Blockchain Valley Ventures is glad to announce that they have conducted a very thorough, quantitative research on the state of DeFi. They have primarily focused on projects that have done a token launch recently and looked to assess what it needs to create strong growth, build a community and generate relevant traction.

Q1 2021 hedge fund letters, conferences and more

Key Messages from report

- We are still very early in the DeFi development, despite large price appreciation. DeFi is still in the first quarter.

- Returns of over 10,000% in some investments with a overall market cap having grown to a Total Value Locked of over USD100bn and a market capitalization of USD90bn

- Blue-chip projects in crypto deliver and investors have made outrageous returns investing in the best teams, despite clearly delayed timelines

- Little external funding is necessary to create large markets, leading DeFi to likely not appear on investor’s radar for a while

- Teams & operations for large DeFi projects remain low, with an average team size of 10 people in DeFi

- Ethereum is still the key ecosystem, but runner-ups like Binance Smart Chain, Polkadot, and Solana are catching up and promise to become relevant additional platforms in DeFi

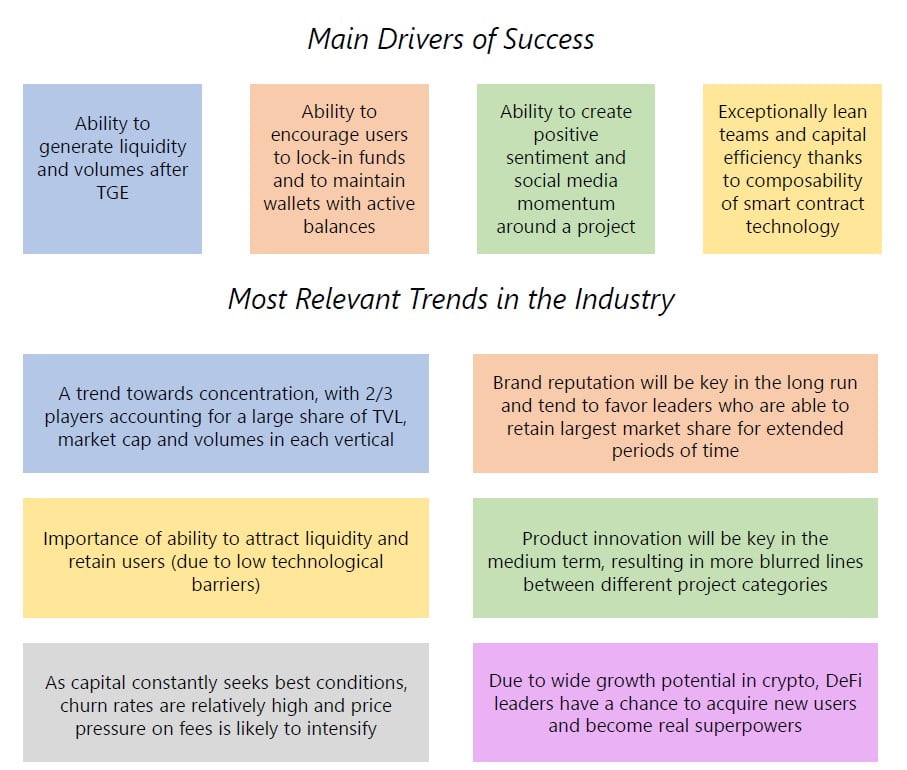

- Strong projects capture most of the value creation, therefore building strong communities that provide long-term support is key to drive token adoption

- Investors can be key in order to support the community creation through their signalling and branding effects

- The next frontier in crypto is DeFi and it will eventually decentralized every area of financial services

Key facts:

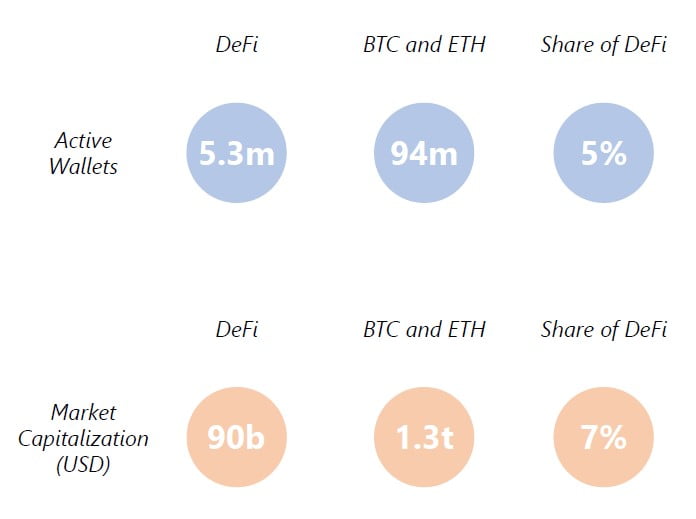

- Yet limited penetration of DeFi even in crypto with just 5-7%

- DeFi attracted USD1bn of funding since 2017 and has turned this funding into a market cap of close to USD100bn, equalling a 100x value appreciation on the capital invested

- Token funding in DeFi makes up over 70% of total funding and is suggested a key parameter for the strong developments. Token economics drive hyper-exponential growth

- European projects have raised least money since 2017 but have attracted most money in 2020. 2021 is expected to yield the rewards from investments in 2020

- 75% of total funding is allocated on projects building on Ethereum, with Multichain, Polkadot and Solana growing fast but from a smaller base

- 60% of projects delivered above 3x and 30% above 10x returns usually within 12 to 18 months, with DEXs providing highest returns followed by Liquidity Aggregators

- The extreme asymmetry of risk/reward makes this market very attractive, however small funding requirements and high complexity, does makes this a difficult market to enter

- Particularly, the areas insurance, staking derivatives, DAOs and social & creators are hot sectors that will likely make 2021 their year

Executive Summary

An in depth analysis of DeFi turn data into insights

The picture that results from this research comprising of approximately 100 DeFi companies, net of market swings which can be very wild over time, is the tale of a new, thriving asset class that is here to stay.

- DeFi has attracted more than USD1b in funding since 2017 at the beginning mostly via tokens, subsequently mostly from institutional investors.

- A staggering 60% of projects delivered at least 3x (i.e. beating the top quartile of traditional VC returns), with close to 30% returning 10x or more, with the additional benefit of a super fast path to liquidity.

- Decentralized exchanges and liquidity aggregators delivered the best returns (46x and 22x respectively), with individual projects returning as much as 762x (by simply comparing current token price with token price at TGE), easily beating the market.

- DeFi reached a Market Capitalization of USD90b in less 18 months and with wide room to grow further as it represents just 5 7% of total crypto industry according to some metrics.

The Future Of DeFi

Ian Lee - Partner, IDEO CoLab Ventures & Co Founder, Syndicate

“Pretty much every area of financial services we believe will eventually be decentralized.”

I entered crypto seven years ago and we worked with teams since then We saw early on that crypto was going to make a big impact on financial services and the only question was how that would happen.

Even before DeFi was the thing, we were looking at what we called “open financial systems” We were convicted about the utility of this sector, hence we started investing in early 2019 supporting teams in protocol and product innovation We were excited by bonding curves and automated market making models allowing to match liquidity outside of centralized coordination of markets.

DeFi felt special to us because it offers things to the world that were very difficult, or impossible to replicate using traditional tools and technologies At the beginning people thought we were crazy and told us that DeFi would not scale and timing was not right We took the risk and continued with what we believed in Our portfolio today includes everything from exchanges, auctions, lending, to derivatives We believe that p retty much every area of financial services will eventually be decentralized.

This space is so new and is moving so fast that the best investors are the ones closest to the technical, product level innovations and developments This is important because, in the same way we identified the bonding curve primitive as a strategic, unfair advantage over centralized and traditional finance.

Spending time improving, modifying and iterating, building and deploying and testing, makes people with those capabilities and expertise able to see the future faster and clearer Good teams can pick and chose their investors DeFi founders are choosing partners that can help them build as co founders.

A new project that we co founded and funded together with other players in the crypto and traditional VC space, like Electric Capital and Kleiner Perkins, is called SyndicateDAO It is a decentralized investing protocol crossed with social network functionality, so maybe best described as a decentralized version of AngelList It aims to democratize investing and leverages on the same primitives from DeFi that can also be applied to the investment world It did not make sense to me that crypto projects are decentralized and capital behind them remains highly centralized.

W e are further looking to solve a core problem in the world in terms of who can access and participate in development and prosperity associated with some of the world's most important technology creations and industries This will also address the problem of wealth inequality over time.

We believe the way people interact with the internet, will be materially different We expect platforms to decentralize governance Mixed with the “social everything”, this will have a sharp impact on finance and shape new DeFi applications and allows us to look through the hype and see the ginormous value creation potential in the long run.

Currently, we see a lot of potential outside the US, and we are also looking at cross chain opportunities on for example Cosmos, Terra and Thorchain We are excited about the crossroads of DeFi and NFTs, DeFi and DAOs and have the general belief that value and investing is about to move further up the stack to the social networking layer DeFi and Social is therefore an area we focus on.

Next big battleground is not linked to liquidity but social networks enabled on top of DeFi Like crypto, DeFi will continue to have boom and bust cycles but I really think we are really in the second inning of a nine inning ballgame for DeFi.

It is inevitable that decentralized finance is going to eat traditional finance at scale Whether this happens now or in a few years is secondary

The Birth Of DeFi

How we got here

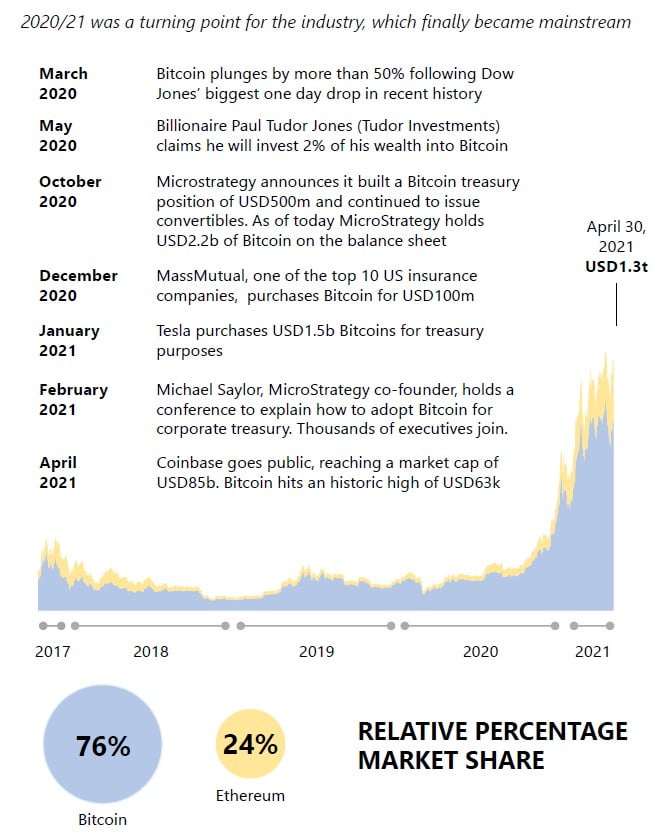

How Crypto Staged A Powerful Come Back

Driven by explosion of BTC and ETH, crypto reached USD1.3t in value

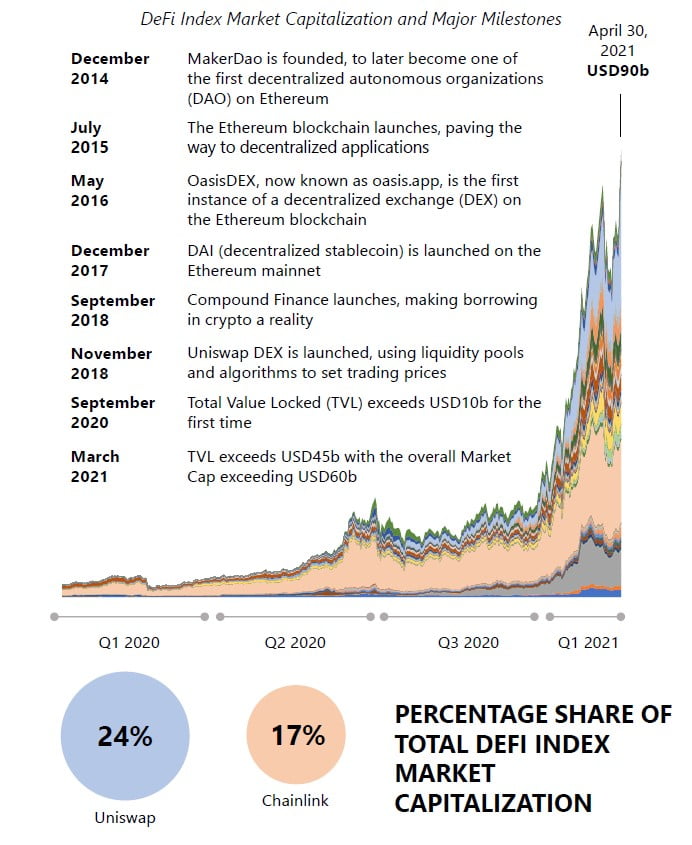

Pace Of Innovation Accelerated Further

In just one year, DeFi went from zero to the driving force of growth for crypto

Despite Explosive Growth, DeFi Just Started

A comparison with BTC, ETH clearly indicates DeFi is still an infant industry

Despite a dramatic growth in DeFi companies since 2020, data clearly shows how much room for growth DeFi still has: - DeFi Active Wallets, i.e. one of the most important drivers of appreciation of tokens, represent only 5% of BTC and ETH - DeFi Market Capitalization, despite climbing to a noteworthy USD90bn, corresponds to just 7% of the total Market Cap for BTC and ETH.

Read the full report here.