Brokerage platforms in 2024 are packed with handy features to remove the complexity from trading assets, and copy trading (also known as social trading) is a prime example. This feature allows you to manage your portfolio passively, automatically replicating the trades of successful investors.

With copy trading becoming increasingly popular, the feature is now commonplace in the brokerage market. With that in mind, we’ve broken down our picks for the best copy trading platform in 2024, with eToro, AvaTrade and Libertex standing out as excellent options.

Disclaimer: eToro is the only platform on this list that is currently available to US residents

Our selections for the best copy trading platform in 2024

Here is a brief introduction to our top six copy trading platforms. Our picks range from beginner to advanced level, with a variety of different features on offer.

- eToro: A mainstay in the online brokerage industry with more than 33 million registered users as of 2023. eToro is famed for its copy trading abilities – the feature is user-friendly and fully automatic.

- AvaTrade: Another trusted, globally-recognized brand, this time specializing in CFDs and forex. The platform’s copy trading feature, AvaSocial, supports stocks, forex, commodities, options and more.

- Pepperstone: Another forex and CFD broker, this trading platform allows users to access copy trading features via three different third party platforms: Signal Start, MetaTrader Signals and DupliTrade.

- Vantage Markets: With minimum deposits of just $50, Vantage Markets allows users to start copy trading directly from the mobile app.

- Trade Nation: Through its proprietary TradeCopier app and powered by the MetaTrader platform, Trade Nation provides an automated, social trading service. Supported assets include stocks, indices, forex, commodities and bonds.

A closer look at the best copy trading platforms in 2024

Let’s now take a closer look at each trading platform and its copy trading software. While the service offered by each broker is fundamentally similar, there is important information cover in terms of fees, jurisdictions, asset classes and more.

1. eToro: The best copy trading platform overall

eToro has earned global acclaim and an industry-leading userbase since it launched in 2007, primarily due to its simple and accessible interface.

As an extension of this accessibility, the broker offers a comprehensive copy trading feature, allowing users to copy trades for all asset classes, including stocks, forex, cryptocurrencies, options, and commodities.

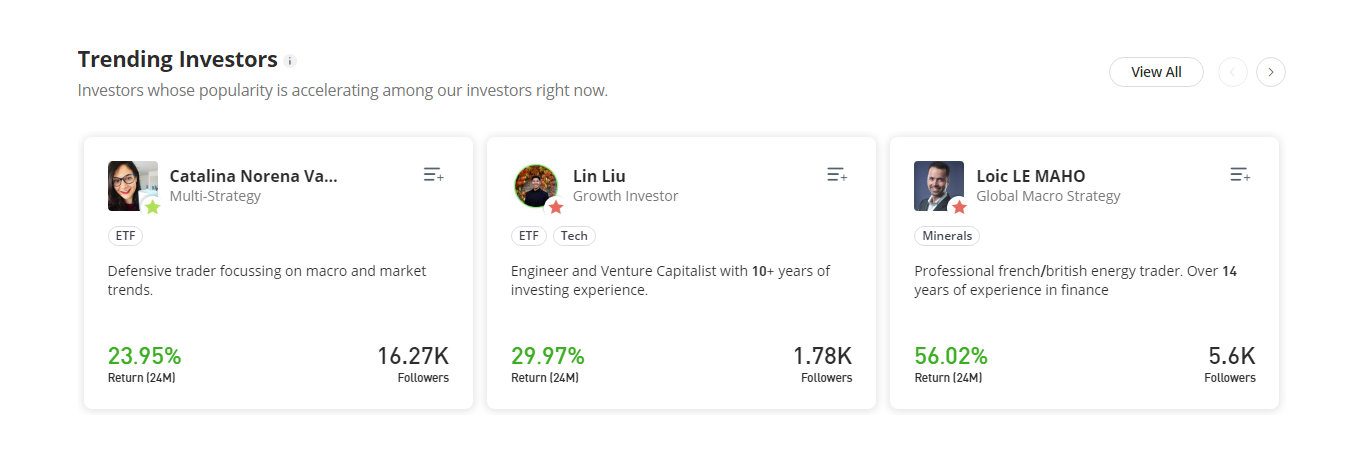

There are a number of different avenues for copy trading on eToro. The broker’s dedicated ‘CopyTrader’ dashboard displays several pre-selected categories, including ‘trending investors’, ‘most copied’, and ‘market outperformers’. You can select a specific trader from any of these lists and copy their trades instantly.

The CopyTrader dashboard also has a ‘find your match’ section for those seeking a slightly more tailored portfolio. Here, you can specify your risk level, desired timeframe and asset types, and choose a trader based on the search results.

eToro is fully licensed and regulated in most of the world’s major regions (including the US, UK, and Australia). The minimum deposit required for US and UK users is $100, but in other jurisdictions, it can range from $50 to $10,000.

eToro charges zero commission for stocks and ETF trades, and a $5 withdrawal fee (excluding USD). There are no additional fees or charges for copy trading.

Pros:

- More than 5,500 trading instruments available

- Globally-recognized brand

- Highly accessible for beginners

Cons:

- Inactivity fee after 12 months

- Withdrawal fees

2. AvaTrade: The best copy trading platform for CFDs

Founded in 2006 and one of the official partners of the Aston Martin F1 team, AvaTrade is another well-known brand with a positive reputation.

The platform has a heavy focus on leveraged CFDs, with more than 1,000 on offer – these included stocks, ETFs, commodities, options, forex and crypto.

The broker’s copy trading feature, AvaSocial, is hosted on a proprietary mobile application for Android and iOS. The interface is simple and intuitive, allowing users to filter traders by their past performance and various other metrics before proceeding.

There is also a functionality to pose questions to traders before proceeding. This is a good example of the feature being geared towards accessibility, making it approachable for less experienced traders.

Like eToro, AvaTrade does not charge any additional fees or commissions for using AvaSocial, again reinforcing it as a great option for beginner investors who are perhaps more tentative. In fact, AvaTrade improves upon eToro’s fees model, with no deposit or withdrawal fees imposed.

Disclaimer: AvaTrade is not available to US residents.

Pros:

- No fees or commissions whatsoever

- 24/7 customer support

- Intuitive interfact

Cons:

- Not available in the US

- Minimum deposit of $100

3. Pepperstone: Highly versatile copy trading platform

Having been on the market for nearly 15 years and with an exceptionally high trust score of 95/100 on ForexBrokers.com, it’s fair to suggest that Pepperstone is another established, reputable brokerage platform.

Pepperstone’s copy trading feature is rather unique in that it is available through multiple third-party providers: Signal Start, Meta Trader Signals and DupliTrade. This diversity of choice is a standout feature for the platform, allowing users to choose a provider that suits their needs

To get started, you must simply create a Pepperstone account and connect it to the trading platform of your choice. Like other brokers, Pepperstone allows you to search for traders based on various personal criteria, such as risk appetite and timeframe.

The average EUR/USD spread offered by Pepperstone is 0.77, and the all-in spread is 0.87. Prospective traders should also be aware that the broker’s minimum deposit is $200, compared to the $100 offered by eToro and AvaTrade.

Disclaimer: Pepperstone is not available to US residents.

Pros:

- Compatibility with several trading platforms

- Low spreads

- No addition fees for copy traders

Cons:

- Most strategies are forex-focused

- Less beginner-friendly than some others

- Not available in the US

4. Vantage Markets: Copy trading with a super quick sign-up process

Another CFD and forex-focused broker, Vantage Markets is known for having an exceptionally quick and simple account-opening process, with seamless deposits and withdrawals to match.

Crucially, the broker also offers an excellent, beginner-friendly copy trading service, with a deposit of just $50 required to get started.

Aside from its dedication to simplicity, what makes Vantage Markets’ copy trading service stand out is that it takes place entirely on Vantage, the broker’s proprietary mobile application. However, excessive display advertising can be a distraction and an annoyance for the user.

It should also be noted that, like other brokers, Vantage Markets offers compatibility with the suite of MetaTrader platforms, each with its own mobile apps.

Vantage Markets is another strong competitor when it comes to fees – it has no deposit, withdrawal or commission fees, and its minimum deposit amount is modest. There are also no additional fees for copy trading.

However, Vantage Markets’ stock CFD fees can be rather high. For instance, a fee of nearly $7 will apply to an Apple CFD.

Disclaimer: Vantage Markets is not available to US residents.

Pros:

- Low non-trading fees

- No withdrawal or deposit fee

- No inactivity fee

Cons:

- High stock CFD fees

- Adverts on the mobile app can be frustrating

5. Trade Nation: Forex-focused broker with proprietary app

Trade Nation is another forex-focused broker, again using its own mobile application, TradeCopier, to facilitate copy trading.

After downloading the app from the Google Play Store or App Store, investors must simply connect their Trade Nation MetaTrader4 account, and they’re good to go.

The experience of using TradeCopier is relatively seamless, with users able to select from various filters to specify their strategic requirements. While focused on Forex, users can also trade stocks, bonds, indeces and more using TradeCopier.

While forex fees are high (0.6 EUR/USD spread), Trade Nation boasts low stock and index CFD fees, and zero fees for inactivity and withdrawal.

What lets Trade Nation down is its lack of customer support. While many trading platforms have a 24/7 customer service or even a personal account manager, Trade Nation provides only an automated chatbot.

Disclaimer: Trade Nation is not available to US residents.

Pros:

- No inactivity fee

- Low stock and index CFD fees

Cons:

- Lack of customer support

- High forex fees

Best copy trader software comparison table

| Platform | Minimum deposit | Inactivity fee | Deposit/withdrawal fee | Mobile app? | Available in the US? |

| eToro | $100 (US/UK) | $10 (12 months) | $5 withdrawal fee (excluding USD) | Yes | Yes |

| AvaTrade | $100 | N/A | N/A | Yes | No |

| Pepperstone | $200 | N/A | N/A | Yes | No |

| Vantage Markets | $50 | N/A | N/A (but international bank processing fees may apply) | Yes | No |

| Trade Nation | N/A | N/A | N/A | Yes | No |

What is copytrading?

Copy trading is an investment strategy that allows individuals to replicate the trades of experienced traders as they happen.

Numerous platforms allow experienced and successful traders to register as ‘signal providers’. By filtering based on risk appetite and other factors, platform users can select a signal provider to copy.

This method is particularly useful for inexperienced and tentative traders, as it allows them to establish a diversified investment portfolio whilst eliminating the process of manually selecting it.

But whilst convenient, copy trading has the potential to carry certain risks. For instance, regardless of past successes, there are no guarantees in the stock markets, and it is perfectly possible for the trades of signal providers to be unsuccessful.

Despite this, copy traders should still conduct their own research before committing to copying a signal provider.

The pros and cons of using copy trading software

As mentioned above, copy trading can be an excellent gateway into the financial markets for newcomers, but it can also be fraught with risks.

With that in mind, here are some of the major advantages and drawbacks of copy trading.

Pros:

- Accessibility: Perhaps the most obvious advantage of copy trading is that it makes the financial markets accessible to those without deep knowledge or experience in the area. As a result, newcomers can establish a portfolio of investments and feel confident about their potential.

- Diversification: This is one of the golden rules of building an investment portfolio, and should apply to any investment strategy. Following multiple experienced traders across various markets and asset classes is a great way to achieve this.

- Learning opportunities: Observing the decisions of experienced traders and how they influence outcomes can be an excellent opportunity for inexperienced traders to learn the fundamentals of the markets. The patterns observed will likely inform the individual’s investment decisions in the future.

Cons

- Lack of independence: Some experienced traders might argue that the best way to learn the financial markets is to make mistakes and learn by doing. By this logic, copy trading might promote a dependency on others, and not serve the individual in the long run.

- Risk: While the trades of experienced investors are theoretically likely to be sound, there are no guarantees in the financial markets, and the risk of loss is still present. Based on this, it’s critical that rookie traders do not expect guaranteed success from copy trading.

- Overcrowding: Perhaps the most prominent risk of copy trading is that certain strategies can become disproportionately popular, therefore impacting their effectiveness.

Methodology

Our panel spends several hours researching each product, developing a deep understanding of its features, utility, and pros and cons.

While our panel is comprised mostly of seasoned financial experts, some have little to no expertise in the area. This gives us a wide range of perspectives, ensuring our verdicts are objective.

FAQs

What is the best copy trading platform?

According to our analysis, the best copy trading platform available today is eToro. The broker’s ‘CopyTrader’ is slick and intuitive, and the platform boasts low fees, best-in-class educational resources, and a wide range of investment options.

Is copy trading profitable?

Yes, copy trading is theoretically likely to be profitable. However, the financial markets are unpredictable, and there is always margin for error, so investors must not expect guaranteed profits from copy trading.

Can you copy trade in the USA?

Copy trading is perfectly legal in the USA, as long as it is done through a regulated broker. Of the five trading platforms listed in this article, only eToro is available to US residents.