Decarbonization is the main market driver across the industrial sector. In every roadmap there is an evolving mix of solutions that span the technology readiness spectrum, each with their own proponents and critics.

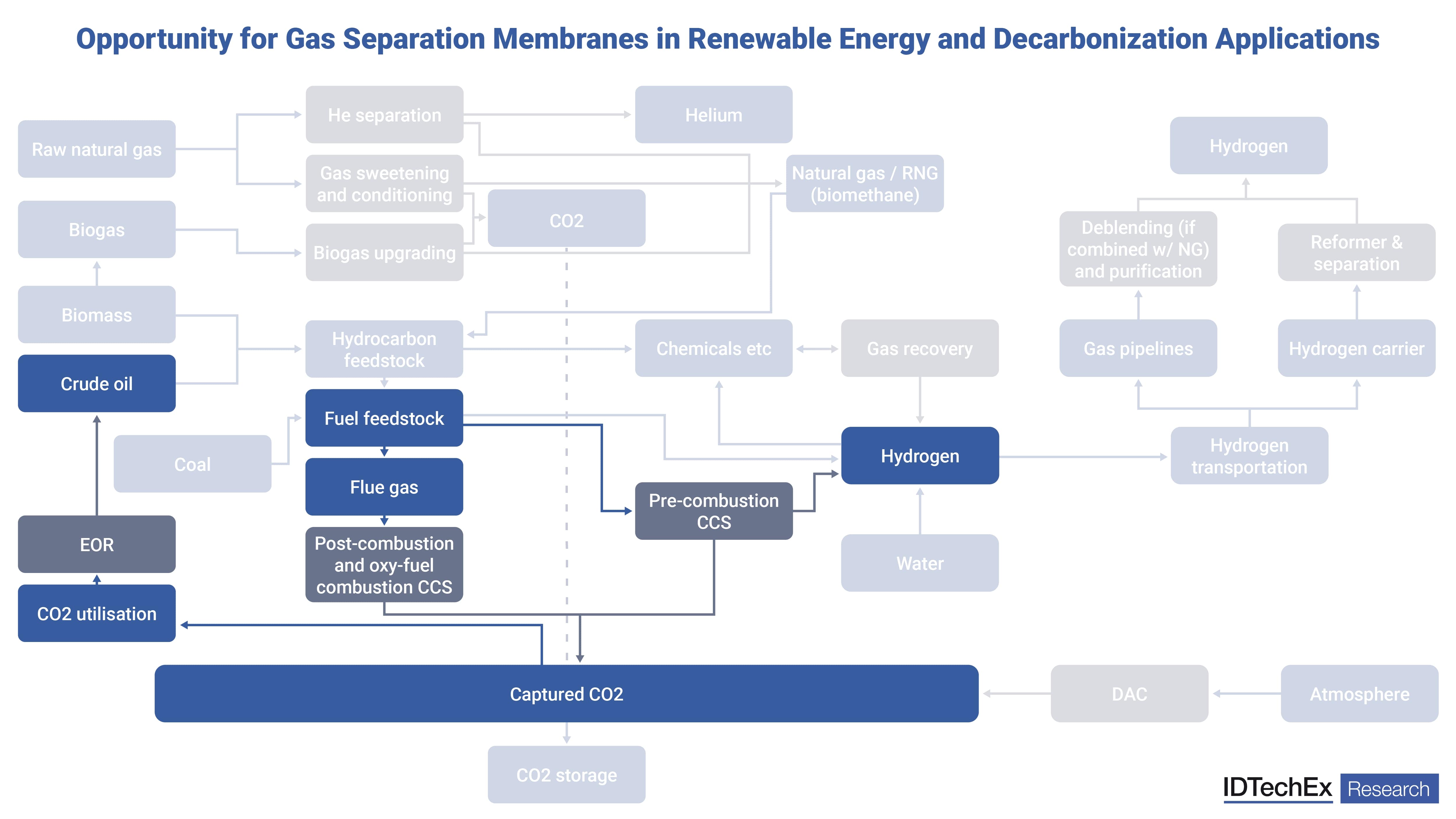

Within these strategies, there are inevitably a wide range of scientific and engineering pain points. One such recurring challenge is that of efficient gas separation; IDTechEx asks: Does this present a market opportunity for membrane technology?

The commercial use of gas separation membranes is not new; the industry grew considerably from the 1980s to the early 2000s. Existing membranes are not suitable for every gas separation application, but in the right use case (including appropriate feedstock, scale, and purity requirements), they can outcompete other separation techniques; this has resulted in the industry growing into a stable market of modest size.

The market is now entering a new growth phase. This is driven by key market factors, primarily renewable energy and decarbonization applications, and technology advancements responding to those needs. IDTechEx has launched a new market report, “Gas Separation Membranes 2023-2033”¸ which provides a critical technology roadmap, company landscape, and market outlook for this evolving industry.

The advantages and disadvantages of the use of polymeric membranes as compared to other separation techniques (e.g., cryogenic or pressure swing adsorption) depend on the application but predominantly focussed around the attractiveness of membranes as a lower energy process and the limitations of their selectivity vs permeability trade-off and lifetime in real-world environments.

Beyond the incumbent polymer membranes there is a wide range of research advancements; many of the most promising materials are beginning to gain some commercial traction and will also help reshape the commercial landscape.

Gas separation membranes have already achieved commercial adoption in multiple applications, specifically nitrogen production, hydrogen recovery, natural gas treatment, and vapor recovery. Here we will look at three large potential areas: Biogas upgrading, carbon capture and hydrogen.

Biogas Upgrading: Membranes Are Well-Positioned to Capitalize on This Growing Market

Biogas consists of high proportions of methane and carbon dioxide. This is mainly used directly, but an increasingly important process involves having the CO2 separated out (and contaminants removed) to produce sufficiently pure methane that can be used in the natural gas infrastructure.

This product is termed biomethane or renewable natural gas (RNG). This is not the only route to biomethane but is the most common.

RNG is not a new industry, but it is set for significant growth over the next decade. There are government drivers, including the EU targeting a greater than 10-fold production increase to 35 bcm of biomethane by 2030, and industry activity from major companies, including the likes of Shell, BP, TotalEnergies, and more.

The upgrading involves a CO2/CH4 separation unit; several solutions are commercial, but membranes have already been in use and are gaining notable market share. The solutions are particularly well-suited for relatively small digester gas projects but not limited to this with a wide range of installations worldwide.

There are membrane materials looking to enter the market, but for the most part, this is satisfied by incumbent hollow fiber polymeric membranes as the only separation process or as part of a hybrid system, such as alongside a cryogenic unit.

The combination of a proven use case, growing supply chain, and large market growth makes this a key area for gas separation membranes over the next decade.

Carbon Capture: Membrane Separation Cannot Compete… For Now

CCUS is a central part of every industrial decarbonization roadmap. At its core, this is a separation challenge, which therefore brings about the question of whether membranes can be used.

Membranes are already used for separation processes in the natural gas industry but are not the dominant technology. This will continue to be a good market for membranes, and with the growing FPSO market and a focus on CO2 utilization for enhanced-oil-recovery (EOR), it is an important part of the CCUS landscape. However, this article will focus on the post-combustion point source carbon capture.

The main gas separation in post-combustion carbon capture is CO2/N2. There are multiple challenging considerations, including that the flue gas is usually at atmospheric pressure and with relatively low CO2 concentration. This makes cost-effective CO2 capture very difficult with incumbent membranes.

Amine scrubbing is the most regularly employed process, but there is increasing competition from alternative chemical & physical absorption solutions as well as adsorption and cryogenic processes.

This technology landscape makes it challenging for incumbent polymeric membranes to gain any market share. Still, nevertheless, we are seeing some pilot studies emerge, such as by Lotte Chemical in Korea. Instead, many companies are turning to emerging membrane materials or hybrid processes.

Polymer composite membranes, including Thin Film Composites (TFC) membranes and Mixed Matrix Membranes (MMM), have received a large amount of research interest, the former particularly prevalent because of the permeability improvement being led by the likes of MTR.

There are also membranes that offer alternative transportation mechanisms, including polymeric based Fixed Site Carriers (FSCs) and inorganic dual-phase membranes. Hybrid processes could involve a fully integrated membrane system, such as in membrane contactors, or alongside another separation process.

Many of these projects remain at the laboratory scale, with some progressing to more notable pilot studies. There are still many unknowns when it comes to the technical and economic viability in a large-scale deployment and an ever-evolving competitive landscape. If any notable success is to be seen, IDTechEx expect it to be in the longer term.

Hydrogen: Struggling to Separate True Opportunities From Dead-Ends

The scale of hydrogen’s role in a net zero future is extensively debated. Proponents envision an extensive green hydrogen infrastructure. Meanwhile, critics rightly point out that both the current hydrogen market needs to be cleaned before any grand plans are pursued and the challenges surrounding hydrogen transportation and use cases beyond particularly hard-to-abate sectors.

Understanding this is essential to assessing the market potential. However, throughout IDTechEx’s analysis, many gas separation membrane players cite hydrogen applications as a key target market.

There are 4 main use cases for gas separation membranes in the hydrogen industry: recovery, production, and transportation by pipeline or carrier. Membranes are already used in hydrogen gas recovery, for example ammonia purge gas. These can be improved and expanded but will not likely change dramatically.

The role in hydrogen production is mostly centered on blue hydrogen (production from fossil fuels combined with carbon capture). This, therefore, has a similar outlook to the previous section. There are material developments for blue hydrogen, including PBI-based membranes, but the most prominent are hybrid approaches; this is most clearly seen by Air Liquide at their Port-Jérôme facility.

Concerning transportation, the proposed membrane role is in the gas separation at the point of use. This could be upgrading the hydrogen at the end of a dedicated pipeline, deblending from natural gas to enable the use of that existing network, or recovering the hydrogen from a carrier (e.g., after ammonia cracking).

The challenge in all these use cases is that if it is to interface with a PEM fuel cell (the dominant technology), it will need to be of very high purity, which incumbent polymer membranes cannot achieve. This again means the industry needs to look to hybrid processes, such as the work between Evonik and Linde, or alternative membranes with high selectivity.

The most notable alternative materials are palladium-based membranes. These have been known for a long-time and have multiple challenges but are continuing to progress and reaching advanced stages of commercial trials for both hydrogen transportation and production.

IDTechEx has a longstanding history of providing unbiased technical market analysis on advanced materials and decarbonization applications. “Gas Separation Membranes 2023-2033” provides clarity on this evolving market with key market forecasts, technology roadmaps and player profiles.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/GasSepMem.

For more information on related topics, please see IDTechEx’s market reports “Blue Hydrogen Production and Markets 2023-2033: Technologies, Forecasts, Players” and “Carbon Capture, Utilization, and Storage (CCUS) Markets 2023-2043”.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.