ValueWalk will be hosting its Actionable Small Cap Webinar on Friday, September 17th, 2021. It will be featuring David Schneider, Assistant Portfolio Manager/Analyst at Hoover Investment Management.

Sign up for ValueWalk’s newsletter and stay upto date.

Q2 2021 hedge fund letters, conferences and more

Lakeland Industries, Inc. (NASDAQ:LAKE) - $22.31

With global headquarters in Alabama, Lakeland Industries is a worldwide leader in high performance safety workwear and protective clothing. Products can cover you from head to toe, protecting you from caustic chemicals, fire, knives, and biological threats. The products for biological threats can be found here.

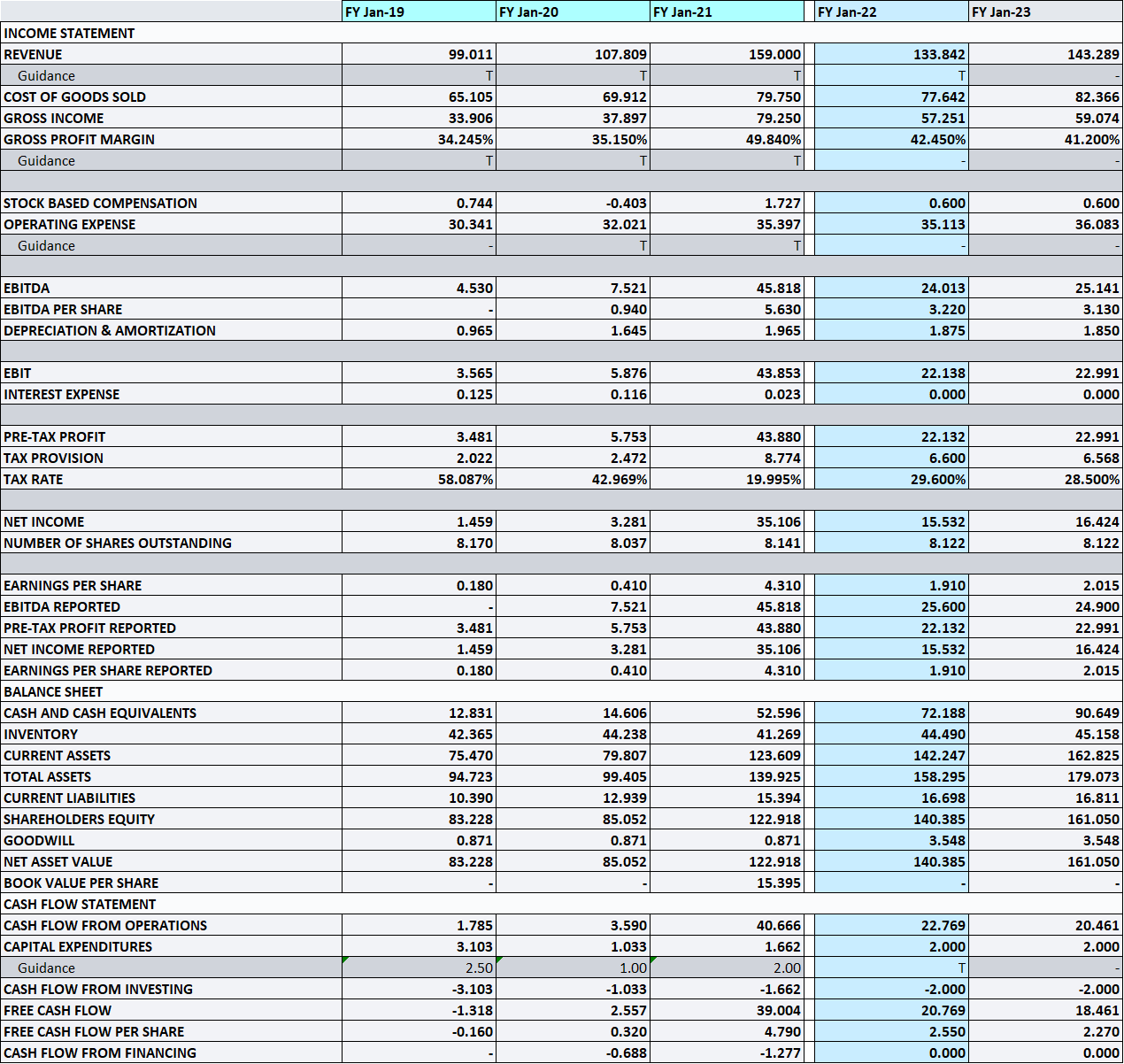

LAKE's Monster Earnings

LAKE is on a January fiscal year and for the year ending Jan 2021 reported monster earnings of $4.31 per share, with free cashflow after everything of $4.79 per share. The company did well supplying protective gear to healthcare workers globally due to covid. When the vaccines came out, the stock began to head south based on the assumption that their big year was a onetime event. But the windfall earned from round 1 of the pandemic threw a lot of cash on the balance sheet and as of April, 2021 they had $7.25 per share in cash. Longterm liabilities are only 1 million. Net-Net working capital was $13.67 per share. The company has 2 sellside firms following it.

CNBC and other drinking bird media companies talk ad nauseum about the Delta variant of covid and how it is an issue for those who have not had their 2 vaccination shots. South America and Mexico are a big unreported problem for those in the USA. South America is dominated by the Lambda variant, not the Delta variant and we have a porous southern border (to put it mildly) It is no surprise that the first case in the US with this was found in a border state – Texas. Texas and other border states are more conservative and have less success in vaccinations than states such as NJ. We already know that the Delta variant is more easily transmitted than the original strain. Some scientists think that Lambda may be worse than Delta. For those here in the USA who have received the Pfizer or Moderna vaccine, you are luckier than many millions worldwide who have received the Chinese CoronaVac vaccine, the mis-hyped AstraZeneca vaccine, or many others. The CoronaVac vaccine is the dominant vaccine in Latin America. The problem with the use of suboptimal vaccines is that due to natural selection – thought of by somebody named Darwin, we are left dealing with many unknowns regarding how transmitting that surviving virus will be different from what existed before. I agree with the belief that if you are unvaccinated, you run an exceptionally high risk of getting Covid. Within one person, you can also have more than one subtype of virus, but that is beyond the scope of this report. It is likely that within a week or two of publication of my tidy note, the news media in the US will be discussing the Lambda variant more, and its possible interaction with Delta.

Despite moderate complacency in the US, covid is spreading rapidly OUS – for example Indonesia, Phillipines, etc. Fortunately for Lakeland, they can distribute globally and have operations detailed here. From the 10-k – “In addition to the United States, sales are made to more than 50 foreign countries, the majority of which were into China, the European Economic Community (“EEC”), Canada, Chile, Argentina, Russia, Kazakhstan, Colombia, Mexico, Ecuador, India and Southeast Asia.”

Manufacturing is in 6 countries: USA, Vietnam, India, China, Mexico, Argentina with recent expansions in Mexico, India, and Vietnam.

Asian distribution can be handled by sales offices in Australia, India, and China. They sell directly to end users and through other distributors. Although the USA historically has been the largest customer of LAKE’s products, that can change due to Covid.

Sellside consensus numbers:

Announcement Of A Buyback Program

What to do with all that balance sheet cash? On Feb 17, 2021, they announced a $5 million buyback program. They were essentially refilling a buyback authorization that was close to running dry. With the stock tanking due to the belief that covid has ended, they put in a new $5 million authorization on July 7. Since May 1 through July 7, LAKE bought back 227,454 shares at an avg price of $22. The most recent ownership data I have is from the end of March, and due to volatility – I assume it is quite stale. The stock is at the level where the company bought back a lot of stock. The virus is growing outside the USA to the point where governments themselves may be threatened. A new report from South America based Credicorp Capital’s Andean Covid-19 Monitor dated 7/19 shows % Covid positive rates in a few countries.

Columbia – 9%, Mexico – 33.4%, Peru – 13.9%, Chile – 8.9%, Brazil 35.7% Mexico, Brazil and Peru are the frightening laggards in simply testing the population. In my opinion, those 3 are powder-kegs.

The Opportunity: Movement in the stock is shared between short term traders vs. investors. The traders are relying on moving averages, overbought/oversold indicators, etc. They have never looked at a balance sheet or statement of cash flows. Rational investors look at traders as prey. The prey creates opportunities for investing. The ownership profile of Lakeland as of the end of March is dominated by US owners. The virus is global. Lakeland distributes globally and has manufacturing in Mexico and Argentina that can easily address the explosion south of our border. They are ready to supply in the far east, also.

For quant nerds, as the share count decreases ROI, ROE etc rise. Over the past few years, Lakeland has, in their spare time diversified raw material sources to improve the gross margin profile, regardless of covid or no covid. The SKU count has dropped, creating more operating leverage.

In 12 months, we will be looking at LAKE on cal 23 numbers. Depending on buybacks, I am figuring about $9-$10 per share in cash with no debt, and “normalized” earnings of $2.25. Net-Net working capital might be close to $14. A simple 13 multiple on $2.25 = $29.25 but you must add the excess cash to that which gives a back of envelope target of $39

What if I am wrong? Given the balance sheet and company buyback with what I believe are abnormally strong numbers coming for longer than is embedded in the stock price, you could have dead money. So, a flat stock or a stock that could be close to double in a year is not too shabby.