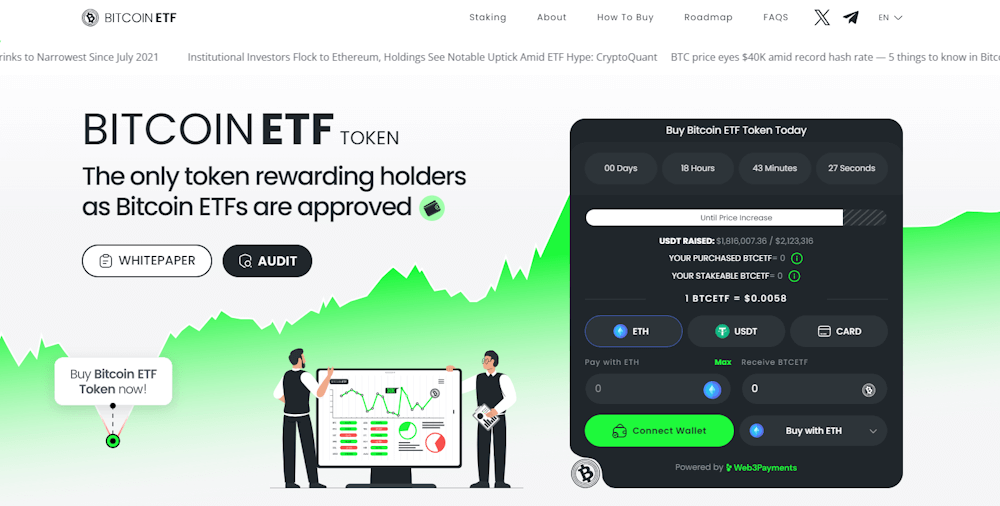

The Bitcoin ETF Token (BTCETF) is a hot new crypto tapping into the growing excitement around the potential debut of the first spot Bitcoin Exchange-Traded Fund (ETF). It offers investors a chance to speculate on the anticipated launch of the ETF and includes a unique token burn strategy linked to the Bitcoin ETF’s development.

The recently launched Bitcoin ETF Token presale allows investors to buy $BTCETF tokens before they are listed on exchanges. This article outlines an in-depth overview of the Bitcoin ETF Token presale while explaining how to buy the Bitcoin ETF Tokens through an easy step-by-step guide.

Key Highlights of the Bitcoin ETF Token Presale

- The Bitcoin ETF Token is a unique crypto project associated with the anticipated launch of the United States’ first spot Bitcoin Exchange-Traded Fund.

- The project is set to reduce its total token supply by up to 25% through a dynamic token burn mechanism tied to five major ‘milestones’ in the Bitcoin ETF sector.

- Currently, $BTCETF tokens are available in the presale phase for $0.0058 per token, appealing to early investors.

- The presale has raised over $1.7 million in a few weeks, indicating investor confidence and high market interest.

- The $BTCETF includes a staking rewards system and a 5% transaction tax designed to incentivize long-term holding and contribute to the token’s stability and growth in the market.

How to Buy Bitcoin ETF Token (BTCETF) In 5 Simple Steps

The Bitcoin ETF Token is one of the most promising new cryptos in its presale phase. This stage allows investors to buy tokens using Ethereum (ETH), Tether (USDT), MATIC, Binance Coin (BNB), or even a credit card. Here’s a step-by-step guide to buy Bitcoin ETF Tokens:

Step 1 – Setting Up a Crypto Wallet

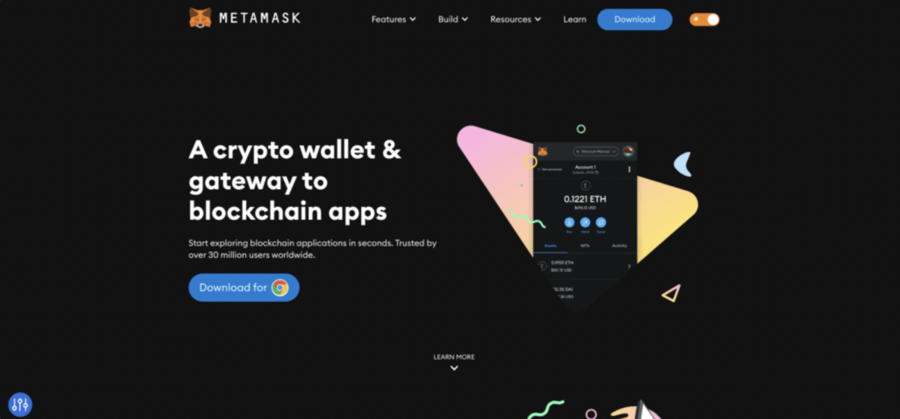

To buy $BTCETF during its presale, it’s necessary to have a crypto wallet compatible with ERC-20 tokens. A recommended option is MetaMask, a secure and free wallet available for both mobile and web browsers.

To start, visit the official MetaMask website to download and install the wallet. Once installed, open MetaMask to set a password for your wallet.

Writing down and securely storing your seed phrase is crucial, as it’s key to recovering your wallet if needed.

Step 2 – Buying Ethereum (ETH) or Tether (USDT)

During the presale, ETH/USDT crypto is exchangeable for BTCETF. If you don’t own any crypto, many crypto exchanges allow you to buy ETH or USDT using various payment methods, including credit/debit cards and bank transfers.

After buying ETH or USDT, transfer them to your MetaMask wallet. It’s worth noting that investors can also use MATIC or BNB to buy BTCETF, but tokens bought using these two cryptos won’t be eligible for early staking rewards of over 140%.

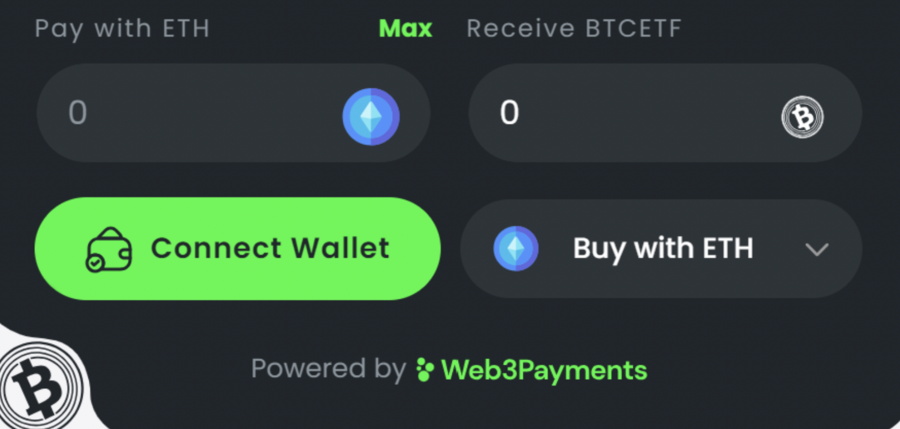

Step 3 – Connecting to the Bitcoin ETF Token ICO

Visit the $BTCETF presale site and choose ‘Connect Wallet.’ Then, select MetaMask and follow the on-screen instructions to confirm the connection.

Step 4 – Buy Bitcoin ETF Tokens

Decide the amount of $BTCETF you wish to buy using ETH/USDT/BNB/MATIC. The platform will compute the matching $BTCETF amount, including transaction fees.

Click ‘Buy $BTCETF Tokens’ to complete the purchase.

Step 5 – Claiming Your BTCETF Tokens

The tokens bought in the presale are not immediately available. They become accessible to buyers after the token generation event.

Once the presale ends, buyers can return to the presale website and click ‘Claim Tokens’ to transfer them to your wallet.

Buyers can enter the Bitcoin ETF Telegram group for the latest updates on token availability.

What is Bitcoin ETF Token?

The Bitcoin ETF Token is an emerging crypto on Ethereum gaining investor traction due to its unique incentive mechanism. Its reward system is aligned with the anticipated launch and approval of Bitcoin Spot ETFs.

Bitcoin ETF Token recently launched a presale for its native token, BTCETF, priced at $0.0058 each at the time of writing.

This presale phase marks an early opportunity for investors to participate. It quickly raised over $1.7 million in just three weeks, showing strong community backing and investor confidence.

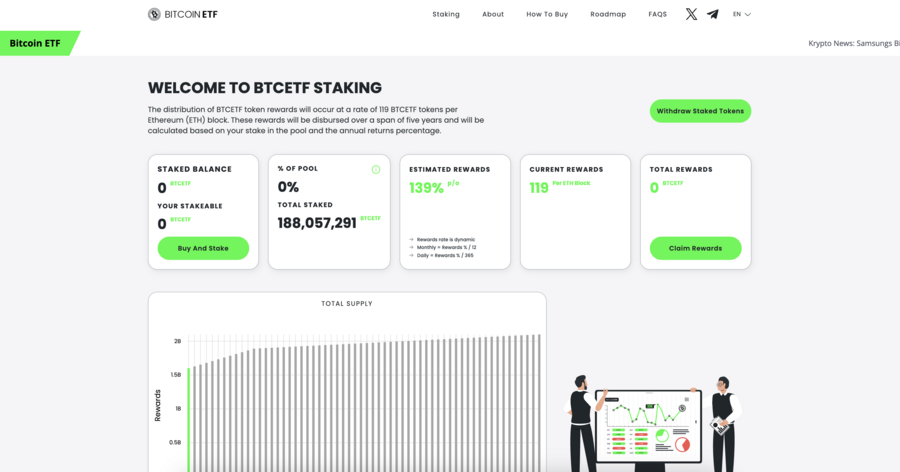

High Annual Percentage Yield (APY) for Early Stakers

Early investors staking their $BTCETF can earn an APY of 139% at press time. This high yield shows the benefits for early participants, though it’s expected to decrease as more tokens are staked.

Up to 25% of the token supply is dedicated to staking rewards. This allocation is spread over five years, reflecting the project’s commitment to long-term growth and stability.

The structured staking rewards aim to provide significant returns for early and long-term staking activities.

To keep updated on the latest developments and reward structures of the Bitcoin ETF Token, you can follow its official account on X (previously known as Twitter).

Dynamic Token Burns

The Bitcoin ETF token has a unique deflationary model aimed at preserving its long-term value by maintaining a limited supply.

BTCETF’s deflationary strategy is designed to mirror and respond to the evolving landscape of Bitcoin ETFs.

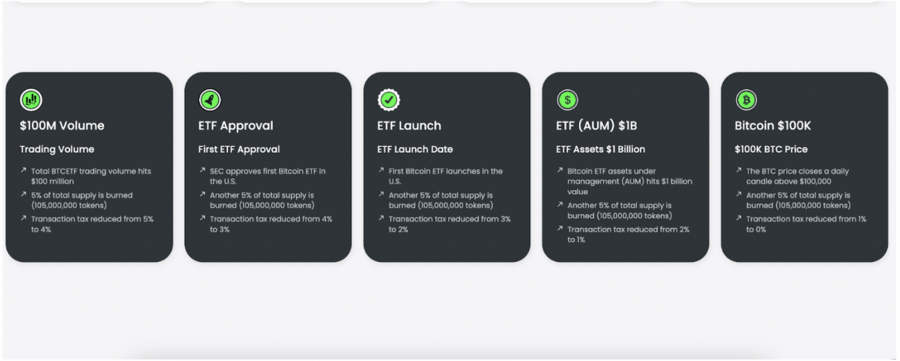

Dynamic Token Burn System: The token burn process is unique in its adaptability, directly linked to significant events and developments in the Bitcoin ETF landscape. Each milestone burn is designed to gradually reduce the total token supply by 25% cumulatively.

The burn mechanism directly responds to significant achievements and advancements in the Bitcoin ETF sector. Token burn milestones and mechanism:

- Trading Volume Trigger: When the BTCETF’s trading volume exceeds $100 million, 5% of the total supply is burned.

- First Spot ETF Authorization: Upon the approval of the first Bitcoin spot ETF, another 5% of the supply will burn.

- Launch of the First Spot ETF: At the first Bitcoin spot ETF launch, 5% of the total supply is again burned.

- AUM Benchmark: A burn of 5% of the supply is triggered when the combined Assets Under Management (AUM) for all Bitcoin ETFs exceed $1 billion.

- Bitcoin Price Milestone: When Bitcoin crosses $100,000, it leads to a further 5% burn of the total supply.

Transaction Tax Structure

- Taxation Mechanism: There is a 5% tax on every transaction within the $BTCETF ecosystem.

- Deflationary Model Adjustment: As each milestone is achieved, the project’s deflationary model adapts by reducing the tax impact by 1%.

BCTETF Tokenomics And Presale

According to the Bitcoin ETF whitepaper, the $BTCETF has a total supply cap of 2.1 billion tokens. Of these, 40% of the supply (840 million tokens) is reserved exclusively for the presale phase for early buyers.

Allocation for Exchange Liquidity and Other Purposes

- Exchange Liquidity Provision: 10% of the tokens (210 million) are allocated to ensure exchange liquidity for smooth trading and market stability after the expected listings.

- Staking Rewards and Token Burning: The remaining 50% of the supply is equally divided between the dynamic token-burning mechanism and staking rewards. This ensures community incentives and contributes to the long-term stability of the token.

Presale Structure of $BTCETF

- Phase-Based Approach: The presale is segmented into ten phases, each with a specific allocation and pricing strategy. Each phase offers 84 million tokens, ensuring a uniform supply throughout the presale phases.

- Pricing Strategy: Starting at $0.005 in the first phase, the price incrementally rises to $0.0068 by the final phase. This tiered pricing encourages early participation and gradually improves the token’s perceived value. The presale is in its fifth stage at press time, with tokens priced at $0.0058 each.

The presale has a hard cap target of $4,956,000. It has already secured over $1.7 million in a relatively short period since its launch. Investors can buy $BTCETF tokens using cryptos like ETH, USDT, BNB, MATIC, or card payments.

Bitcoin ETF’s Journey Since 2013

Many crypto advocates have pursued a Bitcoin ETF’s approval since 2013. However, the journey has been marked by regulatory challenges, given the complexities and grey areas at the intersection of financial regulations and crypto. Some major milestones:

- Early Efforts and Regulatory Hurdles (2013-2017): The initial proposal for a Bitcoin ETF came in 2013 from the Winklevoss twins, who envisioned an investment vehicle to make Bitcoin accessible to mainstream investors through traditional stock exchanges. However, the U.S. Securities and Exchange Commission (SEC) rejected this proposal in 2017, citing concerns about market manipulation, volatility, and the nascent state of crypto markets.

- Incremental Progress and Diversified Approaches (2018-2021): Despite early setbacks, the push for a Bitcoin ETF gained momentum. Various financial institutions submitted proposals, exploring different structures such as futures-based ETFs. In 2019 and 2020, the SEC continued to express concerns over market surveillance and investor protection.

- Breakthrough with Futures-Based ETFs (2021): A significant milestone was achieved in October 2021 with the approval of the first U.S. Bitcoin futures-based ETF, the ProShares Bitcoin Strategy ETF. This ETF tracks Bitcoin futures contracts rather than spot prices, representing the SEC’s cautious yet important step toward embracing Bitcoin-linked investment products.

Current Prospects for Spot Bitcoin ETF Approval

As of 2023, the crypto community remains optimistic about the approval of a spot in Bitcoin ETF, which would directly track the price of Bitcoin itself, offering more direct exposure than futures-based ETFs.

The potential approval depends on improved regulatory frameworks and mechanisms to address the SEC’s concerns over market manipulation and transparency.

The approval of a spot Bitcoin ETF would be a massive moment, potentially steering us into a new era of institutional adoption and mainstream acceptance of Bitcoin.

It would allow broader investor access, improved liquidity, and show a significant step in the maturation of crypto as an asset class. However, the timeline for such approval remains uncertain, contingent on evolving regulatory stances and market developments.

Why Buy BTCETF During the Presale?

Investing in the Bitcoin ETF Token during its presale phase offers an exciting opportunity for potential upside and long-term benefits. Here are key reasons why this stage is attractive for investors:

- Early Advantage: Those participating in the initial stage of the $BTCETF presale can get an immediate upside by the final presale stage.

- Deflationary Mechanisms and Milestone Burns: The long-term supply reduction of $BTCETF, encouraged by the sell tax and specific milestone burns, is designed to continually diminish the total token supply. This decrease in supply, coupled with spikes in demand following positive news in the Bitcoin ETF sector, can increase the token’s value over time.

- Staking Rewards Incentive: The plan to introduce staking rewards for $BTCETF holders adds another incentive layer. This feature encourages investors to hold their tokens, further reducing market supply and potentially improving their value.

- Anticipated Launch Impact: The launch of Bitcoin ETF Token can be significant. Unlike many tokens that face high selling pressure upon launch, $BTCETF is structured to mitigate this through a 5% sell tax. This tax discourages immediate selling, likely leading to a supply-demand imbalance that could sharply drive up the token’s price.

- Uncharted Potential: Amid the ongoing developments in the crypto ETF space, Bitcoin ETF Token could be the next crypto to explode, potentially mirroring the explosive trajectories of successful cryptos in the past.

Bitcoin ETF Token Price Prediction – What is $BTCETF’s Potential?

The potential approval of a Bitcoin spot ETF by regulatory authorities like the SEC could significantly impact the crypto market. Such an event will likely attract billions of dollars into the sector, potentially triggering a massive increase in market value.

In this context, the $BTCETF coin is strategically positioned to capitalize on this scenario, offering an exciting buying opportunity for those looking to benefit from the growing crypto-ETF market.

To date, no ‘spot Bitcoin ETF’ has been launched in the United States. Additionally, linking significant token burns to regulatory milestones, such as the SEC’s approval of a spot ETF, has yet to occur in the crypto domain.

This uniqueness presents challenges in accurately predicting the future price trajectory of the Bitcoin ETF Token.

However, our outlook for the $BTCETF remains positive. We anticipate a substantial increase, potentially by ten times or more, from its current presale price, especially after the final and fifth burn milestone is achieved.

The combination of a sales tax on transactions and the offering of staking rewards acts as a mechanism to limit the influx of new Bitcoin ETF tokens into the market.

This limitation is likely to create upward pressure on the token’s price. Additionally, reaching significant milestones is expected to create buzz and positively impact the token’s value.

Conclusion

The Bitcoin ETF Token is an innovative crypto project closely linked to the anticipated launch of the first Bitcoin ETF in the United States.

This project has set a strategic goal to decrease its token supply by up to 25% through five key milestones. The $BTCETF combines a sell tax and staking rewards to encourage long-term holding amongst investors.

For early investors looking to capitalize on this opportunity, the Bitcoin ETF Tokens are available for purchase at only $0.0058 per token in the ongoing presale phase.

The presale phase has shown impressive initial results, raising over $1.7 million in just a few weeks and generating strong investor interest and confidence in the project.

Visit Bitcoin ETF TokenReferences

FAQs

What is Bitcoin ETF Token (BTCETF)?

The Bitcoin ETF Token (BTCETF) is an innovative crypto linked to the development of the first spot Bitcoin ETF. It is designed to benefit from the evolving crypto-ETF market and features a deflationary model with a unique mechanism for token burns aligned with key regulatory milestones.

How to invest in $BTCETF?

To invest in $BTCETF, set up an ERC-20 compatible crypto wallet, like MetaMask. Purchase Ethereum (ETH) or Tether (USDT) from a crypto exchange and transfer it to your wallet. Connect your wallet to the $BTCETF presale site, choose the amount of $BTCETF to purchase with ETH/USDT/BNB/MATIC, and complete the transaction.