EigenLayer is one of the most anticipated projects on Ethereum in recent years, with a token expected to be airdropped to EigenLayer Points holders.

You can farm EigenLayer Points by using the protocol itself, but deposits are currently closed.

Thankfully though, there are still a number of ways you can buy EigenLayer points, farm them or speculate on their value.

- 1. Buy airdrop points via Kelp DAO

- 2. Trade airdrop point derivatives on Mantle

- 3. Farm points through liquid restaking protocols

Beware though that while EigenLayer is expected to airdrop tokens to points holders, there still hasn’t been an official announcement by EigenLayer about plans for a token.

With that in mind, let’s take a look at how each method works, and the risks involved.

Buy EigenLayer airdrop points via Kelp DAO

Kelp DAO is a liquid restaking protocol that lets you stake Ether (ETH) via EigenLayer in return for a liquid restaking token, rsETH.

rsETH holders earn Eigen Layer points when they stake with Kelp DAO.

Recognizing the demand for EigenLayer points in the wider economy, Kelp DAO has gone ahead and tokenized EigenLayer Points into ERC-20 tokens, called Kelp Earned Points (KEP).

KEP represents a single Eigen Layer Point each, earned by Kelp DAO users.

Kelp DAO claims that any future rewards issued by EigenLayer to points holders – such as EigenLayer tokens – will be distributed to KEP holders.

So this effectively provides you a way to buy IOUs for EigenLayer tokens, before their actual launch.

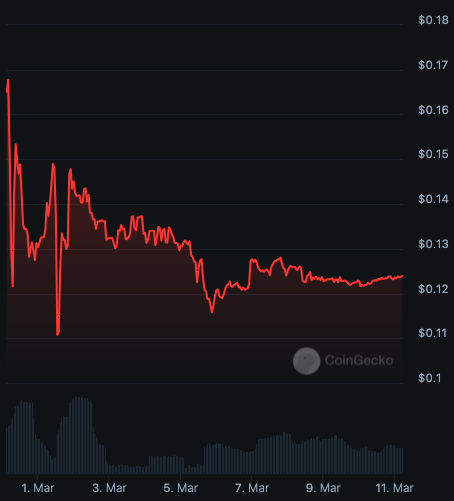

KEP tokens have been trading for between $0.12 and $0.17 since they were launched on March 1st.

You can purchase them on Uniswap, using the following contract address: 0x8e3a59427b1d87db234dd4ff63b25e4bf94672f4

While KEP is a convenient way to invest in EigenLayer before the token officially launches, you’re still buying an IOU and a derivative, which carries its own inherent set of risks.

There’s also the possibility that EigenLayer point holders don’t end up receiving a token airdrop, in which case the KEP could rapidly devalue.

Trade EigenLayer airdrop derivatives on Pendle

Pendle is a “yield trading” protocol that essentially allows you to speculate on the future value of EigenLayer points through a leveraged token.

Specifically, it lets you speculate on eETH rewards which is a liquid restaking token issued by Ether.fi that earns both Eigen Layer Points as well as Ether.fi Loyalty Points.

eETH holders can effectively take out a leveraged trade on Eigen Layer points by depositing eETH into Pendle.

Depositing eETH into Pendle swaps it for two new tokens.

- PT-ETH: This token is proportional to the amount of eETH deposited and represents your principal deposit.

- YT-ETH: This token represents the yield of eETH, with leverage.

Traders can then exchange the rest of their PT-ETH for YT-ETH, effectively allowing them to take out a leveraged bet on the value of eTH rewards (which is both EigenLayer and Ether.Fi points).

It’s important to note that these tokens are complex derivatives, and are set to expire worthless on June 26, 2024.

This strategy therefore carries a lot of risk and is only suited to experienced derivatives traders who understand the fundamentals of options pricing, especially in regards to expiry dates.

Despite the risks involved, Pendle’s TVL reached $2.4 billion by March 11, 2024.

In addition to Ether.fi you can speculate on staking rewards from a range of other liquid staking providers including Swell, Kelp DAO, and Renzo Protocol

Get EigenLayer tokens by farming airdrop points

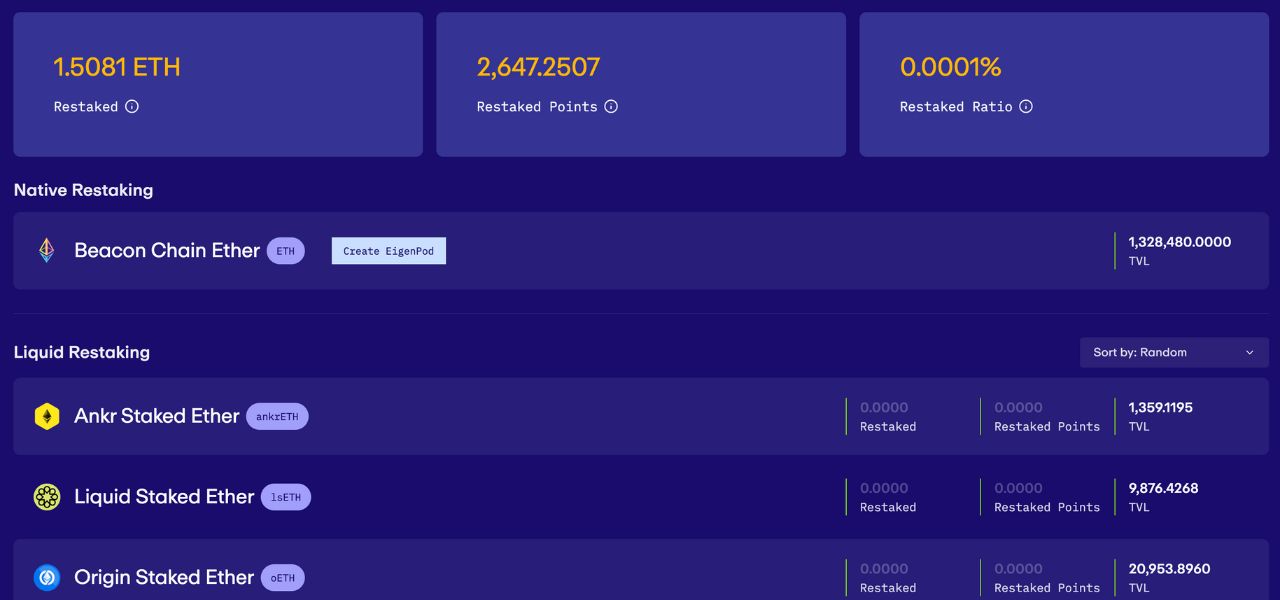

Lastly, there is the option to farm Eigen Layer Points directly.

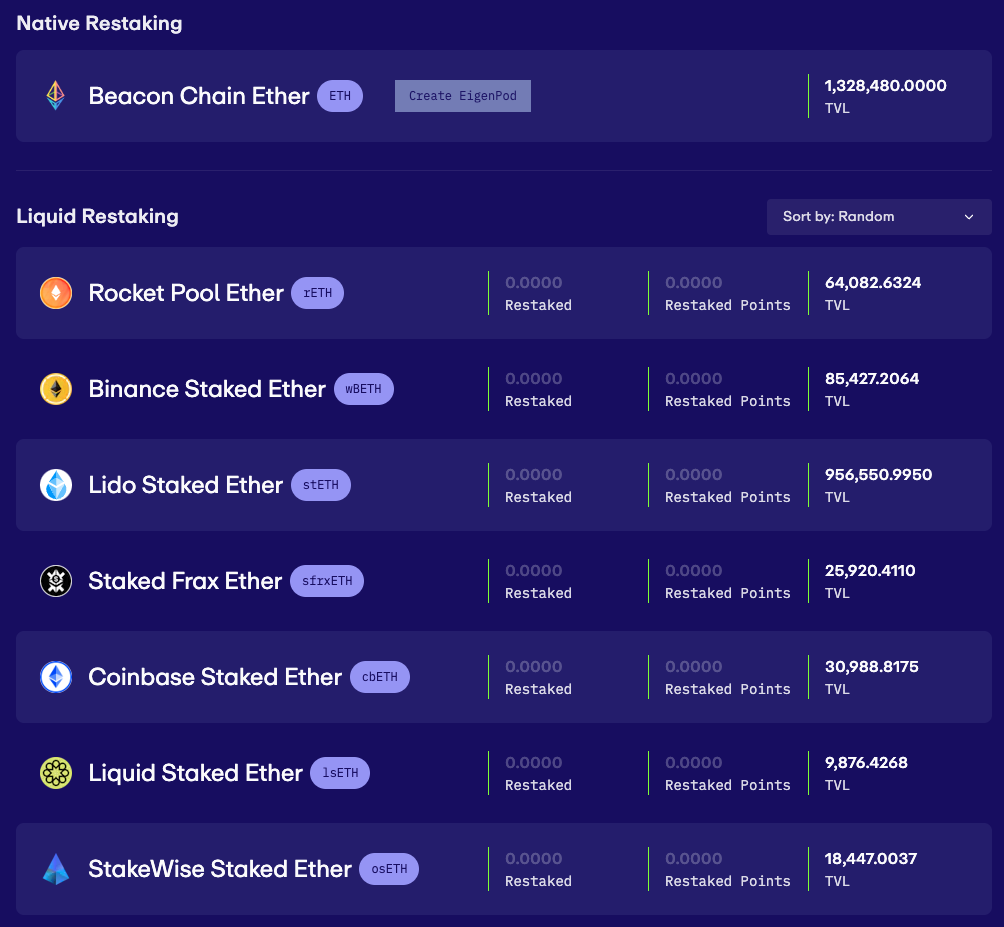

This can be done by using the Eigen Layer protocol directly or using a liquid staking platform.

Using Eigen Layer directly can be difficult because it has supply caps, which are often reached quickly each time they are increased. Make sure to follow EigenLayer’s Twitter for updates on when the cap is raised and new deposits are opened.

Fortunately, you can get around this by using a liquid staking platform such as Ether.fi, Swell, Kelp DAO, or Renzo Protocol.

These platforms let you earn Eigen Layer points by staking through their respective protocols, which can get you around the deposit limits.

This is because Eigen Layer pools are made up of liquid staking tokens, which are issued by these protocols (eg, swETH).

In addition to earning EigenLayer points, you may also receive points from the protocol you choose.

Airdrop farmers have their eyes on Ether.Fi, Swell, and Kelp DAO in particular for a potential token airdrop.

Risks of EigenLayer points and airdrop rewards

EigenLayer is yet to officially announce a token.

This means that there is the possibility that EigenLayer Points won’t be used to airdrop tokens to points holders.

There is also the possibility that certain points holders could be excluded from a token airdrop.

Projects sometimes do this if they expect an account is a Sybil – which is where one person uses several wallets to farm airdrop rewards at scale.

Additionally, residents of the US are frequently excluded from airdrop campaigns due to legal complications.

Several of the methods listed on this page also include purchasing tokens that are effectively IOUs or derivatives.

There is always the risk that such tokens won’t be able to be reimbursed for the underlying asset that they represent.

Pendle is especially complex and tokens are designed to expire at a certain date.

Make sure to remember that this guide is just a starting point, and that you should research each option thoroughly before investing any funds. See our references below for further reading.

What is EigenLayer?

EigenLayer is the pioneer of restaking on Ethereum.

Restaking enables the use of Liquid Staking Derivatives (LSDs), like stETH and swETH, to be used as collateral to stake additional networks.

It currently has more than $11.6 billion of total value locked (TVL), making it the second largest DeFi protocol on Ethereum.

References

- Introducing $KEP — Kelp Earned Points, Kelp DAO Blog, https://blog.kelpdao.xyz/introducing-kep-kelp-earned-points-13877023853a

- Learning Hub, Eigen Layer https://www.eigenlayer.xyz/learn

- Kelp Earned Points, CoinGecko, https://www.coingecko.com/en/coins/kelp-earned-points

- Ether.fi, http://ether.fi/

- Loyalty points, Ether.fi https://etherfi.gitbook.io/etherfi/getting-started/loyalty-points

- Points Trading, Pendle Finance https://app.pendle.finance/points/

- eETH, Pendle Finance, https://app.pendle.finance/points/eETH