For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

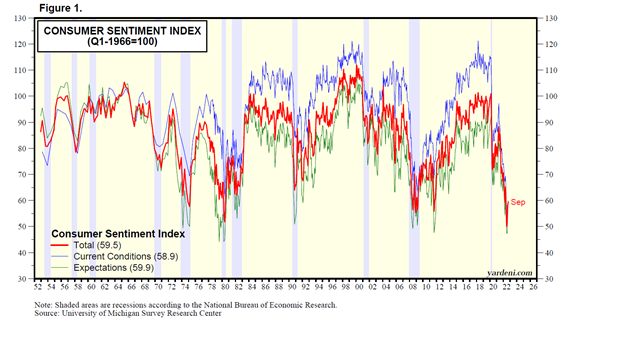

The gloom is so thick you can cut it with Dracula’s spiky front incisors, but that’s good news. Sub-basement sentiment is a key positive contrarian signal that indicates a turnaround in the market is near.

I’ll look at Consumer Sentiment in a minute, but first look at the year like a football game, or a movie.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

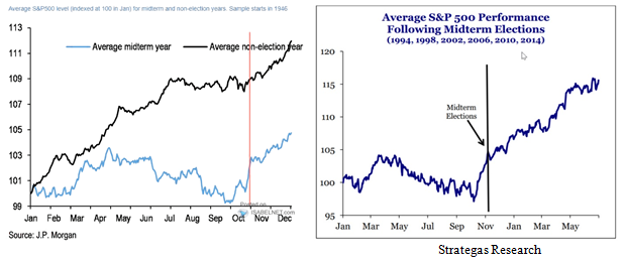

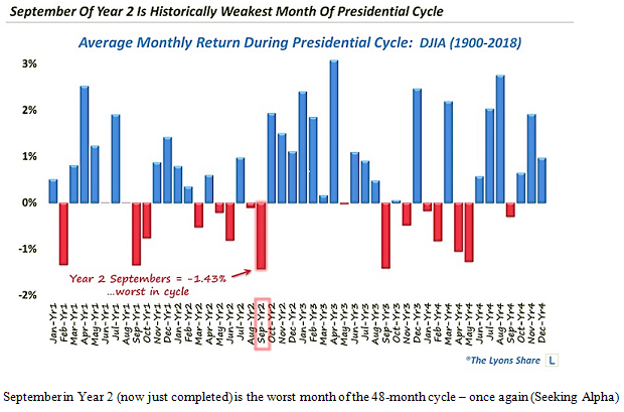

We’re entering the fourth quarter – or the final reel. What’s more, in the election cycle, we’re entering the sweetest spot of the four-year spin cycle of electoral emotions, historically.

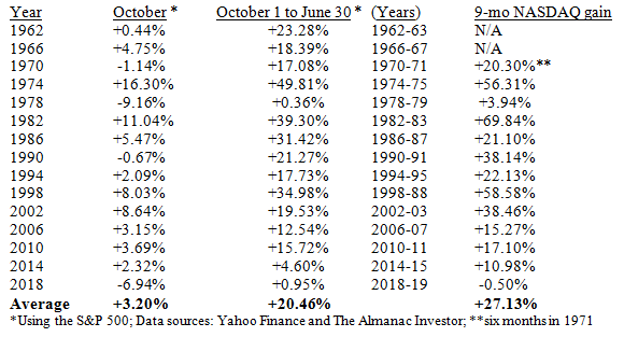

Since 1962, the nine-month span encompassing the fourth quarter of the mid-term election year (starting now, October 1) to the first half of the following year (through June 30, 2023, in this case) has averaged a phenomenal 20.5% gain for the S&P 500. For NASDAQ, which began trading in 1971, the average 9-month gain has been over 27%.

October in Mid-Term Election Years Usually Launches a Spectacular Nine-Month Surge

This table represents phenomenal consistency – until 2018 – and therein lies the dilemma for Fed Chair Jerome Powell and investors. Will Powell repeat his glaring mistakes of 2018, or did he learn his lessons?

In 2018, in a spat with President Trump, Powell raised rates one or two times too many and the market fell 14% in the fourth quarter, falling sharply during Christmas week after his last Scrooge-like rate raise.

Despite Powell’s actions in 2018, the S&P 500 has risen in each of these nine-month spans from the pre-election October through the following June 30 since 1962 (and even since 1950), with 12 of the 15 gains being double-digit, averaging over 20%.

I am not saying we will gain 20% or more this time around, but if Powell can subdue his Uncle Scrooge act this Christmas, we have a chance at some decent gains ahead.

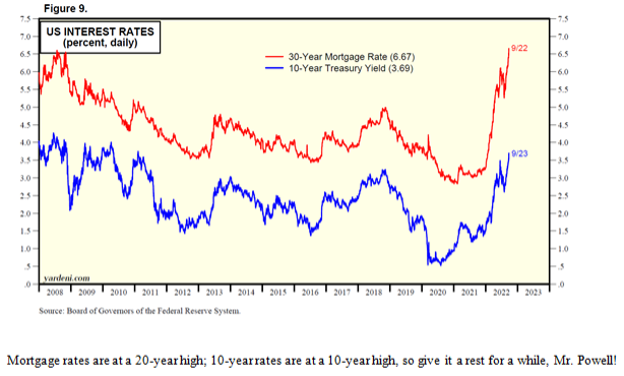

You would think that Chairman Powell has learned his lesson from crashing the stock market in 2018, but he’s not showing much repentance for being wrong about “transitory” inflation last year.

President Biden isn’t bugging him, so what’s in it for Powell to sabotage Biden’s election chances by raising rates 75 basis points less than a week before the election (at the November 2 meeting), or doing it again in December?

Don’t a few of the 400 PhD economists on the Fed staff know about the necessary “lag time” it takes for previous interest rate increases to impact consumer spending in the economy? Give it a rest, Chairman J.

I’ve examined why mid-term election years often fuel market growth in the past. People like to see checks and balances in government – a Congress that can restrain a President, and vice versa. In addition, every fourth quarter is filled with a series of holiday triggers – a Thanksgiving rally and a Santa Claus rally.

People’s spirits tend to pick up over food, family, and (yes) football. In addition, there is the year-end ritual of squaring the tax books for one year and planning for better results next year.

The election cycle is so potent because the public basically looks forward to political change as a positive, and the market anticipates these positives in advance.

Once the mid-term elections are over, the market then looks forward to the next Presidential election, just two years away – a tempting “carrot” in front of the lead donkey, always visible but always tantalizingly out of reach in the near but unreachable future.

Mid-term elections are basically a “restraining order” on the current Party in power. Then, we all look toward a new leader helping to erase all past disappointments of dashed hopes under past political saviors.

Current Sentiment Stinks - That’s the Good News

Our fourth-quarter fate is mostly in the hands of the Federal Reserve, reminding me of a couple of manic-depressive Roaring 20s tunes written by Vincent Youmans (music) and Irving Caesar (words).

A Couple of Investor Blues Songs Reflecting the Federal Reserve’s Extreme Policy Swings:

Sometimes I’m Happy I Want to Be Happy

Sometimes I’m Blue But I Won’t Be Happy

My Disposition Til I Make You Happy, Too

Depends on You (From “No, No, Nannette,” 1925)

(From “Hit the Deck,” 1927) Both Songs by Vincent Youmans & Irving Caesar

While I’m quoting song lyrics, I might as well quote the masters – the Gershwin brothers.

With love to lead the way

I found more clouds of grey

Than any Russian play

Could guarantee.

–George & Ira Gershwin, in the song, “But Not for Me” (1930)

In my regular weekly radio show, I’m honoring George Gershwin’s birthday (September 26, 1898) and that guy who was born in his shadow, Vincent Youmans, born same year, same city, next day (September 27, 1898).

He wrote those manic-depressive songs quoted above. The Gershwin boys’ parents were born in Russia, where papa Moishe Gershovitz may have seen a few of those morbid Russian plays, like Leo Tolstoy’s “The Power of Darkness” (1886), when he lived in St. Petersburg before coming to America.

Shortly after the Gershwin boys were born in America, several downbeat Russian plays presaged regime change, with titles like “The Living Corpse” by Tolstoy (1900), Maxim Gorky’s “The Lower Depths” (1902), and Anton Chekhov’s “The Cherry Orchard” (1904) about the demise of Russia’s landed estates.

Today’s terrible sentiment is once again keyed to a new Russian Play being acted on the global stage by a villain out of central casting, President Vladimir Putin, kidnapping a helpless ingénue tied to the railroad tracks down in Ukraine.

But as the drama unfolds, world nations come to the maiden’s rescue and the evil villain retreats in stages. Despite the costly energy crisis in Europe, causing widespread pessimism going into a frigid winter, there is a chance for a miraculous closing act to this drama, with some classic hero turning this Russian play into a classic Western, with Shane or John Wayne or the Cavalry saving the day.

Regardless of who wrote this script, a deep, dark mood of pessimism usually leaves nowhere to go but up. But for now, the Consumer Sentiment Index is at its lowest level since the financial panics of 1979-82:

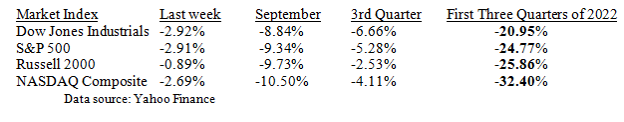

Like any football game, the final score isn’t tallied until the end of the fourth quarter, and there have been some miraculous comebacks in recent games. Here’s the score through the first three quarters of 2022:

Now, it’s all up to whether Jerome Powell wants to channel Paul Volcker or be a Gentle Ben Bernanke. So far, Powell has crossed over to the dark side, promising to inflict “pain” over a long period of time.

Cue John Wayne. Dirty Harry. Shane. Take your pick. It’s the final reel. Let’s wind up this movie right.