Atmos Energy Corporation (NYSE:ATO) engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States. It operates in two segments, Distribution, and Pipeline and Storage.

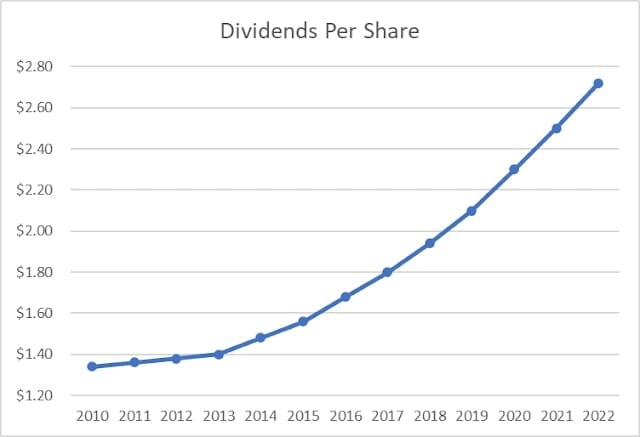

The company is a dividend aristocrat with a 39-year track record of annual dividend increases. The last dividend increase occurred in November 2022, when Atmos raised its quarterly dividend by 8.80% to 74 cents/share.

During the past decade, Atmos has managed to grow dividends to shareholders at an annualized rate of 7.20%. The five-year annualized dividend growth is at 8.70%.

At the same time, the company has managed to boost earnings from $2.37/share in 2012 to $5.61/share in 2022. Atmos Energy is expected to earn $6.03/share in 2023 and $6.42/share in 2024.

Growth will be generated through continued capital investment in the business. The company believes that most of that capex would be immediately accretive within half a year or so. Most of the capex is on increased safety and reliability.

The company’s earnings are generated through regulated gas distribution and natural gas transmission and storage.

Growth in rates over time should compensate for investments. The risk is that states may not be as accommodative to utilities. This risk is somewhat mitigated by the fact that Atmos operates in several states in the US – Texas, Louisiana, Colorado/Kansas, Mississippi, Kentucky.

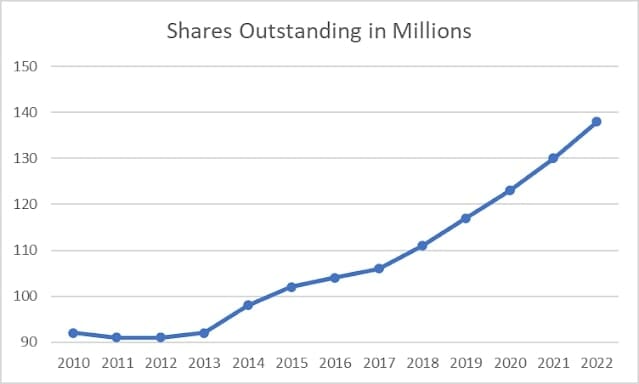

The company obtains capital by selling shares, in order to fund its growth Capex initiatives. As a result, the number of shares outstanding increased from 91 million in 2012 to 138 million in 2022.

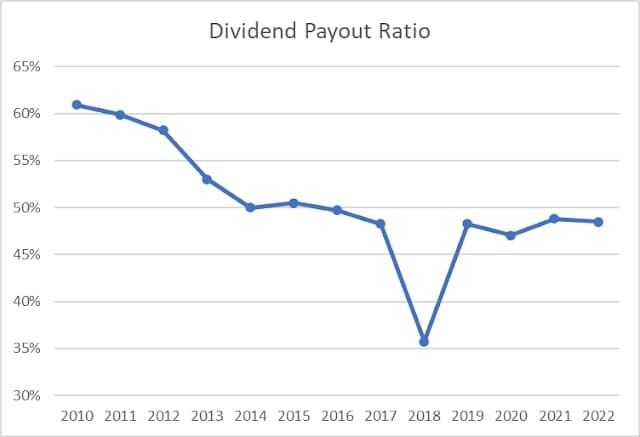

The dividend payout ratio has decreased from 58% in 2012 to 48% in 2022. The lower dividend payout ratio can result in a dividend growth that is higher than earnings growth over the next decade.

I believe that the stock is fairly valued today at 19.30 times forward earnings. The yield is low for a utility at 2.55%, but the dividend payout ratio is lower too.

Relevant Articles:

- Nine Companies Rewarding Shareholders With Raises

- 26 Dividend Champions for Further Research

- 24 Dividend Aristocrats For The Next 24 Years

- Dividend Aristocrats List for 2023

The post Atmos Energy (ATO) Dividend Stock Analysis appeared first on Dividend Growth Investor.