Ahead of the World Economic Forum, some of today’s turbulent state of affairs are explained by S&P Global economists and analysts. We have identified six interconnected themes – energy security, climate and sustainability, technology and digital disruptions, supply chains, capital markets and geopolitical shocks – with the greatest potential for large-scale disruption.

Q4 2022 hedge fund letters, conferences and more

These insights will help decision-makers like asset managers, asset owners, companies, multilateral institutions, nonprofit organizations and governments look beyond the near term and explore the trends that will shape our future. Below are research insights from S&P Global Ratings.

Global Debt Leverage: Is a Great Reset Coming?

Terry Chan, CFA, Managing Director & Senior Research Fellow, S&P Global Ratings

Alexandra Dimitrijevic, Global Head of Research & Development, S&P Global Ratings

Rising rates and slowing economies mean the world’s high leverage poses a crisis risk

The world’s leverage is at a higher level than pre-global financial crisis (GFC) peaks. Yet demand for debt — to help consumers with inflation, mitigate climate change and rebuild infrastructure — will continue. To mitigate the risk of a financial crisis, trade-offs between spending and saving may be needed.

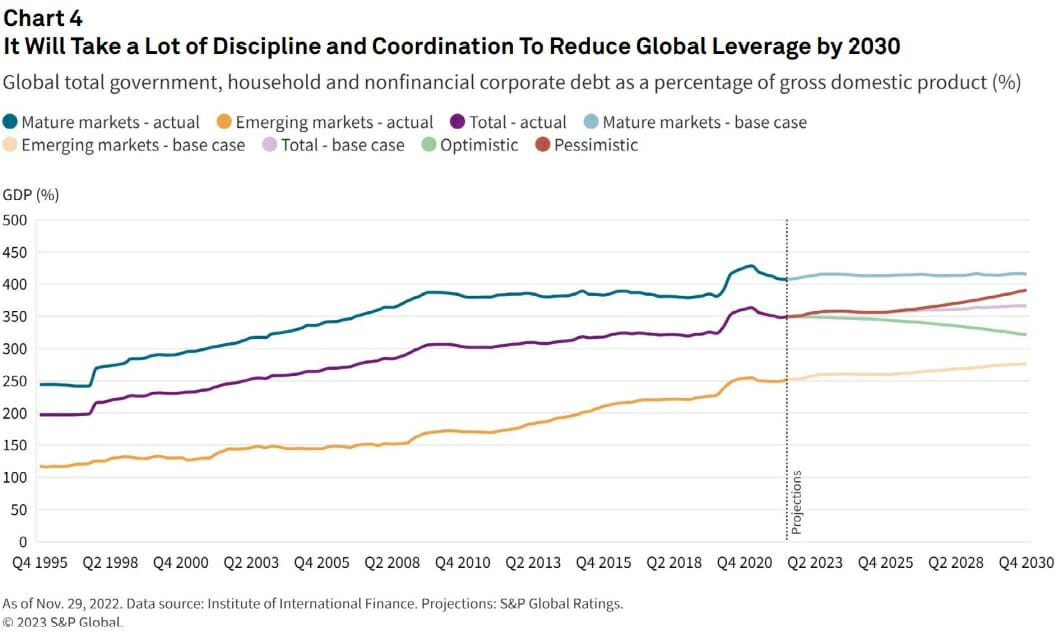

- Record leverage. Global debt has hit a record $300 trillion, or 349% leverage on gross domestic product. This translates to $37,500 of average debt for each person in the world versus GDP per capita of just $12,000. Government debt-to-GDP leverage grew aggressively, by 76%, to a total of 102%, from 2007 to 2022.

- The projected global debt-to-GDP ratio could reach 366% in 2030, above the 349% reached in June 2022.

- Higher interest rates. Debt servicing has become more difficult. Fed funds and European Central Bank rates were up an average of 3 percentage points in 2022. Assuming 35% of debt is floating rate, this means $3 trillion more in interest expenses, or $380 per capita.

- Great Reset. There is no easy way to keep global leverage down. Trade-offs include more cautious lending, reduced overspending, restructuring low-performing enterprises and writing down less-productive debt. This will require a “Great Reset” of policymaker mindset and community acceptance.