The decentralized money landscape is going through a major change in 2024.

At its core, DeFi (decentralized finance) thrives on continuous innovation. While advancements such as, “Restaking” and “Crypto Spans,” are surging in usage to increase yields and connect to more flexible Layer 2 networks like Arbitrum, respectively.

- Multi-chain utility across 6 chains including Ethereum, Solana and Base

- Staking rewards on Ethereum for presale buyers

- Advanced bridging technology with Wormhole and Portal integration

USDT

USDT ETH

ETH MATIC

MATIC- +1 more

- An AI and dog-themed memecoin on Ethereum

- Presale tokens are staked an provide rewards during the presale

ETH

ETH USDT

USDT

- Potential to skyrocket amid Solana meme coin hype

- Rumored to be from the developers $SLERF, which saw huge growth earlier this year

- Similar to Slothana, which recently saw a hugely successful presale and launch

SOL

SOL

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

SOL

SOL ETH

ETH BNB

BNB- +1 more

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

ETH

ETH USDT

USDT BNB

BNB- +1 more

- The 5SCAPE tokens unlock special in-game features

- Brings VR capabilities into Web3 gaming

- An ERC20 token that's compatible with existing Ethereum DeFi platforms and smart contracts

ETH

ETH BNB

BNB USDT

USDT- +2 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

ETH

ETH USDT

USDT Debit

Debit

- Gain exclusive airdrop points by buying and holding $SMOG

- Conquer foes and reap rewards on the Solana blockchain

- Secure your stake on Solana through a direct $SMOG purchase on Jupiter DEX

SOL

SOL ETH

ETH USDT

USDT

- Innovative blockchain-based electric vehicles project

- The eTukTuk prototype is scheduled to be revealed in the first phase

- opBNB will be used in tandem with BNB for scalability and reduce costs

ETH

ETH BNB

BNB USDT

USDT- +1 more

These developments ensure that DeFi remains inclusive and adaptable. Discover the six (6) top DeFi projects carefully analyzed and selected based on their potential to bring about transformative changes for the industry in 2024.

Top DeFi Projects to Consider in 2024

We understand steering through the many P2P finance options can be challenging. That’s why we’ve compiled a list of the top DeFi coins (and projects) that would be perfect for those looking to invest strategically.

These tokens are leading the way in transforming open finance and digital ecosystems, making them ideal candidates for blockchain utility investment.

- Bitcoin Minetrix ($BTCMTX): A revolutionary cryptocurrency that allows users to earn BTC by staking tokens on Ethereum. Users can leverage their existing Ethereum holdings to earn passive income in the form of BTC rewards.

- eTuktuk ($TUK): Sustainable blockchain initiative that aims to provide accessible and eco-friendly transportation options, while also working towards reducing economic disparities in developing countries.

- Mollars ($MOLLARS): Hybrid cryptocurrency designed and developed to be a store of value alternative to Bitcoin.

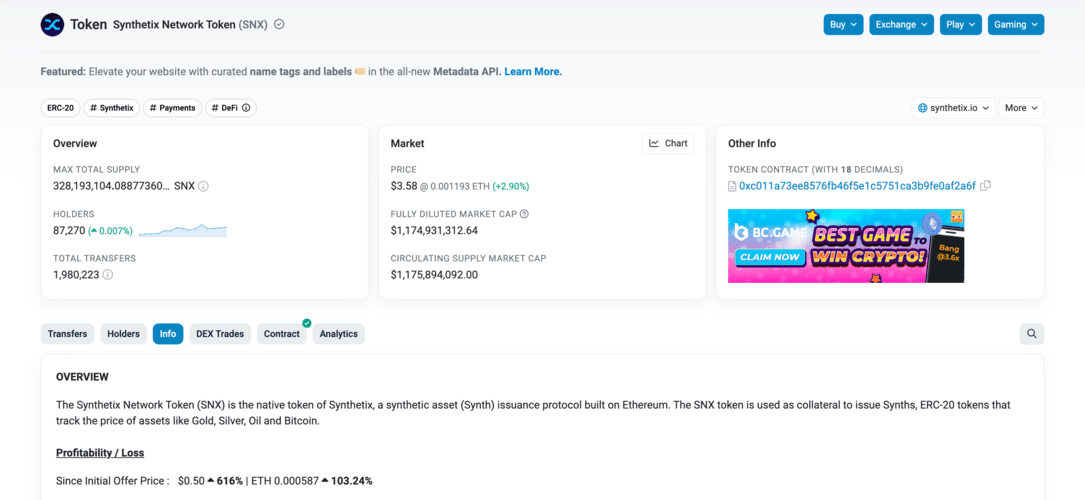

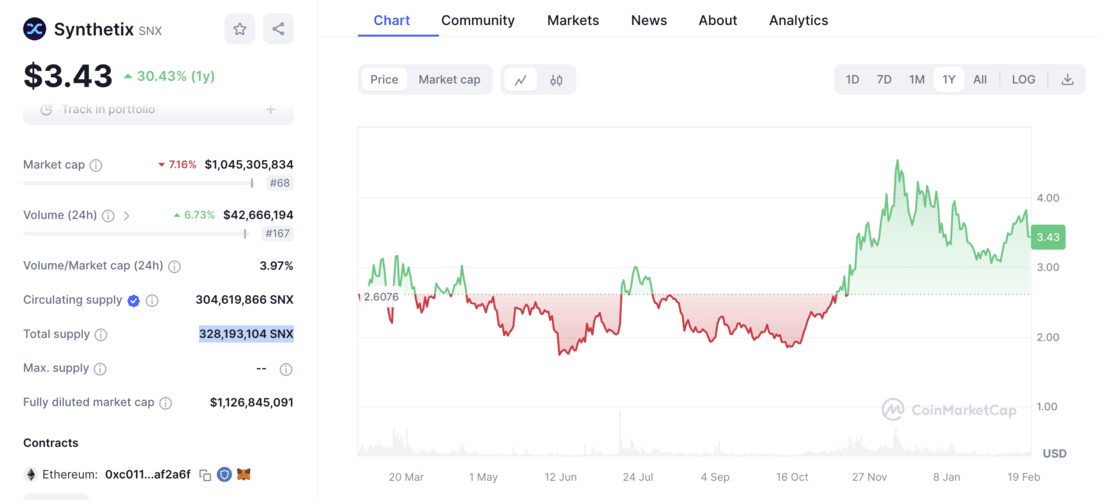

- Synthetix (SNX): Distributed asset insurance protocol on the blockchain, empowering users to trade and issue synthetic assets.

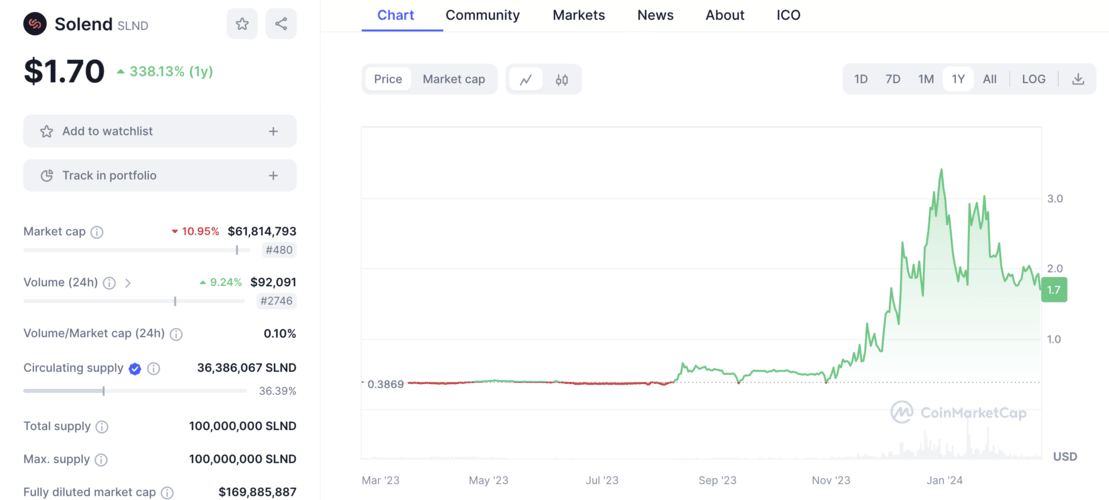

- Solend (SLND): Decentralized protocol offering unique lending and borrowing solutions by leveraging algorithms. This platform empowers users to borrow and lend seamlessly on the Solana blockchain.

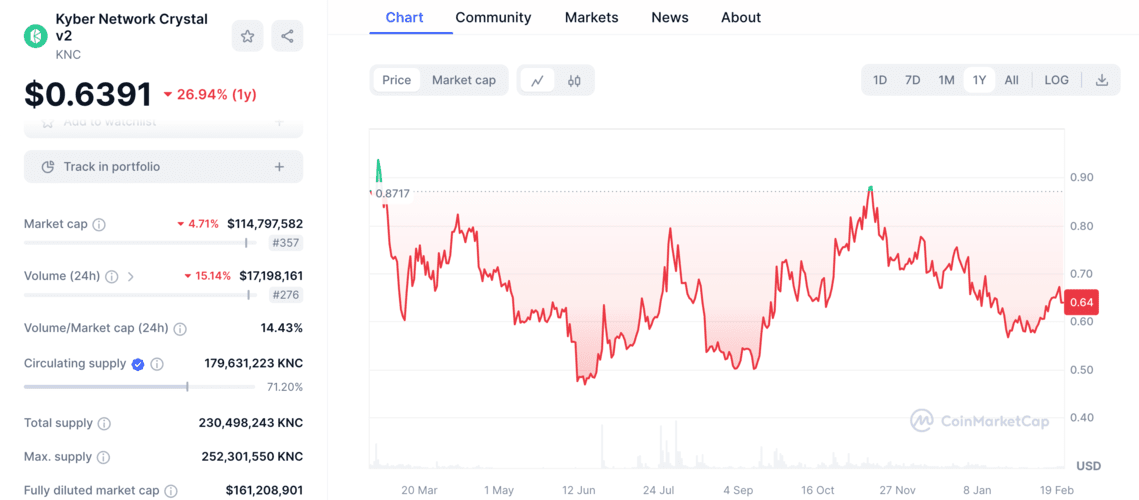

- Kyber Network (KNC): Serves as a hub for multi-chain crypto trading and liquidity, connecting various sources of liquidity to facilitate trades at the most favorable rates.

Are DeFi Cryptocurrencies the Best to Invest?

DeFi has emerged as a revolutionary force, challenging conventional financial systems with a peer-to-peer, blockchain-powered alternative.

This nascent space boasts a current TVL of $75 billion, a significant figure even amidst a slight dip from its $175 billion peak. This demonstrates the substantial interest in DeFi and its resilience in a volatile market.

But within this dynamic ecosystem lies an interesting question: can DeFi coins offer investors greater returns than traditional options? The answer, like any investment, is nuanced.

Firstly, DeFi disrupts the very structure of finance. Eliminating intermediaries like banks and brokers empowers individuals to participate directly in financial activities like lending, borrowing, and trading. This democratization opens doors to potentially higher returns through innovative mechanisms like yield farming and liquidity mining, where users earn rewards for providing liquidity to DeFi protocols.

However, navigating this brave new world comes with inherent risks. Unlike traditional investments, DeFi is still evolving, and its protocols are susceptible to vulnerabilities and exploits. Additionally, the crypto market itself is notoriously volatile, and locking funds in DeFi platforms for specific periods can expose them to potential price swings.

So, are DeFi coins the ultimate investment vehicle? DeFi coins represent an innovative approach to finance, but they’re not a one-size-fits-all solution. Explore their potential, but make sure they align with your overall investment strategy and risk tolerance. Before diving in, thorough research and a balanced portfolio are crucial.

Ultimately, the “best” investment depends on your individual goals and risk appetite. DeFi offers a glimpse into the future of finance, but it’s a journey best embarked upon with careful consideration and a thirst for exploration. The potential for high rewards comes hand-in-hand with the potential for significant losses. Invest wisely.

Reviewing the Best DeFi Coins in 2024 (Review & Analysis)

Exploring the dynamic landscape of DeFi coins reveals a confluence of established track records, rigorous audits, and vibrant communities.

While Ethereum remains the dominant platform for these financial innovations, the emergence of alternative blockchains like Solana and BNB adds a compelling layer of diversification.

Beyond the potential for enhanced returns, these DeFi coins reshape the investment landscape and unlock new avenues for participation within the expansive and rapidly evolving DeFi ecosystem.

1. Bitcoin Minetrix: A Stake in the Future of Cloud Mining

Frustrated by opaque fees, hardware hurdles, and limited control in traditional cloud mining? Bitcoin Minetrix (BTCMTX) seeks to disrupt the scene with its innovative “Stake-to-Mine” approach.

Instead of upfront investments in expensive equipment, users stake their BTCMTX tokens as collateral to secure “mining credits” representing cloud mining power. This eliminates hardware costs and empowers users to manage their participation directly.

Merging Stakeholding With Cloud Mining

Traditional cloud mining solutions are plagued with issues like hardware obsolescence, hidden fees, and lack of control. BTCMTX addresses these concerns through its innovative “Stake-to-Mine” mechanism. This approach eliminates upfront hardware costs and empowers users with control over their participation.

Dual-Revenue Stream: The true highlight of BTCMTX lies in its dual-revenue model. Staking BTCMTX grants access to mining credits and unlocks potential staking rewards of up to 87% annually. Additionally, users receive a share of the actual mining profits, offering a compelling proposition for both staking and mining enthusiasts.

BTCMTX also leverages Ethereum smart contracts to ensure transparency and security. Staked tokens act as the access card to mining, eliminating the need for centralized control. Additionally, mining credits, represented as non-transferable ERC-20 tokens, guarantee the system’s integrity by preventing manipulation or unauthorized use.

Integrating BTCMTX is a seamless process. Begin by acquiring BTCMTX tokens during or after the presale. Next, stake your tokens to generate mining credits, which function as your key to unlocking the platform’s potential. Utilize these credits to redeem designated mining time or claim your portion of the mining yields. Finally, transfer your extracted BTC directly to your wallet.

$BTCMTX Summary

BTCMTX offers a fresh take on cloud mining, addressing key concerns with an accessible, user-controlled approach. The enticing dual-revenue model further adds to its appeal.

However, as a young project, exercising caution and conducting thorough research before investing is crucial. Remember, any cryptocurrency carries inherent risks, and this information should not be considered financial advice.

| Project | Bitcoin Minetrix |

| Ticker | $BTCMTX |

| Blockchain Platform | Ethereum |

| Inception | 2024 |

2. eTukTuk: ‘rEVolution’ for the Transport Industry

Here, we have a bold initiative aiming to transform transportation in developing nations, ultimately impacting air quality, health, and financial inclusion globally.

Founded on a five-year journey, they envision a network of electric vehicles (EVs) and charging stations powered by their native utility token, $TUK.

Integrating Sustainability and Financial Inclusion

eTukTuk’s vision for a greener and more inclusive future rests on two key pillars: sustainable transportation and financial inclusion.

Firstly, they tackle air pollution and CO2 emissions head-on by designing and manufacturing affordable, lightweight electric TukTuks. These familiar vehicles, a mainstay of transport in many developing nations, will receive an eco-friendly makeover, contributing to cleaner air and improved community health.

Secondly, eTukTuk embraces financial inclusion through its innovative DePIN (Decentralized Physical Infrastructure Networks) model.

Powered by blockchain technology, DePIN incentivizes participation from drivers, charging station hosts, and other stakeholders with the project’s native TUK tokens. This fosters a community-driven approach, empowering individuals with financial opportunities while building a robust ecosystem around their electric vehicle (ZEVs) network.

Dedicated apps for both drivers and passengers facilitate payments, data collection, and route planning, ensuring a seamless user experience. The EVSE network, comprised of charging stations, forms the backbone of transactions, accepting TUK and other currencies.

Participants can even earn a share of station transactions through “Power Staking” by locking TUK tokens, further solidifying their stake in the ecosystem’s success.

$TUK Summary

eTukTuk’s value transfer network presents a promising approach to tackling crucial challenges in the transportation sector. While its early stage and competitive environment require careful consideration, its focus on sustainability, community empowerment, and innovative technology makes it a project worth watching

| Project | eTukTuk |

| Ticker | $TUK |

| Max. Supply | 2,000,000,000 |

| Blockchain Platform | Binance Smart Chain (BSC) |

| Inception | 2024 |

3. Mollars: A Store of Value with a Mission

Mollars enters the crypto space with a bold mission: to offer a hybrid store-of-value (SOV) token that challenges Bitcoin’s dominance. While aiming to provide a similar value proposition as Bitcoin, Mollars seeks to address its perceived shortcomings, particularly high transaction fees.

Hybrid Store-Of-Value (SOV) Token

Mollars stands out with its commitment to transparency. Unlike many projects where developers hold a portion of the tokens, Mollars ensures a fair launch by distributing 100% of its supply to the public market. This democratic approach aims to build trust and community ownership.

Beyond its fair launch, Mollars boasts several intriguing features. It plans to bridge cross-chain transactions, potentially streamlining complex transfers between different blockchains. Additionally, the project is developing its own decentralized exchange (DEX), “Mollars.CC.” Increased usage of this DEX could decrease the available token supply, potentially driving up the value for investors.

$MOLLARS Summary

Mollars’ focus on transparency and eliminating developer holdings is commendable. However, its success hinges on its ability to deliver on its promises. While the cross-chain bridging and DEX development are promising, their actual functionality and impact remain to be seen.

Furthermore, the project’s marketing approach, which directly criticizes Bitcoin and its founder, might raise concerns about professionalism and objectivity. While highlighting pain points can be effective, a more nuanced approach would likely resonate better with a wider audience.

Overall, Mollars presents an interesting proposition with its fair launch and ambitious goals. However, its long-term viability depends on its ability to execute its plans effectively and foster a more constructive community dialogue. Whether it truly lives up to its challenge against Bitcoin remains to be seen.

| Project | Mollars |

| Ticker | $MOLLARS |

| Max. Supply | 10,000,000 |

| Blockchain Platform | Ethereum |

| Inception | 2023 |

4. Synthetix: Democratizing Derivatives with Synthetic Assets

Synthetix is a stand-out DeFi project that burst into the scene to create a permissionless and universally accessible derivatives market. It empowers users to trade synthetic assets (“Synths”) that mirror real-world assets like stocks, currencies, and commodities without directly owning them.

This unlocks a plethora of investment opportunities and trading strategies, all within a decentralized and censorship-resistant ecosystem.

Synths and Collateralization

At the heart of Synthetix lies the Synthetix Network Token (SNX). Users lock their SNX as collateral to mint Synths. This collateralization ensures the system’s stability and incentivizes users to participate in its governance.

Synths themselves are created and destroyed through smart contracts, utilizing price feeds (“oracles“) to track the underlying asset’s value.

Kwenta, the platform-specific DEX is integrated within the Synthetix ecosystem and facilitates seamless synths and other cryptocurrency trading. Unlike traditional order book exchanges, Kwenta utilizes peer-to-contract trading, resulting in faster conversions and bypassing the need for centralized intermediaries.

$SNX Summary

Synthetix unveils a captivating world for DeFi enthusiasts, unlocking access to a diverse range of assets without ownership. Imagine building a portfolio encompassing stocks, commodities, and even the US dollar, all within the decentralized realm.

This magic lies in “synths,” digital tokens mirroring real-world assets. To acquire these synths, you lock up SNX, the protocol’s native token, as collateral, ensuring system stability and responsible trading. But the fun doesn’t stop there! Synthetix caters to various tastes, offering traditional financial instruments, cryptocurrencies, and commodities.

However, before diving in, consider the potential pitfalls. Synthetix can be complex, demanding a solid grasp of DeFi concepts to understand synth mechanics and collateralization. Additionally, synth prices can be volatile due to their reliance on external oracles. And, like any DeFi project, smart contract vulnerabilities pose a constant threat.

Ultimately, Synthetix offers a unique and innovative way to navigate the DeFi landscape. While complexities and risks exist, the potential for portfolio diversification and novel trading strategies make it a compelling option for well-informed DeFi participants.

| Project | Synthetix |

| Ticker | $SNX |

| Market Cap (Feb, 2024) | $1,059,587,241 |

| Max. Supply | 328,193,104 |

| Blockchain Platform | Ethereum |

| Inception | 2017 |

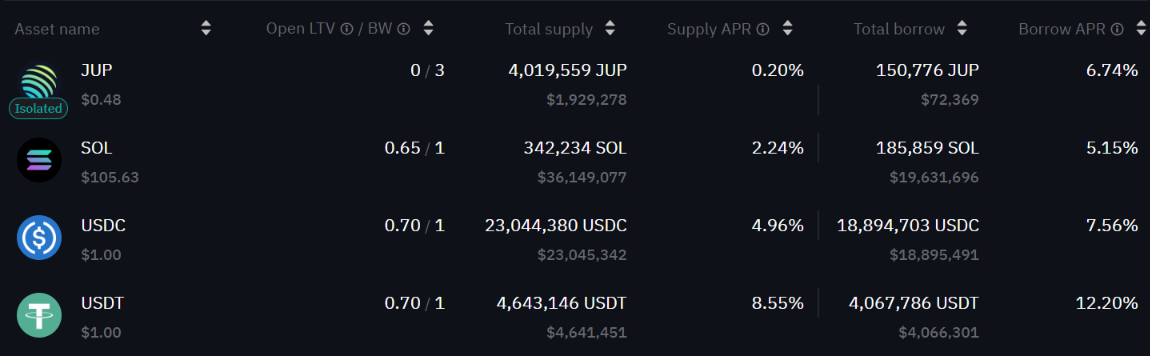

5. Solend: Decentralized Lending Powerhouse on Solana

Solend takes center stage in the bustling DeFi landscape, offering an algorithmic, decentralized lending and borrowing protocol built on the Solana blockchain. This translates to seamless borrowing and lending of assets, all without intermediaries, directly on the Solana network.

Algorithmic Lending and Borrowing

At its core, Solend empowers users to act as lenders and borrowers. Lenders deposit their assets to earn interest, while borrowers leverage their holdings to obtain loans without lengthy approval processes. An autonomous algorithm dictates interest rates and collateral requirements, ensuring a dynamic and efficient lending ecosystem.

Solend boasts a multi-pool structure catering to various asset types and risk profiles. The main global liquidity pool houses established tokens with robust liquidity, while isolated pools support newer or more volatile assets. Also, permissioned pools allow anyone to create isolated pools, fostering community engagement and innovation.

Solend lending and borrowing rates

$SLND Summary

Solend has carved a niche in the DeFi space with its impressive growth. From a modest launch in August 2021, its Total Value Locked (TVL) skyrocketed to a billion dollars within three months, showcasing the platform’s growing traction. Its integration with Solana offers high speed and low fees, further enhancing its appeal.

However, Solend isn’t without its risks. Oracle exploits, and the presence of large borrowers (“whales”) can pose significant threats. The November 2022 oracle exploit exemplifies the potential for manipulation, while the June 2022 whale incident highlights the vulnerability to large-scale liquidations.

Despite these challenges, Solend remains a prominent player in the DeFi landscape. Its innovative approach and the Solana blockchain’s advantages position it well for continued growth. However, considering the associated risks is crucial for users and investors alike.

| Project | Solend |

| Ticker | $SLND |

| Market Cap (Feb, 2024) | $61,900,976 |

| Max. Supply | 100M |

| Blockchain network | Solana |

| Inception | 2021 |

6. Kyber Network: Decentralized Liquidity Powerhouse

Kyber Network (KNC) is a multi-chain platform that acts as a hub for crypto liquidity, facilitating instant token swaps across various decentralized applications (dApps), wallets, and DeFi platforms.

It eliminates the need for intermediaries by aggregating liquidity from diverse sources like token holders, market makers, and DEXes into a single pool. This democratizes access to liquidity and empowers users with competitive swap rates.

Unlocking Seamless Token Swaps

Kyber is a multi-chain liquidity hub, aggregating reserves from various sources like token holders, market makers, and other DEXs. This creates a vast pool of liquidity, ensuring users get the best possible rates when swapping tokens.

KyberSwap, its flagship product, is a one-stop shop for all your DeFi needs. Execute instant token swaps, earn high yields by providing liquidity, discover trending tokens, and even perform cross-chain swaps – all within a user-friendly interface.

Notably, Kyber offers a variety of innovative solutions:

KyberSwap Aggregator: Scans over 100+ liquidity sources across 15 chains to find the most favorable swap rates, promoting market stability.

Limit Orders: Set your desired rates for gasless, slippage-free, and zero-fee trades, executed automatically when the market aligns with your preference.

Cross-Chain Swaps: Swap between tokens on different chains seamlessly through KyberSwap’s integration with the Squid protocol.

Liquidity Solutions: Earn boosted yields by providing liquidity through KyberSwap Classic’s dynamic fee adjustments or KyberSwap Elastic’s customizable price ranges with anti-sniping protection.

$KNC Summary

Kyber Network boasts several strengths. Its deep liquidity pool guarantees competitive swap rates, while its diverse suite of solutions caters to various user needs. Additionally, the KyberDAO ensures community governance, fostering transparency and trust.

Overall, Kyber Network has established itself as a major player in the DeFi space, offering a robust and user-friendly platform for decentralized token swaps.

Its commitment to innovation and multi-chain expansion positions it well for future growth. However, navigating regulatory uncertainties and staying ahead of competition remain key challenges.

| Project | Kyber Network |

| Ticker | $KNC |

| Market Cap (Feb, 2024) | $112,862,097 |

| Max. Supply | 252,301,550 |

| Blockchain network | Ethereum |

| Inception | 2018 |

What are DeFi Tokens Used for?

Decentralized finance tokens are the fuel of the DeFi revolution, unlocking a diverse range of financial activities previously dominated by traditional institutions. These tokens, native to specific blockchain protocols, empower users to engage in peer-to-peer financial interactions without intermediaries like banks or brokerages. But what exactly can you do with these innovative tokens?

1. Tokenized Financial Assets

Just picture this for a moment – you have the power to hold a piece of real estate or a fraction of a stock right in your crypto wallet. How cool is that?

DeFi tokens make this possible through asset tokenization. These tokens represent real-world assets like shares, bonds, commodities, and even artwork, stored securely on the blockchain.

This opens up a new avenue for fractional ownership, increased liquidity, and global access to previously illiquid assets. For example, a DeFi token could represent a portion of a valuable painting, allowing investors to own a piece of it without needing the capital for the entire artwork.

2. Lending and Borrowing via Smart Contracts

Say goodbye to the traditional loan application process and the hassle of credit checks. DeFi tokens facilitate peer-to-peer lending and borrowing through self-executing smart contracts.

These digital agreements automatically connect lenders and borrowers based on pre-defined parameters, eliminating the need for trusted third parties. Users can deposit their DeFi tokens into lending pools, earning passive interest on their holdings.

Conversely, borrowers can access crypto loans at competitive rates, using their DeFi tokens as collateral. This democratizes access to financial services, particularly for those excluded from traditional banking systems.

3. Providing Liquidity in Exchange for High Yields

DeFi platforms rely on liquidity to function effectively. Users who contribute their DeFi tokens to liquidity pools become crucial players in the ecosystem.

In return, they earn rewards in the form of newly minted DeFi tokens or a share of transaction fees. These rewards can offer significantly higher yields than traditional savings accounts, making them an attractive option for crypto investors seeking passive income.

DeFi tokens offer a range of core functionalities, but what’s exciting is that they are constantly evolving and unlocking new possibilities:

More usage scenarios

Instant settlement of trades: DeFi throws traditional settlement processes out the window. Trades involving DeFi tokens happen on-chain, eliminating intermediaries and clearinghouses. This means instant execution (think seconds, not days) and 24/7 accessibility, regardless of time zones.

But the transparency is just as impressive. Every trade detail – price, time, participants – is etched permanently on the blockchain, with no room for manipulation.

Decentralized governance: Some decentralized finance tokens provide holders with voting rights, enabling them to shape the future of the protocol they support.

Yield farming: Using multiple DeFi protocols for complex strategies can potentially yield higher returns, but it requires advanced knowledge and involves significant risks.

Decentralized insurance: DeFi tokens can be used to purchase coverage against hacks, smart contract bugs, or even market crashes, offering a layer of security in the still-nascent DeFi landscape.

The token industry is expanding and evolving with the maturation of technology and regulations, offering diverse use cases for innovation, financial inclusion, and disruption in the future.

Our Best Defi Coins, Summarized

| Project | Token | Total Supply | Chain | Staking | Inception |

| Bitcoin Minetrix | $BTCMTX | 4B | Ethereum | Yes | 2024 |

| eTukTuk | $TUK | 2B | BNB Smart Chain | Yes | 2024 |

| Mollars | $MOLLARS | 10M | Ethereum | Yes | 2023 |

| Synthetix | $SNX | 328,193,104 | Ethereum | Yes | 2017 |

| Solend | $SLND | 100M | Solana | Yes | 2021 |

| Kyber Network | $KNC | 252,301,550 | Ethereum | Yes | 2018 |

Our Verdict on the Best DeFi Coins

DeFi is a rapidly evolving and dynamic space that is buzzing with endless possibilities for investors, traders, and users alike. With its decentralized nature, open finance offers unique opportunities to access financial services and products that were previously unavailable or restricted. From yield farming to liquidity mining, staking to lending, and much more, numerous ways exist to participate in the crypto finance ecosystem and potentially earn attractive returns.

For the Minnows

- eTuktuk ($TUK): This microfinance platform focuses on real-world impact, offering a unique blend of social good with potential returns. Ideal for those seeking a DeFi experience with a conscience.

For the Dolphins

- Kyber Network ($KNC): This veteran liquidity aggregator offers a robust platform with proven stability. A solid choice for those seeking diversified exposure to DeFi without excessive risk.

For the Whales

- Synthetix ($SNX): This synthetic asset issuance platform allows exposure to various traditional and exotic assets without leaving the DeFi realm. Perfect for experienced investors comfortable with higher volatility.

For the Mavericks

- Bitcoin Minetrix ($BTCMTX): This project aims to democratize Bitcoin mining, offering fractional ownership. A high-risk, high-reward option for those seeking exposure to the Bitcoin network.

- Solend ($SLND): This Solana-based lending platform boasts fast transaction speeds and lower fees. A promising option for those exploring alternative DeFi ecosystems.

Disclaimer: This is not financial advice. Please do your own research before making any investment decisions.

References

- https://etuktuk.io/assets/documents/whitepaper.pdf

- https://bitcoinminetrix.com/assets/documents/whitepaper.pdf

- https://www.forbes.com/sites/leeorshimron/2023/08/16/layer-2-wars-heat-up-as-coinbase-launches-base/

- https://www.dlnews.com/articles/defi/defi-news-that-will-shape-2024-coinbase-eigenlayer-makerdao/

- https://primexbt.com/for-traders/what-is-defi-staking/

FAQs

What is the meaning of DeFi?

DeFi, or Decentralized Finance, goes by many names: OpenFi, Programmable Finance, P2P Finance, Web3 Finance, even Crypto Finance. But at its core, it’s an umbrella term for financial services built on blockchains, bypassing traditional institutions like banks.

The industry facilitates peer-to-peer lending, borrowing, trading, and interest-earning directly between users, all powered by the self-executing contracts known as smart contracts and secured by the immutability of blockchain technology.

Is DeFi still popular in 2024?

While not the explosive fad of 2021, DeFi continues to generate interest and grow steadily in 2024. Despite a recent pullback, the DeFi Total Value Locked (TVL) currently sits at an impressive $75 billion, a testament to its resilience and ongoing adoption. While lower than its peak of $175 billion, this sizable TVL indicates a thriving market.

What cryptos are DeFi?

Not all cryptos are DeFi. DeFi applications typically have their own tokens used for governance, staking, or accessing services within their specific protocol. For example, Uniswap (UNI) powers the Uniswap decentralized exchange, while Aave (AAVE) is used in the Aave lending platform.

What utility do DeFi tokens have?

Crypto tokens with utilities serve various purposes beyond just price speculation. They can be used for:

- Governance: Vote on protocol decisions and shape the project’s future.

- Staking: Earn rewards by locking your tokens and contributing to network security.

- Fees: Pay for services within the protocol, like borrowing or trading.

- Discounts: Access exclusive features or reduced fees within the DeFi ecosystem.

What chain is mostly used for DeFi?

Ethereum (ETH) remains the dominant player in DeFi due to its first-mover advantage and large developer community. However, Arbitrum (ARB) is gaining traction with its faster and cheaper transactions, attracting DeFi projects seeking scalability. Other chains like Sei are also emerging, catering to specific DeFi needs.