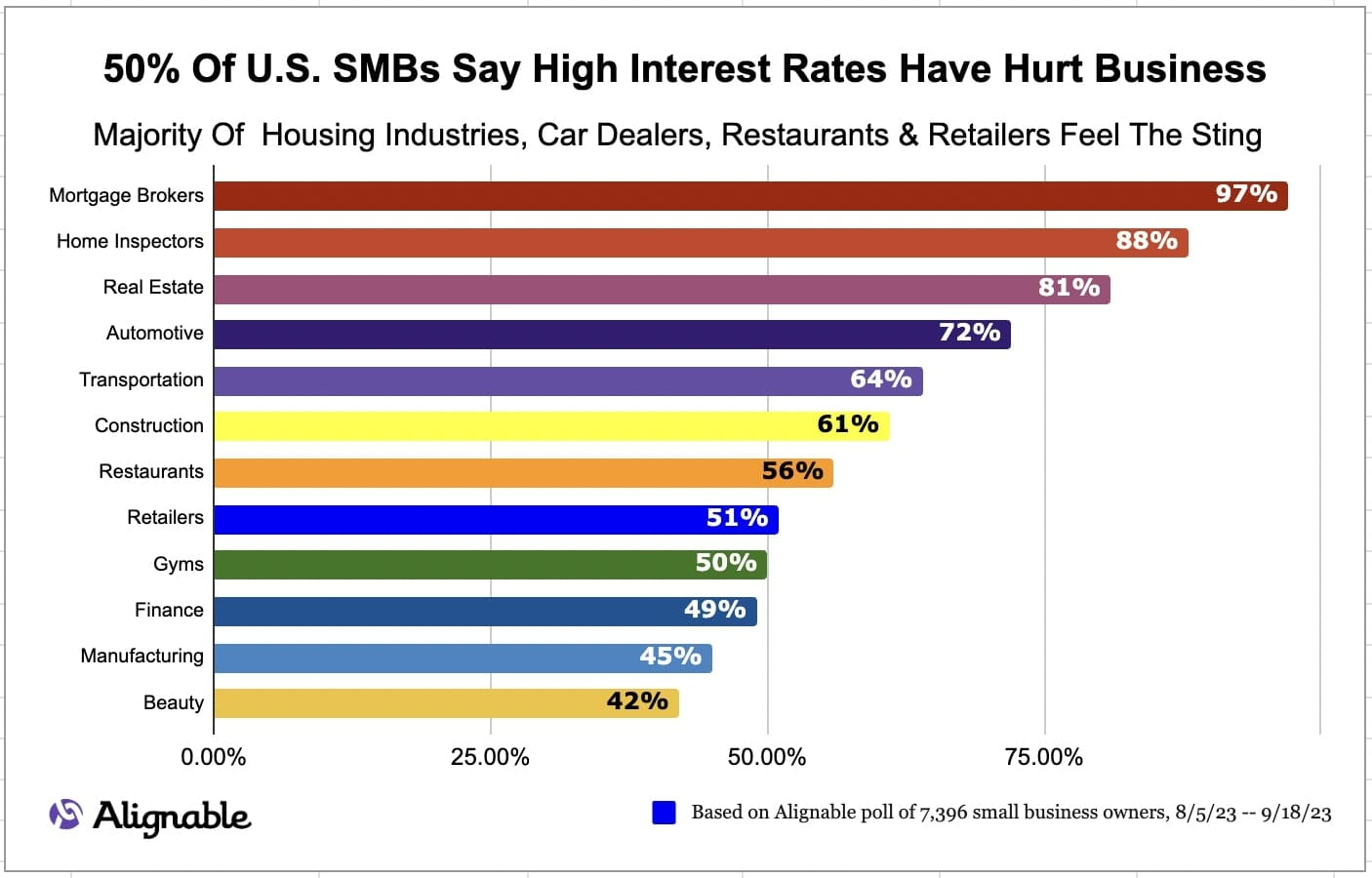

As the Feds contemplate whether or not to raise interest rates again, Alignable’s Small Business Interest Rate Report reveals that:

- 50% of small business owners say steadily increasing interest rates over the past 18 months have directly resulted in economic setbacks for their businesses.

- Further, 66% of the poll respondents in this group believe economic issues will persist even if the Federal Reserve doesn’t raise rates further.

- In fact, 38% of those struggling say that the interest rate must be reduced by at least three points before they envision rebounding again.

High Interest Rates Are Taking A Toll On Small Businesses

These are just a few findings emerging from a poll of 7,396 randomly selected small business owners surveyed from 8/5/23 to 9/18/23. Here are a few other highlights:

- Reasons for the negative economic impact include reduced consumer spending with local businesses, vendors raising prices that are then absorbed by SMBs, deferred expansion plans due to high loan rates, & increased rates on SBA loans.

- Snippets of quotations from affected SMB owners express great intensity, like:

- “High interest rates are killing me.”

- “My locally owned sub shop is being crushed under the weight of my SBA loan that keeps ballooning in monthly interest payments.”

- “The current high rates for loans paired with the lack of housing inventory has created a severe slowdown in real estate transactions.”

- Concerns cut across many sectors: real estate (81%), automotive (72%), transportation (64%), construction (61%), restaurants (56%), retail (51%), finance (49%), manufacturing (45%), & beauty shops (42%).

- Veterans (61%) & minority-owned businesses (58%) are suffering the most in terms of demographic groups.

- Many states have high percentages of SMB owners struggling under the weight of high interest rates, including AZ (63%), NC (59%), CO (58%), MD (57%), PA (56%), FL & TX (each 54%), NJ & MN (each 53%), CA (52%), MA (51%), TN (47%), IL & NY (each 46%), & CT (45%).

To see the full report, go here.