Letters sent to eight of the largest asset managers call out their low support for shareholder proposals raising long-term environmental, social, and governance risks.

Investors Call Out Large Asset Managers On ESG Support

NEW YORK, NY, WEDNESDAY, APRIL 26TH, 2023 – The Interfaith Center on Corporate Responsibility (ICCR) a coalition of over 300 institutional investors representing more than $US4 trillion in assets under management, today announced they had sent letters to the top eight asset managers calling out their low support for shareholder proposals citing long-term environmental and social risks.

The letters were sent to BlackRock (NYSE:BLK), Dimensional (NYMARKET:DFAC), Fidelity (NYSE:FNF), Goldman Sachs (NYSE:GS), JPMorgan Chase (NYSE:JPM), State Street (NYSE:STT), T. Rowe Price (NASDAQ:TROW), and Vanguard (TSE:VFV).

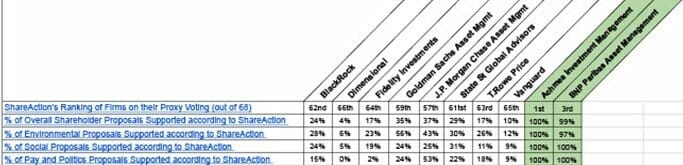

In a report by ShareAction assessing the records of 68 of the top fund managers responsible for voting the proxies of millions of their clients, the eight companies ranked among the lowest in their support for ESG-related shareholder proposals. Research by Georgeson, Majority Action and Morningstar was also used to inform ICCR’s letter.

Of the 68 funds assessed, the eight companies ranked between 57th (JPMorgan Chase) and 66th (Dimensional) with their support of environmental proposals citing corporate climate impacts being slightly higher than their support of proposals raising social risks, such as DEI programs, racial justice impacts, and treatment of workers.

“This is an especially important proxy season with numerous key business issues appearing on proxy statements,” said Tim Smith, ICCR’s Sr. Policy Advisor.

“Shareholder proposals focused on issues of systemic risk such as climate change and worker wages and welfare are gaining increasing support from the mainstream investment community. As investors and clients, we want to learn why there is such misalignment between the proxy voting records of these companies and their peers.”

The letter also pointed out the disconnect between the funds’ proxy voting guidelines regarding the board’s role in mitigating risk and their support for directors who fail to mitigate those risks.

For example, Vanguard’s Investment Stewardship Semiannual Report states that the fund found the many climate proposals on 2022 proxy statements to be overly prescriptive and instead looked to “boards to oversee climate-related risks, to determine mitigation measures, and to provide comprehensive disclosures where material ́risks are present.”

According to ICCR’s letter, “Given this reasoning, if Vanguard were not voting proxies in favor of climate-related shareholder proposals, we would expect it to vote against Board members at companies where there is high climate risk and poor environmental oversight.

Yet, Majority Action’s report found Vanguard supported 100% of directors at climate-critical companies and its support for board members at these companies rose each year. Furthermore, Vanguard supported none of the ten votes against directors flagged by Climate Action 100+ investors.

Vanguard’s exit from the Net Zero Asset Managers Alliance has raised concerns among its shareholders and clients, with over a thousand Vanguard clients expressing their concerns in a public letter.”

The funds’ support for shareholder proposals calling for racial equity audits at multiple companies was also flagged by investors as very low relative to average shareholder support.

Goldman Sachs and Vanguard supported none of the 20 shareholder proposals requesting a racial equity audit in 2022 despite these proposals receiving average shareholder support in the 40s and, in several cases, achieving majority support.

The letters also highlight that firms whose sustainable funds offered noticeably lower support for key resolutions, i.e. proposals supported by 40% or more of a company’s independent shareholders, may raise concerns for their sustainable fund clients.

“We are aware that there has been pressure on asset managers from parties attempting to discredit ESG, however, the fiduciary case for integrating material ESG risk factors into investment decisions and proxy voting is clear and irrefutable,” said Josh Zinner, ICCR’s CEO.

“As a coalition of long-term investors, we see the management of material ESG risks as critical to long-term value creation and the safeguarding of shareholder value. As fiduciaries managing the assets of millions of clients, we believe these funds have an obligation to fully leverage their proxy voting powers to mitigate those ESG risks.”

About the Interfaith Center on Corporate Responsibility (ICCR)

The Interfaith Center on Corporate Responsibility (ICCR) is a broad coalition of more than 300 institutional investors collectively representing over $4 trillion in invested capital.