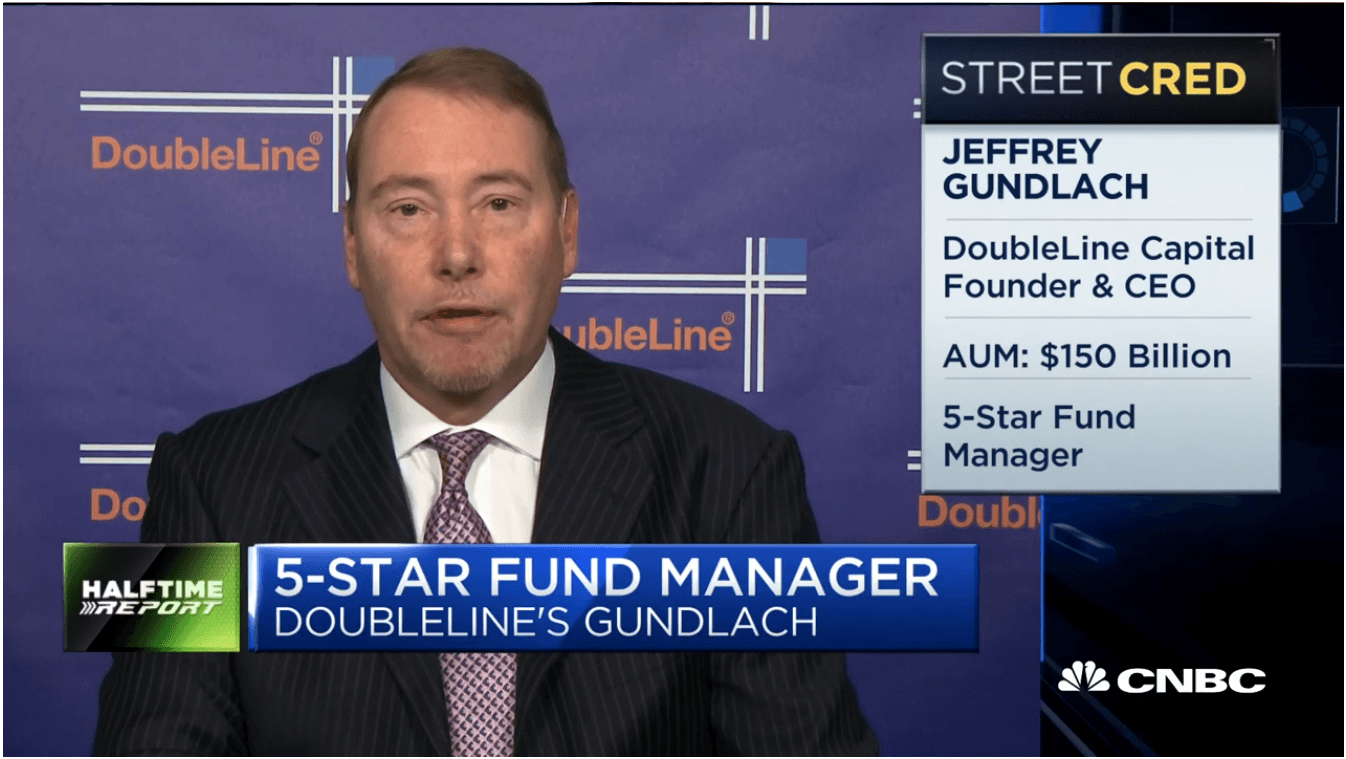

Following are excerpts from the unofficial transcript of a CNBC exclusive interview with DoubleLine Capital CEO, CIO and Co-Founder Jeffrey Gundlach on CNBC’s “Closing Bell” (M-F, 3PM-4PM ET) today, Monday, March 13th.

Gundlach On Silicon Valley Bank

JEFFREY GUNDLACH: I’m not saying Silicon Valley Bank (NASDAQ:SIVB) did anything particularly wrong. They did the classic thing they were borrowing short and, you know, buying long-term fixed rate securities, which by the way, is exactly what the Fed has been doing and that’s why what Dick Bove is saying is correct.

Q4 2022 hedge fund letters, conferences and more

That they own all these treasuries and they’re massively underwater they did quantitative easing. The Fed doesn’t have any money so the only response crises right now is printing money.

Gundlach On Yield Curve Recession

GUNDLACH: But I do think that one of the indicators that had not been signaling recession was the yield curve was getting steeper and steeper and in all the past recessions going back through decades, the yield curve starts deinverting a few months before the recession comes.

So, since we were at peak inversion last week, it was unlikely that we’re going to go into a recession even in the next four to six months. But at this point with the deinversion happening, the four-to-six-month time window is starting to seem much more plausible.

Gundlach On Fed To Raise 25 Points

GUNDLACH: Well, I think the Fed will probably raise just 25 basis points. I would say at this point, the chance, things are happening so quickly that event though it’s a week away, a little over a week away, anything sort of can happen.

But things are happening so quickly, I just think at this point the Fed is going to go 50. I would think 25 and I know people are wondering if they’ll go up at all. I just think to save kind of the program and credibility, they’ll probably raise rates 25 basis points.