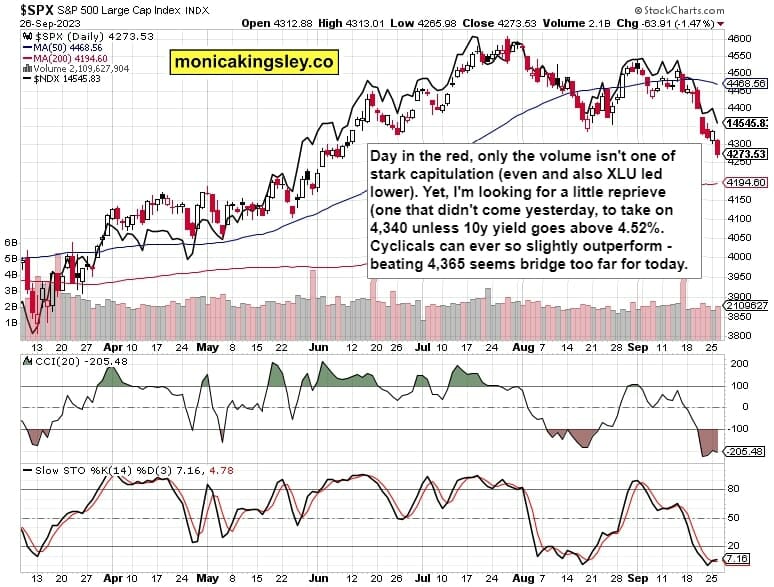

S&P 500 offered only a modest opening rebound, and continued one way south though my daily 4,340 “point of control”, all the way to the key support of 4,315 – undershooting it, and staging a weak premarket rebound. Sectorally, it was a clear washout taking even XLE down over – 0.5%. HYG with TLT mirrored the poor risk taking sentiment, and today the buyers can stage a moderate dead cat bounce targeting 4,340 to 4,365 area, but probably closer to 4,340 only.

Given the selling pressure seen everywhere apart from oil, I‘m not looking for any dramatic stock market reversal this week – as we seem to be headed to the lower 4,2xxs, it‘s a question of path in price and also time, which isn‘t on the side of SPY buyers. Meanwhile, the bearish gold, silver and still bullish oil calls are working out for you without delay!

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren’t enough) – combine with subscribing to my Youtube channel, and of course Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 3 of them.

S&P 500 and Nasdaq Outlook

4,340 isn‘t likely to give way, and actually a break of 4,315, then 4,307, and finally 4,298 are more likely later this week – don‘t have too high (bearish) expectations for today. Any cyclicals outperformance over tech today, would be insufficent to turn the selling pressure, and would offer a daily stabilization on par with Monday at best.

Gold, Silver and Miners

Precious metals still aren‘t a buy, and there is no change to my bearish sentiment shared every last couple of days. Not until yields top, which we‘re still far from doing, at least in time (more than a couple of weeks).

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.