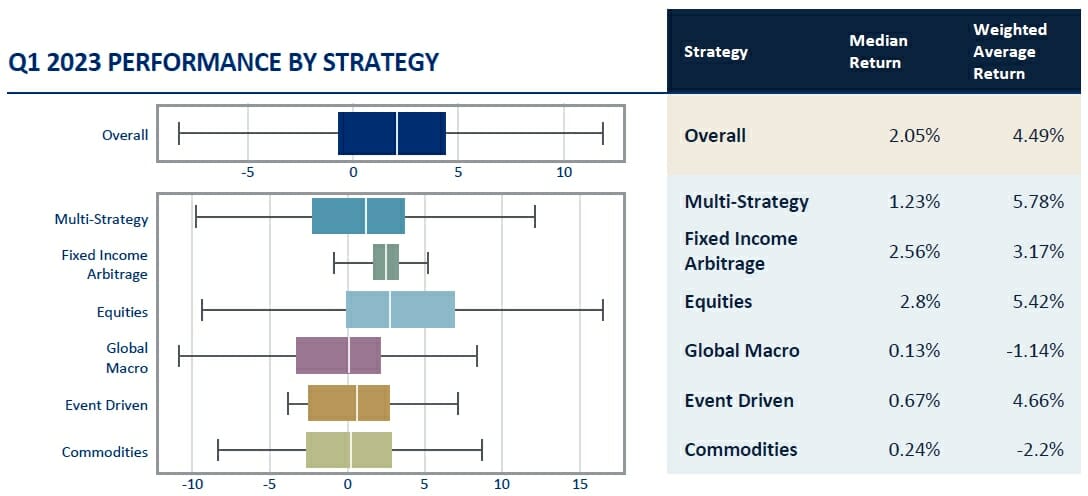

- Multi-Strategy and Equities performed best at 5.78% and 5.42% respectively;

- Funds saw an overall weighted average quarterly return of 4.49%;

- Net redemptions were markedly lower in Q1.

Hedge Funds Continued To Rebound

New York/London, 24 April, 2023: Hedge funds continued to rebound with even better weighted average returns in the first quarter of this year than Q4 2022, with Multi-Strategy and Equities funds continuing as the top performers.

Data from the Citco group of companies (Citco), the asset servicer with over $1.8T in assets under administration (AUA), saw an overall weighted average return of 4.49% in the first quarter of this year – up from 4.11% in Q4.

All fund strategies delivered positive returns with the exception of Commodities at -2.2% and Global Macro at -1.14%. Multi-Strategy and Equities funds bettered their Q4 performance with Q1 weighted average returns of 5.78% and 5.42% respectively.

All AUA categories generated positive weighted average returns, with larger funds significantly out-performing their smaller counterparts. Funds with more than $3B of AUA saw a weighted average return of 6.43% in Q1, by far the best-performing size category; in contrast, the smaller categories of $200-500M and under $200M had weighted average returns of 2.28% and 0.83% respectively.

Capital flows were once again negative, with net redemptions from Citco administered funds totalling $4.8B. However, this was lower than the net redemptions seen in Q3 and Q4 of $9B and $8.9B respectively.

Hybrid funds were again the winners in Q1 in terms of investor flows, with $1.4B of net inflows overall – the only strategy type to experience net inflows for the quarter. Across AUA buckets, all categories saw net outflows; funds between $5B-$10B where the exception, which saw minor net inflows of $300M.

Trade volumes dipped down at the beginning of the year, suggesting managers possibly waited for clarity to emerge following a gloomy global market outlook for 2023. Volumes rose in February, with daily average trade volumes up 13.4% for the month and up again by a further 9% in March.

Citco saw year-on-year growth of almost 20% in Treasury volumes in the first quarter as the impact of rate hikes around the world helped spark increasing interest in the marketplace. Even with this growth, Q1’s total did not hit the record-setting peak seen in Q4, when volumes climbed above 127,000.

Declan Quilligan, Head of Hedge Fund Services, Citco Fund Services (Ireland) Limited, said:

“The first quarter of the year looks promising with hedge fund performance continuing the trend from Q4 with even better overall returns and nearly four-fifths of funds delivering positive performance.

Continuing the main capital flows trend of 2022, Q1 saw redemptions outweighing subscriptions yet again –– with a surge of net outflows in March outweighing combined net inflows in the first two months of the year. However, the quarter’s net redemptions of $4.8B were markedly lower than previous quarters.

“With rate hikes continuing so far this year, we expect Treasury activity to remain elevated. As such, barring a marked decline in inflation and reversal of current monetary policy, the outlook for transaction volume growth remains positive.”