Have you been looking for a cryptocurrency that has both the tech and the hype but has yet to achieve its full potential? There are several cryptocurrencies that can make it to such a list, but one that deserves to be mentioned the most is Chainlink (LINK).

In this article, we’ll cover how to buy Chainlink and the best place to buy this cryptocurrency with the least hassles and most benefits. We will also look at what exactly Chainlink is, what more you can do with this token, and its potential. So, let’s jump right into it!

What exactly is Chainlink (LINK)?

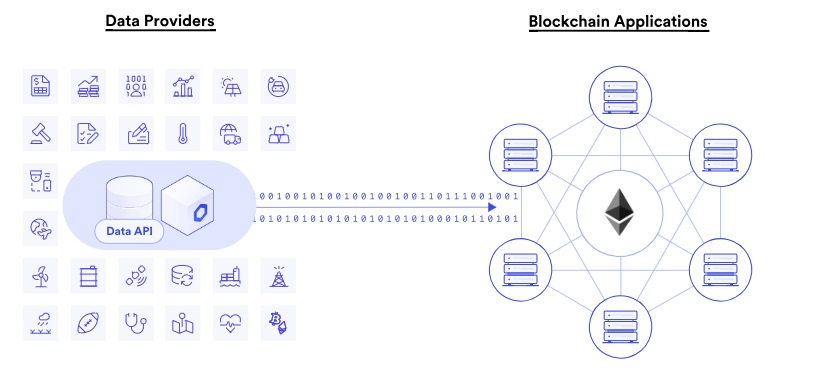

Launched in the summer of 2017, Chainlink was co-founded by Sergey Nazarov and Steve Ellis as a Web3 services platform that delivers real-world data to blockchain-based smart contracts. Such seamless access to reliable, real-world data allows developers to build Web3 applications.

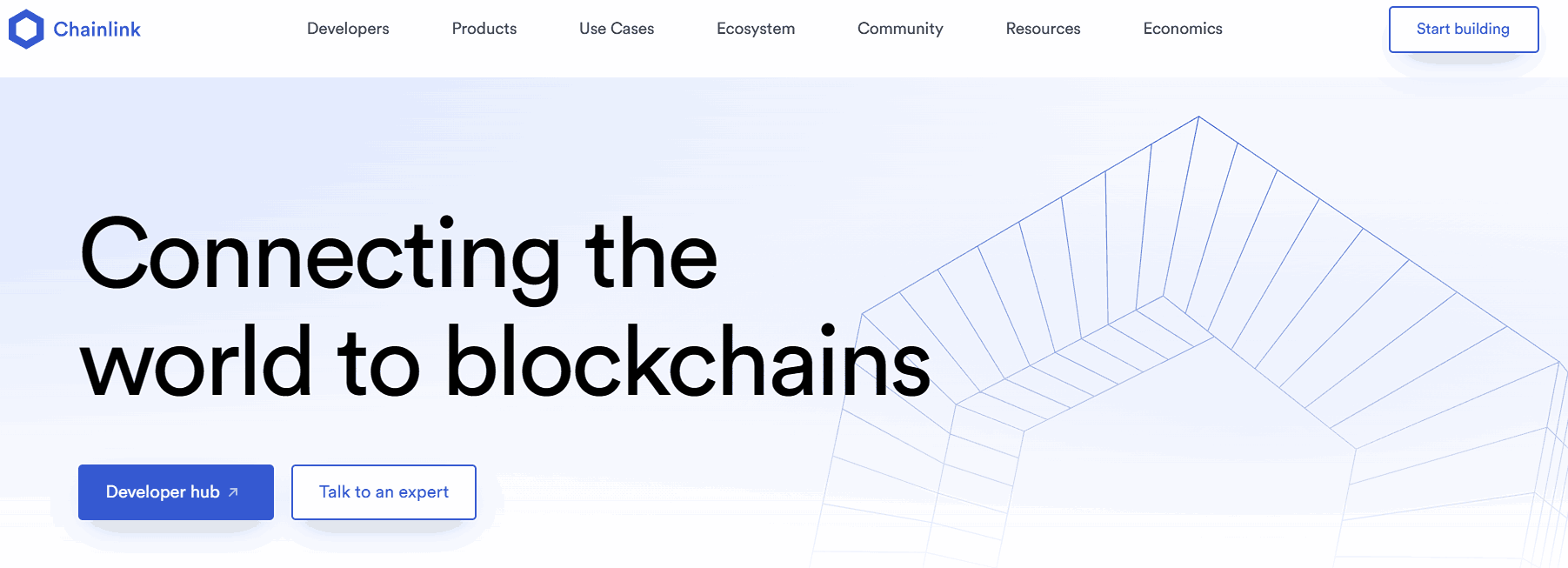

For instance, Chainlink’s crypto price feeds provide financial market data required to issue, settle, and secure a range of DeFi applications such as decentralized crypto lending platforms Aave and Compound, decentralized trading exchanges dYdX and 1Inch, and derivatives liquidity protocol Synthetix.

Smart contracts, pre-specified agreements on the blockchain that automatically execute once certain conditions are met, inherently lack connection to external data. That’s where Chainlink comes in, as it connects them to the real world through Oracles in a highly tamper-resistant and reliable manner. LINK, the native token of Chainlink, is used to pay for services on the network and incentivize the proper operation of decentralized oracle networks (DON).

Today, the Chainlink network is helping secure tens of billions of dollars in value for many leading DeFi applications and various other CeFi companies and financial institutions.

How to Buy Chainlink in Five Simple Steps

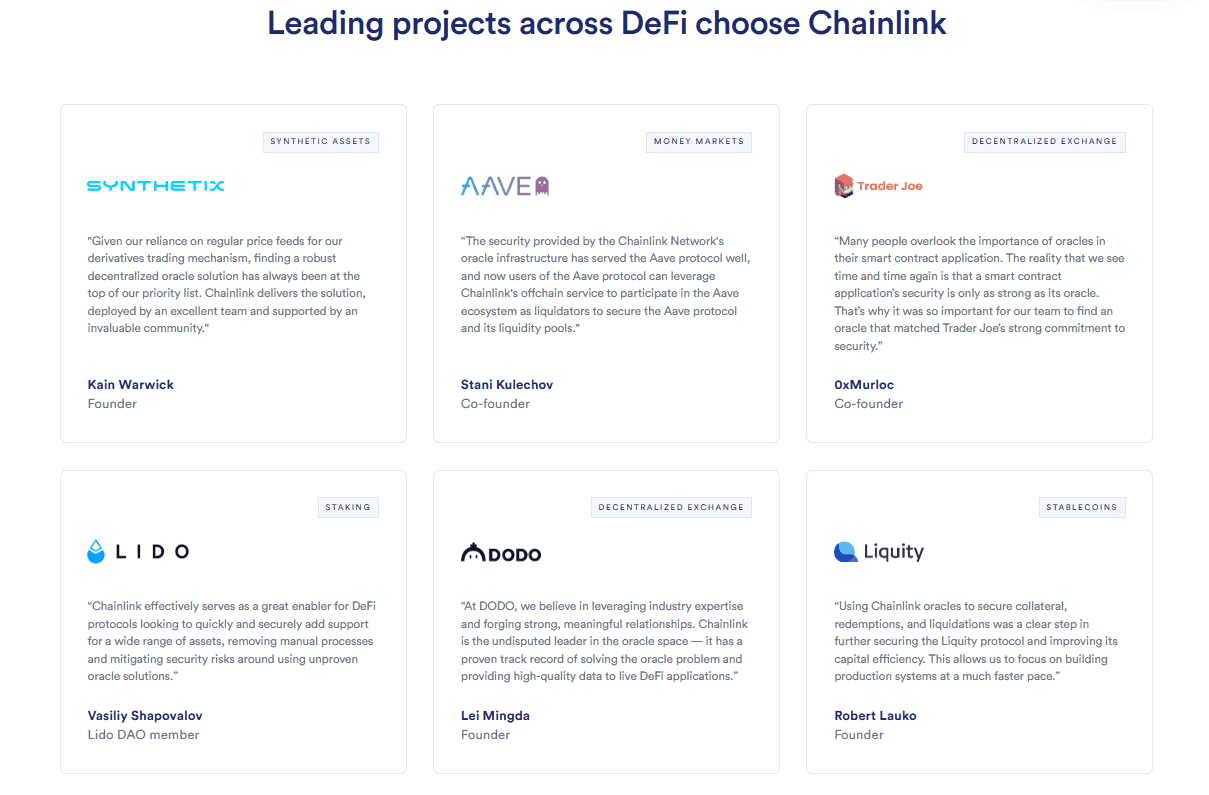

Now, we’ll take you through the process of buying LINK tokens, for which we’ll be using eToro as an example. Here’s how to buy Chainlink step-by-step:

1) Sign Up to a Crypto Exchange

To start, create an account on eToro. Go to the official website and click on the sign-up button. Here, you will have to provide your email address and password. You can also sign up with Apple, Google, or Facebook instead.

2) Complete KYC

Once you create your account, you must verify your identity. First, eToro will send you a verification email. Now, go to your email inbox and click on the link inside to verify your email address.

Once you’ve done that, you’ll have to further provide additional information, such as ID, date of birth, phone number, country of residence, proof of address, social security number, and more, for regulatory compliance. Then, eToro will verify this information, which could take several days.

3) Deposit Funds

Next, deposit funds into your account through one of the several payment methods that eToro supports. For instant deposits, you can use credit/debit card options such as Visa, Mastercard, Diners Club, and Maestro cards. If you prefer not to use credit or debit cards, bank transfers and e-wallets like PayPal are also available.

To deposit, click on the ‘Deposit’ option from the main menu → choose your desired method → add your payment details → fill in the amount that you want to deposit → and finally, click ‘Deposit.’

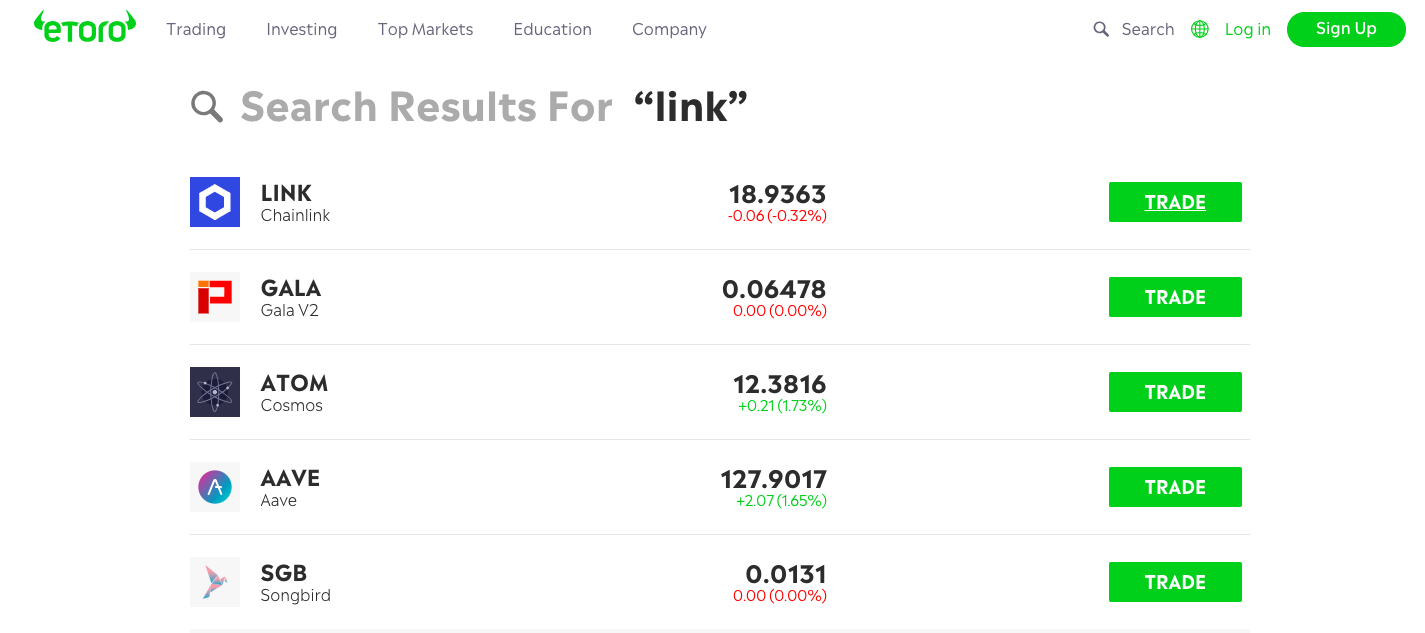

4) Select Chainlink Trading Pair

Next, go to the search bar on the website and type Chainlink or LINK. It’ll take you to the asset page, which has all the relevant information about the asset, such as price, market cap, volume, range, and more, available right there.

If you scroll down, you’ll also find news and discussions about cryptocurrency to help you with your trade.

Where to Buy Chainlink in 2024? The Top Exchanges

Buying Chainlink is a simple process involving a few steps, as we detailed above, but in order to make the most of your experience, you must buy it on the right platform.

With so many crypto exchanges available out there, it can be difficult to find the right platform and make the right choice. To help you make this decision, here are our top three exchanges for buying Chainlink.

1. eToro – User-Friendly Exchange with Social & Copy Trading Features

eToro is a leading trading platform operating in 100+ with over 35 million customers. While it may only support 90 cryptos, it offers a diverse range of assets from stocks to commodities to crypto. It offers an easy-to-use, intuitive interface with trading features to suit both beginners and experienced LINK investors.

One strong feature of eToro is its social elements. eToro has a social trading feed where users can chat strategy, share tips, and discuss their portfolios with each other. Users can also take advantage of the copy trading feature, which lets them mirror the trading strategies of other successful traders in their portfolios. This makes it a great option for those starting out in crypto.

| Number of Cryptos | Fees | Mobile App | Features | |

| eToro | 90+ | 1% | Yes | Copy trading, social trading, Smart Portfolios, diverse asset options |

Pros

- Social and copy trading

- User-friendly

- Diverse range of assets

Cons

- Limited number of cryptpcurrencies

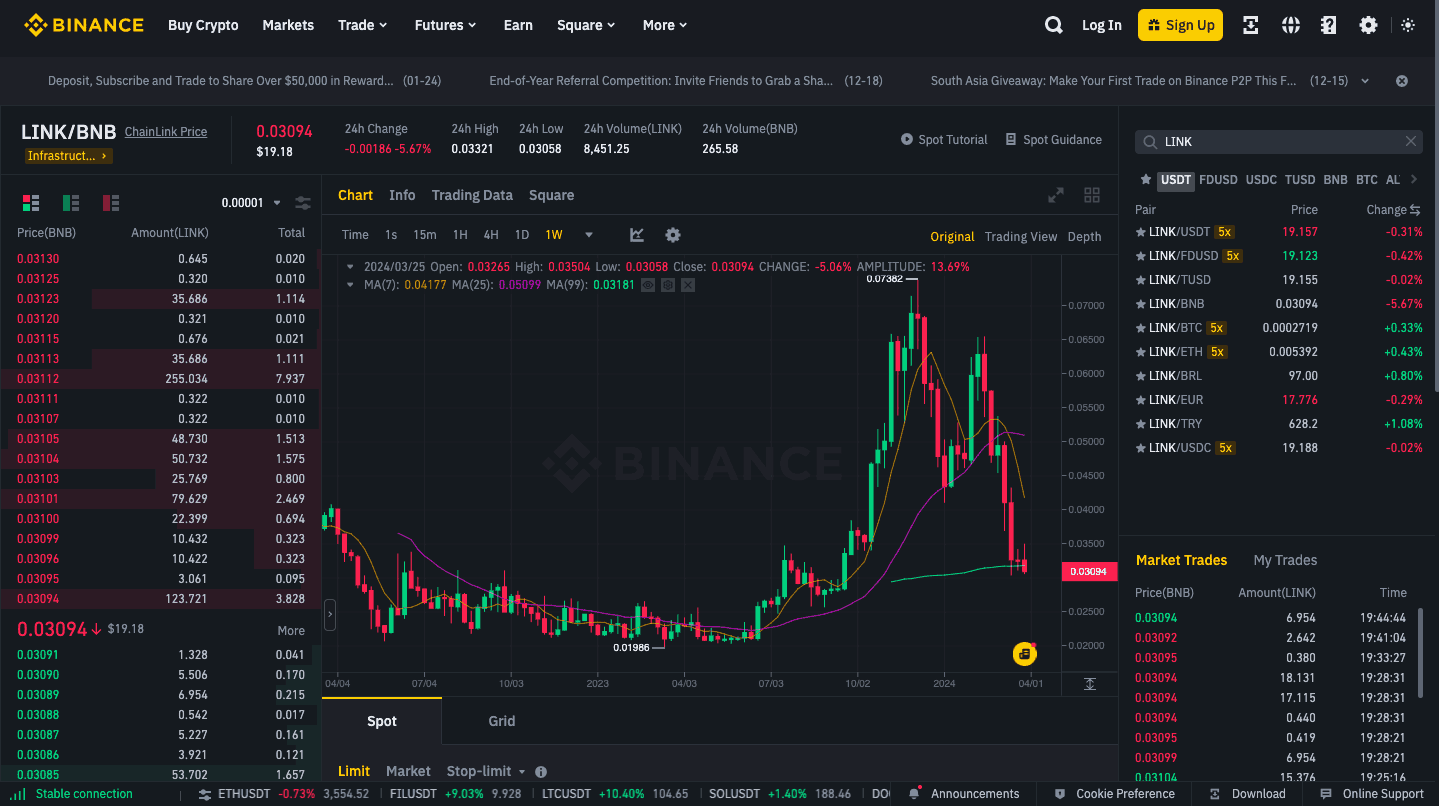

2. Binance – High Liquidity & Wide Range of Trading Pairs

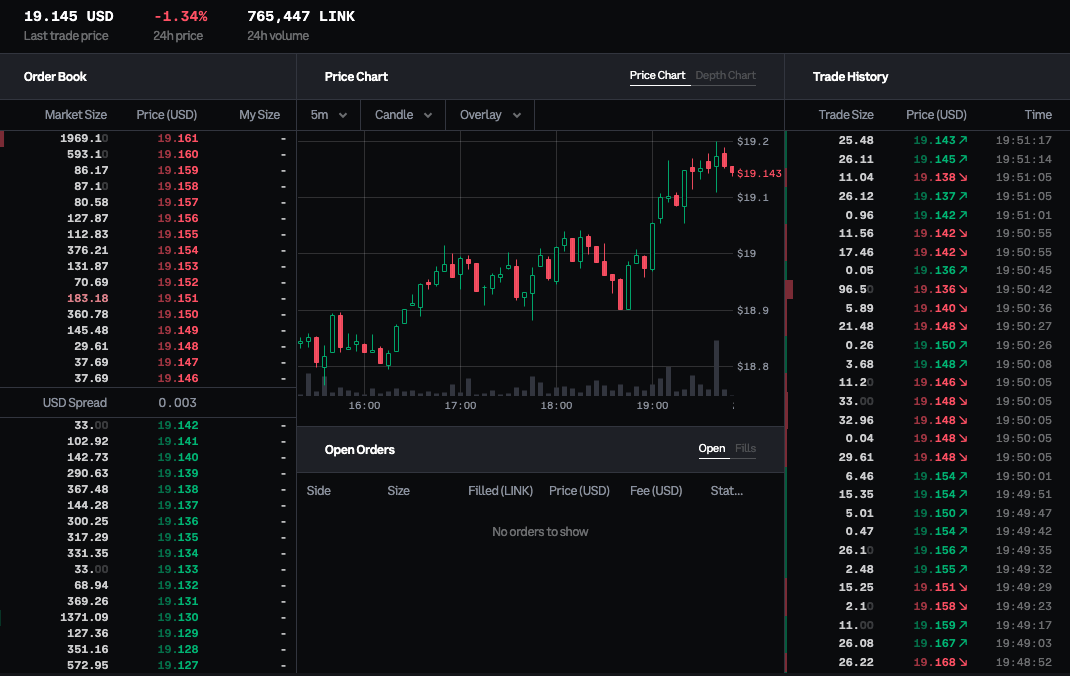

Founded in 2017 by Changpeng Zhao, Binance has grown to become the largest cryptocurrency trading platform globally. On Binance, you can trade LINK against BTC, USDT, USDC, TUSD, BNB, ETH, and other crypto assets on its spot market. It also supports trading of perpetuals and quarterlies on its futures platform. Currently, Binance is offering a 0.09% estimated APR on LINK tokens.

Binance has a wide range of trading options, including passive earning and lending, and there are great educational resources on the platform. In the last 24 hours, Binance logged $24.77 bln in trading volume across 400 coins and over 1,200 trading pairs. The LINK/USDT pair on Binance meanwhile accounts for nearly 14% of all market volume

| Number of Cryptos | Fees | Mobile App | Features | |

| Binance | 400+ | o.1%-0.5% | Yes | Binance Earn, Lending, Mining, ICOs, copy trading, trading bots |

Pros

- Low fees

- High liquidity

- Number of features

Cons

- Regulatory concerns

2. Coinbase – Reliable & Beginner-Friendly

Founded in 2012 by Brain Armstrong, Coinbase is a publicly listed crypto exchange (NASDAQ: COIN). The centralized exchange (CEX) supports a wide range of fiat currencies and over 230 coins and offers about 400 trading pairs.

Coinbase is one of the most reputable exchanges and offers trading solutions for those new to crypto and crypto veterans. It’s also got active customer support including live phone support. However, their fee structure can be complex, and fees can vary hugely depending on the type of transaction. Over the last 24 hours, Coinbase has seen a trading volume of $3.55 bln, of which LINK/USDT accounts for 4.80%.

| Number of Cryptos | Fees | Mobile App | Features | |

| Coinbase | 240+ | o.1%-4.5% | Yes | NFTs, Coinbase card, advanced trading options, passive earning options |

Pros

- Easy to buy and sell crypto

- Crypto rewards porogram

- Active customer support

Cons

- Complex fee structure

How We Ranked The Best Places to Buy Chainlink

Now, let’s see the basis for our exchange ranking to buy Chainlink for a better understanding and a clear picture:

Highest Trading Liquidity

One of the most important things in the market is liquidity. On an exchange, liquidity refers to the platform’s capacity to facilitate trades at prices close to the market rate. The more liquid an exchange, the smaller the difference between the buy (bid) and sell (ask) prices. This results in tighter spreads, translating to lower trading costs.

The higher the liquidity an exchange offers, the better your price becomes and the swifter the execution of trades. Volume and order book depth influence liquidity, which, in turn, affects your ability to have the desired price and ensures a smooth experience.

Most Ways to Buy Chainlink

The best exchange offers its users several ways to buy a cryptocurrency like LINK, including fiat options like USD and GBP, making the whole experience seamless. However, peer-to-peer trading is also essential for regions where banking support is not viable and regulatory challenges persist.

An exchange must also provide options to trade LINK not only against fiat currencies but also against several other crypto assets, specifically majors like BTC and ETH and stablecoins like USDT and USDC.

Cheapest Fees for Buying Chainlink

Fees can quickly eat into one’s profits, especially for those who trade a lot. Not to mention, there are not just trading fees but also other associated costs. These can include blockchain network fees, which vary between networks, and deposit, withdrawal, and funding fees for derivative trading.

A suitable exchange is one that offers competitive fees and special discounts to protect the interests of its users.

Most Reliable Support

Crypto exchanges with a solid track record of listening to user grievances, providing quick and reliable support, and offering enhanced security are typically the most trusted in the market. After all, you wouldn’t want to deposit your hard-earned money on an exchange that ignores your issues. User satisfaction is key to having a reputable exchange.

What is the Best Place to Store Your Chainlink?

Chainlink (LINK) is an ERC-20 token; hence, it can be held in most popular crypto wallets. As for choosing the right wallet, it all depends on your goal.

- If you are involved in active trading, web wallets like MetaMask are the most popular option. These software or hot wallets are free and provide you with the convenience of moving your crypto at speed. However, they are less secure.

- If you want to stake your tokens, a web wallet will work just fine, or you can use a mobile wallet. You can also choose a crypto exchange wallet, though that will mean entrusting the platform with your private keys, which gives you access to your crypto.

- If you want to hold your LINK for the long term, hardware wallets like Ledger and Trezor are your best bet. These are cold wallets with no connection to the internet. While less convenient and more expensive than other wallets, this option is more secure.

What Can You Use LINK Tokens For?

LINK is the native token of Chainlink, which hit an all-time high of $52.70 in May 2021. In 2017, the project raised $32 million in an initial coin offering (ICO), where it sold a total of 350 million LINK tokens out of its 1 billion total supply. It is a utility token that has many use cases within the Chainlink ecosystem:

Node Operator Incentives

LINK tokens are used to incentivize node operators or oracles to provide accurate data. Oracles are data providers that act as an intermediary between blockchain smart contracts and external data feeds. They are responsible for retrieving, validating, and delivering external data.

Every oracle in the network receives a reputation score assigned to them to demonstrate their performance and reliability. When nodes follow the laid out protocols and contribute valuable data, they are rewarded in LINK. At the time of its ICO, the team allocated 35% of the token supply to incentivize node operators.

Data Request Payments

When a developer needs external data, they send a request to Chainlink. To make a request, one must have a sufficient amount of LINK in their subscription balance.

Billing for this process occurs in two steps: during the data request phase, the cost to fulfill the request is estimated and added to the subscription reservation. Then, during the receiving data phase, its fulfillment cost is determined and charged to the subscription account.

The total cost paid in LINK includes gas costs paid to the oracle for fulfilling the request and premium fees paid to nodes for performing the work.

Oracle Network Fees

To use Chainlink services, users are required to pay fees, which are determined by the node operator they choose. Here’s how it works: when making a request, you select a specific oracle, and the fees may vary across different operators.

Staking

Staking is a mechanism through which node operators and community members get the chance to earn rewards in exchange for securing the network and enhancing the reliability of Oracle services by locking up their tokens.

In Dec. 2023, Chainlink launched Staking v0.2 with a pool size of 45 million LINK with a variable reward rate of 4.32%.

Conclusion

Blockchain is a digital ledger of data enhanced by smart contacts, whose capabilities are extended by oracles. Chainlink is the leading decentralized Oracle solution that provides tamper-resistant and reliable data, verifiable randomness, automation functions, external APIs, and much more. These capabilities have helped Chainlink power advanced applications and drive innovation.

Buying LINK offers a great way to become part of this revolution. So, if you want to get your hands on the digital asset token, then get started today!

FAQs

Where can I buy Chainlink?

Chainlink is a multi-billion dollar market cap crypto asset that is listed on a wide variety of crypto exchanges and, hence, can be bought on Kraken, Coinbase, KuCoin, Binance, OKX, Bybit, Crypto.com, and other platforms.

Is Chainlink a good investment?

LINK is the native utility token of the decentralized oracle network Chainlink, used for staking and paying node operator fees. As a core component of Chainlink, which secures billions of dollars in decentralized application transactions, LINK possesses significant potential.

Can I buy Chainlink with a credit card?

Yes, you can buy Chainlink with credit cards like Visa and Mastercard on various crypto trading platforms. However, regional regulatory restrictions may apply.

Is Chainlink only on Ethereum?

Although Chainlink is a decentralized blockchain oracle network built on Ethereum, it also supports Solana, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Fantom, Polkadot, Cosmos, Cardano, Near, and other ecosystems.

Does Chainlink have a future?

As an oracle network, Chainlink is integral to Web 3 applications and, as such, is widely integrated into many crypto projects. With mainstream financial institutions entering crypto in droves, Chainlink’s goal to unite DeFi and TradFi holds great potential for its bright future.

Can I buy Chainlink on Coinbase or Binance?

Yes, you can buy Chainlink on Coinbase as well as Binance against both fiat currencies and crypto assets.

References

- Chainlink’s Total Value Secured (TVS) Surpasses $75 Billion (prnewswire.com)

- Top Cryptocurrency Exchanges Ranked By Volume (CoinMarketCap)

- ERC-20 Token Standard (Ethereum.org)