Past volatility fades as regulations solidify and adoption booms, making crypto a powerful investment with upsides outweighing downsides. This raises the question – ‘Is crypto a good investment option?

This analysis dives deep into both the upsides and downsides of entering the cryptocurrency market, equipping you to make informed choices and capture the potential of this evolving financial landscape.

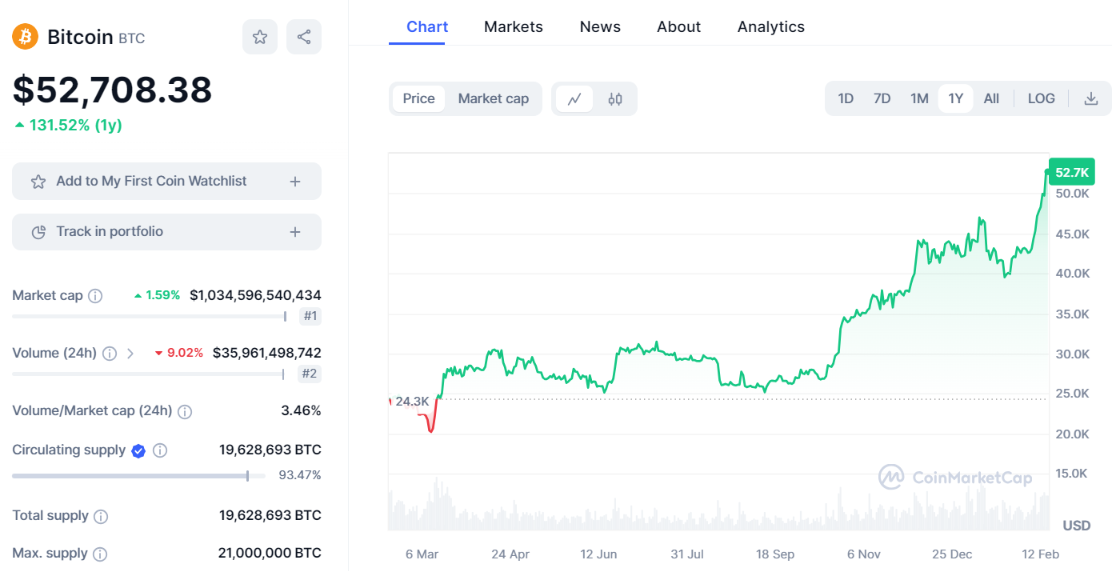

When choosing a new investment, the S&P500 annual returns are often compared. In 2023, the S&P500 gained approximately +25%. Using Bitcoin as an example although many cryptocurrencies shined in 2023, BTC gained approximately +150%.

The higher returns left many to wonder whether crypto is a good investment in the upcoming year.

Best Cryptocurrencies to Invest in 2024

- Multi-chain utility across 6 chains including Ethereum, Solana and Base

- Staking rewards on Ethereum for presale buyers

- Advanced bridging technology with Wormhole and Portal integration

USDT

USDT ETH

ETH MATIC

MATIC- +1 more

- An AI and dog-themed memecoin on Ethereum

- Presale tokens are staked an provide rewards during the presale

ETH

ETH USDT

USDT

- Potential to skyrocket amid Solana meme coin hype

- Rumored to be from the developers $SLERF, which saw huge growth earlier this year

- Similar to Slothana, which recently saw a hugely successful presale and launch

SOL

SOL

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

SOL

SOL ETH

ETH BNB

BNB- +1 more

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

ETH

ETH USDT

USDT BNB

BNB- +1 more

- The 5SCAPE tokens unlock special in-game features

- Brings VR capabilities into Web3 gaming

- An ERC20 token that's compatible with existing Ethereum DeFi platforms and smart contracts

ETH

ETH BNB

BNB USDT

USDT- +2 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

ETH

ETH USDT

USDT Debit

Debit

- Gain exclusive airdrop points by buying and holding $SMOG

- Conquer foes and reap rewards on the Solana blockchain

- Secure your stake on Solana through a direct $SMOG purchase on Jupiter DEX

SOL

SOL ETH

ETH USDT

USDT

- Innovative blockchain-based electric vehicles project

- The eTukTuk prototype is scheduled to be revealed in the first phase

- opBNB will be used in tandem with BNB for scalability and reduce costs

ETH

ETH BNB

BNB USDT

USDT- +1 more

- Potential to cash in on animal-themed hype

- Forthcoming AI features

- Fully audited by Coinsult

- Shiba themed memecoin with staking utility

- Earn rewards for referring new buyers

ETH

ETH BNB

BNB USDT

USDT- +1 more

Why Invest in Cryptocurrencies?

Cryptocurrencies are poised for a transformative impact, even greater than the dot-com boom.

While some remain cautious due to past volatility, astute investors see the immense potential simmering beneath the surface. This isn’t just about fleeting gains; it’s about harnessing a financial paradigm shift driven by decentralization, innovation, and inclusive access.

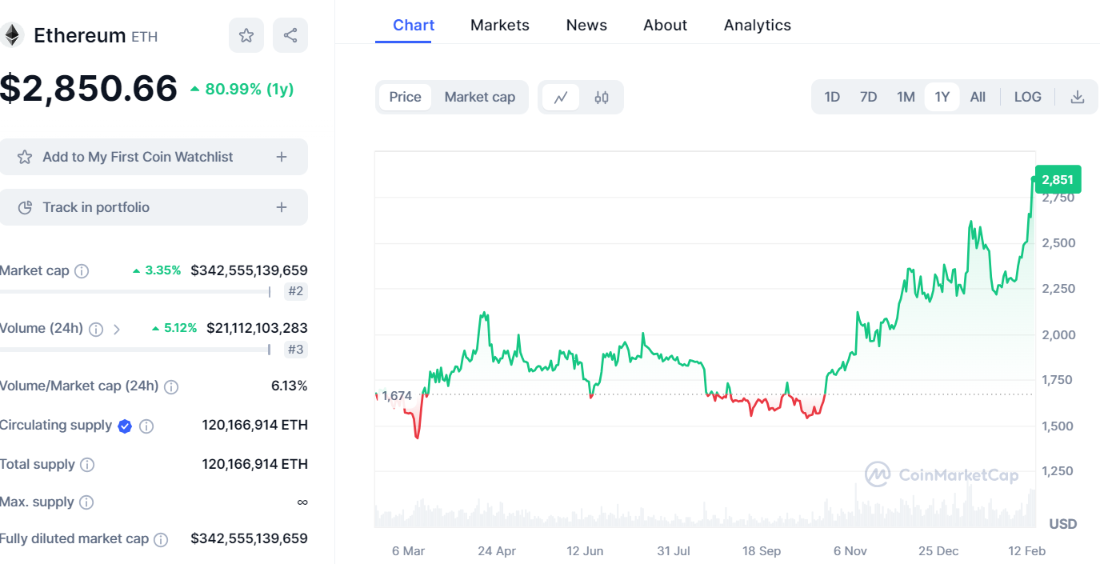

source: coinmarketcap

The market cap of all cryptocurrencies is nearing $2 trillion at the time of this writing. Wall Street’s interest in spot Bitcoin ETFs following the SEC’s approval earlier this year has rekindled the interest in cryptocurrencies.

Even Major brands and Fortune 500 companies recognize the potential of blockchain and digital assets and are adopting the technology. This is evident in recent developments:

- Tesla’s acceptance of Bitcoin as a payment option was a watershed moment, signaling the growing mainstream adoption of cryptocurrency. (At the time of writing, Tesla only accepts Dogecoin (DOGE) as payment for their products.)

- Mastercard has collaborated with crypto exchanges – Binance, Nexo, and Gemini to offer cryptocurrency payment cards in certain countries.

- Microsoft certified Ethereum-focused BlockApps as the first official offering on its Azure Blockchain as a Service platform.

- Even Walmart is getting involved, using blockchain for supply chain management and offering crypto cashback.

Main Events for Crypto in 2024

Explore the evolving crypto industry of 2024 and discover four significant events that will make it a more valuable investment opportunity.

- Ethereum Dencun Upgrade: This highly anticipated upgrade is expected to take place on 13 March 2024 at 08:55 am EST (approx.) although it was originally scheduled for the end of 2023. Also known as EIP-4844, the ‘proto-danksharding’ aims to reduce ether gas fees on layer 2 networks such as Arbitrum.

- Bitcoin’s Halving Event: Roughly every four years, the number of new Bitcoins minted by miners is cut in half. This controlled scarcity and increasing demand have historically driven significant price rallies. With the next halving expected around mid-April, 2024, anticipation is already building as BTC soared above $50,000.

- Potential Spot ETH ETF Approval by the SEC: The VanEck spot ETH ETF final deadline on May 23, 2024. The SEC must either approve or disapprove the ETF. Although Gary Gensler made it clear that one should not assume the SEC will approve the new spot Ethereum ETF, there are speculations it will. Cathie Woods, CEO of Ark Invest believes the SEC will give a green light to the new crypto ETF.

- Spot Bitcoin ETFs Gaining Traction: The recent approval and positive inflows into Bitcoin spot ETFs in the US indicate institutional interest. This mainstream adoption paves the way for broader acceptance and potentially higher valuations for the entire crypto market.

These are brief insights into the captivating advancements driving the cryptocurrency industry forward. Despite the ongoing instability, the potential for change and substantial long-term returns is hard to ignore.

Keep reading to discover a compelling case for why this year demands a careful evaluation of adding cryptocurrencies to your investment portfolio.

New Dawn for Crypto: Spot Bitcoin ETFs Finally Approved

The long-awaited arrival of spot Bitcoin ETFs unleashed a torrent of capital, instantly impacting the market. Analysts point to strong inflows as a critical driver of recent price action.

In the first week, capital flows into the 11 US-listed ETFs ballooned to a staggering $1.64 billion, pushing Bitcoin’s price to a 25-month high of $51,600. This represented a daily increase of 4.1% and propelled the token’s market cap to a whopping $1.005 trillion.

These initial inflows highlight the pent-up demand for accessible Bitcoin exposure among traditional investors. The familiar ETF structure and the convenience of regulated exchanges have unlocked significant capital previously held on the sidelines.

This influx has buoyed Bitcoin’s price and bolstered overall market confidence, potentially paving the way for further stability and growth.

However, the story doesn’t end there. The journey of institutional adoption has just begun, and future capital inflows could have an even more profound impact on the cryptocurrency landscape.

With the SEC‘s validation and the floodgates now open, we can expect even more sophisticated investors to enter the arena, further accelerating the mainstream integration of crypto and fueling innovation within the ever-evolving digital asset ecosystem.

While celebrating this milestone, the crypto community awaits the next potential breakthrough: spot ETFs for Ethereum (ETH).

Given its unique functionalities and burgeoning role in decentralized finance (DeFi), could ETH follow Bitcoin’s path and gain regulatory approval? The potential implications for the crypto landscape are boundless.

Next Spot Crypto ETF: Ethereum

The possibility of the US Securities and Exchange Commission (SEC) approving spot Ethereum Exchange-Traded Funds (ETFs) on May 23 has sent ripples through the financial landscape.

Such approval could catalyze mainstream adoption, mirroring the impact witnessed with Bitcoin ETFs.

However, Ethereum’s “programmable blockchain” functionality introduces complexities beyond those Bitcoin presents. The SEC has historically expressed concerns regarding market manipulation and investor protection concerning smart contracts.

While the recent approval of Bitcoin ETFs offers hope, navigating Ethereum’s regulatory landscape remains nuanced.

Several factors temper the optimism, meaning the SEC may opt for a cautious approach, rejecting applications. Additionally, legal distinctions between Bitcoin and Ethereum could complicate the approval process. Despite these hurdles, the possibility itself merits analysis.

Should spot Ethereum ETFs become a reality, the impact would be multifaceted. Traditional investors would gain convenient access to this burgeoning asset class, potentially causing price appreciation. However, such developments necessitate robust infrastructure.

This is where the Ethereum Dencun Upgrade enters the equation.

Recognizing the need for scalability and security in the face of mainstream adoption, this upgrade aims to enhance the network’s capabilities.

Upon examination of the technical aspects, it becomes clear that Dencun allows for a more secure and scalable Ethereum, poised to leverage opportunities from regulatory approval.

Ethereum Dencun Upgrade: ‘Fixing’ Ether Gas Fees

Understanding key developments like the ETH Dencun upgrade is crucial for embarking on your crypto investment journey. This section will simplify the basis of the upgrade, aiding you in making informed decisions.

Imagine Ethereum as a digital highway teeming with transactions. However, congestion often results in exorbitant gas fees, comparable to tolls, hindering accessibility. Scheduled for March 2024, the Dencun Upgrade arrives as a solution, introducing “blobs” and “proto-danksharding” to combat this gridlock.

Blobs function as neatly compartmentalized data packages. Instead of cramming everything into a single lane, transactions are compressed and stored separately, enabling efficient processing. This alleviates congestion, contributing to reduced gas fees, a welcome development for investors seeking cost-effective participation.

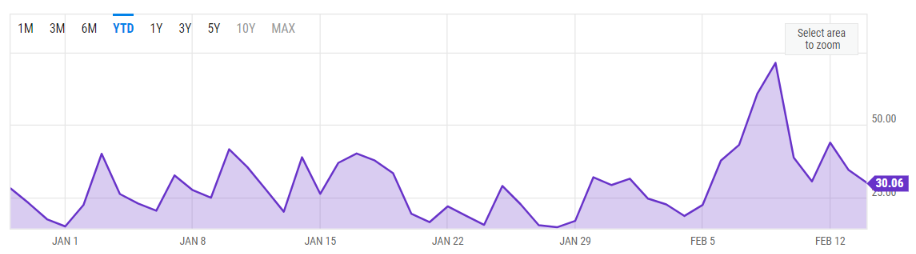

Ethereum average gas fee, source: ycharts

Furthermore, the Dencun Upgrade isn’t merely a traffic fix. Recall “The Merge,” the 2022 transition to a more sustainable system. Building upon this foundation, the upgrade incorporates elements of the Shanghai Upgrade and lays the groundwork for future enhancements.

Here’s where Ethereum Improvement Proposals (EIPs) come into play.

Think of them as blueprints for these upgrades. The Dencun Upgrade implements several crucial EIPs, including the highly anticipated EIP-4844, or “proto-danksharding.” This technical term translates to virtually splitting the highway into multiple lanes (shards) to accommodate more traffic simultaneously. While still in its early stages, proto-danksharding holds immense potential for scalability, increasing Ethereum’s transaction capacity and potentially attracting more users and developers.

Naturally, you’re intrigued about how this upgrade might impact your investments. While predictions are inherently probabilistic, smoother network operations, lower gas fees, and enhanced scalability could contribute to a more robust and user-friendly Ethereum ecosystem. This, in turn, could attract more developers and users, driving increased demand for ETH, the network’s native token.

While Ethereum undergoes a major network upgrade, Bitcoin prepares for its halving event on April 19th, 2024. This event, designed to reduce the available supply of Bitcoin, could significantly impact the entire digital asset market through potential supply shock effects.

Despite their seemingly disparate paths, both cryptocurrencies are paving the way for the future of their respective industries in unique ways.

The Bitcoin Halving: Reducing BTC Mint Rate

The Bitcoin halving, a scheduled event inscribed within the blockchain’s code, embodies a unique economic phenomenon.

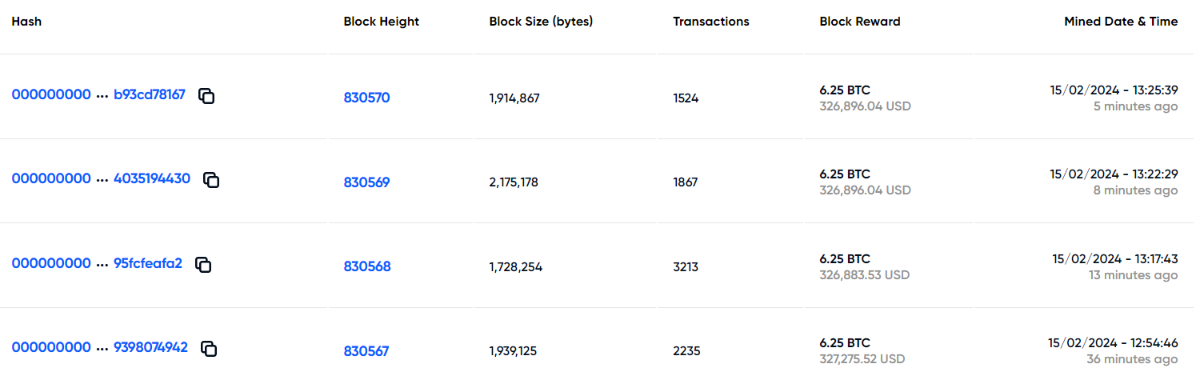

Every 210,000 blocks mined, approximately every four years, the reward for miners verifying transactions is halved. This deliberate reduction in supply mimics precious metals, aiming to create scarcity and potentially drive long-term value appreciation.

The BTC halving is expected to occur at a block height of 840,000. It is estimated to take place between 04/13/24-04/22/24, which is in less than 10,000 blocks.

source: blockexplorer

Consider a hypothetical gold mine where the amount of extracted ore diminishes by 50% every predetermined period. This preordained supply shock sets Bitcoin apart from conventional assets, offering investors a glimpse into a future where scarcity is not a random occurrence but a programmed certainty.

While the potential impact of the halving on Bitcoin’s price is a subject of much debate, it undeniably presents a unique investment opportunity. However, the crypto landscape extends far beyond Satoshi’s Vision.

| Halving Rate | Block Height # | Mining Reward per Block | Date |

| – | 0 | 50 BTC | Inception |

| 1st Halving | 210,000 | 25 BTC | November 28, 2012 |

| 2nd Halving | 420,000 | 12.5 BTC | July 9, 2016 |

| 3rd Having | 630,000 | 6.25 BTC | May 11, 2020 |

| 4th Halving | 840,000 | 3.125 BTC | April 2024 |

| 5th Halving | 1,050,000 | 1.5625 BTC | March 2028 |

| 6th Halving | 1,260,000 | 0.78125 BTC | February 2032 |

| 7th Halving | 1,470,000 | 0.390625 BTC | January 2036 |

The Bitcoin halving will continue to recur every 48 months for 116 years (2140). BTC miners will then earn network fees as opposed to minting new coins.

Historically, every having so far has resulted in a Bitcoin rally, pushing to historic highs. As there is some correlation between Bitcoin and other cryptocurrencies and tokens, a rally in Bitcoin often translates into a rally in other cryptos.

While there is much debate on the potential impact of the halving on Bitcoin’s price, it presents a unique investment opportunity.

While Bitcoin laid the foundation, the crypto landscape offers a vast array of unique investment opportunities. In the next section, we’ll explore unique strategies tailored to your financial goals and risk tolerance, venturing beyond Satoshi’s vision to unlock the full potential of the crypto-verse.

What Sectors Can You Invest in Crypto?

Want to dabble in the future of finance? Explore Decentralized Finance (DeFi) projects that power peer-to-peer lending and borrowing. Crave digital art ownership? Dive into the Non-Fungible Token (NFT) market, where unique creations thrive. Or, fuel your gaming passion with tokens powering virtual worlds and economies.

There are various investment opportunities within crypto, each with its unique benefits.

1. Layer 1 and Layer 2 Chains

The blockchain world is buzzing with innovation, and one of the most exciting areas is the development of Layer 1 and Layer 2 solutions. These are two distinct approaches to scaling blockchain technology, addressing the growing demand for faster, cheaper, and more efficient transactions.

- Layer 1: It is the Mainnet where projects/tokens can be built/created. The transaction fees are often paid in the Mainnet cryptocurrency. Transactions in Sponge and Uniswap for example that are built on Ethereum are paid in ETH.

- Layer 2: Operate on top of existing Mainnets (layer 1), processing transactions off-chain before finalizing them on the main chain. This allows for faster and cheaper transactions. Lightning Network for Bitcoin (BTC) and Optimism for Ethereum (ETH) are famous layer 2s.

Layer 1 Examples

Picture tracking your food’s journey from farm to table on a secure, transparent blockchain. Or picture seamless financial transactions without relying on traditional banks. These are just a few real-world use cases showcasing the growing potential of Layer 1 solutions. In supply chain management, DeFi, ticketing and identity, gaming, and the metaverse, Layer 1 blockchains are laying the foundation for a more transparent, secure, and interconnected future.

Ethereum, the leading Layer 1 platform, is poised for a significant leap forward with its upcoming Dencun upgrade in 2024. Sharding, a key innovation, promises to revolutionize scalability by dividing the blockchain into multiple shards, enabling parallel transaction processing.

Rollups further elevate efficiency by handling transactions off-chain before finalizing them on the main chain, reducing congestion and lowering fees. Additionally, advancements in the Ethereum Virtual Machine will optimize smart contract execution, paving the way for even more robust applications.

Meanwhile, Ripple’s CBDC Platform empowers central banks and governments to explore the realm of digital currencies. This secure and scalable solution offers interoperability, programmability, and regulatory compliance, enabling seamless integration of CBDCs into existing financial systems.

Layer 2 Examples

For smaller, everyday transactions, Layer 2 solutions offer agile alternatives. The Lightning Network on Bitcoin excels at micropayments, facilitating lightning-fast and cost-effective transactions ideal for tipping content creators or purchasing online goods.

Ethereum’s DeFi ecosystem finds a champion in Optimism, an Optimistic Rollup solution that tackles scalability by processing transactions off-chain before finalizing them on the main chain. This translates to faster, cheaper transactions, fueling the growth of various DeFi applications.

But the quest for scalability doesn’t stop there. Superchains emerge as a novel concept, connecting independent blockchains through a central “hub chain,” enabling seamless interoperability and transaction flow across different networks.

The Optimism Superchain

The future of blockchain lies in the collaborative evolution of both Layer 1 and Layer 2 solutions however, blockchain’s slow and pricey transactions present a roadblock to progress. Layer 2 solutions like Optimism are like express lanes, speeding things up. But Optimism’s Superchain goes further.

Think of it as a dedicated highway system for Ethereum, built on interconnected “OP Chains”. Shared security, seamless communication, and open-source tools make it efficient and flexible for diverse applications.

Unlike isolated roads, the Superchain offers enhanced security, a smooth user experience, and lightning-fast transactions, finally tackling the scalability challenge. Combining Layer 2 efficiency with a network design, the Superchain paves the way for a more accessible and scalable blockchain future.

Why do Layer 1 and Layer 2 solutions hold the potential for high returns?

- The demand for scalable and efficient blockchain solutions surges across industries like finance, supply chain management, and gaming. This creates a fertile ground for Layer 1 and 2 projects to thrive.

- Early adoption of promising Layer 1 and 2 projects can offer significant growth potential as the technology matures and mainstream adoption increases.

- The rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse fuels demand for faster and more affordable blockchain transactions. Layer-1 and Layer-2 solutions address this critical need, positioning them for significant growth as digital adoption accelerates.

2. Crypto Payments Services

Cryptocurrency payments have become increasingly popular, transforming the way we conduct transactions.

According to Statista, the global crypto payments market ballooned to US$1.29 billion in 2022 and is expected to surge to US$4.85 billion by 2029. This potential has attracted the attention of major players like Alchemy Pay and Binance Pay, who are developing the necessary infrastructure to enable smooth cryptocurrency payments worldwide.

Crypto Payments Services Examples

Alchemy Pay, a pioneer in Web3 payments, has secured a crucial foothold in Hong Kong. Recent regulatory developments, including the SFC’s support for spot crypto ETFs, create fertile ground for deeper integration between traditional finance and crypto. This opens exciting growth opportunities for fiat-crypto payment gateways like Alchemy Pay.

Meanwhile, Binance Pay has been gaining popularity in Brazil with its contactless cryptocurrency payment solution. The platform has processed over $100 million in transactions worldwide since its launch, making it a preferred option for many. One of its key features is the flexibility it offers in payment options.

Users can pay in either Brazilian Real or cryptocurrency, allowing for seamless and convenient transactions. This feature has been particularly attractive for those who prefer using digital currencies for everyday transactions.

Why Crypto Payments Services Hold the Potential for High Returns?

- Rapid adoption: Growing consumer demand for crypto payments is fueling market expansion.

- Technological advancements: Innovations like blockchain scalability and interoperability are overcoming technical hurdles fueling further adoption.

- Regulatory progress: Governments worldwide are exploring regulations for crypto, creating a more stable environment for investment.

- Cross-border efficiency: Crypto payments offer faster, cheaper, and more secure cross-border transactions than traditional methods.

- Market expansion: The global market is rapidly growing, creating significant demand for innovative payment solutions.

- Merger and acquisition activity: Consolidation within the TradFi sector can create value for investors.

3. Meme Coins Have a Market

Meme coins, the playful rebels of the cryptocurrency world, have surged in popularity, capturing the imagination of both seasoned investors and crypto newcomers. While some dismiss them as fleeting trends, others see them as holding potential for remarkable returns.

Tip: Explore this sector with an unbiased lens, analyzing both its benefits and inherent risks.

Meme coins, named after internet jokes and pop culture references, have carved a unique niche in cryptocurrency. While often dismissed as speculative, they offer distinct characteristics:

- Accessibility: Meme coins’ low per-token value makes them an entry point for curious newcomers.

- Community-driven: Strong online communities fuel meme coin popularity and can influence value.

- High Volatility: Rapid fluctuations in price are a defining feature, requiring a high-risk tolerance.

- Uncapped Supply: Many meme coins have no limit on the total number minted, impacting individual token value.

Meme Coins Examples

- Shiba Inu (SHIB): This “Dogecoin killer” reached an impressive 1000x return for early investors and continues to evolve. Its recent launch of Shibarium, a dedicated blockchain, aims to attract developers and build a dApp ecosystem.

- Smog (SMOG): This Solana-based token uses a novel airdrop mechanism, allowing users to earn rewards and participate in its unique ecosystem. Its success has spawned imitators, but SHIB remains the leading name in this space.

- Songe V2 (SPONGE): A meme coin on Ethereum. Sponge V1 posted substantial gains in the market when it was first launched. Sponge V2 is an improved version with more benefits to holders.

Why Do Meme Coins Hold the Potential for High Returns?

- Early-stage potential: Meme coins are still young, offering the chance to invest in emerging projects with high growth potential.

- Community engagement: Strong communities can drive adoption and value, creating opportunities for significant returns.

- Innovation and utility: Many meme coins are moving beyond jokes, developing dApps and other functionalities that enhance their value proposition.

4. Tokenization of Real World Assets

Fueled by the groundbreaking convergence of tangible real-world assets (RWAs) and digital tokens, the tokenization of RWAs is transforming investment landscapes, presenting attractive opportunities for experienced investors and curious novices alike.

Imagine owning a fraction of a skyscraper or investing in a Picasso – tokenization makes it possible. This process involves converting ownership of physical assets like real estate, art, or commodities into digital tokens stored on a secure blockchain. These tokens are easily divisible, transferable, and tradable, unlocking a realm of benefits:

- Increased Liquidity: Traditionally, illiquid assets, like real estate, become accessible to a broader investor base through fractional ownership via tokens.

- Streamlined Processes: Tokenization automates cumbersome administrative tasks, reducing transaction costs and simplifying ownership management.

- Digital Ownership: Securely store and manage ownership rights on a transparent blockchain, eliminating paperwork and potential fraud.

This burgeoning space has attracted the attention of major financial institutions like BlackRock, JP Morgan, and HSBC, who are actively exploring tokenization for various assets.

Companies like Propy (real estate) and Ondo (financial assets) lead the charge, developing innovative platforms for seamless interaction with tokenized RWAs.

Real-World Applications

Propy is revolutionizing the real estate industry with its PropyKeys solution. This platform allows property owners to tokenize their titles, securely store property data on the blockchain, and facilitate seamless transactions with crypto investors.

Ondo Finance, on the other hand, focuses on democratizing access to institutional-grade financial products. They aim to bridge the gap between traditional finance and blockchain technology, making sophisticated financial instruments accessible to a broader audience. This opens doors to potentially high returns from previously exclusive asset classes while ensuring investor protection and regulatory compliance.

Why Do Tokenized RWAs Hold the Potential for High Returns?

- Increased liquidity: Tokenization can unlock new capital sources, increasing asset values.

- Reduced friction: Streamlined processes and automation can lower transaction costs, benefiting investors and issuers.

- Global reach: Digital assets transcend geographical barriers, creating a truly global investment market.

- Diversification: Access to previously inaccessible asset classes can help diversify your portfolio with unique investment opportunities.

- Efficiency gains: Blockchain technology can reduce costs and facilitate faster transactions, potentially increasing return rates.

- Emerging markets: As regulatory frameworks evolve and technology matures, new asset classes and innovative products will likely emerge, further expanding the investment landscape.

Growth Potential

Traditional institutions ‘ regulatory clarity and broader adoption will drive future growth. New asset classes like carbon credits and intellectual property are being explored for tokenization, expanding the investment landscape.

5. Crypto in Health and Insurance

Blockchain technology promises to bring improved security, efficiency, and transparency to an industry that has traditionally been fragmented.

Imagine transforming physical healthcare assets – medical records, insurance policies, drug supplies – into secure, easily managed digital tokens. This is the essence of tokenization, facilitated by distributed ledger technology (DLT). Think of DLT as a shared, secure record-keeping system where everyone involved can access the same, tamper-proof information.

This technology holds potential, particularly in addressing the challenge of securely managing sensitive data. With the proliferation of electronic medical records, patient privacy, and recordkeeping concerns are at an all-time high.

Picture All the Benefits

- Enhanced security: Blockchain technology creates an unalterable record of patient data, making it resistant to tampering and hacking attempts.

- Improved data management: By providing patients with secure and controlled access to their medical data, data sharing between providers can be streamlined, leading to better care coordination and reduced administrative burdens.

- Faster claims processing: Smart contracts can automate claims processing, resulting in quicker reimbursements for patients and providers. It also facilitates real-time insurance information that reduces administrative costs.

- Transparent clinical trials: Blockchain technology can securely track research data, boosting trust and efficiency in drug development.

- Drug authentication: Blockchain can help verify the authenticity of medications, which is crucial to combat counterfeiting and ensure patient safety.

With the rise of electronic health records, secure data management is more critical than ever. Nexus Mutual, a leading player in this space, uses blockchain to create decentralized insurance products for smart contracts, offering a glimpse into the future of healthcare financial solutions.

Real-World Applications

Nexus Mutual isn’t the only example. VitaDAO, a decentralized organization, recently launched Matrix Biosciences, a biotech company developing therapeutics for cancer and aging. This collaboration showcases the potential of blockchain to fund and accelerate scientific research.

Why Crypto in Health and Insurance Holds the Potential for High Returns?

- Rapid growth: The sector is expected to grow at a CAGR of 40% between 2023 and 2030, driven by rising healthcare costs and the need for efficient solutions.

- Untapped market: The sector is still in its early stages, offering opportunities for early adopters to capitalize on its growth potential.

- Growing demand for data security and privacy: As healthcare data becomes increasingly valuable, secure management solutions are paramount.

- Rising costs in traditional healthcare: Blockchain’s efficiency has the potential to streamline processes and reduce administrative burdens, leading to cost savings.

- Increasing government support: Many governments are exploring blockchain’s potential in healthcare, paving the way for wider adoption.

6. Crypto-based Entertainment Services

Blockchain-powered crypto entertainment services are revolutionizing how we consume and interact with content, offering innovative experiences, direct creator support, and investment opportunities. These services leverage cryptocurrencies and blockchain infrastructure to enable:

- Direct peer-to-peer transactions: Seamless payments for entertainment experiences like gaming, streaming, and even VR concerts, bypassing intermediaries and empowering creators.

- New revenue streams: Creators can tokenize their content as NFTs, sell virtual assets, and access micropayments, all with secure and transparent ownership tracking.

- Enhanced engagement: Blockchain opens doors for interactive experiences, fan governance, and gamified loyalty programs, fostering deeper connections between creators and their communities.

This sector is already gaining traction, with a global video streaming market valued at $103 billion (in 2023). Leading players like Livepeer (decentralized video transcoding) and CEEK VR (virtual reality events) are showcasing the potential of this space.

Real-World Applications

Livepeer, a leading decentralized video transcoding network, boasts a network capable of handling video streaming volumes exceeding Twitch, YouTube, and Facebook combined. Their recent $20 million fundraise underscores the growing interest in their technology.

CEEK VR, on the other hand, focuses on creating premium social VR experiences. By leveraging smart contracts, they empower creators with new revenue streams and enable users to interact, connect, and enjoy exclusive content within immersive virtual worlds.

Why Do Crypto-based Entertainment Services Hold the Potential for High Returns?

The entertainment industry is booming, and crypto-based services are positioned to capture a significant share. This convergence offers several advantages:

- Direct creator support: By eliminating middlemen and empowering creators, these services offer fairer value distribution and potentially higher returns for creators and investors. Creators gain control over their work and access new revenue streams.

- Engaging user experiences: Decentralization often fosters unique experiences and passionate communities of users and creators, leading to increased adoption and potential value growth.

- Wider adoption of blockchain technology: The possibilities of blockchain in entertainment extend beyond video streaming and VR to include gaming, music, and other forms of entertainment as it gains mainstream acceptance.

7. Blockchain Games Development Companies

Blockchain game development companies are revolutionizing the gaming industry by introducing immersive, interactive, and player-driven experiences. Imagine a world where gamers can directly own their in-game assets and trade them with others without intermediaries.

This is the power of blockchain games, which is paving the way for a decentralized future, potentially transforming the over $220 billion gaming industry.

Leading companies like Immutable and Dapper Labs are already making significant progress. If you’re looking for an investment opportunity that combines innovation with entertainment, this sector is worth considering.

Immutable and Dapper Labs in the Spotlight

Immutable, the leading web3 gaming platform, has partnered with Ubisoft, a titan in the gaming industry, to leverage its expertise in building top-notch games on Immutable’s robust platform. Their successful TestNet launch of Immutable zkEVM and game demos also showcase their commitment to innovation.

Dapper Labs, renowned for CryptoKitties and NBA Top Shot, continues to push boundaries with Disney Pinnacle, an exciting new NFT application. Their proven track record in the NFT space, from CryptoKitties to collaborations with major sports leagues, speaks volumes about their potential.

How Blockchain Game Development Companies Inspire High Returns Potential

- Rapid Growth: The global gaming market is expected to reach $268.8 billion by 2025, with blockchain games poised for explosive growth within this sector.

- NFT ownership: Blockchain games allow players to truly own their in-game assets, such as characters, items, and virtual land. These digital assets can be traded on secondary markets, creating a new level of player engagement while fostering a thriving digital economy and potential value appreciation.

- Engaged Communities: Blockchain games foster strong communities through shared ownership and governance, leading to increased engagement and potential network effects.

- Play-to-earn model: The play-to-earn model, where players can earn rewards through gameplay, attracts a new generation of users to blockchain games. This model can create a sustainable economy within blockchain games and drive up the value of game tokens.

- Scarcity and uniqueness: Blockchain games often use non-fungible tokens (NFTs) to represent in-game assets. These NFTs are scarce and unique, which gives them potential value as collectibles.

Choose your crypto exchange such as Binance, MEXC, or OKX to invest in cryptocurrencies. Crypto wallets also allow you to buy and sell cryptocurrencies without the need to register on an exchange. Many options exist, so choose one that suits your needs (e.g., mobile, hardware).

New Blockchain Projects to Consider in 2014

While many crypto projects exist in today’s markets, below are several new projects to consider adding to your crypto portfolio.

1. Dogeverse (DOGEVERSE): New Multi-Chain Meme Coin

Our top pick for the best new blockchain projects to consider in 2024 is Dogeverse ($DOGEVERSE). This is a new meme cryptocurrency, which has been soaring since its presale launch.

From a total supply of 200 billion tokens, 30 billion are currently being distributed for the ongoing presale. At the time of writing, $DOGEVERSE is priced at $0.00031 per token. In only a couple of months, the Dogeverse presale has raised more than $13 million.

Another 20 billion tokens will be offered through Dogeverse’s staking mechanism. $DOGEVERSE can be staked on the smart contract to generate up to 75% APY (Annual percentage yield).

What is Dogeverse About?

Dogeverse stands out from other meme tokens, as it is the first-ever multi-chain Doge-themed meme coin. By using Portal Bridge and Wormhole technology, Dogeverse will allow token holders to connect with six blockchains.

It is originally built on Ethereum, but soon will be compatible with Solana, Avalanche, Polygon, Binance, and the Base blockchain. Therefore, token holders can connect with the blockchains offering the highest throughput, scalability, and security.

For more information, go through the Dogeverse whitepaper and join the Telegram channel.

| Total Tokens | 200 billion |

| Tokens Available in ICO | 30 billion |

| Blockchain | Ethereum |

| Token type | ERC-20 |

| Minimum Purchase | N/A |

| Purchase With | USDT, ETH, Credit Card |

2. Wiener (WAI): AI-powered Meme Token With High Staking Rewards

WienerAI ($WAI) is a popular meme token that combines two fun trends: AI and memes. It’s built on the ERC-20 blockchain and aims to be the best dog-themed crypto coin by blending the fun of memes with the power of AI.

WienerAI’s story is set in the future (New Silicon Valley, 2132), where a crazy scientist accidentally puts hot dog DNA into a robot dog.

Many people are joining the “Sausage Army” to support WienerAI, which could be the next big meme token. The presale raised over $1.3 million in less than 14 days of launch, showing huge investor support.

If you buy $WAI during the ongoing presale, you can earn many rewards just by holding the coin. The platform offers a high APY of over 700% at press time. Over 1.4 billion $WAI tokens have already been staked on the platform, showing huge community trust in WienerAI.

The platform offers 30% of the total 69 billion tokens in the presale at a much lower price before the coin hits exchanges. The remaining tokens are distributed in a way that rewards its users and increases community engagement.

At the time of writing, you can get each $WAI for only $0.000704. But this price will increase in the next round.You can join WienerAI’s Telegram channel or follow it on X for the latest presale updates.

| Total Tokens | 69 Billion |

| Tokens Available in Presale | 20.7 Billion |

| Blockchain | Ethereum |

| Token Type | ERC20 |

| Minimum Purchase | N/A |

| Purchase With | ETH, USDT |

3. Sealana (SEAL): Hottest Solana Meme Coin

Sealana ($SEAL) is a new Solana-based meme cryptocurrency. The central figure of this meme project features an obese and lazy American Redneck seal. The seal decides to start trading crypto tokens, hoping to move out of his mom’s basement.

The main avatar of Sealana is inspired by a popular character from the South Park series, World of Warcraft Guy.

What is Sealana About?

Sealana wants to become one of the fastest-growing SOL-based meme projects in the crypto space. It is based on one of the fastest and most efficient blockchains in the world, which can help promote widespread token adoption.

Sealana has also emerged at a period where SOL-based meme tokens are in high demand. Recently, meme coins such as Popcat soared by over 250%. Sealana jumps aboard the meme coin hype train, with the recent launch of the $SEAL presale.

In only a week, the Sealana presale has raised more than $260K. For an investment of 1 SOL, you will get 6,900 $SEAL tokens. Stay tuned for further project updates by joining the Sealana Telegram channel and following Sealana on X (Formerly Twitter).

| Total Tokens | N/A |

| Tokens Available in ICO | N/A |

| Blockchain | Solana |

| Token type | SPL |

| Minimum Purchase | None |

| Purchase With | SOL |

3. Smog (SMOG): Meme Coin Promises Massive Solana Airdrop

Emerging within the Solana ecosystem, Smog Token ($SMOG) has garnered significant attention within the meme coin space. Launched in February 2024, Smog amassed 10,000 holders within its first 48 hours, fueled by its ambitious “Dragon’s Court” airdrop campaign and meme-centric branding.

Embracing the spirit of decentralization, Smog has renounced ownership of its token contract, locking the total supply and empowering the community. Additionally, it has transcended Solana’s borders, bridging the Ethereum network to expand its reach and user base.

What is Smog About?

Smog’s core innovation lies in its airdrop mechanism. By holding tokens, users accumulate “airdrop points“, granting them access to an endless series of reward distributions dubbed the “historic airdrop”. This gamified approach aims to foster community engagement and drive long-term token value.

Smog’s meteoric rise in its early days speaks volumes about its potential to capture the imagination of the crypto community.

The renounced ownership and multichain functionality demonstrate a commitment to decentralization and inclusivity, appealing to core crypto values. Its airdrop mechanism introduces a novel engagement strategy, but its long-term sustainability and the true value of the airdropped tokens remain to be seen.

| Hard Cap | $42,844,021 |

| Total Tokens | 1.4 Billion |

| Tokens Available in Presale | 490 Million (Airdrop rewards) |

| Blockchain | Solana |

| Token Type | SPL |

| Minimum Purchase | N/A |

| Purchase With | USDT, ETH |

Tips for Investing in Crypto (for 2024)

The world of cryptocurrency can be alluring, filled with stories of overnight riches and revolutionary technology. But before diving headfirst into this dynamic market, it’s crucial to equip yourself with the knowledge and strategies to approach it with caution and awareness. Here are some useful tips to navigate your crypto investment journey:

1. Money Management is the Key

While the crypto market offers tantalizing possibilities, it’s crucial to acknowledge its inherent risk. Price fluctuations can be dramatic, and projects can even cease to exist altogether.

Therefore, adopt a conservative approach. Never invest more than you can comfortably afford to lose, and consider cryptocurrency a high-risk asset class entirely separate from your essential financial needs.

Start small, gradually build your understanding, and prioritize the security of your funds – they are the foundation of your financial well-being. Remember, responsible investment requires calculated steps, not impulsive bets.

2. Don’t Put All Your Eggs in One Basket

Just like any investment, diversification is key to managing risk in the volatile world of cryptocurrency. Instead of betting on a single project, spread your investments across different currencies and ventures.

Consider established players like Bitcoin and Ethereum, but also explore promising newcomers with strong real-world applications.

This diversified approach helps build a more balanced portfolio, making you less vulnerable to market swings and boosting your chances of long-term success.

3. Stay Updated on the Project Development

Projects are like living organisms, constantly iterating and evolving, and so should your understanding of them. Don’t be a passive investor! Take charge of your portfolio by actively engaging with the projects you support.

Dive into their official channels, where you’ll find a treasure trove of information: roadmaps detailing their ambitions, white papers outlining their technical blueprint, and regular development updates showcasing their progress.

By diligently tracking these key indicators, you gain a crucial vantage point. You’ll understand where the project is and where it’s headed, empowering you to make informed decisions about your investment.

4. Track your Crypto Portfolio

Investing in cryptocurrencies presents exciting opportunities, but its inherent volatility demands responsible portfolio management. Manually tracking holdings across multiple exchanges and wallets can be cumbersome and error-prone, hindering informed decision-making and potentially impacting tax compliance.

Crypto portfolio tracking tools like Koinly offer a sophisticated solution that offers a holistic view of your portfolio, eliminating the need for manual data entry and ensuring accuracy.

Koinly helps identify high-performing and underperforming assets by automatically synchronizing transactions across multiple platforms. It also allows you to monitor historical trends and correlations between cryptocurrencies, providing timely notifications based on preset parameters.

References

FAQs

Are Crypto Investments Risky?

Yes. Cryptocurrencies are highly volatile, meaning their prices can swing dramatically. Research and understand the risks involved before investing.

How Much Money Do I Need to Start?

Any amount. Some platforms let you buy fractions of coins, so you don’t need thousands to start. However, start small and only invest what you can afford to lose.

What Are the Best Tokens to Invest In?

There are no “best” tokens. Each has unique features and risks. Do your research, don’t rely solely on recommendations, and consider diversifying across different projects.

How Much Money Can I Make?

Impossible to predict. Past performance doesn’t guarantee future results. Focus on understanding the technology and projects, not chasing unrealistic returns.

Are Cryptocurrencies Regulated?

Regulations are evolving globally. Each country has its approach, and the landscape is changing quickly. Stay informed about regulations in your region.

Do I Need to Pay Tax for Investing in Crypto?

Yes, in most countries. Crypto gains are typically taxed as capital gains. Consult a tax professional for specific advice in your jurisdiction.