Many trading platforms allow you to buy and sell crypto automatically. This is usually through copy trading or bots, depending on the platform. Either way, auto trading allows you to invest in the crypto market passively.

In this guide, we compare the 7 best crypto auto trading platforms for 2024. Our reviews cover the type of auto trading supported, fees, expected returns, available crypto markets, safety, and much more.

7 Top Bitcoin Auto Trading Platforms Listed for 2024

You’ll find the 7 best crypto auto trading platforms for 2024 listed below:

- MEXC: Another popular auto platform for copy trading, you’ll have access to over 5,000 verified traders on MEXC. A profit-sharing agreement ensures you only pay fees when copy traders make money. Multiple strategies to choose from, covering spot trading and leveraged futures.

- OKX: Tier-one crypto exchange with over 9 million auto trading bots to choose from. Select a bot and allow it to trade 24/7 without emotions or fatigue. OKX doesn’t have a minimum investment policy, which will appeal to casual investors. Plenty of strategies are supported, including arbitrage trading and dollar-cost averaging.

- Binance: The world’s largest crypto trading platform, Binance supports over 86,000 auto bots. These cover spot trading, futures, and options. Binance also has over 2,000 verified copy traders and there’s no minimum investment requirement. Hundreds of cryptocurrencies are supported and fees are set by the bot creator/copy trader.

- KuCoin: Offers six free auto trading bots that were developed in-house. Bots are trained to trade crypto futures. KuCoin doesn’t charge any fees, users only need to cover the trading commissions. One of the most popular bots is the ‘Martingale’ strategy, which doubles down on losing trades.

- CryptoHopper: This option is ideal for beginners who want to build their own auto bot but don’t have any coding knowledge. CryptoHopper offers a ‘drag and drop’ system, allowing anyone to create a strategy from scratch. Backtesting facilities are supported and bots can be connected to crypto exchanges via APIs.

- Bybit: Top-rated derivatives platform offering crypto auto bots with various strategies. Many bots trade with high leverage, so consider your risk tolerance. Bybit also offers copy trading tools. Both options are free to access but come with profit-sharing agreements. Bybit supports over 400 cryptocurrencies and leverage of up to 125x is available.

- Coinrule: User-friendly marketplace that sells pre-built trading bots. Many focus on short-term strategies, such as swing and day trading. Bots usually cost under $10, which is a one-time payment. No subscription fees are required when trading under $3,000 per month. Anything above this requires at least a basic plan, costing $29.99 per month.

Reviewing the Best Cryptocurrency Auto Trading Platforms

Let’s dive straight into our detailed reviews of the best Bitcoin auto trading platforms listed above.

1. MEXC: Thousands of Experienced Traders to Copy With a Profit-Sharing Agreements

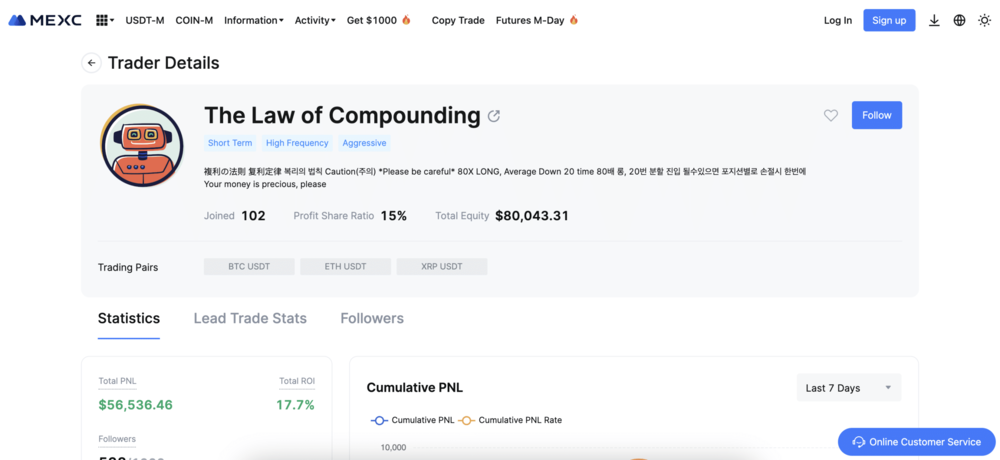

MEXC is also one of the best crypto auto trading platforms for copy trading. Thousands of traders have signed up for its copy trading program, so you’ll have plenty of strategies to choose from. For instance, while many MEXC traders engage in spot trading, some opt for leveraged futures.

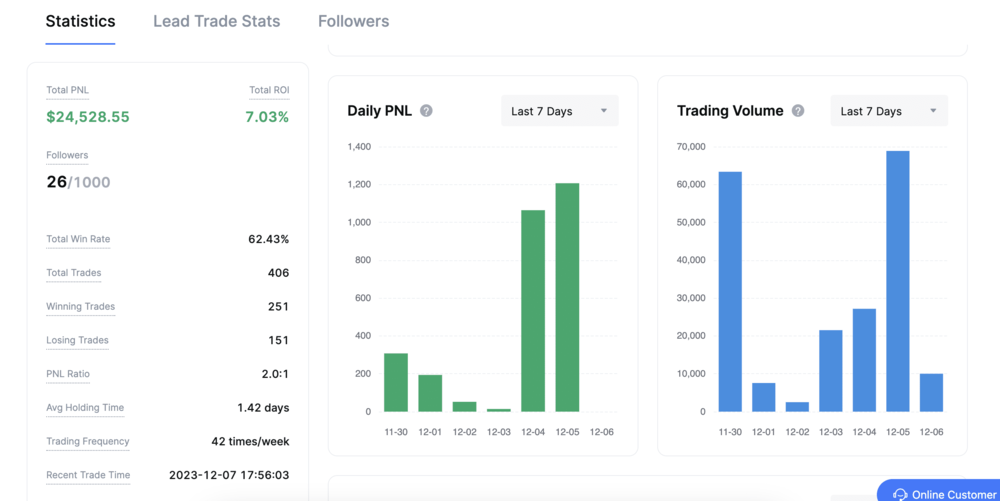

Clicking on a trader will reveal key metrics, such as their preferred marker, cumulative profit and loss, historical win rate, average holding time, and trading frequency. MEXC has installed a profit-sharing agreement, which is set by each trader. We found this to average 10-20%. Although this is high, nothing is paid if the trader doesn’t make a profit.

Once you’ve selected a trader, you’ll need to deposit USDT into your MEXC spot account. There is no minimum deposit or investment amount. What’s more, unless you’re trading significant amounts, MEXC doesn’t KYC its users. MEXC is also known for its fast withdrawal speeds; most payout requests are approved in minutes.

| Type of Crypto Auto Trading | Directly copy experienced crypto traders that use MEXC |

| Fees | Profit-sharing agreement. Set by traders but averages 10-20% |

| Minimum Investment | No minimum, but investments must be made in USDT |

Pros

- More than 5,000 crypto traders to choose from

- Only pay fees if the trader is profitable

- Full historical data for each trader

- No KYC process unless you’re trading huge amounts

- 24/7 customer support is available via live chat

Cons

- Only USDT deposits are accepted when copy trading

- Doesn’t hold licenses with any reputable governing bodies

2. OKX: 9 Million+ Crypto Auto Bots to Choose From With 24/7 Trading

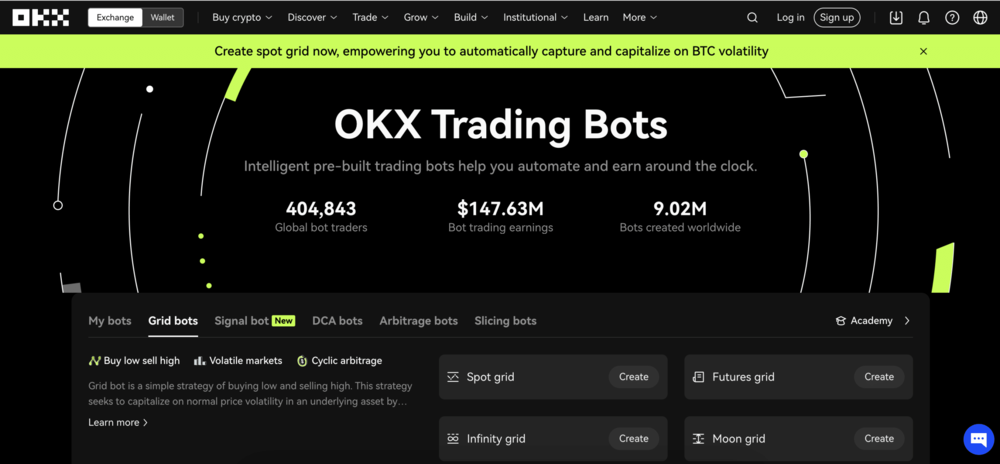

OKX is a tier-one crypto exchange that offers more than 9 million auto trading bots. Apart from a few designed by OKX itself, the majority have been developed by third-party traders. Each crypto bot will have its own strategy, from arbitrage and swing trading to dollar-cost averaging. You can view how each bot works, alongside the past performance and other key metrics.

This includes total assets under management, historical profit and loss, and a detailed log of each trade. OKX bots can be used in spot trading and leveraged futures markets. In particular, we like that OKX supports hundreds of new cryptocurrency tokens. This means your chosen auto bot has access to a huge range of tokens.

Moreover, OKX is one of the largest crypto exchanges for daily trading volume, so there’s plenty of liquidity. Another benefit is that your auto trading bot will be active 24 hours per day, 7 days per week. This is something that copy trading tools cannot rival. In terms of fees, you can choose from a profit-sharing agreement or a monthly subscription.

| Type of Crypto Auto Trading | Over 9 million auto trading bots to choose from, which operate 24/7 |

| Fees | Profit-sharing agreement or a monthly subscription, which varies depending on the bot |

| Minimum Investment | No minimum |

Pros

- Best crypto auto trading platform for bots

- More than 9 million bots to choose from

- Bots trade 24/7

- No minimum investment requirements

- Supports hundreds of the best altcoins to buy

Cons

- Finding a suitable bot can be time-consuming

- US clients are not accepted

3. Binance: Auto Bots and Copy Trading Tools at the World’s Largest Exchange

Binance, the world’s largest crypto exchange, offers a variety of auto trading tools. This includes more than 86,000 auto trading bots. Some of the most popular strategies include rebalancing, dollar-cost averaging, grid trading, and short-selling. Not only can Binance bots buy and sell spot cryptocurrencies but futures and options too.

Alternatively, Binance also offers copy trading tools. You’ll get to mirror the most successful traders on the exchange. Traders can be filtered by their past performance, return on investment, assets under management, and much more. Similar to other Bitcoin auto trading platforms, Binance has implemented a profit-sharing agreement.

The specific percentage is determined by the bot creator or the trader being copied. There are no minimum investments when copy trading on Binance. Although bots do require a minimum, this is rarely more than $10. Binance deposits can be made in crypto or fiat. That said, some currencies are currently suspended, including euros and pounds.

| Type of Crypto Auto Trading | Choose from over 86,000 auto trading bots or 2,000 copy traders |

| Fees | Profit-sharing agreement, set by the bot creator or the trader being copied |

| Minimum Investment | No minimum with copy trading. Bots come with a minimum, but usually below $10 |

Pros

- More than 86,000 auto trading bots covering many different strategies

- Also supports more than 2,000 verified copy traders

- Huge liquidity levels and hundreds of supported cryptocurrencies

- No minimum when. copy trading

Cons

- Some fiat currencies are currently suspended for deposits

4. KuCoin: Free Auto Trading Bots for the Crypto Futures Markets

KuCoin is one of the best crypto auto trading platforms for futures. It offers six different bots that were designed in-house. All bots are free, so you’ll only pay the respective trading commissions. At KuCoin, this amounts to just 0.06% of the trade amount. One of the most popular KuCoin bots is the ‘Martingale’ strategy.

If the bot loses a trader, it will double down on the next one. This is repeated until a trade is successful. At this point, the bot reverts to the original stake. Another popular bot is the ‘DCA’ strategy. This automatically dollar-cost averages crypto futures, helping you avoid volatility over time.

KuCoin also allows users to create their own bots. This means you can automate your proven strategy 24/7. Many different data points are supported, including technical indicators, stop-losses, and take-profits. Bots can also trade with leverage; KuCoin supports up to 100x. KuCoin accepts crypto and fiat deposits; both require KYC before getting started.

| Type of Crypto Auto Trading | 6 free auto trading bots developed by OKX to trade crypto futures |

| Fees | No additional fees, simply cover the respective trading commissions (From 0.06% per slide) |

| Minimum Investment | No minimum |

Pros

- 6 free trading bots designed by OKX

- Bots are trained to trade crypto futures 24/7

- No minimum investment requirements

- Users can also create their own auto-trading bots

Cons

- All accounts require KYC

5. CryptoHopper: Build a Custom Auto Crypto Trading Bot Without Any Coding Knowledge

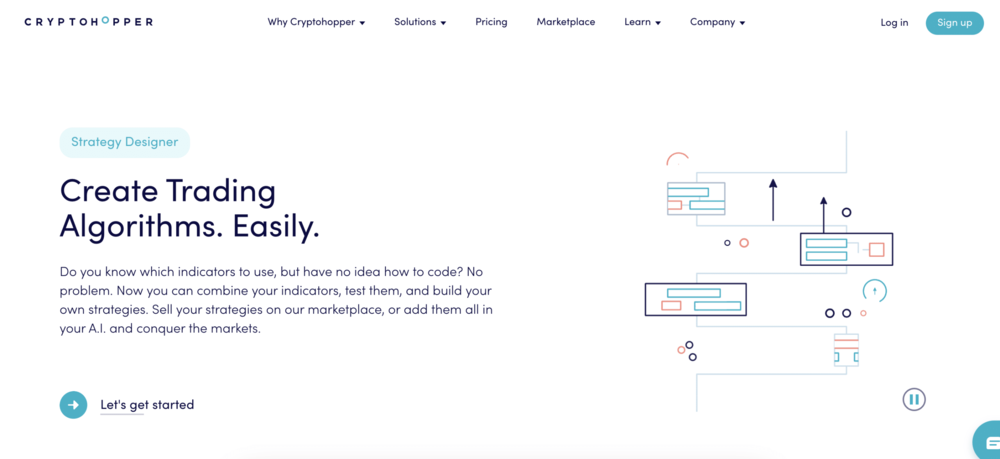

If you’re looking to build a custom bot but you don’t have any coding knowledge, CryptoHopper is worth considering. It has developed a simple strategy-building tool that uses a ‘drag and drop’ model. The bot can be customized for any strategy and covers technical indicators like the MACD and 50-day moving average.

The bot can also be deployed based on volume, volatility, price movements, and much more. We like that CryptoHopper also offers backtesting facilities. This allows you to see how the bot would have performed based on historical trading events. CryptoHopper can also be used in demo mode, which mirrors live market conditions.

Once you’re ready to execute the bot, you can connect it with the best crypto exchanges via an API. This includes Coinbase, Binance, Crypto.com, KuCoin, and OKX. Although CryptoHopper offers a free plan, this doesn’t include access to the strategy builder. Prices start from $29 per month, which is reduced to $24.16 when paying annually.

| Type of Crypto Auto Trading | Custom auto trading bots that don’t require any coding knowledge. Also has a marketplace for buying pre-built bots |

| Fees | $29 per month to access the strategy builder. More expensive plans offer additional features. Discounts are available when paying annually |

| Minimum Investment | N/A |

Pros

- Best crypto auto trading platform for building custom bots

- No coding knowledge is needed – drop and drag only

- Backtesting and demo mode facilities

- Connects to most exchanges via an API

Cons

- Monthly fees start from $29

- You’ll need a proven strategy before building a bot

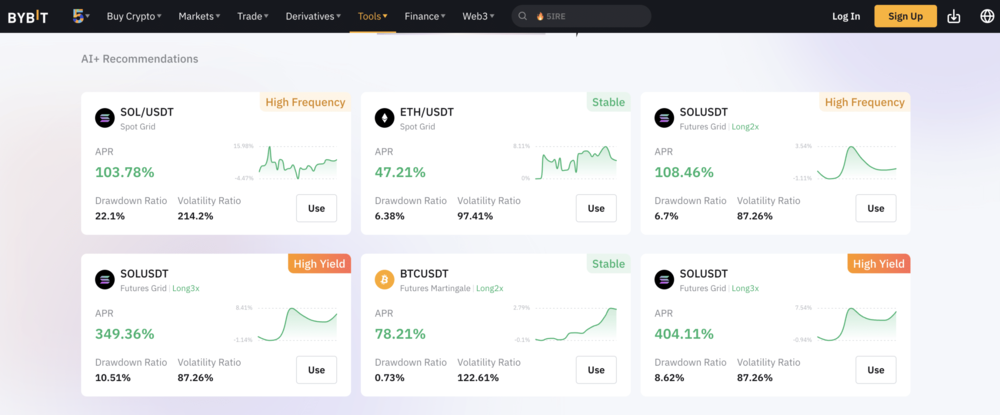

6. Bybit: High Leverage Bots for Crypto Derivative Trading

Bybit – one of the most popular crypto derivative platforms, offers hundreds of auto bots. The majority have been built to trade perpetual futures with leverage. Depending on the cryptocurrency, Bybit offers leverage of up to 125x. Bots are created by third-party traders who monetize their proven strategies.

This is achieved through a profit-sharing agreement, meaning you won’t need to pay anything to access the chosen bot. We like that some bots focus exclusively on specific cryptocurrencies. This enables the bot to get an intimate understanding of historical pricing trends.

In addition, Bybit also offers copy trading tools. You can find traders based on their historical returns, the most followers, the lowest drawdown, and much more. Clicking on a trader will reveal a huge range of stats, including individual trades. Similar to auto bots, copy trading comes with a profit-sharing program.

| Type of Crypto Auto Trading | Auto trading bots designed by third-party traders. Also offers copy trading |

| Fees | Profit-sharing agreement, set by the bot creator or the trader being copied |

| Minimum Investment | No minimum |

Pros

- Specialist bots that automatically trade crypto derivatives with leverage

- Copy trading tools are also available

- Get started with any amount

- One of the best crypto leverage trading platforms (125x)

Cons

- Auto trading with leverage is very risky

- Currently being sued by FTX regarding recovery assets for bankruptcy proceedings

7. Coinrule: Crypto Auto Bots for Casual Traders With Low Monthly Volumes

The final option is Coinrule, which is a marketplace for auto crypto bots. Many bots are designed as day traders, meaning they will actively buy and sell cryptocurrencies 24/7. Trades rarely remain open for more than a few hours and each bot has its own risk-management strategies.

One of the most popular bots is the ‘RSI MA’. This uses the Relative Strength Index and moving average indicators alongside trailing stop losses. This auto bot costs just $2.99. Another popular option is ‘Buy the Dip’. This bot automatically buys cryptocurrencies when they enter a market correction. At just $7.99, this bot is also cost-effective.

Coinrule bots can be imported into popular crypto exchanges like Binance and KuCoin. We found that Coinrule also enables users to create their own custom bots, no coding is needed. Coinrule offers a free plan that allows your bot to trade up to $3,000 per month. If you need higher limits, basic plans start from $29.99 per month.

| Type of Crypto Auto Trading | Pre-built bots that can be imported into popular crypto exchanges. Also enables users to build custom bots |

| Fees | One-off fee on pre-built bots, often below $10. No subscription fees on monthly trading volumes of under $3,000. Paid plans start from $29.99 per month. |

| Minimum Investment | N/A |

Pros

- Buy pre-built auto trading bots for under $10

- Many day trading strategies to choose from

- No subscription fees when bots trade under $3,000 per month

- Also enables users to build custom bots

Cons

- The free plan limits users to one connected exchange

- Pro plans cost $449.99 per month

How Does Bitcoin Auto Trading Work?

In simple terms, auto trading platforms allow you to automatically trade cryptocurrencies. In general, there are two different ways of achieving this. First, some platforms offer auto trading bots. The bot will be programmed to follow pre-defined conditions. For example, it might buy Ethereum when the 24-hour price drops by 6%.

Or, the bot might day trade cryptocurrencies based on technical indicators like Bollinger Bands and the MACD. Bots are particularly popular with traders who want 24/7 exposure to the crypto markets. After all, unlike humans, bots don’t experience fatigue or emotions.

The second method is copy trading. You’ll automatically copy the buy and sell positions of an experienced trader. You can choose a trader based on many metrics, such as past performance, average holding times, and preferred cryptocurrency markets. Regardless of your chosen method, crypto auto trading bots allow you to invest passively.

You won’t need to have any prior knowledge of fundamental or technical analysis, let alone cryptocurrencies themselves. We found that the best crypto auto trading platforms double up as exchanges. This offers an all-in-one service, meaning third-party integration isn’t needed. That said, some providers only offer individual bots, which need to connect with an exchange.

Best Practices When Selecting a Crypto Auto Trading Platform

This section will help you choose the best crypto auto trading platform. We’ve crafted a checklist of important metrics, so read on to ensure you choose the right provider.

Type of Auto Crypto Trading

First, you’ll need to decide which auto crypto trading tool you prefer. This is a choice between copy trading and bots.

Copy trading involves copying a human trader. Anything they buy or sell will be replicated in your portfolio. This will be at a proportionate amount based on what you invested.

Bots are preprogrammed to follow specific conditions. Unlike human traders, bots cannot make subjective trading decisions. What’s more, bots can operate 24/7. However, bots are riskier, as you won’t benefit from the experience of a human trader.

Regulation and Client Protection

Safety is the most important factor when researching crypto auto trading platforms.

It was launched in 2007 and has an excellent reputation for client safety. It keeps client funds in segregated bank accounts and cryptocurrency deposits are protected by institutional-grade security.

In contrast, many other platforms in this space are unregulated or licensed in shady offshore locations. So, you’ll need to look beyond fees, markets, and other metrics until you’re confident the platform is safe,

Fees

Crypto auto trading platforms charge fees in many different ways. This is also the case with KuCoin bots, which were developed in-house.

However, the majority of platforms have a profit-sharing agreement in place. This means you’ll pay a percentage of any profits generated. This is usually determined by the trader being copied or the bot creator. On average, you should expect to share around 10-20% of your profits.

If you’re using a third-party marketplace like Coinrule or CryptoHopper, then you’ll need to pay a one-off fee for your chosen bot. Depending on your requirements, you might also need to pay a monthly subscription. Once connected with an exchange, the bot will also accumulate trading commissions.

Transparency on Key Trading Data

Choosing a crypto auto trading platform is one thing. Selecting a copy trader or bot is just as challenging. After all, some platforms offer thousands of options. On OKX, you’ll have over 9 million bots to choose from.

Therefore, it’s important the platform offers transparent metrics on each trader or bot. For example, you’ll want to know the past performance, average holding time, maximum drawdown, preferred market (e.g. futures or spot trading), and much more.

This will help you make an informed decision.

Supported Markets

Don’t forget to explore what markets the auto trading tool covers.

Conversely, copy traders on Bybit generally trade leveraged derivatives, such as perpetual futures and options. This is a lot more risky, considering leverage can result in liquidation. This is especially the case when using an auto bot that can only follow predefined conditions.

You should also check which specific cryptocurrencies the platform supports.

What is the Best Crypto Auto Trading Tool for Futures?

There are two options when it comes to futures crypto trading with auto tools:

- First, if you’d prefer copying an experienced human trader, MEXC is the best option. You’ll have over 5,000 futures traders to choose from and fees are only required if a profit is made.

- Second, if you want an automated bot to trade futures, OKX is a great option. It has more than 9 million bots to choose from, many specializing in futures.

Minimum Investment Requirement

There are two minimum investment figures to check when choosing a crypto auto trading platform. First, the platform might have a minimum deposit requirement. This will likely be the case when depositing fiat money.

Second, the auto trading tool itself might come with a minimum investment threshold. Just make sure the minimum requirements are suitable for your budget and risk tolerance.

Deposit and Withdrawal Methods

On top of account minimums, don’t forget about specific payment methods. Most platforms accept cryptocurrencies, which often enables you to trade anonymously.

If you want to deposit fiat money, many platforms accept debit/credit cards. If the payment is being processed by a third party, expect to pay between 2-5%. Regulated auto trading platforms directly accept payments, meaning much lower fees. For instance, USD deposits are fee-free. Other currencies are charged just 0.5%.

Make sure your chosen platform also allows fiat withdrawals. Check the minimum and maximum withdrawal limits, plus any applicable fees. Time frames are also important; you’ll want your withdrawals approved as quickly as possible.

Usability

Although auto trading tools enable you to trade passively, the platform should still offer a user-friendly experience. For example, you should be able to filter copy traders or bots with ease. This should include key metrics, such as historical returns and risk ratings.

Opening an account should be seamless, as should deposits and withdrawals. Most importantly, setting up a copy trading or bot investment should be simple. No technical experience should be necessary.

Customer Support

And finally, we also expect crypto auto trading platforms to offer excellent customer support. If live chat is available, check what times it’s available; they’re not always 24/7.

You should also check waiting times. Some crypto platforms are known for keeping clients on hold for several hours. Some platforms only offer email or ticket support, which will be a drawback.

Is it Legal to Use Crypto Auto Trading Systems?

Regardless of where you’re based, auto trading cryptocurrencies is perfectly legal. As we’ve established, most providers are exchanges that directly support copy trading or auto bots.

That being said, you should consider what crypto products are being traded on your behalf. For example, those based in the UK won’t be able to access crypto leverage, as per the FCA. Therefore, UK traders won’t be able to use an auto trading system that specializes in crypto futures, options, or perpetual swaps.

The Verdict

Auto trading tools allow you to trade cryptocurrencies passively. No prior experience is needed either. We found that the best option for beginners is MEXC.

After selecting a seasoned investor, you’ll automatically copy their positions. Follow the link below to get started today!

References

- https://www.finra.org/rules-guidance/guidance/reports/2021-finras-examination-and-risk-monitoring-program/segregation

- https://www.wsj.com/articles/binance-became-the-biggest-cryptocurrency-exchange-without-licenses-or-headquarters-thats-coming-to-an-end-11636640029

- https://www.bloomberg.com/news/articles/2023-11-11/ftx-sues-crypto-firm-bybit-to-recover-assets-worth-953-million

- https://www.finra.org/rules-guidance/rulebooks/finra-rules/1210

FAQs

Is there an automated crypto trading platform?

Yes, MEXC’s copy trading tool enables users to automatically buy and sell crypto. Simply choose an experienced trader and copy their positions passively.

What is the best auto crypto trader?

OKX, Binance, and KuCoin are popular options for auto crypto bots. MEXC offers copy trading tools, which is another form of auto trading.

Is automated crypto trading profitable?

Some auto crypto trading systems are profitable. However, some will lose money, so make sure you consider the risks.

Does Binance do automated trading?

Yes, Binance offers copy trading and auto bots that trade crypto futures on your behalf.