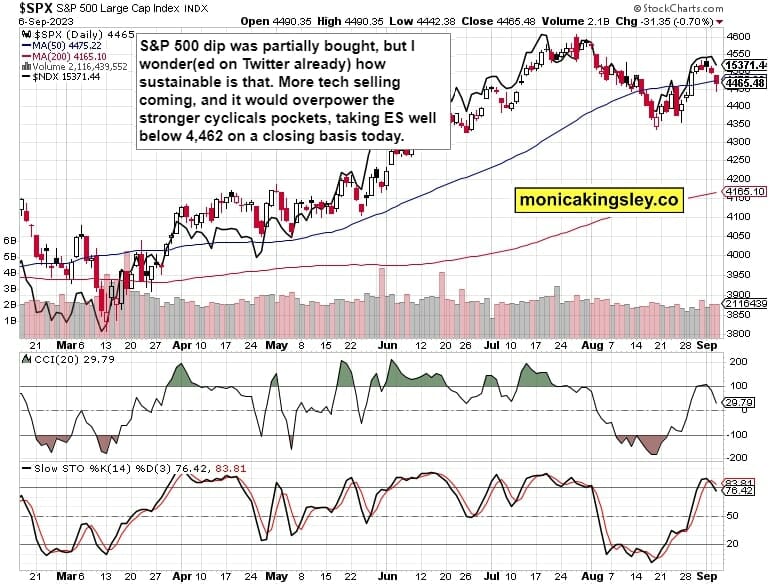

S&P 500 continued succumbing to rising yields, breaking with ease the 4,492 support, and then rebounding off the mid 4,460s – the Nasdaq bounce taking much else alongside, was a bit too steep, and not reflecting the earnings prospects to put it mildly (which is of course an intraday remark into a larger medium-term reckoning).

Likewise the fact that still solid consumer spending is the result of both almost fully depleted excess savings and the current savings rate dip to merely 3.5%. Add in stubborn inflation expectations, the gap between core and headline inflation to be resolved by again rising headline CPI, and still relatively solid job market, all of which goes to highlight more tightening needs, and rising rates reflect that. 10y yield has still a way to go (in time) before declining – and if not earlier, then the Sep FOMC with no hike, would do the job of bringing yields down.

Besides, housing is getting concerning, and JOLTS sign of the times (let‘s remember not only dismal current but also) last month‘s data had been revised down by 417,000 and that‘s the largest revision ever.

Needless to say, the short ES bets are working fine in both swing and intraday trading services for clients. Thanks and enjoy – I‘m opening today‘s analysis exceptionally for all!

More details are in individual chart sections. As usual, I‘ll be commenting amply on both intraday Telegram channels – from stocks to real assets – and of course on Twitter!

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren’t enough) – combine with subscribing to my Youtube channel, and of course Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 3 of them.

S&P 500 and Nasdaq Outlook

4,462 wouldn‘t be beaten today – the back and forth grind lowr, goes on Today‘s session would go mostly in one direction, and I would look at 4,432 target with comfort. In the Intraday Signals channel and on Twitter, I‘ll cover more sectoral perspectives as we go – bears have the reins clearly today.

Gold, Silver and Miners

Time for an early bid to emerge – relatively from nowhere. The stock market woes may help with some safe haven buying of gold, and keep long end of the curve in check. Watching for a bottom forming – if true, that would be very bullish that it happens in low $1,940s already. Silver is though to be still lagging for now behind gold.

Crude Oil

Crude oil is to consolidate next, aand sellers haven‘t yet arrived, but would probably achieve sideways to a little down move in prices at best. Supply driven resilience to monetary policy.

Copper already visited my Sat worst case target of $3.77, and doesn‘t look settled yet. Together with silver, would lag behind gold in this QT focus environment.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.