VanEck’s subsidiary has launched a meme coin index (MEMECOIN). MarketVector tracks the top meme coins in the crypto markets. This is a significant milestone for the meme coin sector, which some seasoned investors have mocked.

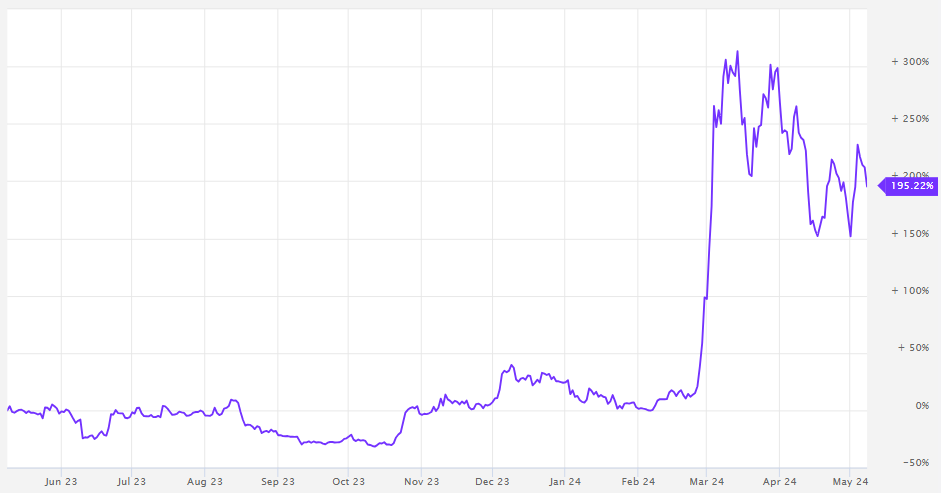

The new index has gone live, demonstrating a one-year ROI of around +195 %. The Year-to-Date performance (YTD) is +135.41%. The market cap is $44.14B.

source: marketvector

The index tracks some meme coins, including Dogecoin, Shiba Inu, Pepe, Bonk, and Dogwifhat. DOGE has the most weight, 30.69% of the index.

The next review will take place on May 27, 2024.

What does the MEMECOIN index mean for the crypto industry?

First, it is recognized that many investors seek out meme coins. At the time of this writing, the index tracks only 6 meme coins.

More meme coins will likely be added to the index, which may trigger significant volatility in the new coins. Market participants may track the MEMECOIN index for any changes. The meme coins were added to the index based on their market cap.

To avoid regulatory concerns, the index highlighted that the “coins are intended for entertainment purposes.”

With numerous meme coins released frequently (mainly on Solana), it is only a matter of time before the next ‘Bonk’ will be unearthed.

Current and new meme coin projects may focus on increasing their market cap to enter MEMECOIN. This paves the way for innovation and creativity in the meme coin industry.

Will the MEMECOIN index signal a spot ETF for meme coins?

Approving a spot meme coins ETF will not take place so quickly, especially not in the United States. Gensler repeated his stance in a recent interview that almost all cryptocurrencies are regarded as a security.

However, if interest in MEMECOIN remains elevated, it may lead to a spot meme coins ETF application in the coming years.

It is important to highlight that meme coins are extremely volatile and prone to strong price swings. If you are new to crypto, 99bitcoins offers blockchain-based educational courses for new traders.