The world of decentralized finance (DeFi) is booming. With the total value locked (TVL) surpassing $100 billion as of March 2024, demand for DeFi products and services is undeniable.

This growth coincides with the emergence of DeFi 2.0, an evolution promising to address challenges and unlock new possibilities.

But which DeFi 2.0 tokens hold the most promise? Let’s explore the best contenders in this exciting new landscape.

Best DeFi 2.0 tokens

- Multi-chain utility across 6 chains including Ethereum, Solana and Base

- Staking rewards on Ethereum for presale buyers

- Advanced bridging technology with Wormhole and Portal integration

USDT

USDT ETH

ETH MATIC

MATIC- +1 more

- An AI and dog-themed memecoin on Ethereum

- Presale tokens are staked an provide rewards during the presale

ETH

ETH USDT

USDT

- Potential to skyrocket amid Solana meme coin hype

- Rumored to be from the developers $SLERF, which saw huge growth earlier this year

- Similar to Slothana, which recently saw a hugely successful presale and launch

SOL

SOL

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

SOL

SOL ETH

ETH BNB

BNB- +1 more

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

ETH

ETH USDT

USDT BNB

BNB- +1 more

- The 5SCAPE tokens unlock special in-game features

- Brings VR capabilities into Web3 gaming

- An ERC20 token that's compatible with existing Ethereum DeFi platforms and smart contracts

ETH

ETH BNB

BNB USDT

USDT- +2 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

ETH

ETH USDT

USDT Debit

Debit

- Gain exclusive airdrop points by buying and holding $SMOG

- Conquer foes and reap rewards on the Solana blockchain

- Secure your stake on Solana through a direct $SMOG purchase on Jupiter DEX

SOL

SOL ETH

ETH USDT

USDT

- Innovative blockchain-based electric vehicles project

- The eTukTuk prototype is scheduled to be revealed in the first phase

- opBNB will be used in tandem with BNB for scalability and reduce costs

ETH

ETH BNB

BNB USDT

USDT- +1 more

Listing our 7 best DeFi 2.0 tokens for 2024

This section explores DeFi 2.0’s hottest tokens for 2024, helping you diversify your DeFi portfolio. Get ready to explore the future of finance with our top picks for the year’s hottest DeFi 2.0 tokens.

- Dogecoin20 (DOGE20) injects DeFi features and eco-friendliness into the beloved meme coin. This ERC-20 token raised $2 million in just four days, showcasing strong investor interest. Dogecoin 2.0 combines the fun and virality of meme coins with the utility and innovation of DeFi.

- Green Bitcoin (GBTC) gamifies DeFi 2.0 with a “predict-to-earn” mechanism. Users stake $GBTC tokens to forecast Bitcoin’s price daily. Accurate predictions win rewards from a pool fueled by staking activity, fostering a lively DeFi ecosystem.

- 5thscape (5SCAPE) carves a niche in the burgeoning DeFi 2.0 market by bridging the gap between VR gaming and blockchain technology. Fueled by its native token, 5SCAPE, the platform grants exclusive access to a treasure trove of VR experiences, from games to educational content, movies, and high-quality VR hardware.

- eTukTuk (TUK): Combats air pollution and carbon emissions on a global scale by replacing gasoline-powered tuk-tuks with electric vehicles (EVs) and building sustainable charging infrastructure, specifically in developing nations.

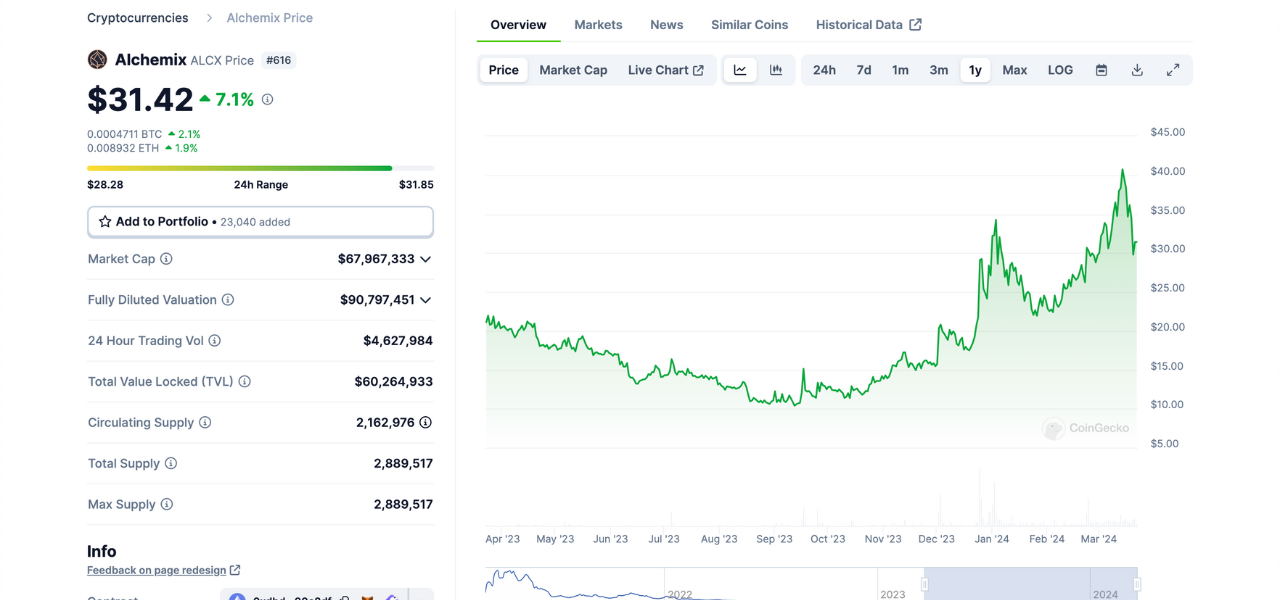

- Alchemix (ALCX) is a DeFi 2.0 protocol that lets users borrow against the future yield of their DAI deposits. By minting alUSD, a synthetic token, users gain immediate access to capital while their DAI generates yield in a Yearn vault. This yield automatically repays the loan over time, offering a unique lending experience.

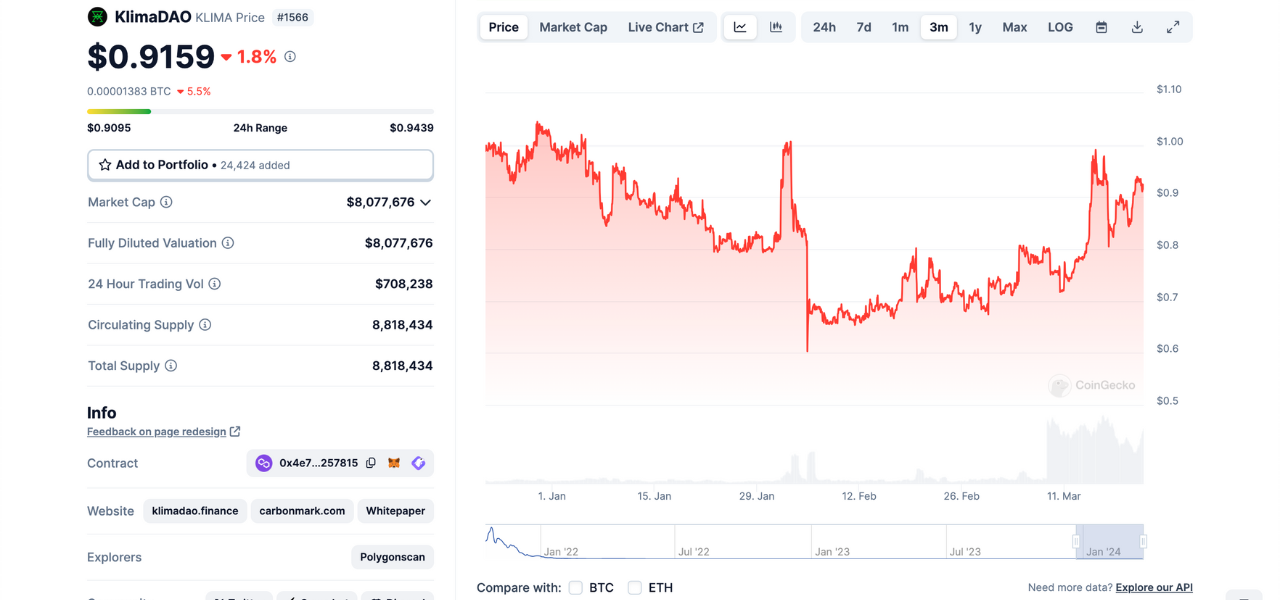

- KilmaDAO (KLIMA) is a decentralized collective that tackles climate change by building a robust Digital Carbon Market. Their online platforms and tools aim to create a transparent and efficient voluntary carbon market, accelerating global climate finance by trading digital carbon assets.

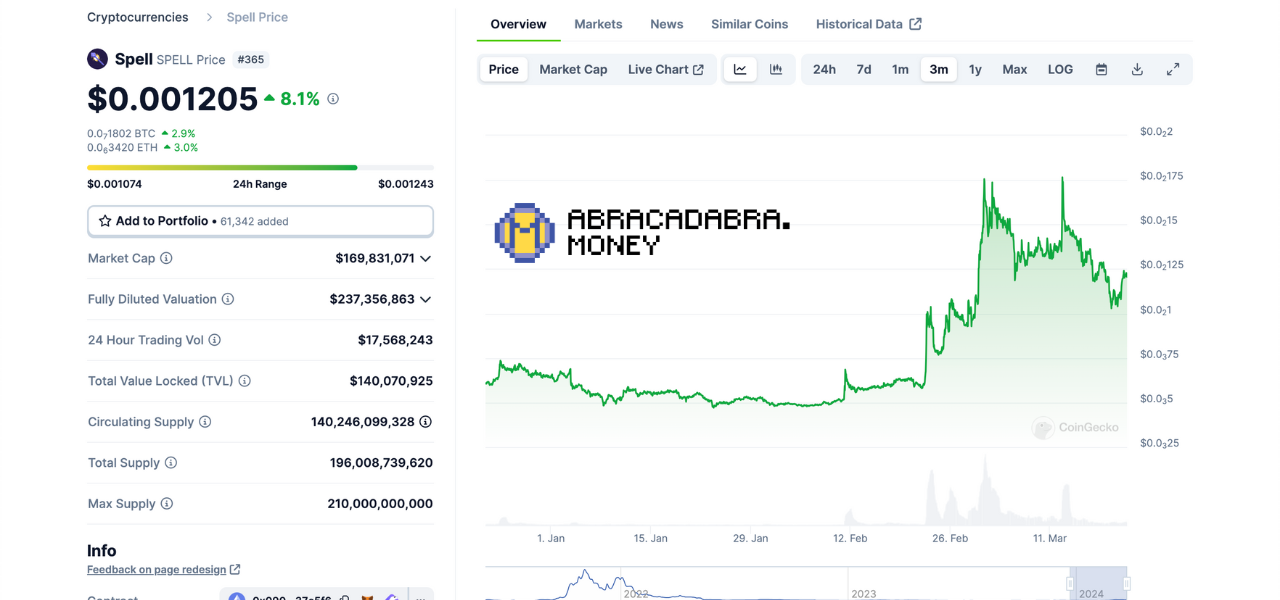

- Abracadabra (SPELL) takes a novel approach to DeFi 2.0 by enabling users to put their income-generating holdings to work. Unlike conventional DeFi lending platforms, Abracadabra allows users to borrow stablecoins using interest-bearing tokens (ibTKNs) as collateral.

What is DeFi 2.0?

Decentralized finance (DeFi) is leaping forward with DeFi 2.0. This next generation tackles the growing pains of DeFi 1.0, specifically scalability, compatibility between blockchains, and long-term viability.

DeFi 2.0 achieves this by leveraging advanced technologies like layer 2 solutions and bridges between blockchains. The focus in DeFi 2.0 is on providing secure and efficient financial services like lending, borrowing, trading, and yield farming.

These projects prioritize user experience, security, and interoperability for DeFi applications. This results in benefits such as lower fees, faster transactions, and less network congestion for users.

Balancing Risk and Reward

While DeFi 2.0 builds on the foundation of DeFi 1.0, it embraces a higher risk tolerance. This allows for more experimentation and innovation within the DeFi space, and projects are more willing to explore new approaches, even if they carry some risk.

This fosters a dynamic environment where groundbreaking ideas can take root and promising DeFi applications emerge – all while staying true to the core principles of decentralization and trustless operation.

In essence, DeFi 2.0 retains the familiar mechanisms of DeFi 1.0 but injects them with innovation, paving the way for a more robust and user-friendly future for decentralized finance.

How DeFi 2.0 improves on DeFi 1.0

| DeFi 1.0 Limitation | (What it is) | DeFi 2.0 Solutions |

| Scalability | Low liquidity in DeFi markets leads to volatile price swings during token swaps. | Explores faster, cheaper blockchains and Layer 2 scaling. |

| Liquidity | Single oracles or controlled governance models may have centralized elements. | Uses Protocol-Controlled Liquidity (PCL) mechanisms where protocols lock their tokens to create deeper liquidity pools. |

| Centralization | Single oracles or controlled governance models may have centralized elements | Prioritizes DAOs and community governance to distribute power |

| Security Risks | Bugs in smart contracts can result in hacks and loss of funds | Emphasizes audits and multi-signature security to reduce vulnerabilities |

| Capital Inefficiencies | Locked DeFi capital reduces market efficiency. | Introduces innovative solutions like fractionalized lending protocols |

Best DeFi 2.0 tokens to watch in 2024

The DeFi 2.0 landscape is thriving with innovation, bringing forth groundbreaking projects at an impressive pace.

This section identifies seven DeFi v2 projects to add to your watchlist, carefully selected based on factors like their disruptive potential, strong teams, and engaged communities.

1. Dogecoin20 ($DOGE20): A greener Doge with DeFi muscle

Dogecoin20 injects DeFi features and eco-friendliness into the beloved meme coin. This ERC-20 token raised $2 million in just four days, showcasing strong investor interest. Dogecoin20 aims to combine the fun and virality of meme coins with the utility and innovation of DeFi.

Passive income, anti-inflationary, built on Ethereum

- DeFi 2.0 Ready: Built on the Ethereum blockchain, Dogecoin20 is a DeFi-ready protocol allowing integration with various decentralized finance projects.

- Passive Income: Stake $DOGE20 to earn rewards, encouraging long-term holding and reducing sell pressure.

- Eco-Friendly: Utilizes Proof-of-Stake, unlike Dogecoin’s energy-intensive mining, making it a more sustainable option.

- Anti-Inflationary: Limited supply (140 billion) combats inflation, protecting investor holdings over time.

- Uniswap Launch: Scheduled listing on the world’s largest DEX (Decentralized Exchange) Uniswap boosts accessibility to crypto traders from different chains (ETH primarily).

Project review

Dogecoin20 isn’t a Dogecoin replacement but an homage with a modern twist. It capitalizes on the meme coin craze while offering investors a more feature-rich and sustainable token.

The project’s unique staking ecosystem, eco-friendly approach, and potential for passive income make it an exciting project for DeFi 2.0 and meme coin enthusiasts. The low entry point and upcoming Uniswap launch add to its appeal to early investors.

| Ticker | DOGE20 |

| Max. Supply | 140,000,000,000 |

| Blockchain platform | Ethereum |

| Inception | 2024 |

Pros

- Philanthropic Doge: Aims to be a “wholesome” meme coin with charity focus, attracting socially conscious investors

- Early DeFi mover: Bridges the gap between meme coins and DeFi, appealing to investors seeking both

- Community-building: Playful mascot and meme potential could foster a strong, engaged community

Cons

- Doge reliance: Success relies heavily on Dogecoin’s popularity. A fading Dogecoin could sink $DOGE20

- Meme Coin volatility: Inherent volatility of meme coins remains a risk, despite DeFi features

- Uniswap listing risk: Listing doesn’t guarantee success. High competition demands $DOGE20 stands out

2. Green Bitcoin ($GBTC): Predict Bitcoin daily, and win rewards with GBTC’s DeFi model

Green Bitcoin is a DeFi 2.0 innovator with its gamified staking mechanism for Bitcoin price predictions. Users stake $GBTC tokens to compete in daily price prediction contests, earning rewards from a pool fueled by staking activity.

Staking meets price prediction

Green Bitcoin’s core feature is Gamified Green Staking, a novel approach that combines staking with price prediction. Users lock their $GBTC tokens and submit their forecasts for Bitcoin’s price within a designated range, aiming to land in the “Green Zone.”

Rewards are distributed proportionally based on the accuracy of predictions and the amount of $GBTC staked. Additionally, Green Bitcoin employs daily and weekly challenges based on Bitcoin’s price action to keep users engaged and incentivized to participate.

Project review

Green Bitcoin taps into the popularity of Bitcoin price predictions while offering a DeFi 2.0 twist. The predict-to-earn model allows anyone to profit, regardless of trading experience. However, the project is still in its presale phase, so its long-term viability remains to be seen.

| Ticker | GBTC |

| Max. Supply | 21,000,000 |

| Blockchain platform | Ethereum |

| Inception | 2023 |

Pros

- Educates DeFi Newcomers: Gamified staking introduces DeFi concepts in a fun, accessible way

- Community Potential: Shared interest in Bitcoin and staking can foster a strong user community

- Decentralized Price Discovery: Widespread adoption could contribute to a more decentralized way to discover Bitcoin’s price

Cons

- Manipulation Risk: Smaller user base makes price prediction contests more susceptible to manipulation

- Smart Contract Risk: Inherent risk exists due to potential vulnerabilities in the smart contracts

- Limited Scope: Focuses solely on Bitcoin price prediction, potentially limiting its appeal

3. 5th Scape (5SCAPE): Bridging VR and DeFi 2.0

5th Scape aims to be a frontrunner in Best DeFi 2.0 tokens [Secondary keywords] by merging VR gaming with cryptocurrency. Their 5SCAPE Coin grants access to exclusive VR experiences, including games, educational content, and even movies.

This integration of DeFi and VR creates a unique ecosystem. 5SCAPE tokens are the gateway to this world, allowing users to purchase premium VR content and potentially high-quality VR hardware.

Community-driven VR development for the future

The project focuses on building a massive library of 3D VR games with innovative mechanics and gripping narratives. Titles like MMA 3D and Cricket 3D aim to push the boundaries of VR gaming.

5th Scape also boasts a developer center, a collaborative hub that fosters innovation within the DeFi 2.0 and VR space. This focus on community-driven development could be a significant advantage in the ever-evolving blockchain finance landscape.

Project review

The VR market is exploding. With a massive user base of 65.9 million in the U.S. alone (as of 2023) and an estimated global audience of 171 million, the trend is only accelerating.

Experts predict a staggering 3.67 billion users will join the AR and VR market by 2028. 5th Scape is poised to ride this wave by offering a unique blend of DeFi 2.0 features and immersive VR experiences.

5th Scape offers a compelling proposition for gamers and VR enthusiasts interested in the potential of DeFi 2.0. The project’s success hinges on delivering high-quality VR experiences and leveraging blockchain technology.

| Ticker | 5SCAPE |

| Max. Supply | 5.21B |

| Blockchain platform | Ethereum |

| Inception | 2024 |

Pros

- VR Democratization: 5th Scape tackles VR accessibility by potentially offering hardware through DeFi, making VR more inclusive

- Data-Driven Content: Their focus on user-desired VR experiences could propel them to the top of VR entertainment

- Early Mover Advantage: Early DeFi 2.0 integration positions them to capitalize on the booming VR market

Cons

- Unproven Tech: Success hinges on the smooth operation of their DeFi 2.0 and VR integration

- Fierce Competition: Both VR and DeFi 2.0 are competitive. They’ll need constant innovation to stand out

- Content Sustainability: Maintaining a high-quality VR library is crucial. They need a strategy for a steady stream of compelling content

4. eTukTuk (TUK): Sustainable TukTuks + solar charging stations + DeFi staking

eTukTuk directly addresses the challenges of air pollution and financial exclusion in developing economies. Their solution is a comprehensive ecosystem that combines:

- Solar-powered Charging Stations: A network of conveniently located stations powered by renewable energy ensures easy access to charging.

- Affordable Electric TukTuks: Designed for local manufacturing, focusing on lower costs and increased driver earnings.

- $TUK Token: This is the utility token of the eTukTuk ecosystem. It fuels transactions, incentivizes network participation, and unlocks “Power Staking” features.

eTukTuk’s mission aligns perfectly with the global push for Zero Emission Vehicles (ZEVs), making it a timely and impactful project.

Affordable EVs, shared economy model

eTukTuk goes beyond eco-friendly transportation. Here’s what sets them apart:

- Disruptive affordability: eTukTuk’s locally manufactured EVs aim to be significantly cheaper than traditional gasoline-powered TukTuks.

- Shared economy integration: The network promotes efficient resource utilization through strategically placed charging stations and ZEVs.

- DeFi-powered Staking (“Power Staking”): Users who stake TUK tokens contribute to the network’s growth and earn rewards in return. This fosters a financially inclusive model for all participants.

Project review

eTukTuk merges eco-conscious goals with innovative DeFi features. By enabling users to participate in the network’s success through staking, eTukTuk creates a financially inclusive future for sustainable transportation. This positions eTukTuk as a strong Best DeFi 2.0 tokens category contender.

| Ticker | TUK |

| Max. Supply | 2,000,000,000 |

| Blockchain platform | Binance Smart Chain (BSC) |

| Inception | 2024 |

Pros

- Potential for First-Mover Advantage

- Combines Clean Energy with Eco-Friendly Transport

- Empowers Local Manufacturing and Economic Development

Cons

- Battery Range Limitations May Affect Usability

- Reliance on Government Support for ZEV Policy Implementation

- Competition from Established Transportation Providers

5. Alchemix (ALCX): DeFi Innovation with self-paying loans

Alchemix is a DeFi 2.0 protocol shaking things up with synthetic assets. Users deposit DAI stablecoins to mint alUSD, a synthetic token representing a future yield on the deposit. This unlocks immediate access to the value of their deposit without waiting for yields to accrue.

Borrowing with future yield

Alchemix offers a unique take on lending. Deposit DAI and borrow up to 50% of its value as alUSD.

Alchemix automatically puts your DAI in a Yearn vault, generating a yield (around 12% APY) that seamlessly repays your loan over time. Borrowers can use alUSD for purchases or stake it within Alchemix for even more returns.

Additionally, Alchemix boasts:

- Vaults: Similar to other DeFi platforms, Alchemix offers Vaults to generate yield advances. These Vaults currently accept DAI as collateral.

- Transmuter: This built-in tool ensures a 1:1 peg between alUSD and DAI, allowing users to redeem their synthetic tokens for the underlying asset anytime.

Project review

Alchemix injects innovation into DeFi lending. Users gain immediate access to deposited capital while earning yield. The automatic yield-based repayment system simplifies loan management. With its unique features, Alchemix is a strong contender in the Best DeFi 2.0 Tokens category.

| Ticker | ALCX |

| Max. Supply | 2.89M |

| Blockchain platform | Ethereum |

| Inception | 2021 |

Pros

- Composability Potential: Integrates with DeFi tools like Yearn, opening doors for future innovation

- Reduced Leverage Risk: Borrowing only 50% of DAI value mitigates over-leveraging

- Algorithmic Improvement Potential: The Transmuter system offers room for future optimization

Cons

- Smart Contract Risk: Relies on secure smart contracts, vulnerabilities could lead to hacks

- Yield Dependence: Repayment relies on consistent Yearn vault yield, a drop could cause issues

- Limited alUSD Use Case: Currently, alUSD’s function is mainly for borrowing, broader adoption is needed

6. KlimaDAO (KLIMA): Building a global marketplace for climate action with DeFi 2.0

KlimaDAO is a frontrunner in DeFi 2.0, building the infrastructure for a transparent and global Digital Carbon Market. Their KLIMA token fuels this marketplace, aiming to accelerate climate finance through DeFi mechanisms.

Accelerating climate finance

KlimaDAO’s innovation lies in using DeFi 2.0 to create a market for real-world carbon credits.

Their Carbonmark platform simplifies institutional access to carbon credits and KlimaDAO’s infrastructure. Partnering with Circle, Carbonmark allows institutions secured custody and easy USD conversion for institutions.

In 2022, KlimaDAO processed over $4 billion in carbon credit trades. Its treasury also grew to over $100 million, demonstrating a robust foundation for future growth.

Project review

KlimaDAO’s impact is undeniable. In 2022, they facilitated over $4 billion in carbon credit trades.

Their protocol powers platforms like Carbonmark and partners with organizations like Polygon and Circle. This empowers airlines, automakers, and even celebrities like Mark Cuban to meet sustainability goals. With over 100,000 token holders and a proven track record, KlimaDAO is a key player in shaping the future of DeFi 2.0 and sustainable finance.

| Ticker | KLIMA |

| Max. Supply | 8.82M |

| Blockchain platform | Ethereum |

| Inception | 2021 |

Pros

- First-mover advantage: KlimaDAO’s early entry into carbon DeFi leads them in partnerships and brand recognition

- Strong community: Over 100,000 token holders fuel project growth and advocacy

- Major player integrations: Partnerships with Polygon, Circle, and others position KlimaDAO for mainstream adoption

Cons

- Regulatory uncertainty: New carbon credit market regulations could hinder KlimaDAO’s growth

- Volatile underlying asset: KLIMA token value relies on carbon credit prices, introducing market fluctuations

- Manipulation risk: Digital carbon markets can be vulnerable to price manipulation

7. Abracadabra (SPELL): Unlocking leverage for DeFi 2.0

Abracadabra stands out in the crowded DeFi 2.0 landscape by unlocking liquidity for yield farmers. This innovative platform lets users collateralize interest-bearing tokens (ibTKNs) – like those earned from Curve, Yearn, or SushiSwap – to borrow stablecoins.

Borrow USD coins with interest-bearing tokens

Abracadabra.money offers a unique twist on DeFi lending:

- Collateralize ibTKNs: Unlike most platforms, Abracadabra accepts ibTKNs, which continuously generate returns, as collateral for loans. This frees up liquidity trapped in these tokens.

- Mint Magic Internet Money (MIM): Abracadabra’s native stablecoin, MIM, is pegged to the US dollar and can be minted using ibTKNs as collateral. MIM boasts multi-chain functionality, allowing easy transfer across various blockchains.

- Governance via SPELL: SPELL token holders have a say in Abracadabra’s future. They can vote on proposals to shape the platform’s development.

Project review

This lending platform‘s ability to leverage ibTKNs creates a unique niche in DeFi 2.0. This innovation allows users to amplify their returns by borrowing MIM against their ibTKNs and deploying those borrowed funds into additional yield-generating opportunities.

However, users should carefully consider the added risks involved. Leverage can magnify profits and losses; even small price swings can trigger collateral liquidation. It’s crucial to properly size your positions and constantly monitor market conditions to avoid these pitfalls.

| Ticker | SPELL |

| Max. Supply | 210M |

| Blockchain platform | Multichain protocol (On Ethereum (ETH), Avalanche (AVAX), Fantom (FTM), and Arbitrum) |

| Inception | 2021 |

Pros

- First-mover advantage: KlimaDAO’s early entry into carbon DeFi leads them in partnerships and brand recognition

- Strong community: Over 100,000 token holders fuel project growth and advocacy

- Major player integrations: Partnerships with Polygon, Circle, and others position KlimaDAO for mainstream adoption

Cons

- Regulatory uncertainty: New carbon credit market regulations could hinder KlimaDAO’s growth

- Volatile underlying asset: KLIMA token value relies on carbon credit prices, introducing market fluctuations

- Manipulation risk: New markets like the Digital Carbon Market can be vulnerable to price manipulation

Earning with DeFi 2.0

DeFi 2.0 opens doors to potentially lucrative returns on your crypto assets. Here’s a roadmap to navigate these opportunities:

Staking: Become a network validator by locking your Best DeFi 2.0 tokens in a smart contract. This contributes to network security and earns you rewards.

Liquidity Provision: Think of yourself as a market maker. Supply tokens to decentralized exchanges (DEXs) to create liquidity pools that facilitate trading. In return, you collect a portion of the swap fees generated.

Yield Farming: This strategy involves strategically moving your crypto holdings between DeFi platforms to maximize interest earned. It’s akin to constantly seeking the best savings account rates but on steroids. However, yield farming can be complex and carries higher risks due to its dynamic nature.

The decentralized finance landscape is rife with innovation but also potential pitfalls. Avoid projects that lack a clear path to revenue generation. These can operate similarly to unsustainable Ponzi schemes, where early investors are paid with funds from later entrants.

Focus on DeFi 2.0 projects with real-world utility and a well-defined token economic model. These factors can increase your chances of finding sustainable DeFi 2.0 tokens with long-term earning potential.

DeFi 2.0 vs. GameFi

DeFi 2.0 aims to revolutionize traditional finance. Its tokens aim to improve lending, borrowing, and trading protocols on the blockchain, making them faster, more adaptable, and more efficient. DeFi 2.0 is essentially an upgrade for core financial services on the blockchain.

GameFi, however, takes a different approach. It merges gaming with decentralized finance, creating a “play-to-earn” model. Gamers can earn cryptocurrency through gameplay and by owning digital assets within the game itself. This creates a new kind of in-game economy where players have a stake in the game’s success.

Interestingly, the line between DeFi 2.0 and GameFi isn’t always clear-cut. Some innovative GameFi projects leverage DeFi 2.0’s infrastructure to create their in-game economies. Here’s how:

- Earning & Lending: DeFi 2.0’s lending protocols can be integrated into GameFi, allowing players to earn interest on their crypto earned through gameplay. Imagine storing your in-game tokens and generating passive income!

- NFT Utility: DeFi 2.0’s focus on NFTs (non-fungible tokens) perfectly complements GameFi’s reliance on in-game assets. These NFTs, representing unique digital items within the game, can be collateral for loans within DeFi 2.0 protocols.

This synergy between DeFi 2.0 and GameFi creates a dynamic ecosystem where players can enjoy the game and potentially earn a return on their investment and in-game assets.

So, how do you choose? DeFi 2.0 beckons if you’re interested in financial innovation. If the thrill of playing to earn and exploring new gaming experiences is more your style, then GameFi might be the better fit.

Comparison Chart: Our Best DeFi 2.0 Tokens Side-by-Side

| Token | Chain | Supply | Inception |

| DOGE20 | Ethereum | 140B | 2024 |

| GBTC | Ethereum | 21M | 2023 |

| 5thscape | Ethereum | 5.21B | 2024 |

| TUK | Binance Smart Chain (BSC) | 2B | 2024 |

| ALCX | Ethereum | 2.89M | 2021 |

| KLIMA | Polygon | 8.82M | 2021 |

| SPELL | Multichain [Ethereum (ETH), Avalanche (AVAX), Fantom (FTM), Arbitrum] | 210M | 2021 |

FAQs

What is DeFi?

DeFi stands for Decentralized Finance. It’s a growing ecosystem of financial products and services built on blockchain technology. DeFi aims to remove intermediaries like banks, making finance more open and accessible.

What is DeFi 2.0 investment?

DeFi 2.0 investment involves buying tokens associated with DeFi 2.0 protocols. These tokens can potentially increase in value but are also subject to price fluctuations.

Are DeFi 2.0 tokens profitable?

DeFi 2.0 tokens have profit potential, but there are no guarantees. They often power DeFi 2.0 protocols, and their value can be tied to their success. Don’t mistake high APYs for free money.

Where to buy DeFi 2.0 tokens?

Many cryptocurrency exchanges offer DeFi 2.0 tokens. Look for reputable exchanges with a strong track record and security measures.

What are the risks of DeFi 2.0?

DeFi 2.0 is a new and evolving space with inherent risks. These include scams, hacks, high volatility, and complex protocols. Only invest what you can afford to lose and do your own research.

Is there a limit on how many tokens I can buy?

Limits on DeFi 2.0 token purchases typically depend on the exchange you use and any regulations in your area. Some exchanges may have minimum or maximum buy-in amounts.

What is the DeFi 2.0 protocol?

A DeFi 2.0 protocol is a set of rules that govern a DeFi 2.0 application. These protocols enable various DeFi functions like lending, borrowing, and trading. Understanding the protocol is crucial before investing in its token.

Is DeFi good or bad?

DeFi has the potential to revolutionize finance by making it more inclusive and efficient. However, it’s a complex and risky space. Carefully weigh the potential benefits and risks before getting involved.

Is DeFi still profitable?

DeFi can be profitable, but it’s not guaranteed to make money. The profitability of DeFi 2.0 tokens depends on various factors, including market conditions and individual project success.

Sources

- https://www.coinchange.io/blog/defi-research-news-january-2024

- https://www.statista.com/statistics/426469/active-virtual-reality-users-worldwide/

- https://www.spglobal.com/en/research-insights/featured/markets-in-motion/understanding-voluntary-carbon-markets

- https://www.gemini.com/cryptopedia/abracadabra-money-spell-token-abracadabra-crypto-lending#section-leveraged-yield-farming-on-abracadabra-money