Rewards credit cards are a great way to earn free perks; simply for making purchases. You won’t need to pay interest either when paying your statement in full each month.

This guide compares the best credit cards for rewards in 2024. Read on to discover the top rewards cards for travel, cash back, air miles, and more.

Best Credit Cards for Rewards Reviewed

Let’s get straight into our reviews of the best credit cards for rewards in 2024.

1. Citi Double Cash® Card: Overall Best Rewards Credit Card for Beginners

The Citi Double Cash® Card is our overall top pick. First-time applicants will receive $200 cash back after spending $1,500 on purchases. You’ll have up to six months to hit your target, making it ideal for credit card beginners. In addition, the Citi Double Cash® Card offers unlimited 1% cash back on all purchases.

Once the purchase is settled with Citi, you’ll get an extra 1% cash back. Crucially, there are no category restrictions, meaning all purchases are eligible. Another benefit is that cash back is increased to 5% when making bookings via the Citi Travel portal. This offer is extended until the end of 2024.

This is also one of the best credit cards for balance transfers. You’ll get 0% APR for 18 months. After that, you’ll pay an APR of between 19.24% and 29.24%, depending on your credit score. The balance transfer fee is 3% when completed within four months of being approved. Finally, the Citi Double Cash® Card comes without application and annual fees

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Citi Double Cash® Card | $200 cash back after spending $1,500 on purchases within six months. | Unlimited 2% cash back on all purchases. 1% is paid when making the purchase, while the other 1% is paid when settling the transaction. 5% cash back on Citi Travel bookings. | None | 0% on balance transfers for the first 18 months. Standard APRs of between 19.24% and 29.24% |

Pros

- Best rewards credit card for first-timers

- Get $200 cash back when spending $1,500

- Unlimited 2% cash back on all purchases

- No annual fees

- 0% APR on balance transfers within the first four months

Cons

- APRs of up to 29.24% when monthly statements aren’t settled in full

2. Wells Fargo Active Cash® Credit Card: Best Option for Unlimited Cash Back With 0% APR on Purchases

Wells Fargo Active Cash® Credit Card is a great option for spreading out purchases. You’ll pay 0% APR for the first 15 months. This also includes balance transfers made within 120 days of being approved for the card. After that, the variable APR increases to 20.24%, 25.24%, or 29.99%.

The Wells Fargo Active Cash® Credit Card also comes with a generous introductory offer. First-time applicants will receive $200 cash back after spending just $500. You’ll have three months to hit the $500 target. When it comes to long-term rewards, the Wells Fargo Active Cash® Credit Card offers 2% cash back on all purchases.

There are no restrictions on spending categories and an unlimited amount of cash back can be earned. Cash back can be redeemed against your credit card statement, to a Wells Fargo account, gift cards, or via an ATM withdrawal. Additional card benefits include $600 worth of cell phone protection and zero liability protection. No annual fees are charged.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Wells Fargo Active Cash® Credit Card | $200 cash back after spending $500 on purchases within three months. | Unlimited 2% cash back on all purchases. No restrictions on spending categories. | None | 0% on purchases for the first 15 months. After that, APRs of 20.24%, 25.24%, or 29.99% |

Pros

- Popular rewards credit card for spreading out purchases

- 0% APR on purchases made within the first 15 months

- Earn an unlimited 2% cash back without category restrictions

- Introductory offer of $200 cash back when spending $500

- No annual fees

Cons

- Introductory cash back credited up to two months after meeting the spending target

3. Citi Custom Cash® Card: Best Option for Cash Back on Preferred Spending Categories

If you’re looking to earn rewards on a specific spending category, the Citi Custom Cash® Card could be the best option. In a nutshell, you’ll earn 5% cash back on your preferred category; capped at $500 per month. Among others, spending categories include grocery stores, gas stations, restaurants, and streaming services.

After you’ve reached the $500 limit, the cash back rewards are reduced to 1%. That said, you can earn an unlimited amount of cash back at the lower rate. First-time applicants can claim an introductory reward of $200. Simply spend $1,500 within six months of opening the account. There are no annual fees payable on this rewards card.

What’s more, you’ll get 0% APRs on all purchases and balance transfers for the first 15 months. Do note that balance transfers need to be made within four months of being approved. Standard APRs range between 19.24% and 29.24% depending on your creditworthiness. As always, you can avoid these high APRs by settling your monthly statement in full.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Citi Custom Cash® Card | $200 cash back after spending $1,500 on purchases within six months. | 5% cash back up to $500 on a preferred spending category. Unlimited 1% cash back thereon. | None | 0% on purchases and balance transfers for the first 15 months. Standard APRs of between 19.24% and 29.24% |

Pros

- Earn 5% cash back on your preferred spending category

- Unlimited 1% cash back after reaching your $500 monthly limit

- $200 introductory offer when spending $1,500

- 0% APR on purchases and balance transfers for 15 months

Cons

- Minimum cash back redemption of $100

4. Capital One Venture Rewards Credit Card: Best Option for Travel Rewards

One of the best options for frequent travelers is the Capital One Venture Rewards Credit Card. First-time applicants will receive 75,000 miles after spending $4,000 on purchases. However, this needs to be met within three months of opening the account. After that, you’ll get 2x miles for every $1 spent.

This increases to 5x miles when booking hotels or rental cars via the Capital One Travel portal. There are no limits on how many miles you can earn each month. In terms of value, Time explains that Capital One miles are worth between $0.01 and $0.022. The specific value depends on how the miles are redeemed.

The Capital One Venture Rewards Credit Card comes with additional travel perks which is ideal for those on the hunt for the best travel credit card. This includes 0% foreign transaction fees when making purchases outside of the US. You’ll also get a $100 credit for TSA PreCheck or Global Entry. However, do note that the card comes with an annual fee of $95. Moreover, this rewards credit card required an ‘Excellent’ credit score for approval.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Capital One Venture Rewards Credit Card | 75,000 miles after spending $4,000 on purchases within three months. | Unlimited 2x miles for every $1 spent. Increased to 5x miles when booking hotels or car rentals via the Capital One Travel portal. | $95 | 19.99%, 26.24%, or 29.99%, based on your creditworthiness. |

Pros

- Get 75,000 bonus miles when spending $4,000

- Get 2x miles for every $1 spent

- Earn 5x miles when using the Capital One Travel portal

- No limits on miles earned

Cons

- Annual fee of $95

- ‘Excellent’ credit rating is needed

5. Chase Freedom Flex® Credit Card: Best Option for Earning Rewards on Gas and Groceries

Chase Freedom Flex® Credit Card is a great option for earning rewards on gas and groceries. These two spending categories offer 5% cash back in the first year, capped at $12,000 worth of purchases. This means you can earn up to $600. However, one of the main drawbacks is that gas and grocery purchases made in Walmart or Target are not eligible.

In addition, the introductory offers a $200 bonus when spending $500 within the first three months. Standard cash back of 5% is available when making purchases on Chase Ultimate Rewards. You’ll also get 3% on dining, takeouts, and drugstore purchases. Any other spending categories are reduced to 1%.

Cash back rewards never expire, so can be redeemed at any time. The standard APR on the Chase Freedom Flex® Credit Card is between 20.49% and 29.24%. However, first-time applicants will get 0% APR on purchases and balance transfers for the first 15 months. Another benefit is that the card comes without annual fees.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Chase Freedom Flex® Credit Card | $200 cash back after spending $500 on purchases within three months. | 5% cash back on gas and grocery purchases in the first year (excluding Target and Walmart, up to the first $12,000). Standard cash back of 1-5% depending on the spending category. | None | 0% on purchases and balance transfers for the first 15 months. Standard APRs of between 20.49% and 29.24%. |

Pros

- New applicants get a $200 bonus for spending just $500

- Earn 5% cash back on gas and grocery purchases in the first year

- Unlimited cash back of between 1-5% on other categories

- 0% APR on purchases and balance transfers for 15 months

Cons

- Target and Walmart purchases are ineligible for 5% rewards

6. Delta SkyMiles® Gold American Express Card: Best Option for Air Mile Rewards

One of the best rewards credit cards for earning air miles is the Delta SkyMiles® Gold American Express Card. New cardholders will receive a generous introductory offer; 40,000 bonus miles are credited after spending $2,000 within the first six months. What’s more, there are no annual fees for the first year.

After that, you’ll pay $99 annually. The Delta SkyMiles® Gold American Express Card offers 2x miles for every dollar spent in US restaurants and supermarkets. 2x miles are also offered when making purchases directly with Delta. All other purchases are credited at 1x mile per dollar. Cardholders also receive one free checked bag for each Delta flight.

This is in addition to a $100 Delta credit when spending $10,000 in a calendar year. There’s also a 15% discount on travel bookings made via the Fly Delta app. Other perks include priority boarding and 20% cash back on in-flight purchases. Standard APRs range from 20.99% to 29.99%. Similar to most American Express rewards cards, you’ll need an ‘Excellent’ credit score.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Delta SkyMiles® Gold American Express Card | 40,000 miles after spending $2,000 on purchases within six months. | 2x miles with Delta on US dining and supermarket purchases. 1x miles on all other spending categories. Additional perks include priority boarding, one free checked bag, and in-flight discounts. | $99, but waived for the first year. | 20.99% to 29.99% |

Pros

- Some of the best credit card rewards for frequent flyers

- 40,000 bonus miles when spending $2,000 in the first six months

- 2x miles for every $1 spent in US restaurants and supermarkets

- Get priority boarding and a free checked bag on all Delta flights

Cons

- The introductory offer doesn’t include 0% APR purchases

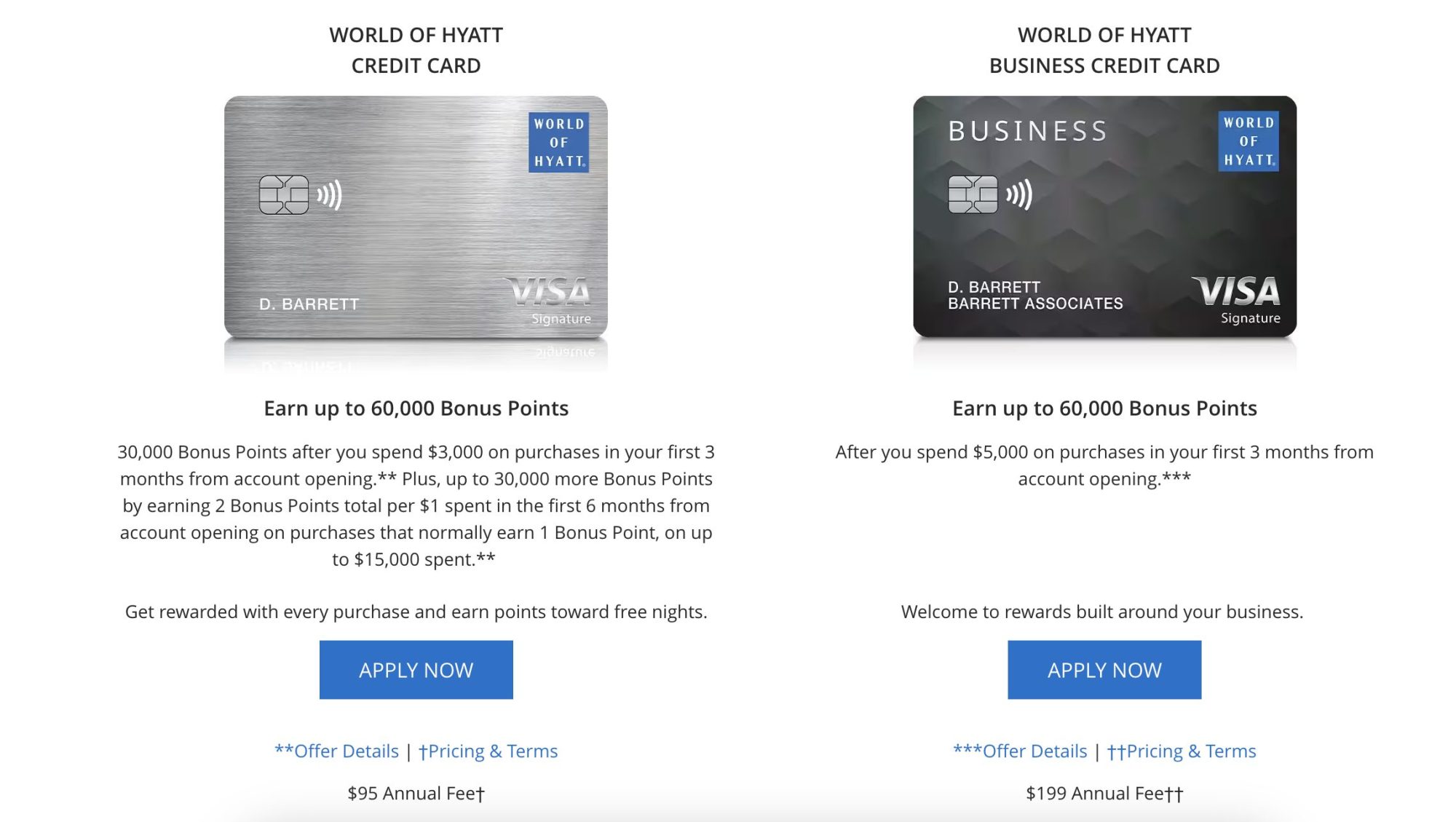

7. World of Hyatt Credit Card®: Best Option for Hotel Rewards

With over 1,300 hotels in 76 countries, Hyatt offers one of the best credit cards for hotel rewards. New customers will receive an introductory bonus of up to 60,000 Hyatt points. The first 30,000 points are credited after spending $3,000 within the first three months. The next 30,000 points are credited after spending $15,000.

However, you’ll only have six months after being approved. Cardholders earn 9 points for every $1 spent in Hyatt hotels and resorts. This is reduced to 2 points per $1 on dining, gym memberships, and airline purchases. All other purchases are credited at 1 point per $1. The World of Hyatt Credit Card® also offers complimentary World of Hyatt Discoverist status.

Cardholders also receive one free stay every year (category 1-4 hotels and resorts). A second night is offered when spending at least $15,000 in a calendar year. You’ll also receive five qualifying nights toward your next loyalty status. The World of Hyatt Credit Card® has an annual fee of $95 and APRs of between 21.49% and 28.49%.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| World of Hyatt Credit Card® | Up to 60,000 Hyatt points after meeting minimum spending requirements. | 9 points per $1 spent in Hyatt hotels and resorts. 2 points on dining, gym, and airline purchases. 1 point for other spending categories. Additional perks include World of Hyatt Discoverist status, one free stay, and five qualifying nights. | $95 | 21.49% to 28.49% |

Pros

- Best points credit card for hotel rewards

- Introductory offer includes up to 60,000 Hyatt points

- Earn up to 9 Hyatt points for every $1 spent

- Instantly receive World of Hyatt Discoverist status

- Get one free stay every year

Cons

- Annual fee of $95

8. Capital One SavorOne Cash Rewards Credit Card: Best Option for Earning Cash Back on Everyday Purchases

The Capital One SavorOne Cash Rewards Credit Card is one of the best options for earning cash back on everyday purchases. You’ll get unlimited 3% cash back on groceries, streaming services, entertainment, and dining. This is increased to 5% when booking hotels and rental cars via the Capital One Travel portal.

What’s more, you’ll earn 10% cash back on Uber and Uber Eats purchases until November 2024. All other purchases earn 1% cash back. Best of all, this rewards credit card comes without annual fees. You’ll also benefit from zero foreign transaction fees when making purchases overseas.

The Capital One SavorOne Cash Rewards Credit Card also comes with an attractive introductory offer. After spending just $500 within three months, $200 cash back will be credited to your account. New cardholders also receive 0% APR on purchases and balance transfers for the first 15 months. The APR increases to 19.99% – 29.99% thereon.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Capital One SavorOne Cash Rewards Credit Card | $200 cash back after spending $500 on purchases within three months. | 1-5% unlimited cash back depending on the spending category. 10% cash back on Uber and Uber Eats purchases until November 2024. | None | 0% on purchases and balance transfers for the first 15 months. Standard APRs of 19.99% to 29.99% |

Pros

- Earn 3% unlimited cash back on everyday purchases – including groceries

- 10% cash back on Uber and Uber Eats purchases until November 2024

- New customers get $200 cash back after spending $500

- No annual fees

- 0% APR on purchases and balance transfers for the first 15 months

Cons

- Walmart and Target purchases aren’t eligible for 3% cash back

9. U.S. Bank Altitude® Go Visa Signature® Card: Best Option for Foodies

The U.S. Bank Altitude® Go Visa Signature® Card offers the best credit card points for foodies. This rewards credit card offers 4x points for every $1 spent on food-related purchases. Not only does this include dining but also takeout and restaurant deliveries. You’ll also get 2x points for every $1 spent in grocery stores, gas stations, and streaming services.

Unlike other point credit cards, Walmart and Target purchases are eligible. All other spending categories earn 1x points for every $1 spent. U.S. Bank Altitude® Go Visa Signature® Card also offers 20,000 bonus points as an introductory offer. This values the offer at $200. Simply spend $1,000 within the first 90 days to qualify.

Points – which never expire, can be redeemed for cash back, gift cards, and travel. There is no annual fee and new cardholders get 0% APR for the first 12 months. This covers both balance transfers and purchases. After that, APRs range from 18.24% to 29.24%. According to U.S. Bank, its cards generally require a ‘Good’ to ‘Excellent’ credit score.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| U.S. Bank Altitude® Go Visa Signature® Card | 20,000 points ($200) after spending $500 on purchases within 90 days. | 4x points on dining and food deliveries. 1-2x points on other spending categories. | None | 0% on purchases and balance transfers for the first 12 months. Standard APRs of 18.24% to 29.24% |

Pros

- Best credit card for points

- 4x points on dining and food deliveries

- 2x points on groceries and other daily purchases

- Get 20,000 bonus points after spending $500

- No annual or foreign transaction fees

Cons

- APRs of up to 29.24% after 12 months

10. Bilt World Elite Mastercard® Credit Card: Best Option for Earning Rewards on Rent Payments

Bilt World Elite Mastercard® is one of the few credit cards to offer rewards on rental payments. You’ll receive 1 point for every $1 spent on rent, capped at 100,000 points annually. This is the case even if you don’t pay rent with a credit card. Simply complete the payment via the Bilt World Elite app and a check will be sent to the landlord on your behalf.

What’s more, you’ll earn 2x and 3x points per $1 on travel and dining purchases, respectively. All other purchases earn 1 point per $1. That said, all point values are doubled on the day you pay rent (excluding rent itself). This means you’ll earn 6 points for every $1 spent on US dining purchases.

This is also one of the best rewards credit cards for travel perks. Cardholders get trip cancellation and interruption protection, trip delay reimbursement, and zero foreign exchange fees. Although the Bilt World Elite Mastercard® Credit Card comes without annual fees, a major drawback is the lack of introductory rewards.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Bilt World Elite Mastercard® Credit Card | None | 1x points on rent payments. 2x to 3x on other spending categories. Points are doubled on the day you pay rent (excluding rent itself). | None | 21.49%, 24.49%, or 29.49%, based on your creditworthiness. |

Pros

- Earn rewards points when paying rent

- Earn up to 6x points on dining on rent day

- Travel perks include trip cancellation and interruption protection

- No annual fees

Cons

- No introductory offer for new cardholders

Rewards Credit Card Comparison

Still not sure which rewards credit card is right for you? Here’s a comparison of the best credit cards for rewards in 2024.

| Rewards Credit Card | Introductory Offer | Rewards | Annual Fee | APR | Learn More |

| Citi Double Cash® Card | $200 cash back after spending $1,500 on purchases within six months. | 2% cash back on all purchases. 1% is paid when making the purchase, while the other 1% is paid when settling the transaction. 5% cash back on Citi Travel bookings. | None | 19.24% and 29.24% | Check Eligibility |

| Wells Fargo Active Cash® Credit Card | $200 cash back after spending $500 on purchases within three months. | Unlimited 2% cash back on all purchases. No restrictions on spending categories. | None | 0% on purchases for the first 15 months. After that, APRs of 20.24%, 25.24%, or 29.99% | Check Eligibility |

| Citi Custom Cash® Card | $200 cash back after spending $1,500 on purchases within six months. | 5% cash back up to $500 on a preferred spending category. Unlimited 1% cash back thereon. | None | 0% on purchases and balance transfers for the first 15 months. Standard APRs of between 19.24% and 29.24% | Check Eligibility |

| Capital One Venture Rewards Credit Card | 75,000 miles after spending $4,000 on purchases within three months. | Unlimited 2x miles for every $1 spent. Increased to 5x miles when booking hotels or car rentals via the Capital One Travel portal. | $95 | 19.99%, 26.24%, or 29.99%, based on your creditworthiness. | Check Eligibility |

| Chase Freedom Flex® Credit Card | $200 cash back after spending $500 on purchases within three months. | 5% cash back on gas and grocery purchases in the first year (excluding Target and Walmart, up to the first $12,000). Standard cash back of 1-5% depending on the spending category. | None | 0% on purchases and balance transfers for the first 15 months. Standard APRs of between 20.49% and 29.24%. | Check Eligibility |

| Delta SkyMiles® Gold American Express Card | 40,000 miles after spending $2,000 on purchases within six months. | 2x miles with Delta on US dining and supermarket purchases. 1x miles on all other spending categories. Additional perks include priority boarding, one free checked bag, and in-flight discounts. | $99, but waived for the first year. | 20.99% to 29.99% | Check Eligibility |

| World of Hyatt Credit Card® | Up to 60,000 Hyatt points after meeting minimum spending requirements. | 9 points per $1 spent in Hyatt hotels and resorts. 2 points on dining, gym, and airline purchases. 1 point for other spending categories. Additional perks include World of Hyatt Discoverist status, one free stay, and five qualifying nights. | $95 | 21.49% to 28.49% | Check Eligibility |

| Capital One SavorOne Cash Rewards Credit Card | $200 cash back after spending $500 on purchases within three months. | 1-5% unlimited cash back depending on the spending category. 10% cash back on Uber and Uber Eats purchases until November 2024. | None | 0% on purchases and balance transfers for the first 15 months. Standard APRs of 19.99% to 29.99% | Check Eligibility |

| U.S. Bank Altitude® Go Visa Signature® Card | 20,000 points ($200) after spending $500 on purchases within 90 days. | 4x points on dining and food deliveries. 1-2x points on other spending categories. | None | 0% on purchases and balance transfers for the first 12 months. Standard APRs of 18.24% to 29.24% | Check Eligibility |

| Bilt World Elite Mastercard® Credit Card | None | 1x points on rent payments. 2x to 3x on other spending categories. Points are doubled on the day you pay rent (excluding rent itself). | None | 21.49%, 24.49%, or 29.49%, based on your creditworthiness. | Check Eligibility |

What to Know About Credit Card Rewards

In simple terms, rewards credit cards allow you to earn ‘rewards’ when making purchases. In many cases, credit card rewards are free, assuming there are no annual fees and you clear your statement balance in full every month.

The specific rewards you can earn will vary depending on the type of credit card. This covers everything from cash back and air miles to hotel points and business perks. Let’s explore how the best credit cards for rewards work in more detail.

Cash Back

Cash back is the most popular type of credit card reward. Every time you make an eligible purchase, you’ll receive a percentage back.

- For example, suppose your chosen rewards credit card offers 3% cash back.

- Throughout the month, you make $3,000 worth of purchases.

- You receive $90 worth of cash back.

- This can usually be used to offset your credit card statement.

- This means you’ll pay $2,910, even though you spent $3,000.

There are some important terms to look for when selecting a credit card for cash back rewards.

For a start, cash back percentages are often based on the spending category. For instance, you might get 5% cash back when using the credit card for dining purchases. But only 1% on when using the card for gas.

Additionally, some credit cards offer unlimited cash back. However, others cap the cash back rewards up to a certain amount each month or year.

Crucially, cash back credit cards are best used for everyday purchases. After all, you’ll receive rewards for purchases you were going to make anyway.

Airline Miles

Airline miles, or simply ‘air miles’, are aimed at frequent flyers. Instead of receiving cash back, you’ll earn rewards that can be used with airlines.

- For example, suppose your credit card offers 5 air miles for every $1 spent.

- After spending $10,000, you’ll have 50,000 air miles.

- Depending on the airline, this could be enough to cover an entire trip.

Not only can air miles be used to pay for flights but also business class upgrades. The specific exchange rate will depend on the rewards credit card. What’s more, you might need to use a specific airline like Delta. In other cases, the air miles can be used with any airline of your choosing.

Air mile credit cards usually come with additional travel perks. For example, consider the Delta SkyMiles® Gold American Express Card. Holders receive priority boarding on all Delta flights. Not to mention one free checked bag.

Additionally, air mile credit cards will often come with travel insurance, discounts on in-flight purchases, and TSA PreCheck credit.

Hotel Points

Some of the best credit cards for rewards specialize in hotel points. You’ll need to choose a specific hotel franchise, such as Marriott Bonvoy or Hilton. That said, one of the most popular is the World of Hyatt Credit Card®.

- For every $1 spent, this credit card offers between 1 and 9 Hyatt points.

- Hyatt points can be used to pay for hotel stays.

- Not only that, but the World of Hyatt Credit Card® also offers World of Hyatt Discoverist status, which comes with additional perks.

- The card also comes with one free night per year, with an extra night offered when spending at least $15,000 in a calendar year.

It’s best to focus on one hotel rewards program. This will give you the best chance of increasing your loyalty status. And in the meantime, earn credit card rewards every time you stay. This is because you’ll earn bonus points when using the card within the hotel, including food and beverage.

Business Rewards

Some rewards credit cards are aimed at businesses. These credit cards can be lucrative for business owners, considering that purchase amounts are likely to be larger than personal cards. Rewards can come in many different forms, including cash back, air miles, and hotel points.

It’s best to choose a card that aligns with the business. For example, if a credit card is used to make day-to-day business purchases, cash back might be the best option. However, if the card is used to book international flights, air miles might be preferable.

Choosing the Best Rewards Credit Card

You must consider whether rewards credit cards are right for your financial circumstances. The rewards you receive are only worthwhile if you’re paying your balance in full every month. If you don’t, you’ll likely be paying more interest than the rewards are worth.

The only exception here is if you get an introductory offer. For instance, some rewards credit cards offer 0% interest for the first 12-15 months. Most importantly, if there’s a chance you won’t meet the minimum monthly payments; avoid getting a rewards credit card.

Not only can missed payments result in additional fees but you’ll harm your credit score. Another important factor is the type of rewards card. For example, frequent flyers should focus on credit cards offering air mile rewards.

Those spending long periods in hotels should stick with hotel loyalty points. If you’re planning to use your credit card for day-to-day purchases like gas and groceries, cash back rewards are the best option.

Another thing to consider is your ‘earn and burn’ strategy. For instance, how do you plan on ‘earning’ reward points throughout the month? Although using your credit card to earn rewards is wise, you shouldn’t buy things solely for this purpose.

Only use the card if you were planning to make the purchase anyway. Similarly, consider how you will ‘burn’ the points, meaning redeem them. Some redemption methods can be more favorable than others. For example, using cash back to offset a credit card statement is often better than receiving a gift card.

How to Compare Credit Cards for Rewards

This section will help you choose the best credit card for rewards in 2024. We cover the most important factors to explore, including the type of rewards, introductory offers, and annual fees.

Introductory Offer

Depending on your goals, it can be worthwhile taking out a rewards credit card simply for the introductory offer. This offers bonus rewards for first-time cardholders, often after meeting minimum spending requirements.

- For example, the Citi Double Cash® Card comes with $200 in cash back. The only requirement is to spend $1,500 within the first six months.

- The Wells Fargo Active Cash® Credit Card offers even more favorable terms. While you’ll still get $200 in cash back, only $500 needs to be spent to qualify.

If you’re more interested in travel-related perks, there are plenty of introductory offers to consider. For instance, the World of Hyatt Credit Card® offers up to 60,000 Hyatt points after meeting minimum spending requirements. While the Delta SkyMiles® Gold American Express Card offers 40,000 air miles after spending $2,000 within the first six months.

If you don’t meet the spending requirements, you’ll lose out on the introductory offer. Therefore, make sure you’re aware of the required terms before applying for the card.

Not all rewards credit cards come with introductory offers. Moreover, the introductory offer might not necessarily be worth targeting. For instance, suppose you want the World of Hyatt Credit Card® to get complimentary Discoverist status. In this instance, you might decide against the minimum spending requirement.

Type of Rewards

You should focus on credit cards that offer the most suitable rewards for your circumstances. For example, if you only travel a couple of times each year, it doesn’t make sense to target air miles or hotel points. Instead, cash back is likely the best option.

That said, if you’re a frequent flyer, make sure you choose the right rewards program. For instance, the Delta SkyMiles® Gold American Express Card will only be suitable if you frequently travel with Delta Air Lines.

Similarly, the World of Hyatt Credit Card® should only be considered if you regularly stay in Hyatt hotels.

Spending Categories

The best credit cards for rewards usually come with spending categories. Put simply, this means your rewards depend on the type of purchase being made.

- For example, if you spend a lot of money on gas and grocery purchases, the Chase Freedom Flex® Credit Card is worth considering. These spending categories pay up to 5% in cash back. While other categories pay between 1-3%.

- Alternatively, if you regularly spend money on food-related purchases, the U.S. Bank Altitude® Go Visa Signature® Card is the better option. You’ll get 4x points for every $1 spent on takeouts, food deliveries, and dining. In contrast, gas station purchases pay just 2x.

- If you don’t have a standout spending category, the Citi Double Cash® Card is a great option. You’ll get unlimited 2% cash back on all purchases, regardless of the category. Do note that you’ll receive 1% when making the purchase, and another 1% when settling the statement.

Spending categories should also be considered when targeting other reward types. For instance, the Capital One Venture Rewards Credit Card offers 2x miles for every $1 spent. However, you’ll get 5x miles on travel-related bookings. Some cards offer higher points on airline purchases, and others on hotels.

Ultimately, you should spend some time assessing where you spend the majority of your money each month. You can then focus on rewards credit cards that align with your spending categories.

Rewards Limits

Another important factor is the rewards limits set by the credit card provider.

For example, the Citi Custom Cash® Card offers 5% cash back on your preferred spending category, whether that’s gas, groceries, or streaming. However, the 5% rate is capped at $500 per month.

After that, the cash back rate is reduced to just 1%. This means that the Citi Custom Cash® Card is more suitable for conservative spenders.

Higher spenders will be more suited for the Citi Double Cash® Card. Although the cash back rate is lower at 2%, there are no limits.

Annual Fee

Fees should also be considered when browsing the best credit cards for points. After all, some credit cards come with annual fees. This needs to be paid irrespective of whether you use the card.

Now, we should note that just because annual fees are charged, it can still make sense to take out the card. However, it all depends on the rewards that you expect to receive. And how this compares to the annual fee.

For example:

- Suppose you’re planning to travel for several months and are considering the World of Hyatt Credit Card®.

- This credit card comes with an annual fee of $95. Once approved, you’ll automatically secure World of Hyatt Discoverist status

- This gets you various perks, such as late checkout, premium internet, and free water. Ordinarily, you’d need to stay 10 nights in a calendar year to secure this status, which will invariably cost a lot more than $95.

- Moreover, the World of Hyatt Credit Card® offers one free stay per year, plus up to 60,000 points when meeting the minimum spend requirements.

- Taking all of this into account, the $95 annual fee pays for itself.

The same methodology should be applied to cash back credit cards. For example, suppose you’re paying $100 in annual fees. You get unlimited 2% cash back on all purchases. To cover the annual fee, you’d need to spend at least $5,000.

0% APR Period

According to CNBC, the average APR (Annual Percentage Rate) on general-purpose credit cards is now 21.19%. Fortunately, the best credit cards for rewards come with introductory offers. In many cases, you can secure 0% interest for over a year.

For example, the Wells Fargo Active Cash® Credit Card offers 0% APRs on purchases and balance transfers for the first 15 months. This means that you’ll avoid paying interest even if you don’t pay the statement balance in full. However, you’ll still need to pay at least the minimum, which is often 5% of the outstanding balance.

Nonetheless, using an interest-free credit card can help you maximize your rewards. This is especially the case when targeting a high-value introductory offer.

Just remember that 0% APRs on balance transfers usually come with transfer fees. According to Experian, this averages 3-5% of the transfer value.

Eligibility

Your credit score will not only determine your APR, but whether you’re eligible for your chosen rewards credit card. Put simply, some of the best credit cards for rewards are only available to those with ‘Excellent’ credit.

As such, those with bad credit are rarely eligible for the best rewards. The key problem is not all lenders display their eligibility requirements.

Nonetheless, a good starting point is to use a credit card eligibility checker. After entering your personal and financial details, the platform will run a ‘soft’ credit check. This should give you an idea of what rewards credit cards you’re eligible for.

Crucially, soft credit checks do not appear on your credit report, meaning your score isn’t harmed.

Additional Perks

It’s also worth checking whether your preferred rewards credit card comes with additional perks.

For example, if you’re opting for an air miles credit card, perks can include travel insurance, priority boarding, and free checked baggage. Similarly, you might also get free airport lounge access, Global Entry credit, in-flight discounts, and zero fees on foreign transactions.

Another perk that all rewards credit cards should come with is fraud protection. This means you’ll be reimbursed if your credit card information is stolen or used without your authorization.

How Many Credit Cards Should I Have?

Many consumers ask the question “How many credit cards should I have?”. According to certified financial planner Cathy Curtis, the optimal number is two credit cards, although three should be the maximum.

Any more than this can hurt your credit score, as each application is visible to the main credit bureaus.

Pros and Cons of Credit Cards for Rewards

Still not sure whether rewards credit cards are right for you?

Here are what benefits and drawbacks to consider:

Pros

- Earn rewards on purchases you would have made anyway

- Introductory offers often come with generous bonus rewards

- Many rewards credit cards come without annual fees

- You’ll avoid interest by paying your statement in full each month

- You can increase your credit score by always paying on time

- Additional perks can include airport lounge access and travel insurance

- Some cards come with 0% interest on purchases for over a year

Cons

- Non-introductory APRs are often high

- Interest and fees can mean you’re paying more than the rewards are worth

- Falling behind on repayments can harm your credit score

- An ‘Excellent’ credit score is often needed to get the best rewards

- There can be a temptation to make unnecessary purchases

Alternatives to Reward Credit Cards

Rewards credit cards might not be suitable for everyone. Here are some alternatives to consider:

Charge Cards

Just like rewards credit cards, charge cards allow you to make purchases with credit. They often come with rewards and perks too. However, charge cards not only require you to settle your balance in full every month but they often come without a credit limit.

As such, if you’re a high spender that always settles their credit card balance, charge cards could be a much better alternative.

For example, the Platinum Card® from American Express offers travel insurance, complimentary lounge access in over 500 airports, $240 worth of digital entertainment credit, and 5x points when booking flights and hotels.

Secured Credit Cards

If you’re unable to get a rewards credit card because of bad credit, secured credit cards could be a good alternative. Secured credit cards require an upfront payment, which is effectively your credit limit.

For example, if you put $1,000 on a secured credit card, your credit limit is also $1,000. This can help you build your credit score over time. Once you’ve reached a suitable score, you can then consider a rewards credit card.

Debit Cards

Some debit cards also come with rewards. This is a great option if you don’t want access to credit.

For example, the Discover Cashback Debit Account offers 1% cash back on purchases, capped at $3,000 per month. Put otherwise, if you spend at least $3,000 each month, you’ll earn $360 after a year.

- Discover which is better, debit or credit cards here.

Balance Transfer Cards

If you’re currently paying interest on other credit cards, it could be worth getting a balance transfer card. These cards allow you to pay off credit card balances with high APRs.

In doing so, you’ll then owe money to the balance transfer card, but at 0% interest. Many balance transfer cards offer 0% APRs for 12-18 months. Once you’ve cleared your debt levels, you might then consider a rewards credit card.

- You can read more about how to avoid credit card interest here.

Methodology

There are hundreds of rewards credit cards to choose from. To provide a fair and impartial evaluation, we followed a strict methodology. This enabled us to rank the 10 best rewards credit cards for this comparison guide. Initially, we created a shortlist of reputable providers that are authorized to offer credit to US consumers.

We then developed sub-categories to cover each reward type, including air miles, cash back, hotel points, and business perks. We then analyzed the rewards offered and the required spending structure. For instance, how many points are awarded for each dollar spent, and what value each point carries once redeemed.

Redemption methods, minimums, limits, and time frames were also considered. We also looked at additional perks offered by each rewards credit card. For example, fraud protection, travel insurance, lounge access, and free hotel stays. Our methodology also ranked providers based on annual fees and APRs.

We also prioritized rewards credit cards with generous introductory offers. Not only in terms of bonus rewards but minimum spending requirements. Our research ensured that all financial circumstances were covered, meaning we ranked cards for people with various credit scores. These factors resulted in a well-rounded and transparent scoring system.

Conclusion

In summary, credit cards are a great way to earn rewards, whether that’s cash back, air miles, or hotel points. However, it’s important to consider the financial risks; rewards credit cards are only worth it if you pay your balance in full each month.

You should also consider whether the rewards are worth the minimum spending requirements and annual fee, if applicable. Always read the terms and conditions before applying for a card.

References

https://time.com/personal-finance/article/capital-one-miles-value/

https://www.cnbc.com/select/retail-credit-card-interest-hits-record-high/

https://www.experian.com/blogs/ask-experian/how-to-avoid-balance-transfer-credit-card-fees/

https://www.transunion.com/blog/personal-finance/what-is-apr

https://www.cnbc.com/2023/06/24/how-many-credit-cards-should-you-have-its-not-zero-say-experts.html

FAQs

What is the best credit card with rewards?

The Citi Double Cash® Card is one of the best rewards credit cards for everyday purchases. You’ll get unlimited 2% cash back on all spending categories.

Which credit card has the most benefits?

The Delta SkyMiles® Gold American Express Card comes with many benefits, including priority boarding, one free checked bag, in-flight discounts, and other travel perks.

What credit card do you get the most points?

The U.S. Bank Altitude® Go Visa Signature® Card is one of the best rewards cards for points. First-time applicants get 20,000 bonus points after spending $500. You’ll then get up to 4x points for every $1 spent on purchases.

Which credit cards give you the highest balance?

The Platinum Card® from American Express comes with the highest balance. There are no credit limits, although you’ll need to settle your balance in full every month.