Crypto staking has become a popular way for investors to earn passive income on their holdings.

With the rise of new staking platforms and innovative protocols offering increased accessibility and attractive returns, there’s more opportunity than ever to participate.

This article will explore some of the best cryptocurrencies to stake in today’s evolving market. We’ll look closer at these cryptos’ features, their potential for growth, and the benefits of staking them.

- Multi-chain utility across 6 chains including Ethereum, Solana and Base

- Staking rewards on Ethereum for presale buyers

- Advanced bridging technology with Wormhole and Portal integration

USDT

USDT ETH

ETH MATIC

MATIC- +1 more

- An AI and dog-themed memecoin on Ethereum

- Presale tokens are staked an provide rewards during the presale

ETH

ETH USDT

USDT

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

SOL

SOL ETH

ETH BNB

BNB- +1 more

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

ETH

ETH USDT

USDT BNB

BNB- +1 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

ETH

ETH USDT

USDT Debit

Debit

- Gain exclusive airdrop points by buying and holding $SMOG

- Conquer foes and reap rewards on the Solana blockchain

- Secure your stake on Solana through a direct $SMOG purchase on Jupiter DEX

SOL

SOL ETH

ETH USDT

USDT

Listing 7 of the Best Crypto Coins to Stake in 2024

- Dogeverse: Best crypto coin to stake with new eco-friendly take on doge meme coins; 60% + yield

- Mega Dice Token: Hot new GameFi token with daily staking rewards based on Casino’s performance

- Pyth network: Bridges the data gap for DeFi by providing secure price feeds directly from leading institutions; 25% APY

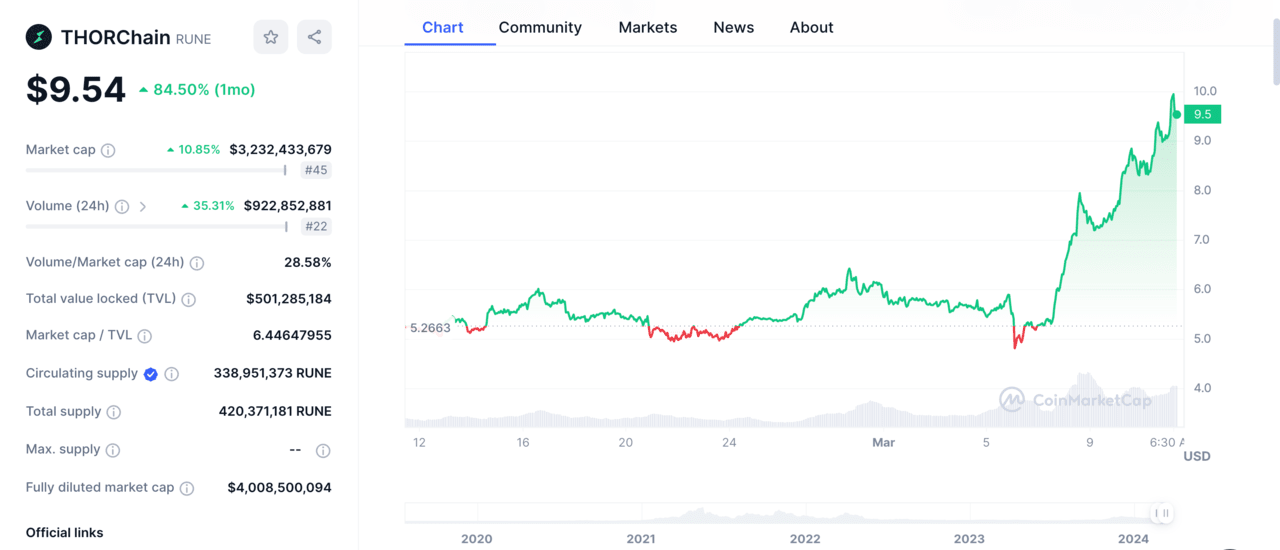

- THORChain: A decentralized liquidity protocol for swapping cryptocurrencies across various networks; 27.89 APR

- Sponge V2: Successor to the 100x $SPONGE meme coin, offers high staking rewards. P2E game in development; 43% APY

- Flow: High-speed NFTs and collectibles platform, attracting partners like Warner Music, UFC, and NFL; 8.99% yield

- Cosmos: Ambitious protocol creating an interoperable ecosystem of blockchains. 16% return

1. Dogeverse ($DOGEVERSE): Best Crypto coin to Stake with 60%+ APY

New-to-the-scene memecoin Dogeverse is our choice for the best crypto coin to stake. It builds on the popularity of coins like Dogecoin and Shiba Inu while offering a new innovative staking system that provides investors with high yields.

High staking yields for early investors

Dogeverse is the best staking coin right now that offers really high rewards and works on many different blockchains. Buying $DOGEVERSE early can help you earn over 60% of staking rewards (APY).

The platform allows you to stake your $DOGEVERSE tokens even before the presale ends. Of the 200 billion total token supply, 20 billion (10%) are reserved for staking rewards.

Dogeverse has witnessed huge investor traction, with over 25.8 billion $DOGEVERSE tokens staked in just a few weeks. It also raised over $13 million during this time, showing massive community and trust in the project.

$DOGEVERSE review

At the time of writing, early buyers can get the $DOGEVERSE tokens for just $0.00031.

Unlike many other tokens Doge-themed tokens, which often don’t offer much utility, Dogeverse offers high staking rewards and the ability to work on many blockchains.

One of the main features of Dogeverse is that it is interoperable with big blockchains like Ethereum, Binance, Polygon, Avalanche, and Solana. This means users can enjoy lower fees and faster transactions across different networks.You can join the Dogeverse Telegram group and follow its X (formerly Twitter) handle to get recent updates.

| Total Tokens | 200 Billion |

| Tokens Available in Presale | 30 Billion to 57 Billion |

| Blockchain | Multi chain |

| Token type | ERC-20 standard using Wormhole |

| Minimum Purchase | N/A |

| Purchase With | ETH, USDT, BNB, SOL, MATIC, AVAX, BASE, Credit Card |

Pros

- High APY for early buyers

- Capitalizes on the strong Doge fanbase in the crypto world

- Earn high levels of passive income during presale

Cons:

- Limited utility apart from staking

- As a meme coin, it is susceptible to market volatility

2. Mega Dice Token ($DICE): New GameFi token with daily Staking rewards based on Casino’s performance

The next best staking coin to watch out for is the Mega Dice Token ($DICE). Mega Dice is a crypto casino that combines the popular trends of Solana coins with GameFi.

The platform’s native Mega Dice Token is central to the platform and offers many benefits, like getting cashback back when you play at the casino, getting free tokens through airdrops, and special perks NFT perks.

Daily Rewards

The platform gives daily staking rewards to people who hold $DICE based on how well the casino performs.

Other similar projects like Rollbit and TG.Casino have done really well. Many think Mega Dice Token could perform similarly, especially as the GambleFi market is projected to grow massively.

You can earn a 10% referral commission (with no limit) on the amount invested in presale by someone you referred.

The casino is quite popular, with over 50,000 players, 10,000 active users every month, and a $50 million bet each month.

$DICE Review

Early buyers can get $DICE for just $0.069 at the time of writing. This price will increase in the upcoming presale round.

You can buy $DICE using Solana, ETH, USDT, and BNB. There are 420 million tokens in total, and 147 million of them are available in the presale.The platform also has an airdrop program that offers $2.25 million in rewards to early supporters. You can join the Mega Dice Telegram channel and follow it on X (previously Twitter) for recent updates.

| Total Tokens | 420 Million |

| Tokens Available in ICO | 147 Million |

| Blockchain | Solana |

| Token type | SPL |

| Minimum Purchase | N/A |

| Purchase With | SOL, ETH, BNB |

Pros

- Win from an airdrop prize pool

- Free tokens for early private sale investors

Cons

- Yet to launch many platform features

- New token can attract initial volatility

3. Pyth network ($PYTH): Reliable Data Feeds for Smart Contracts

Pyth Network (PYTH) is a first-party oracle network designed to deliver high-quality market data directly to smart contracts across multiple blockchains.

By connecting DeFi applications with verified price feeds from leading exchanges and professional traders, Pyth aims to unlock the full potential of smart contracts through reliable, real-world data.

Decentralized price feeds, high accuracy

Access to trustworthy, real-time data is crucial for traditional DeFi. However, it can be challenging to obtain such data. Pyth aims to solve this problem by creating a decentralized marketplace for verifiable data feeds.

These feeds are obtained directly from top financial institutions, including Binance and Cboe Global Markets, ensuring data accuracy and eliminating the risk of manipulation often associated with centralized oracles.

Pyth goes beyond simply providing a price. It incorporates innovative features like confidence intervals, allowing users to assess uncertainty surrounding a particular data point. This is particularly valuable in volatile markets, where understanding market sentiment is crucial.

Additionally, Pyth boasts extensive multi-chain compatibility, offering seamless integration for developers building on various blockchains.

Pyth also has a robust reward system that rewards publishers based on various factors, including the volume of data they contribute (stake weight), the accuracy of their submissions (quality score), and their ability to align their feeds with actual market conditions, incentivizing publishers to provide dependable and timely data.

$PYTH Review

Pyth Network prioritizes data integrity by relying on first-party sources, fostering trust, and minimizing errors. Confidence intervals provide valuable information for DeFi applications, enabling more sophisticated decision-making.

The network’s impressive adoption rate, with over 250 applications leveraging its price feeds, underscores its growing influence within the DeFi ecosystem. Furthermore, the permissionless integration process facilitates broader adoption by developers.

Pyth’s innovative approach and commitment to high quality data-position it as a promising player in the evolving Oracle landscape.

| Project | Pyth network |

| Ticker | $PYTH |

| (24hr) Trading Volume | $318,503,307 |

| Max. Supply | 9,999,989,215 |

| Blockchain Platform | Solana (integrated with over 45 blockchains) |

| Launched | 2021 |

Pros

- Reliance on first-party sources ensures data accuracy and minimizes manipulation risks

- Confidence intervals provide valuable insights into market uncertainty

- Seamless integrations across multiple blockchains entices developers

Cons:

- Lacks the ability to access real-world data directly

- Network data hinges on maintaining publisher integrity

4. THORChain ($RUNE): Permissionless Swaps Across Blockchains

THORChain is a revolutionary decentralized liquidity protocol designed to smash through the siloed nature of blockchains.

Unlike traditional exchanges, THORChain allows users to seamlessly swap cryptocurrencies across various networks, including Bitcoin and Ethereum, without relinquishing their assets’ control.

This permissionless exchange eliminates the need for centralized order books, fostering a more open and efficient trading environment.

Swap crypto, any chain

THORChain utilizes a native token called RUNE, which serves a triple purpose within the ecosystem. It acts as a base currency, powers platform governance, and ensures network security.

To mitigate impermanent loss, THORChain implements a unique system using slip-based fees and strategically placing liquidity where it is most needed.

Users can directly swap Bitcoin, Ethereum, stablecoins, and more across nine blockchains to facilitate value exchange between cryptocurrencies without pegged assets.

For high-volume traders, THORChain offers a feature called Streaming Swaps. This breaks down large swaps into smaller transactions executed over time, significantly reducing overall fees.

Finally, THORChain’s “Savers” feature enables single-sided liquidity provision, allowing users to deposit assets and earn returns without worrying about impermanent loss.

$RUNE Review

THORChain operates under a unique economic model. Unlike profit-driven platforms, THORChain directs all generated fees to the network participants, rewarding node operators and liquidity providers for their contributions.

The team itself isn’t allocated any specific share, incentivizing them to work towards the project’s overall success alongside everyone else.

The protocol also takes DeFi lending a step further with its flagship Lending protocol. Users can borrow against their native holdings, receiving a USD-denominated debt in their chosen asset. These loans are groundbreaking – no liquidations, interest accrual, or expiration dates.

| Project | THORChain |

| Ticker | $RUNE |

| (24hr) Trading Volume | $922,852,881 |

| Max. Supply | 500M |

| Blockchain Platform | (Launched on) Cosmos |

| Launched | 2021, (Mainnet) 2022 |

Pros

- Secure and permissionless crypto swaps

- Native asset settlements for true value exchange

- Innovative features reduce swap fees and impermanent loss

Cons:

- Relatively new project with evolving technology

- Complex underlying mechanics for some users

5. Sponge V2 ($SPONGEV2): Capitalizing on Meme Coin Craze with Staking & Play-to-Earn

Sponge V2 is a new cryptocurrency building on the success of its predecessor, the $SPONGE meme coin.

Launched in May 2023, $SPONGE rode a wave of popularity inspired by the iconic cartoon character SpongeBob SquarePants (though not officially affiliated).

Now, Sponge V2 aims to capitalize on the existing community and attract new investors by offering a unique play-to-earn game and impressive staking rewards.

Stake $SPONGEV2 for high yields, win tokens in-game

Unlike its predecessor, Sponge V2 boasts distinct tokenomics and aims to become the dominant version. Investors can stake their $SPONGEV2 tokens to earn exceptionally high APYs (over 488% at the time of writing), creating a cycle of increased staking and upward price pressure.

A play-to-earn game is also in development, allowing users to win $SPONGEV2 through gameplay. This free-to-play (with earnable rewards for paid users) model has the potential to expand the Sponge V2 community significantly.

$SPONGEV2 Review

Sponge V2 takes advantage of the popularity of the $SPONGE meme coin to expand its reach. The project has already seen over 9 billion tokens being staked, which is a good sign for those interested in staking rewards.

Additionally, Sponge V2 has announced the launch of a play-to-earn game, which could attract new investors. It’s important to keep in mind, however, that as with all meme coins, Sponge V2’s value is heavily influenced by hype and market trends.

| Project | Sponge V2 |

| Ticker | $SPONGEV2 |

| (24hr) Trading Volume | $91,540 |

| Max. Supply | 150B |

| Blockchain Platform | Ethereum |

| Launched | 2024 |

Pros

- Earn attractive yields by staking $SPONGEV2 tokens

- Free-to-play game with earnable rewards for users, fostering community growth

- Leverages existing fanbase of the original $SPONGE meme coin

Cons:

- Inherently susceptible to market hype and volatility

- Limited Utility Beyond Staking and Play-to-Earn

6. Flow ($FLOW): Powering the Next Generation of Digital Collectibles

Flow is a blockchain platform focusing on high-speed transactions and has become a key player in the rapidly expanding blockchain-based entertainment and investment industry.

The platform is specialized in NFTs and collectibles, making it an excellent choice for creating secure and scalable NFT applications. Its innovative architecture and developer-friendly approach further enhance its value.

Launched by Dapper Labs, the creators of CryptoKitties, Flow offers developers a secure and scalable environment for building NFT-based applications.

Notable use cases on Flow include NBA Top Shot, a platform for trading collectible highlights, and Dr. Seuss collectibles (Seussibles).

Building Scalable and Secure NFT Experiences

Flow utilizes a unique multi-role architecture that separates different tasks across various node types. This allows the network to achieve high transaction speeds without compromising security or decentralization.

Additionally, Flow uses a novel programming language called Cadence, which simplifies development and streamlines the creation of complex NFT applications.

Flow prioritizes user onboarding by integrating fiat on-ramps and user-friendly security features, such as using the Dapper Wallet without managing complex seed phrases.

$FLOW Review

To further enhance user experience and drive mainstream adoption of NFTs, Flow recently launched its U.S. dollar stablecoin, FUSD, allowing for easier fiat on-ramping within the ecosystem.

Flow prioritizes high-profile partnerships, as evidenced by investments from Warner Music. The platform allows fans to interact with their favorite artists and purchase NFTs.

It has also successfully collaborated with leading sports organizations such as the UFC and NFL, which have launched their own NFT collectible experiences on Flow.

Additionally, Flow partnered with Filecoin and the InterPlanetary File System (IPFS) to provide decentralized storage for NFTs minted on the network.

However, Flow’s multi-role architecture departs from traditional blockchain models, raising questions about long-term decentralization.

| Project | Flow |

| Ticker | $FLOW |

| (24hr) Spot Trading Volume | $321,662,284 |

| Max. Supply | 1,493,452,839 |

| Blockchain Platform | Flow blockchain |

| Launched | 2020 |

Pros

- Architecture enables high transaction throughput without compromising security

- Cadence and a suite of developer tools entice developers and streamline dApp creation

- FUSD, fiat on-ramps, and user-friendly security enhance experiences

Cons:

- Multi-role architecture differs from traditional blockchains, raising questions about long-term decentralization

- Success hinges on attracting developers and users to its NFT-focused ecosystem

7. Cosmos ($ATOM): Building an Ecosystem of Interoperable Blockchains

Cosmos, known as “The Internet of Blockchains,” is a pioneering solution to bridge communication gaps among different blockchain networks. Launched in 2016 in collaboration with The Interchain Foundation, Cosmos raised over $17 million through a successful Initial Coin Offering (ICO) in 2017, laying the foundation for its ambitious project.

Blockchains almost all operate independently, and sharing information or swapping tokens is a difficult task. Cosmos aims to change that by connecting blockchains using the Cosmos Blockchain.

A network of interoperable blockchains

At the heart of Cosmos lies its network of interoperable blockchains, termed as Zones. These Zones, each with distinct applications and governance models, can interact autonomously while being connected through Cosmos Hub. Cosmos Hub serves as the primary blockchain, facilitating interconnectivity among Zones and monitoring their states through the Inter-Blockchain Communication Protocol (IBC).

It offers a range of tools to developers, such as Cosmos SDK and CometBFT, and enables interoperability between blockchains. Some of the blockchains that can be connected using the Interchain Stack include BNB Chain, Cronos, Thorchain, and fetch-ai.

The platform has an ambitious aim but is dedicated to achieving it. Since their launch, they have continually rolled out improvements and new developments.

$ATOM Review

ATOM holders can stake their tokens to validate transactions, earning rewards and contributing to network security. Additionally, ATOM serves as a means for transaction fees and governance voting, fostering community participation and network stability.

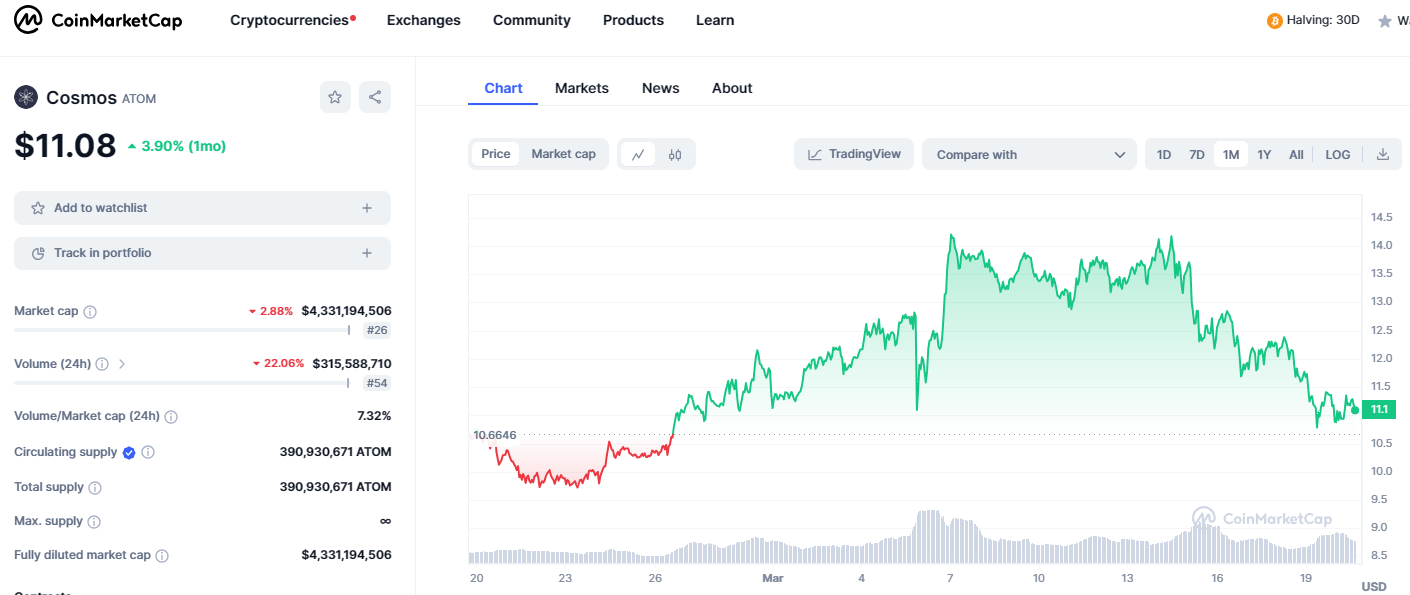

While the token has not returned to its all-time high of $44.70, it’s maintained an active community. It performed relatively well during the last bear market. The token had a spike in price at the start of 2024 and is currently trading at $11.08.

ATOM holders can stake their tokens on various platforms with yields of up to 16% currently, although this can vary from platform to platform.

| Project | Cosmos |

| Ticker | $ATOM |

| (24hr) Spot Trading Volume | $337,794,278 |

| Max. Supply | 390,930,671 ATOM |

| Blockchain Platform | Cosmos |

| Launched | 2017 |

Pros

- Connecting blockchains across the market

- Facilitates the easy swapping of tokens

- Each blockchain is sovereign and independent, strengthening the network

Cons:

- Tokens need to be staked for a minimum of three weeks

- The project is complex to understand for average users

Best crypto coins to stake compared

| Project | Token | Total Supply | Chain | Min. Lockup period | Max. APR/APY |

| Dogeverse | $DOGEVERSE | 200B | Multi-chain | N/A | 60%+ |

| Mega Dice Token | $DICE | 420M | Solana | N/A | – |

| Pyth Network | $PYTH | 9.99B | Solana | 6 months | 20% – 25% |

| THORChain | $RUNE | 500M | Cosmos | N/A | 27.89% (Dual APR) |

| Sponge V2 | $SPONGEV2 | 150B | Ethereum | N/A | 43% |

| Flow | $FLOW | 1.5B | Flow | 7 days | 8.99% |

| Cosmos | $ATOM | 390M | Cosmoc | 21 days | 16% |

Why stake Cryptocurrencies?

Staking cryptocurrencies has emerged as a compelling way to earn returns, similar to dividend investing in the traditional market.

Validators who contribute to the network’s security by staking their coins earn interest on their holdings. This symbiotic relationship strengthens the overall integrity of the blockchain.

For long-term crypto holders, staking presents a low-risk approach to generating passive income. Unlike active trading, which has inherent volatility, staking provides a steady stream of earnings without constant market monitoring.

Consider Bitcoin (BTC), known for its slow and steady growth. Staking allows investors to accumulate interest while patiently waiting for market upswings. It acts as a financial buffer during periods when the value of cryptocurrencies might not experience immediate spikes.

The beauty of staking is that it doesn’t require advanced technical knowledge. Many exchanges now offer automatic staking for supported currencies, making it accessible even for those new to crypto.

Balancing risk and potential

While staking offers attractive returns, it’s essential to understand the inherent risks. Staking rewards, often called Annual Percentage Yields (APYs), can vary significantly.

Stablecoins typically offer around 5%, while some low-cap cryptos can boast APYs as high as 1000%. Finding promising low-cap cryptos with reasonable APYs of 30% to 70% is also possible. However, the higher the reward, the greater the risk.

High APYs can be a red flag for potential rug pulls (scams where developers abandon a project after taking investor funds) or unsustainable tokenomics (economic structures) that might lead to price crashes.

[ Read what happened with $WIF]

Additionally, if the underlying project gains significant traction, the APY will likely decrease as more users participate in staking.

By understanding the mechanics, potential rewards, and associated risks, you can leverage staking as a strategic approach to navigating the ever-evolving crypto landscape.

Consider the case of a trader who bought into Dogwifhat (WIF) on November 30, 2023. The trader purchased 5.1 million WIF tokens for only $1,749. Thanks to the possibility of staking rewards and an increase in overall market value, the value of these tokens has now skyrocketed to an astonishing $10.9 million.

While such astronomical returns may not be commonplace, they highlight the potential for substantial passive income from crypto, mainly through staking.

Is Staking Crypto Coins Risk-Free?

Tempting as it may seem, crypto staking isn’t a risk-free ride. Here’s a breakdown of the key challenges:

- Locked-in holdings: Staking often restricts access to your crypto for a fixed period. This means you can’t sell it on a whim, potentially missing out on potential profits if the market surges.

- Market volatility: Even if staking rewards are attractive, the value of your staked crypto can still fluctuate. If the market dips, you could have less than initially invested, even with staking rewards.

- Platform and slashing risks: Not all staking platforms are created equal. Research their reputation and security measures. Additionally, some blockchains penalize validators for misconduct, potentially leading to a loss of staked assets.

By understanding these potential drawbacks, you can make informed decisions about incorporating staking into your crypto strategy.

References

- https://www.coindesk.com/policy/2023/02/22/nbas-top-shot-nfts-may-be-securities-judge-rules-in-dapper-labs-case/

- https://blockchainreporter.net/laser-digital-joins-forces-with-pyth-network-to-enhance-defi-data-accuracy/

- https://blockgeeks.com/guides/thorchain-lending-the-most-comprehensive-guide/

- https://www.musicbusinessworldwide.com/warner-music-group-backed-blockchain-firm-dapper-labs-raises-250m-in-new-funding/