Morningstar recently launched the Morningstar Global Brain Health Innovation Index and has published a new research paper that outlines the Index and the next wave of innovation in neurology, with expected progress in treatment options for disorders such as Alzheimer’s, Parkinson’s, dementia, and more.

The oncoming wave of innovation has the potential to significantly help patients across a broad range of neurological disorders while rewarding investors supporting the companies that are leading in neurological research and development.

Key findings at a snapshot

- The effects of the aging U.S. (and global) population. With direct medical costs expected to balloon, new therapies that can treat strokes and conditions like Alzheimer’s are needed with improved safety, efficacy, and flexibility.

- The next wave of pharmaceutical innovation will likely center on neurology. Innovation in healthcare tends to support decade-long periods of product development within therapeutic areas. Morningstar believes we are just entering a wave of innovation in neurology, with the previous waves of innovation taking place in cardiology (2000s) and oncology (2010s).

- Recent approvals in brain health set the stage. 54 neurology drugs have been approved in the past decade – including within subsegments such as migraine, spinal muscular atrophy, Duchenne muscular atrophy, and most recently, Alzheimer’s, with the approval of Aduhelm and Leqembi likely to spark a surge in new investment into treating the disease.

- Neurology is the second most active area of pharmaceutical development. The number of neurology drug candidates has grown by 229 since 2011; according to IQVIA data from Feb. 2022, there were 616 drugs in the pipeline in neurology as of 2021, representing 10% of the total drug pipeline.

Executive Summary

Innovation in Brain Health Is Unlocking Revolutionary New Treatments To Meet Rapidly Growing Demand

With an aging population, reduced stigma around mental illness, and new drug and device technologies, we think the 2020s will be a decade of innovation in brain health.

In Alzheimer’s disease, Biogen and Eisai’s Leqembi was approved at the start of 2023 and Eli Lilly’s donanemab could follow by 2024, bringing new treatments to patients that slow the course of the disease, rather than only attempting to control symptoms.

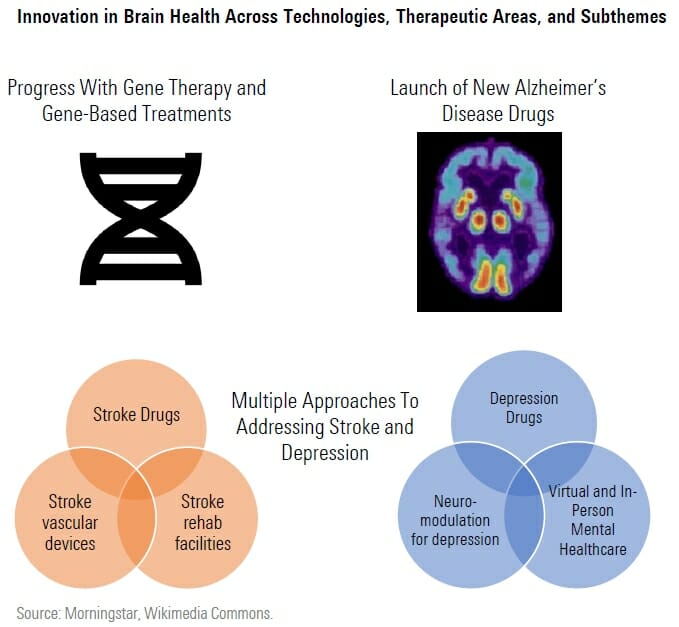

At the same time, technology for gene based therapies is progressing. In spinal muscular atrophy, DNA based therapy and gene therapy are both already available, allowing infants to develop at near normal rates in this otherwise life threatening condition. In Duchenne muscular dystrophy, the first gene therapy could be approved in 2023 that helps patients make their own dystrophin protein, potentially helping them regain mobility and function.

In some areas of brain health, we see progress across all three subthemes in our index. In depression, new rapid acting drugs are approaching the market for patients struggling to find the right treatment, just as neuromodulation also emerges as a potential treatment and mental healthcare virtual offerings expand. Stroke treatments are in development that could help patients for a longer time window after stroke onset, as well as preventive therapies with safer profiles. New technologies in neurovascular devices as well as rehabilitation are also improving outcomes for stroke patients.

Index Objective

As demand for brain-related care increases, new technologies are allowing pharmaceutical firms, device firms, and other healthcare services firms to launch products to help patients in this complex market. Companies that steer their product portfolios toward brain health will be more likely to enjoy financial benefits while also playing a critical role in addressing the unmet needs of patients globally.

The Morningstar Global Brain Health Innovation Index aims to provide concentrated thematic exposure to companies advancing the broader field of neuroscience. The Index targets companies with material revenue exposure and increasing profit exposure to innovations that aim to prevent or treat brain-related disease.

To inform index stock selection, Morningstar equity analysts provide thematic exposure scores across each of three sub-themes.

Morningstar Thematic Index Scoring Methodology

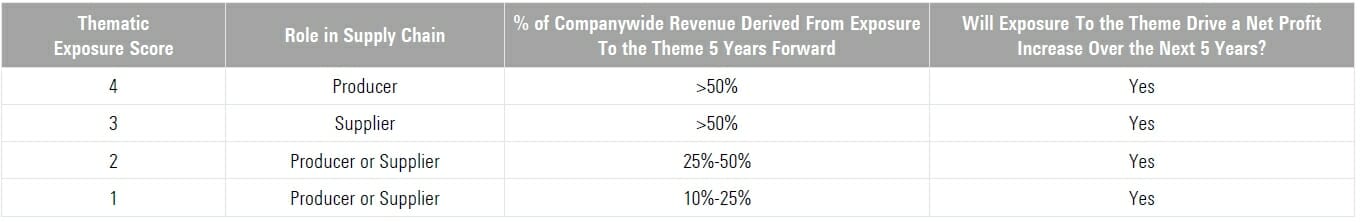

Leveraging the insights of Morningstar equity analysts, the scoring methodology below determines company level thematic exposure scores for each Brain Health Innovation sub theme. Focusing on producers of innovative solutions and their suppliers, all Index holdings offer material reven ue exposure to the overarching theme and are likely to enjoy a net profit increase from that exposure.

If a firm is projected to derive less than 10% of companywide r eve nue from exposure to the theme in five years’ time or is not likely to enjoy a net profit increase from that exposure over the next five years, it receives a score of “0” and is excluded.

“Producers” of brain health innovation solutions are eligible for a higher thematic exposure score than “suppliers,” as the producers are typically closer to the innovation itself and, all else equal, likely offer a higher degree of thematic purity.

About the Author

Karen Andersen, CFA, is a healthcare strategist for Morningstar Research Services LLC, a wholly owned subsidiary of Morningstar, Inc. She is responsible for biotechnology research. Before joining Morningstar in 2005, Andersen received a master’s degree in business administration from Rice University, where she served as senior healthcare analyst for the M.A.

Wright Fund and earned the distinction of Jones Scholar. She has scientific research experience in both academic (at Rice University and the University of Queensland in Australia) and industry (at Lexicon Genetics and a subsidiary of Genzyme). Andersen also holds a bachelor’s degree in biochemistry from Rice University, where she graduated magna cum laude. She is a member of Phi Beta Kappa and holds the Chartered Financial Analyst® designation.