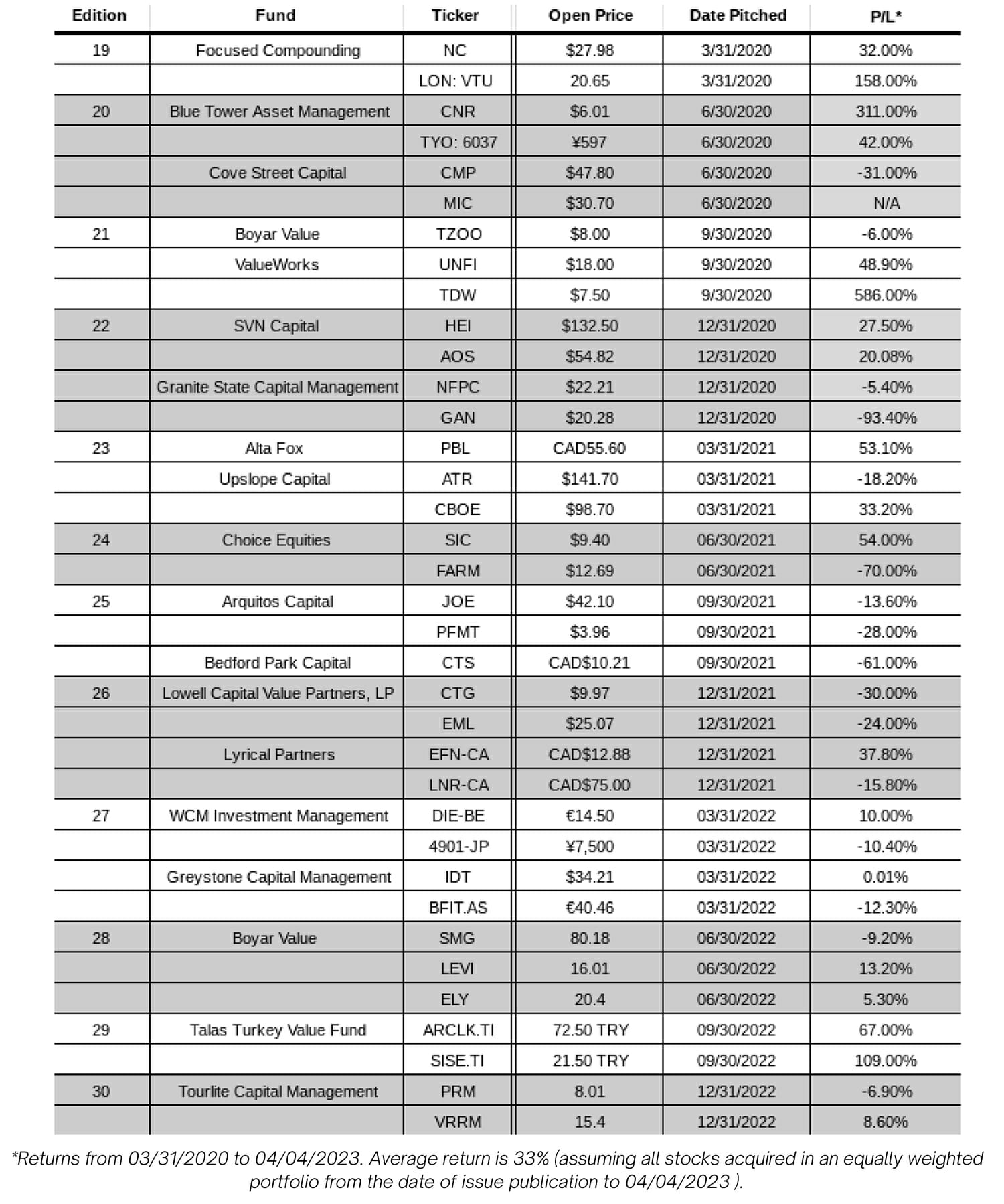

Hidden Value Stocks issue for the first quarter ended March 31, 2023, featuring Lowell Capital Value Partners’ investment idea: Sylvamo (NYSE:SLVM). Also, an interview with Buckley Capital Partners’ Managing Partner, Zack Buckley.

Lowell Capital’s Investment Idea

Lowell Capital has not featured in Hidden Value Stocks in the past, but the value-focused firm outperformed in a tough market last year, returning -6.7% for the year to the end of November, compared to the S&P 500’s -13.1% return.

Lowell’s area of focus is small-cap value, with a preference for “under-followed or misunderstood companies which generate strong cash flows.” In its December letter to investors, the firm discussed its current largest long position, Sylvamo Corp (NYSE:SLVM). Here’s a condensed version of the fund’s analysis:

“Sylvamo Corp produces and supplies printing paper in Latin America, Europe, and North America. The Company offers uncoated freesheet paper products, such as cutsize and offset paper, and markets pulp, aseptic, ad liquid packaging board, as well as coated unbleached kraft papers.”

“SLVM has a highly cash-generative business model and management consistently refers to the company as a “cash flow story”. The Company is focused on using that cash to increase shareholder value through maintaining a strong financial position, returning cash to shareholders, and reinvesting in the business.

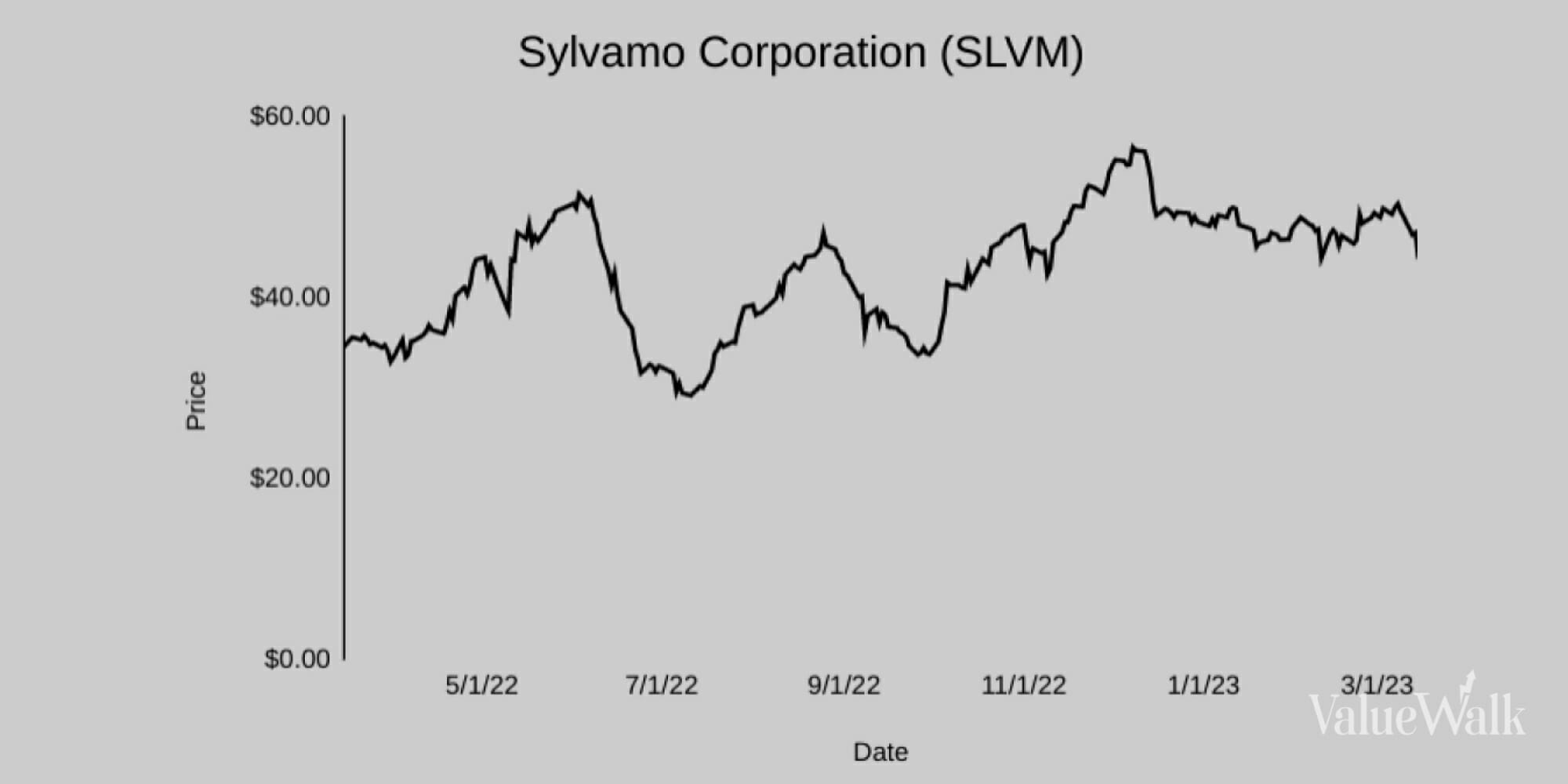

SLVM estimates about $210m of free cash flow for 2022 but this is after expensing about $128m of one-time costs related to the spin-off from IP. On a pro forma basis, adding back these one-time costs, we estimate SLVM free cash flow for 2022 is about $338m or about $7.50 per share.

This compares to our purchase price of about $40 per 7 share. At our purchase price, we were investing in SLVM at a free cash flow yield of about 10% to 12% on an unleveraged basis, versus a 10-year treasury rate of 3.5%.”

“We believe as investors recognize SLVM’s exceptional and unique business model and market position in its three key markets of North America, Latin America, and Europe, SLVM could trade for 10x its adjusted EPS and FCF per share or more or up to $75 per share or higher.

On an adjusted EBITDA basis, we believe SLVM could trade for 5x adjusted EBITDA of about $800m in 2023 less net debt of about $500m at yearend 2023 for a market cap of about $3.5b or about $75 per share.

We believe SLVM management is focused on returning cash to shareholders and we believe SLVM could eventually pay out a large share of annual FCF in dividends, possibly as much as $5 per share.

Further, we believe SLVM could be an attractive acquisition for a strategic or financial buyer, given its unique market share and cost positions. In fact, one successful strategic investor, Atlas Holdings, has recently taken a 14% stake in SLVM, which we believe could lead to an eventual sale.”

Interview With Buckley Capital Partners

Interview with Zack Buckley, Managing Partner at Buckley Capital Partners.

First, could you give us a bit of background on Buckley Capital and the firm’s history?

I became interested in investing when I was 16 years old. My dad was an emergency room doctor, and my mom was a psychologist. Despite being intelligent, my parents were horrible investors. They invested in stocks in the late 90s and sold out at the bottom in 2002.

Subsequently, they bought single-family homes from 2002-2007, which unraveled during the GFC. Given this dynamic, I wanted to be a doctor but a better investor as well, so I started reading business and investing books.

I came across value investing through Buffett and Munger and was completely hooked. In my sophomore year of college, I dropped out of my pre-med classes and switched to business full-time. At the same time (Jan 2008), my dad gave me $100,000 to manage.

From my early college years, I had my sights set on working in the hedge fund industry. Given The University of Miami was not a conduit to the investment management industry, I took it upon myself to start my partnership.

Subsequently, I was able to raise $500,000 and launch in January 2011. Through networking I did also manage to get an analyst role at Baker Street Capital.

You worked under Vadim Perelman of Baker Street Capital, who earned 40% annualized investing in small caps from 2009 to 2015. What major lessons did you learn from this highly talented investor?

I thought having a mentor was crucial to becoming a great investor, as Warren Buffett had learned from Graham. At the time (2010), Vadim was considered to be one of, if not the smartest small-cap investors, so I was very excited to learn from working with him.

Vadim helped me learn the foundational skills of being a great analyst – screening for stocks, modeling, how to run calls with management teams and the sell side. He was also great with scuttlebutt, as an example he had me friend around 1,000 employees of one company on Facebook to talk with them and get to know the business.

Lastly, I also learned from the people I met through Vadim and started to grow my network within the hedge fund industry.