Bitcoin is on the rise again, although it recently dropped by 53%, mimicking the last Bitcoin plunge in 2019. After that 2019 fall, it slipped an additional 62% in 2020. Analysts believe this fall may happen again, but many are optimistic given Bitcoin’s rise over the weekend. Some investors are encouraged by the idea to buy now, but others are turning back to other crypto assets to hedge against the volatility. PAXG, a gold-backed stablecoin, is one place people are turning to escape volatility in the crypto market. Backed by the gold price, digital gold tokens are on the rise.

Q1 2021 hedge fund letters, conferences and more

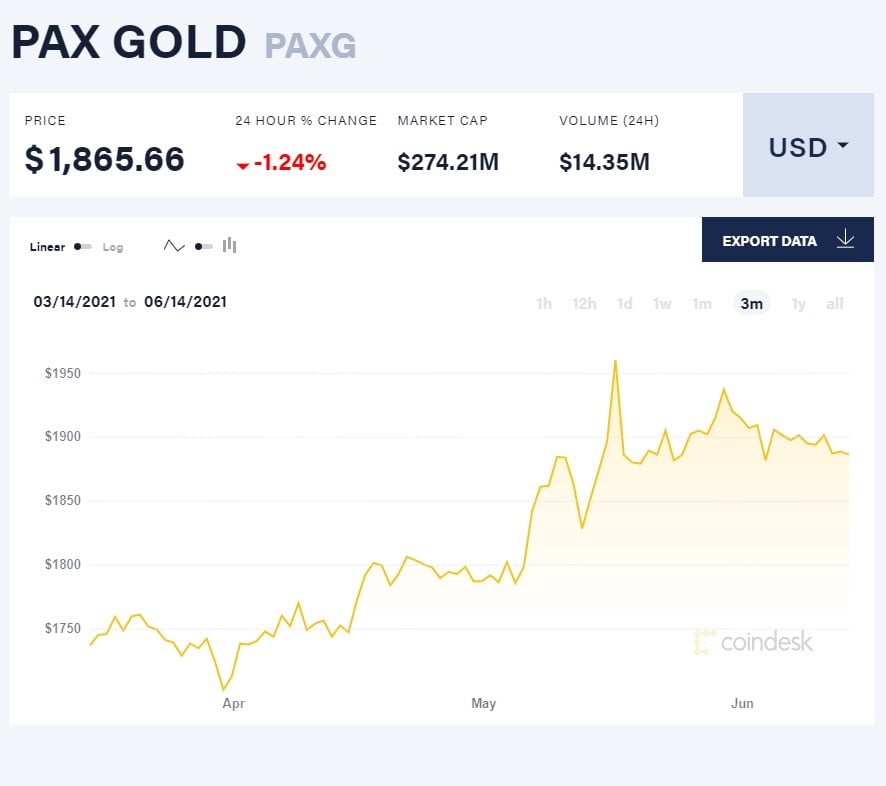

PAXG has steadily increased over the past few months, despite its competition with gold-backed stablecoin Tether Gold (XAUT). In fact, PAXG just saw a major push in May after Warzirx, an India-based exchange under Binance, listed it for trading.

Source: CoinDesk

Demand for PAXG through Warzirx could prove to be important for the price of PAXG since India is a major source of gold demand in the world. Culturally significant, gold is often purchased in India for holidays, weddings, and more. Therefore, this new realm for investing could partially explain the 2.5x increase in the PAXG supply. But this might not account for the entire picture.

Instead, Carl Vogel, a senior production manager at Paxos, attributes the recent success of PAXG to rising investor demand. More specifically, he sees this as a response to the fears over inflation and the volatile cryptocurrency market. PAXG trades primarily on Binance. However, Paxos saw institutional investors making direct investments with them for PAXG over the past six months.

Inflation Now: Contributing to the Rise of PAXG?

Consumer prices are up 5% in the past year from May 2020 to May 2021. This is the fastest pace since August 2008, on par with the reopening economy and further use of stimulus payments. Additionally, the recent cyberattack on the Colonial Pipeline and the meatpacking giant JBS also contributed to major price rises. Independent hacking groups ransomed supplies of gasoline and meat, leading to production shutdowns. The FBI may have been able to seize the ransomed assets back, but this did not fully restore gasoline prices to the levels they were before the attack.

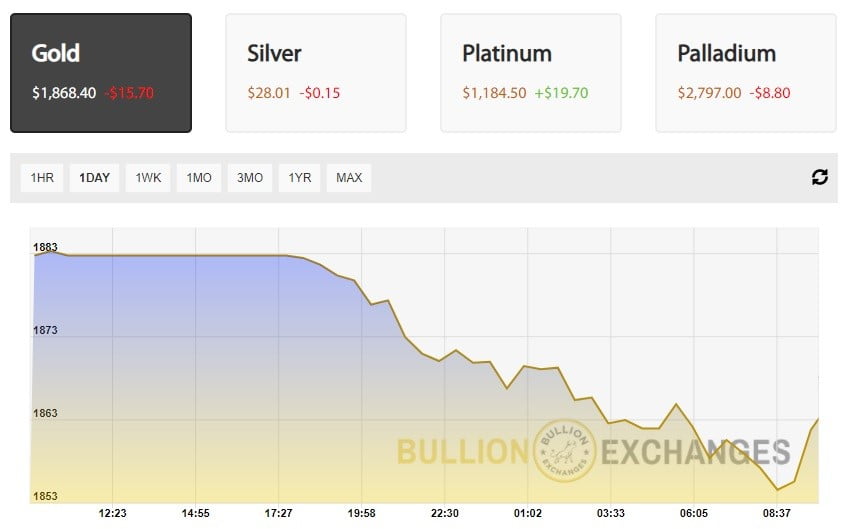

Inflation, aggravated by limited supply, further ramps up concern for the strength of the dollar. Although normally this would show a rise in cryptocurrency and gold, Bitcoin's recovery is slow. Similarly, the gold price struggles to keep above the $1,900 level, continuing the battle from last week. Gold fell at Monday's open to a low of $1854 per oz.

Source: Bullion Exchanges

The US dollar pointed up last week, contributing to a resurgence in trust in the dollar, for now. Gold and silver are down today amid recent market optimism in the lack of geopolitical or economic turmoil. How this may continue given the surge in COVID cases in the UK with the new Delta variant is uncertain.

Gold-Backed Stablecoins: PAXG or Tether Gold (XAUT)?

Gold backs both PAXG and Tether Gold, and you can cash out your crypto for physical gold anytime. There are no custody or insurance fees for either gold-backed stablecoin, and it is just as easy to buy as Bitcoin is. But what are the main differences between the two?

Both PAXG and XAUT are stablecoins backed by 1 fine troy oz of London Good Delivery bars, and you can own fractional stakes of gold for both. However, a major benefit of PAXG is its transparency with investors. Paxos discloses that all the gold for PAXG is stored in Brinks’ vaults in London, one of the most secure vaults in the world. Meanwhile, Tether Gold’s vaults are mostly unknown except for the fact that they are in Switzerland. This lack of fine details is not unfamiliar for Tether, they also operate the successful USDT stablecoin mysteriously.

On top of that, Paxos is the first cryptocurrency company that the New York State Department of Financial Services approves of and regulates. The government monitors and authenticates the tokens, making them highly reliable in comparison to any of its competition. PAXG utilizes the Ethereum smart contract system. Each token contains info on the gold bar associated with PAX via the serial number and brand code. Additionally, PAXG does not charge a commission for storing the physical gold for your gold-backed stablecoin.

Arcane Research is a cryptocurrency portfolio company. One of their analysts Velte Lunde said that gold tokens are the most liquid cryptocurrency. These are very easy to buy and sell, and you never have to deal with the physical gold if you decide not to “cash-out” of your digital holdings. Perhaps Bitcoin is still king of the crypto market. As more investors move in, some may be drawn in by gold-backed stablecoins.

Where Does Digital Gold Go From Here?

New demand for PAXG may continue to rise as more and more companies list it for trading through their application. Although not yet available on Coinbase, Binance sees the most trading of PAXG behind those who buy direct from Paxos. New demand for PAXG also stems from Metawhale Gold. This program holds reserves of the gold-backed stablecoin to act as an inflationary balance and insurance policy for holders.

The recent pullback in crypto confidence and the correction of Bitcoin and Ether add to the appeal of PAXG. The gold-backed stablecoin is viewed as a more stable digital asset. As Bitcoin and Ether move up and down sporadically, PAXG opens the world of gold investing to traders of all kinds. This is especially true for younger traders new to investing. PAXG is easy to understand: it is a digital token that represents gold ownership. It is not paper gold: you can easily take ownership of your physical gold anytime through an authorized dealer, like Alpha Bullion.

Vogel of Paxos also recently stated in an interview with Coindesk:

“If you are an institutional money manager, when the market starts to become volatile and the crypto market starts to become volatile, you may need to allocate your portfolio to compensate for that to make sure you are meeting your certain risk thresholds. Therefore, gold tends to be, in very volatile times, a very natural and great asset class to go ahead and diversify into.”

Vogel advocates for gold as a hedge against uncertainty. As crypto-assets face more restrictions, the crypto market can become a very uncertain place. PAXG trades 1:1 with the gold price, making it far less subject to massive spikes or crashes.