Stock trading signals work as follows; you’ll receive a notification telling you exactly which companies to invest in. Signals are generated by experienced analysts, although AI and machine learning systems are also becoming popular.

The overall objective is to make profitable stock trades without needing to do any of the legwork. This guide compares the best stock trading signals in 2024 for accuracy, past performance, pricing, target markets, and much more.

List of the Best Stock Trading Signals for Accuracy

We’ll start with a brief overview of the best stock trading signals available in 2024:

- AltIndex: Unique stock trading service based on alternative data insights, machine learning, and AI. AltIndex explores social networks, forums, search engines, and other platforms to evaluate consumer sentiment. It tracks thousands of companies and has a solid strike rate of 75%. Over a 6-month period, AltIndex users make average returns of 22%. Prices are competitive, ranging from $0, $29, and $99 per month.

- Stocklytics: This signals provider specializes in technical analysis. Stocklytics has a team of in-house analysts who research thousands of stocks and ETFs around the clock. Members receive a technical signal once a trading opportunity is discovered. Suggested entry, exit, and risk-management orders are provided, making Stocklytics ideal for beginners.

- CNBC Investing Club: Backed by Jim Cramer, Jeff Marks, and Zev Fima, the CNBC Investing Club will appeal to investors seeking fundamental data. The service not only includes stock picks and market commentary but also fully-fledged insights. You’ll discover which companies offer the best long-term upside and have access to daily market updates. Full functionality costs $599.99 annually, so CNBC isn’t cheap.

- Zacks Ultimate: Based on historical backtesting, Zacks Ultimate has provided average annualized gains of 24%. It offers short and long-term trading ideas across many portfolio niches. This includes growth and undervalued stocks, plus emerging industries like blockchain and cannabis. Zacks Ultimate charges $299 per month.

- Stocks Signal: App-based signals service for iOS users covering the NYSE, NASDAQ, and NYSE American. Buy and sell signals come with the suggested entry and exit prices. Also offers custom stock price tracking. Stocks Signal charges $29.99 per month, although sizable discounts are available on longer plans.

- StockTrot: Offers signals on new Form 4 filings, which notify the SEC of insider transactions. StockTrot gives you near-real-time alerts when company insiders buy or sell their own stock. Full functionality costs just $12.99 per month, and less when purchasing a quarterly or annual plan.

- Stock King Options: Specializes in US stock options signals. Each signal comes with a limit, stop-loss, and take-profit price. 1-3 signals are sent each day via the Stock King Options Telegram group. The gold plan, costing $89 per month, adopts a swing trading strategy. Alternatively, opt for the day trading strategy at $150 per month.

- Alpha Picks by Seeking Alpha: This signal service sends two long-term stock recommendations every month. It targets undervalued companies with strong fundamentals, momentum, and forward-looking estimates. Stocks must be priced at $10 or more and have a minimum valuation of $500 million. Alpha Picks has produced gains of 52% since September 2022.

A Closer Look at the Top Stock Market Trading Signals

Stock buy and sell signals help you outperform market benchmarks, so you’ll be required to pay a monthly subscription. This means that research is crucial when selecting a signal provider.

This section reviews the stock signal providers listed above, covering everything you need to know about each service.

1. AltIndex – AI-Driven Stock Trading Signals Based on Alternative Data Insights

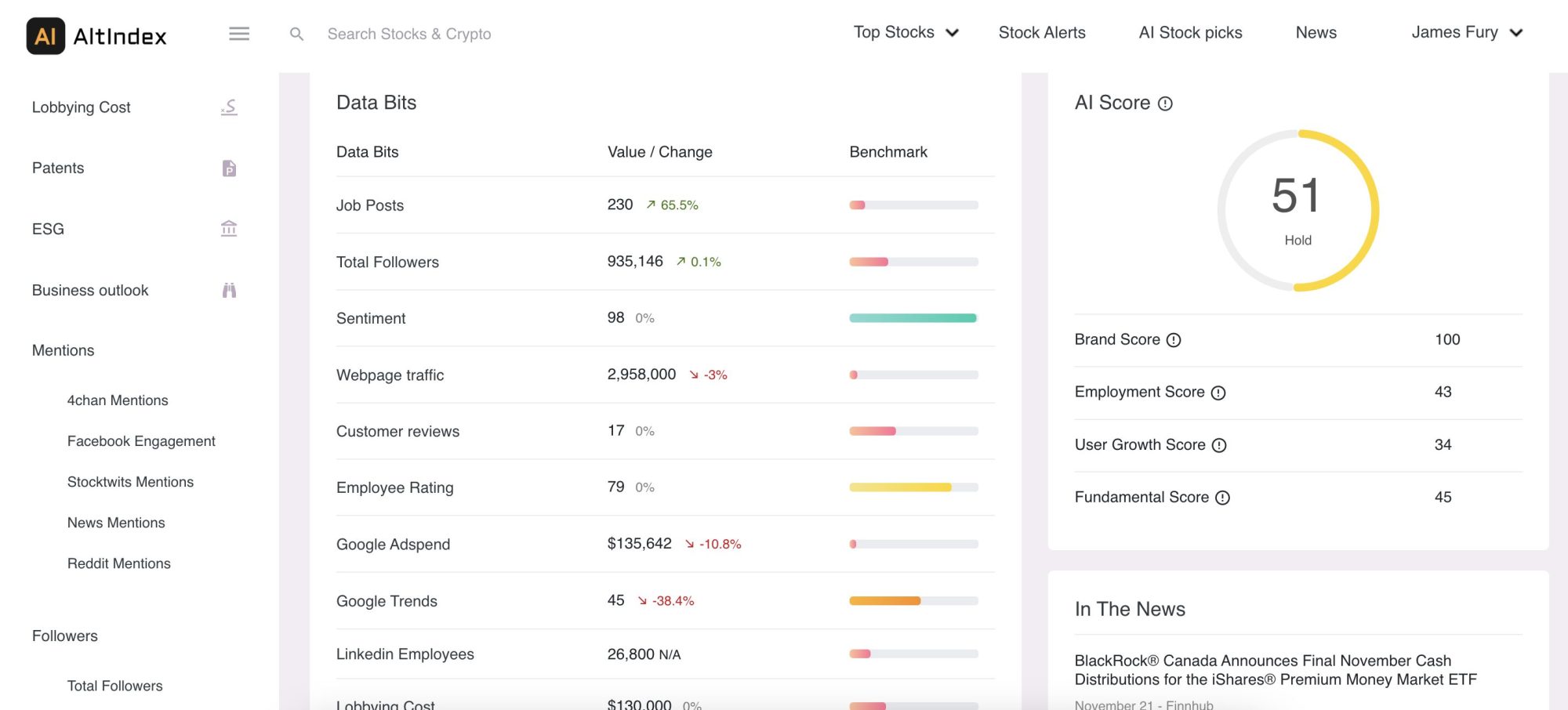

AltIndex – which is one of the best alternative data providers, offers a top-performing signals service. Put simply, its trading signals have an average 6-month return of 22% since the service was launched. This converts to a win rate of 75%, based on all signal distributions. AltIndex is a great alternative to traditional research methods, as it doesn’t rely on fundamental data.

Nor does it leverage technical patterns or indicators. Instead, AltIndex extracts alternative data insights from social media, online forums, search engines, and other platforms. It analyzes likes, search trends, shares, comments, and more to evaluate social sentiment on companies. This is a solid indicator that can predict short-term stock price movements.

In addition to social sentiment, AltIndex also collects data from job postings, SEC and patent filings, app downloads, and news mentions. Its data feeds are analyzed by AI, which generates an overall investability score from 1 to 100. According to its methodology, companies with a high AI score typically enter a bullish trend.

The upward trend usually begins a few weeks or months after the signal is identified. This gives you plenty of time to enter a position before stock prices react. AltIndex has three pricing plans, ranging from $0, $29, and $99 per month. The number of signals you receive depends on the plan. There is also an enterprise plan which comes with custom pricing.

All pricing plans distribute stock trading signals via email. You won’t be required to do any further research, as signals tell you which companies to buy and at what price. AltIndex also sends sell signals. This will happen if a stock has a very low AI score. Alongside its trading signals, AltIndex also offers one of the best free stock screeners.

| Signal Service Overview | Trading signals are generated by AI and are based on alternative data and social sentiment insights. Invests in companies with strong consumer sentiment before stock prices react. |

| Past Performance | 75% win rate, average 6-month returns of 22%. |

| Free Signals? | 1 free signal each month. |

| Target Markets | Covers most US-listed stocks, Bitcoin, and some of the best altcoins |

| Pricing | Plans range from $0 to $99 per month |

Pros

- Get a first-mover advantage through alternative data insights

- Stock trading signals have a 75% win rate

- Average 6-month returns of 22%

- Tracks and analyzes thousands of US-listed stocks

- Affordable subscriptions that can be canceled at any time

Cons

- Only 1 free signal each month on the free plan

2. Stocklytics – Technical Trading Signals With Clear Entry, Exit, and Risk-Management Suggestions

Stocklytics offers the best stock trading signals for technical traders. It has a team of experienced analysts who research the markets around the clock. Some of the indicators leveraged by Stocklytics include the Moving Average Convergence Divergence (MACD), Bollinger Bands, and the Relative Strength Index (RSI).

When Stocklytics discovers a notable technical reading, it distributes signals to its members. This includes clear, actionable insights – meaning you simply need to place the suggested orders. Not only does this include the entry price but also sensible risk management orders. This means that no prior trading experience is needed.

The main drawback of Stocklytics is that it doesn’t offer any information about past performance. This makes it tough to know whether its signals are profitable. That said, Stocklytics offers a freemium plan, so you’ll be able to test its signals on a brokerage demo account. If the signals perform well, you might consider the premium plan, which costs just $25 per month.

| Signal Service Overview | Trading signals are generated by in-house technical analysts. Commonly used indicators include the MACD and RSI. Signals include the required entry, exit, and risk-management order prices. |

| Past Performance | Not stated. |

| Free Signals? | A freemium plan is available but will include limitations. |

| Target Markets | 5,700+ stocks and 2,400 ETFs. |

| Pricing | Premium plans cost $25 per month. |

Pros

- Best stock trading signals for technical strategies

- No prior experience is needed – signals come with suggested entry and exit prices

- Signals are generated by an in-house team of analysts

- Thousands of stocks and ETFs are researched around the clock

- Also offers one of the best stock portfolio trackers

Cons

- Past performance metrics are not published

3. CNBC Investing Club – Insightful Research Reports on the Best Stocks to Buy or Sell

CNBC Investing Club will appeal to investors who like to make informed decisions. It offers a signal service that focuses on fundamental insights. For instance, when a new signal has been generated, you’ll receive a full report outlining the investment thesis. The report will discuss the long-term potential of the respective company, alongside the risks to consider.

Many CNBC signals are provided by Mad Money host Jim Cramer. Although some CNBC signals are available for free, you’ll need a premium plan to get the most out of the service. The standard plan costs $99.99 for 4 months or $249.99 annually. This includes research signals and reports, plus advanced charting tools.

That said, you’ll need to pay $599.99 per year for full functionality. This gives you additional stock picks, price targets, analyst ratings, and a proprietary stock screener with in-built strategies. Similar to Stocklytics, CNBC doesn’t publish its past performance. Moreover, it doesn’t offer flexible monthly plans or a free trial. Therefore, you’re relying on the CNBC brand.

| Signal Service Overview | Fully-fledged investment club that covers trading signals, market insights, research reports, and live commentary. Aimed at investors who need assistance building long-term wealth. |

| Past Performance | Not stated. |

| Free Signals? | Some research reports are free, but most require a paid subscription. |

| Target Markets | All US-listed stocks. |

| Pricing | Standard plans cost $99.99 for 4 months or $249.99 annually. Premium plans cost $599.99 annually. |

Pros

- Get expert insights from Jim Cramer, Jeff Marks, and Zev Fima

- Features include trading signals, market commentary, and research reports

- Ideal for long-term investors focused on fundamental data

- Never miss a market beat with daily updates from the CNBC team

Cons

- Expensive – full functionality costs $599.99 per year

- Doesn’t publish past performance metrics

4. Zacks Ultimate – Average Annualized Returns of 24% Since 1988 Based on Historical Backtesting

Zacks Ultimate is an established stock signals provider that will appeal to short and long-term investors. It has a full-time team of researchers that find investment opportunities for its subscribers. Zacks Ultimate has many different portfolios active, each targeting a niche market. This includes emerging industries like alternative energy, biometrics, and cannabis.

It also has portfolios focused on undervalued and growth stocks, not to mention commodities and ETFs. Some of its recent short-term trades include Meridian Bioscience and NVIDIA, which gained over 79% and 231%, respectively. Recent long-term signals include Penske Automotive and Macy’s, which netted members over 183% and 147%.

According to Zacks Ultimate, its stock signals have produced average annualized returns of 24% since 1988. However, importantly, this is based on backtesting methods, so do bear this in mind. Moreover, Zacks Ultimate will set you back $299 per month. You can try Zacks Ultimate for 30 days for just $1, with no obligation to continue after the trial period.

| Signal Service Overview | Established research team has multiple portfolios active, covering various stock niches and industries. Members are told which investments to make, so no independent research is needed. |

| Past Performance | Based on backtesting methods, average annualized returns of 24%. |

| Free Signals? | No, but offers a 30-day trial for $1 with full access |

| Target Markets | US-listed stocks, ETFs, and commodities. Covers various strategies, including undervalued and growth stocks, but high-growth industries. |

| Pricing | $299 per month. |

Pros

- Stock buy signals target average annualized gains of 24%

- Backed by Zacks Investment Research – which was founded in 1978

- Suitable for short-term and long-term investors

- Get full functionality for 30 days for just $1

Cons

- Subscriptions cost $299 per month

- Past performance metrics are based on backtesting methods

5. Stocks Signal: Stock Price Signals for iOS Users Delivered Directly to Your Smartphone

Rated 4.5/5 over 7,300 ratings, Stocks Signal is one of the most popular signal apps for iOS users. It comes with unparalleled market insights, including specific buy and sell signals. Each signal comes with a suggested entry and exit price, alongside a brief overview of the respective analysis.

When a new signal is discovered, you’ll receive a push notification directly on your iPhone. Unfortunately, the Stocks Signal app doesn’t support Android users. Nonetheless, Stocks Signal tracks all stocks on the NYSE, NASDAQ, and the NYSE American. The app also offers alternative data insights and technical readers.

There’s a free plan available, but you’ll be missing out on its full signal service. Premium plans cost $29.99 per month or $74.99 annually. This comes without signal limitations or delays, and you’ll also get real-time pricing. The Stocks Signal app also offers price tracking, meaning you’ll receive a notification when one of your stock targets is triggered.

| Signal Service Overview | Buy and sell signals covering stocks on the NYSE, NASDAQ, and NYSE American. Suggested entry and exit prices are included with each signal. |

| Past Performance | Not stated. |

| Free Signals? | Yes, but with pricing restrictions and delays. |

| Target Markets | US-listed stocks. |

| Pricing | The freemium plan comes with limitations. Premium plans cost $29.99 per month or $74.99 annually. |

Pros

- Rated 4.5/5 on the App Store across 7,300 reviews

- Signals are sent in real-time via push notifications

- Buy and sell signals come with suggested entry and exit prices

- One of the best investment tools for tracking stock prices

Cons

- Doesn’t offer an Android app

- Freemium plans come with signal delays

6. StockTrot: Receive Stock Signals Within Minutes of Insider Transactions Being Filed With the SEC

StockTrot offers the best stock trading signals for insider transactions. You’ll receive a notification within minutes of a new Form 4 filing being made with the SEC. This means that a company insider has purchased or sold its own stock. You can then determine whether or not this information is material, and trade accordingly.

For example, suppose the CEO of a medium-cap technology company buys $300,000 worth of stock with their own funds. Naturally, this would suggest the company is performing well, and that the CEO believes a stock surge is likely. Similarly, you might decide to short-sell a stock if a company insider sells a large number of shares.

StockTrot is best used with other research tools, such as earnings reports, financial news, and analyst ratings. Nonetheless, it offers very competitive pricing; you’ll pay just $12.99 per month. Alternatively, you’ll pay $29.97 quarterly or $99 annually. Once you’re signed up, you can add companies to your portfolio. This means you’ll only receive signals about stocks you’re tracking.

| Signal Service Overview | Near-real-time signals when insider transactions are filed with the SEC. Know within minutes when a company insider buys or sells their own stock. |

| Past Performance | N/A |

| Free Signals? | Yes, but you won’t be able to set your own filters. |

| Target Markets | US-listed stocks. |

| Pricing | To set custom filters (e.g. minimum purchase value, market capitalization, etc.), a premium plan is needed. Premium plans cost $29.99 per month, $29.97 quarterly, or $99 annually. |

Pros

- Receive stock market signals when an insider transaction is filed with the SEC

- Notifications are sent within minutes of the filing being made

- Discover small-to-medium cap gems

- Set your own custom filters – ensuring you only receive relevant signals

Cons

- You’ll need to do additional research before acting on a signal

7. Stock King Options: 1-3 Daily Stock Options Signals With Limit, Take-Profit, and Stop-Loss Prices

Next up is Stock King Options, which specializes in US-listed options contracts. This is a passive service, meaning you’ll be told which options to buy or sell. Stock King Options also include the suggested limit, stop-loss, and take-profit prices. All signals are sent in real-time via the Telegram group.

In most cases, you’ll receive 1-3 signals every day, but this depends on your pricing plan. For example, the gold plan costs $89 per month and comes with 1-2 daily signals. This plan focuses on a swing trading strategy, so options positions can remain open for several weeks. For 2-3 daily signals, you’ll need the platinum plan.

This costs $150 per month and focuses on a day trading strategy. Therefore, this plan will only be suitable if you have time to actively trade. Moreover, signals are traded during US stock market hours. So if you’re outside of the US, consider your local time zone. Throughout 2022, Stock King Options claims to have made gains of 3,307%.

| Signal Service Overview | Specializes in stock options signals. Choose from a day trading or swing trading strategy. Expect 1-3 signals per day, depending on your plan. |

| Past Performance | Claims to have made 3,307% throughout 2022. |

| Free Signals? | No. |

| Target Markets | US-listed options contracts. |

| Pricing | The gold plan ($89 per month) adopts a swing trading strategy and comes with 1-2 daily signals. The platinum plan ($150 per month) adopts a day trading strategy and comes with 2-3 daily signals. |

Pros

- Best stock trading signals for options traders

- Receive 1-3 daily signals depending on your plan

- Choose from a day or swing trading strategy

- Claims to have made 3,307% in 2022

Cons

- Stated returns cannot be independently verified

8. Alpha Picks by Seeking Alpha: Two Monthly Signals Targeting Undervalued Stocks With Long-Term Potential

Alpha Picks offers the best stock trading signals for long-term investors. Backed by Seeking Alpha, this signal service distributes two stock recommendations every month. This means you can follow Alpha Picks passively, as you simply need to place the suggested buys. Stocks are selected based on their long-term potential, so you’ll be expected to hold for several years.

You’ll be notified when a stock position should be sold. This will happen if an existing stock is rated a ‘Hold’ for over 180 days. In terms of the methodology, Alpha Picks focuses on five core metrics; momentum, fundamentals, profitability, valuation, and forward-looking estimates.

In addition, Alpha Picks has a ‘minimum criteria’ list that must be met before distributing a new recommendation. This includes a ‘Strong Buy’ quant rating for at least 75 days, a stock price greater than $10, and a market capitalization of at least $500 million. Alpha Picks has generated gains of 52% since its inception in September 2022.

| Signal Service Overview | 2 long-term signals are sent monthly. The methodology focuses on momentum, fundamentals, profitability, valuation, and forward-looking estimates. |

| Past Performance | 52% gains since September 2022. |

| Free Signals? | No. |

| Target Markets | US-listed stocks with a market capitalization of at least $500 million. |

| Pricing | $199 annually, reduced to $99 in the first year. |

Pros

- Popular stock recommendation service for long-term investors

- 2 buy signals are sent each month

- Ideal for passive investors who don’t have time to research the markets

- 52% gains since September 2022

Cons

- Doesn’t offer flexible monthly plans

Stock Market Signals Overview

There are many different types of stock signal services, so let’s cover the basics. Some providers offer fully-fledged recommendations, meaning you’re told which stocks to buy or sell. This is often based on fundamental research, undertaken by experienced analysts.

For instance, they’ll discover a stock they believe to be undervalued, and then signal the funding to paying members. Some providers specialize in technical analysis. This type of service is aimed at short-term strategies, such as day or swing trading. Signals are based on technical patterns and indicators, such as the RSI.

There are also stock trading signals based on alternative data. This explores information from alternative sources, such as social media, insider transactions, Google trends, and satellite imagery. AltIndex falls into this category, as it analyzes consumer sentiment on social networks, including Facebook, X, and Reddit.

AltIndex looks at billions of metrics in real-time, analyzed by machine learning and AI. Outside of the stock recommendation space, some signals provide insights. This could include pricing notifications, SEC filings, or upcoming earnings reports. These services require independent research, as they don’t inform you of which companies to invest in.

How do Stock Trading Signals Work?

Now let’s look at some examples of how stock trading signals work.

Methodologies

There are three types of research methods leveraged by signal services.

Fundamental Research

First, there’s fundamental research. The provider will likely have a team of in-house analysts who research earnings reports, financial ratios, and broader industry trends.

They’ll hand-pick companies they believe have a long-term upside, meaning you’ll be advised to hold for several years. For instance, Alpha Picks sends just two stock signals every month.

Technical Research

Second, there’s technical research. This is a price-focused method that looks at historical trends. Technical analysts use indicators to discover patterns, helping them to assess whether a stock will rise or fall in the short-term. This method aligns with day and swing trading strategies, meaning you’ll need to be more active.

Alternative Data

Third, there’s alternative data research. This is an ‘outside the box’ approach to investing, as neither fundamental nor technical data is leveraged. Instead, alternative data uses non-traditional sources to discover insights and trends.

For instance, AltIndex evaluates consumer sentiment on social media. The objective is to assess whether consumers are positive or negative on specific companies and sectors. Unlike other research methods, alternative data is proactive, not reactive.

In other words, it helps investors make market moves before the data becomes public knowledge.

Signal Details

Regardless of the research method, signals usually allow investors to trade passively. You’ll be told which stocks to buy or sell, meaning you simply need to create the order with your broker.

With short-term signals, you’ll likely receive a limit order suggestion. This is the price you should enter the market at, based on the provider’s analysis. Short-term signals should also come with risk-management orders, including take-profits and stop-losses.

Long-term signals are slightly different, as you’ll be holding for several years. This means the entry price is less important. Nonetheless, the provider will still inform you when it’s time to sell. Signals are often sent via email, SMS, or push notifications, depending on the provider.

Selecting a Stock Signals Provider: Top Tips

We’ll now explain how to select the best stock signals app for your investing goals.

Signal Strategy

The first step is to explore what trading strategy the signal provider deploys. This is important, as it will determine how active you need to be. After all, you’ll be required to follow the signals like-for-like via your brokerage account.

If you have time to trade every day, then you’ll want to follow a day trading strategy. For instance, Stock King Options distributes 2-3 signals every day, which you’ll need to action as soon as they arrive.

If this doesn’t suffice, then a medium-to-long-term strategy is the best option. AltIndex signals, for example, typically remain active for several months. This means you won’t need to be available straight away.

And then there’s Alpha Picks, which distributes just two signals every month. Although this will appeal to passive investors, you should be prepared to keep positions open for several years.

Past Performance

Past performance doesn’t guarantee future results. But it does provide insights into the historical returns made by each signal provider. Not only should the signals produce consistent gains, but at a faster pace than the market average.

Most signal providers use the S&P 500 or Dow Jones as their benchmark. For instance, suppose the Dow Jones has grown by 10% on average over the prior 10 years. Over the same period, the signal provider should have superseded these gains.

Not all trading signal providers are legitimate, meaning they publish past performance metrics that cannot be verified independently. Anyone can create a signals service and make bold claims, so make sure you do your own due diligence.

Supported Markets and Financial Instruments

Most signal providers focus on the NYSE and NASDAQ, which are the largest stock markets globally. Regardless of where you’re based, you shouldn’t have any issues finding brokers that support these exchanges.

That said, some signal services also specialize in non-US stocks, so you’ll need to ensure your broker supports these markets. Moreover, you’ll also need to consider what type of financial instruments you need access to.

For example, Stock King Options offers options signals. Not all online brokers support options trading, so bear this in mind.

Similarly, some of the best stock trading signals will suggest short-selling a company. Once again, this isn’t a service offered by all online brokers, so make sure you’re prepared before proceeding.

Subscription Fees

Some providers offer free stock signals, but there’s usually a catch. In some cases, you might get a few free signals every month, but you’ll need to upgrade for full functionality. Free signals sometimes come with delays too. This can be problematic if you’re following a day trading strategy – where every second counts.

Crucially, signal providers are in business to make money. If you want to outperform the major index funds, you should be prepared to pay. Prices can vary wildly, and they’re often linked to the provider’s past performance.

You should consider whether the monthly subscription fee aligns with your investment budget. For instance, if you’re investing around $500 per month, Zacks Ultimate won’t be suitable. It charges $299 per month, which would be nearly 60% of your investment bankroll.

We should mention that some signal providers only offer annual plans. This is risky, as you won’t have the option of canceling if you’re not happy with the service. Always check the terms and conditions regarding cancellations before paying.

Customer Support

Customer support is very important when using a trading signal service. Beginners often need assistance with best practices, such as how much to risk on each signal.

Customer support is also handy if you’re unsure about a particular trade or if you’re facing account issues. Live chat is the best communication channel, but some signal providers only offer email support.

Are Stock Trading Signals Profitable?

Trading signals are aimed at beginners who have little to no experience in the stock market. But are signals actually profitable? The simple answer is that some signal providers are profitable, while others aren’t. Stock signal providers won’t be in business for long if they’re not generating consistent gains.

In fact, returns should supersede index funds like the Dow Jones and S&P 500. After all, these index funds are simple and cheap to invest in, so signals should outperform broader market growth.

For instance, AltIndex – which leverages alternative data, has made average 6-month gains of 22%. In the prior 6 months, the Dow Jones has grown by 6.7%. While the S&P 500 has increased by almost 10%. This means that AltIndex has more than doubled the returns of the leading benchmarks.

Similarly, Alpha Picks claims to have made returns of 52% since September 2022. Over the same period, the S&P 500 grew by just over 20%. However, there are also signal providers that go on prolonged losing runs. Moreover, you’ll need to be wary of hyperbole claims. Oftentimes, historical returns are difficult to verify.

Ultimately, although the best stock trading signals can make you money, past performance isn’t reflective of future returns. Therefore, you should consider the risks before parting with any funds.

Conclusion

Trading signals are ideal if you want assistance on which stocks to buy or sell. We’ve ranked the leading signal providers and overall, AltIndex is our top pick. AltIndex combines alternative data with AI and machine learning, giving investors an edge in the market.

Its stock signal service has an average 6-month gain of 22%. Prices range from $0 to $99 per month, depending on how many signals you want.

References

- https://www2.deloitte.com/us/en/pages/financial-services/articles/alternative-data-perspectives-and-insights.html

- https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins-69

- https://www.schwab.com/learn/story/ins-and-outs-short-selling

- https://www.cnbc.com/2023/07/21/difference-between-the-sp-the-dow-and-the-nasdaq.html

- https://www.statista.com/statistics/270126/largest-stock-exchange-operators-by-market-capitalization-of-listed-companies/

- https://www.reuters.com/markets/quote/.DJI/

- https://www.bloomberg.com/quote/SPX:IND

FAQs

What is the best signal to use for trading?

Alternative data is one of the best signals to use for trading. AltIndex analyzes social sentiment to assess whether society views stocks positively or negatively.

Where do traders get signals?

Traders often get signals by performing technical or fundamental analysis. Alternative data is another research method, which explores information from non-traditional sources.

Where can I get the best stock trading signals?

The best stock trading signals for alternative data insights is AltIndex. If you’re more interested in buy-and-hold strategies, consider Zacks Ultimate or Alpha Picks.