The trickiest part of stock trading and investing is figuring out what stock to buy and when. While there are many ways that traders and investors can approach this problem—for example, fundamental analysis or technical analysis—even the best investors can benefit from help.

Stock tips offer insights into what stocks have the potential to make bullish moves that traders and investors can profit from. They’re trade ideas and predictions delivered by expert analysts and AI algorithms.

In this guide, we’ll take a closer look at the 8 best stock tips services for 2024 and explain how to use stock tips to make great profits in the market.

The 8 Best Stock Tips Services

Let’s dive straight into the 8 best stock tips services to use today for actionable market insights:

- AltIndex – Alternative stock data provider offering insights into social media sentiment, customer satisfaction, employee reviews, and more. Also offers AI-powered stock price predictions to help traders spot profitable stocks.

- WallStreetZen – Get daily stock picks based on top Wall Street Analysts, corporate insiders, and custom-built screens. Assigns scores and profit targets to every stock pick to make decisions easier.

- Seeking Alpha – In-depth stock research platform for fundamental investors. Uses quantitative modeling, Wall Street ratings, and financial analysts to curate a list of the top stocks to buy.

- Mindful Trader – Swing trading service based on a high-performance backtested technical strategy. Copy the trades with alerts to find success in the market in only minutes per day.

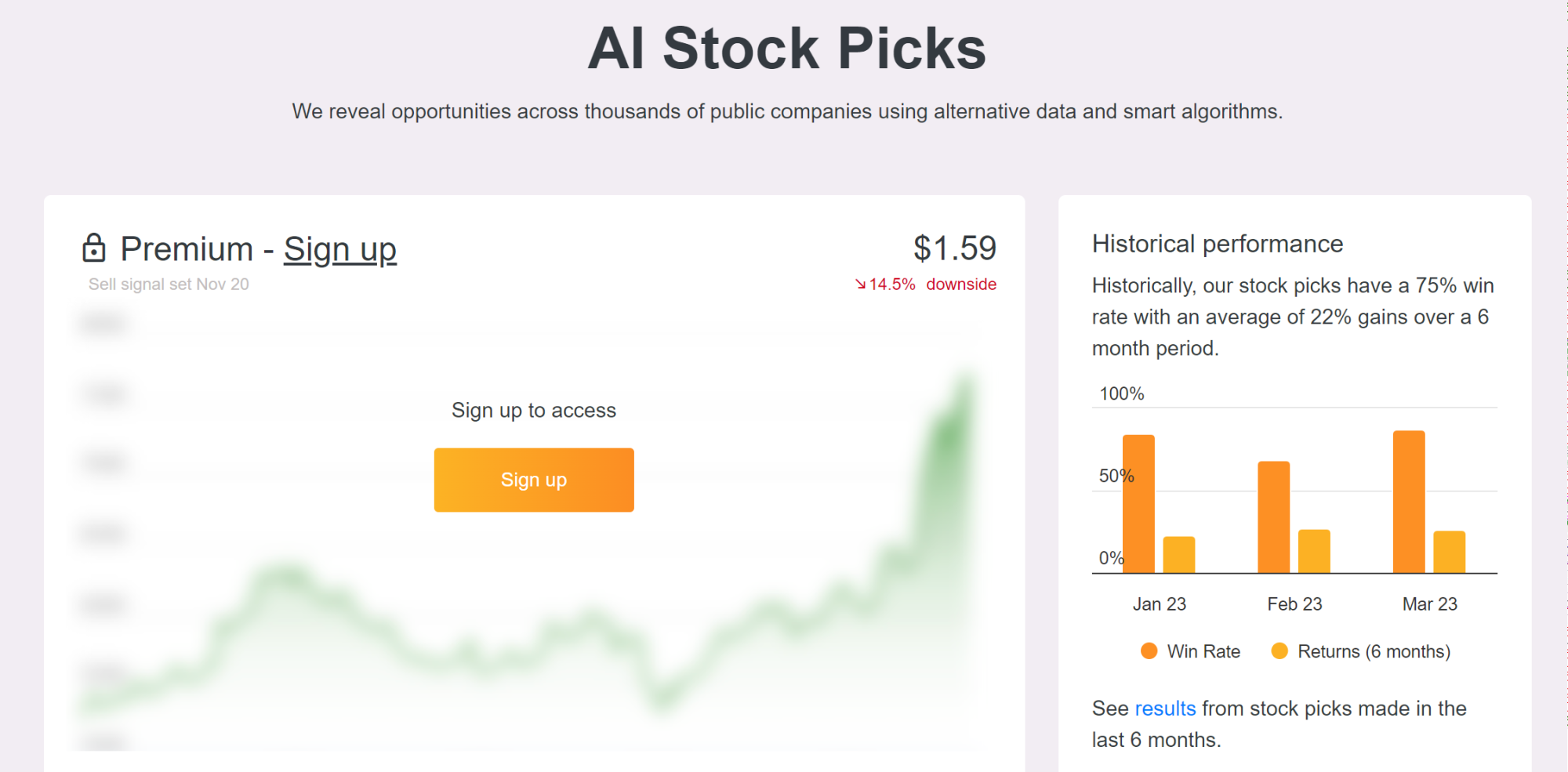

- Danelfin – AI-powered stock rating platform that scores stocks based on fundamental, technical, social sentiment, and risk factors. Offers actionable trade ideas with predicted win rates and profit targets based on backtesting.

- Gorilla Trades – Stock picking newsletter focused on short-term swing trades. Offers new trade ideas daily with price targets and stop losses. Delivers hundreds of profitable trades per year.

- Option Samurai – Options scanning platform with pre-built scans to help traders find actionable setups and strategies. Also offers stock scores and unusual options order flow scanner.

- Stansberry’s Investment Advisory – Investment newsletter offering one new long-term stock pick per month. Build a long-term portfolio of winning stocks in sectors that are poised to explode.

A Closer Look at the Best Stock Tips Services

We put together quick reviews of the best stock tips platforms to help traders and investors decide which service is best for their needs.

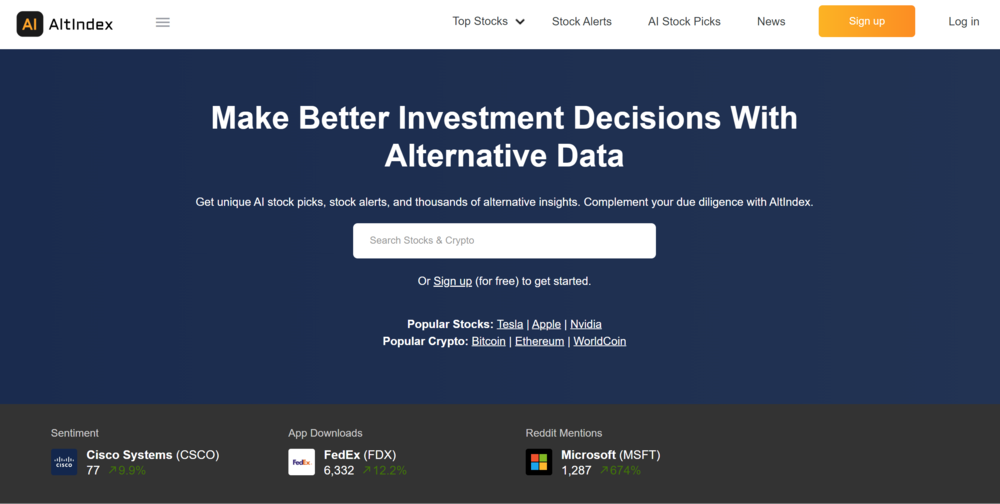

1. AltIndex – Alternative Data Provider with AI-powered Price Predictions and Top 10 Stocks List

AltIndex is an alternative data platform that goes beyond standard fundamental and technical analysis metrics. It gives investors insights into how a company is really doing in between earnings reports so that they can make informed decisions about whether to buy or sell a stock.

Some of the types of alternative data AltIndex offers include webpage traffic, social media mentions, app downloads, Google Ads spending, job advertisements, and patent filings. Investors can use all of this data to get a sense of whether a company is growing or shrinking, innovating or stagnating, or gaining or losing customers.

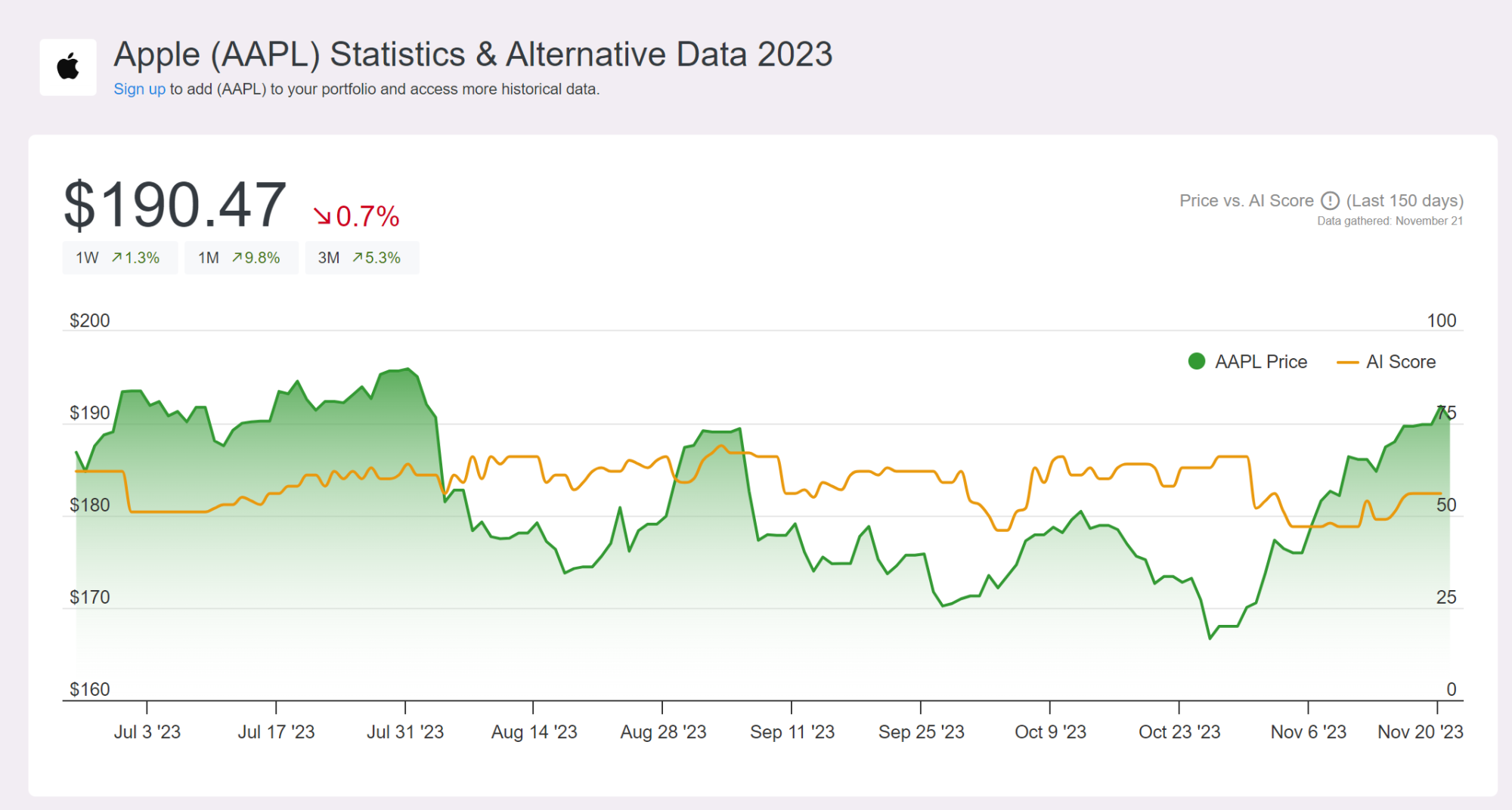

While investors can study AltIndex’s data on their own to gain insights, the platform also uses AI to make decision-making easier. AltIndex scores every stock on a scale from 0-100 based on how bullish or bearish it is over a 3-month time frame. The AI score is further broken down into factors like brand score, employment score, fundamental score, and user growth score.

AltIndex also uses its AI to make highly accurate 3-month price predictions. Swing traders and investors can see the price target for each stock and the AI’s confidence in the prediction.

AltIndex curates a list of the top 10 stock ideas each day based on these AI predictions, giving traders a starting point for ideas. It also offers detailed lists of the best stocks across a wide range of market sectors, which is ideal for investors who have a good feeling about a sector but need to know which company to bet on.

Investors can use AltIndex for free and get 20 stock reports and 1 AI stock pick per month. Paid plans start at only $29 per month for unlimited stock reports and 10 AI stock picks per month.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

| AI-powered price predictions | Yes | Yes | From $29/month |

Pros:

- Detailed alternative data for thousands of stocks

- Easy-to-interpret stock scores with factor breakdowns

- AI-powered price predictions with confidence ratings

- Curated lists of top trade ideas and stocks by sector

- Alerts based on trade ideas and alternative data trends

Cons:

- Limited news analysis and no news alerts

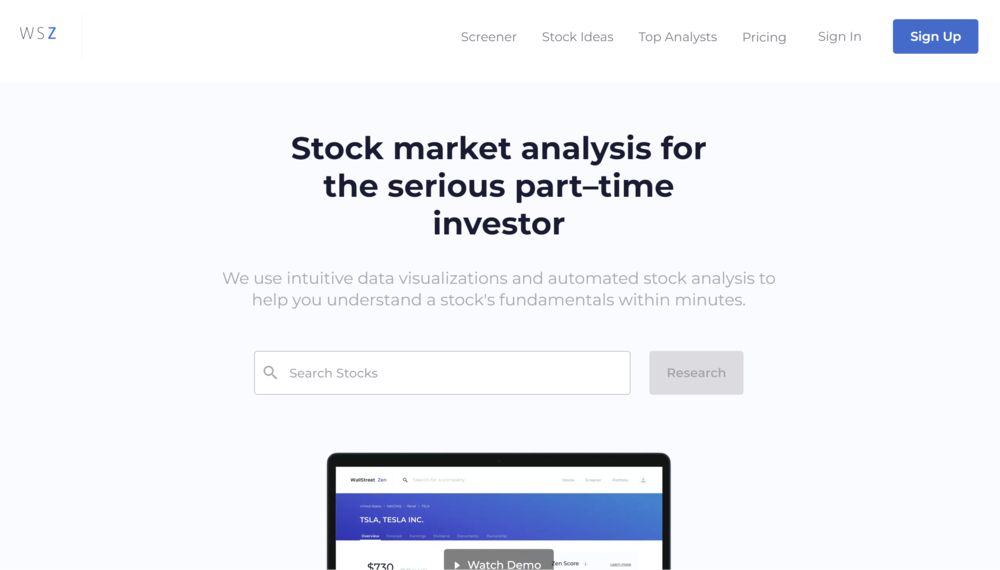

2. WallStreetZen – Daily Stock Picks Based on Wall Street Analysts, Corporate Insiders, and More

WallStreetZen is an automated stock research platform that provides investors and traders with actionable ideas and powerful visualizations.

This stock tips service is especially good for following the moves of top-performing Wall Street analysts. You can see what stock picks the top 25% of analysts have recommended, with extra weight given to stocks by multiple top analysts. Each recommendation is backed by an explanation and a profit target to help investors make decisions.

Investors who want to research individual stocks will also find plenty to like at WallStreetZen. The platform assigns scores from 0-100 to every stock, plus dives into factor scores for valuation, financials, forecast, dividends, and performance. Scores are compared against the industry average, letting investors know how a company stacks up against its peers.

WallStreetZen also conducts a series of due diligence checks on each stock. These include checking its price-to-earnings ratio to see if it’s fairly valued and checking whether a stock’s earnings have grown faster than the market average.

Investors get access to a detailed screener that they can use to find stocks that meet their criteria and that Wall Street analysts love.

WallStreetZen offers a limited amount of data for free, but access to Wall Street picks and the screener required a Premium subscription for $19.50 per month (paid annually).

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

| Pre-made ideas lists | Yes | Yes | $19.50/month |

Pros:

- View trade ideas from top 25% of Wall Street analysts

- All trade ideas include profit targets

- Stock scores broken down into 5 factor categories

- Customizable stock screener

Cons:

- Most stock ideas require a 12-month timeframe or longer

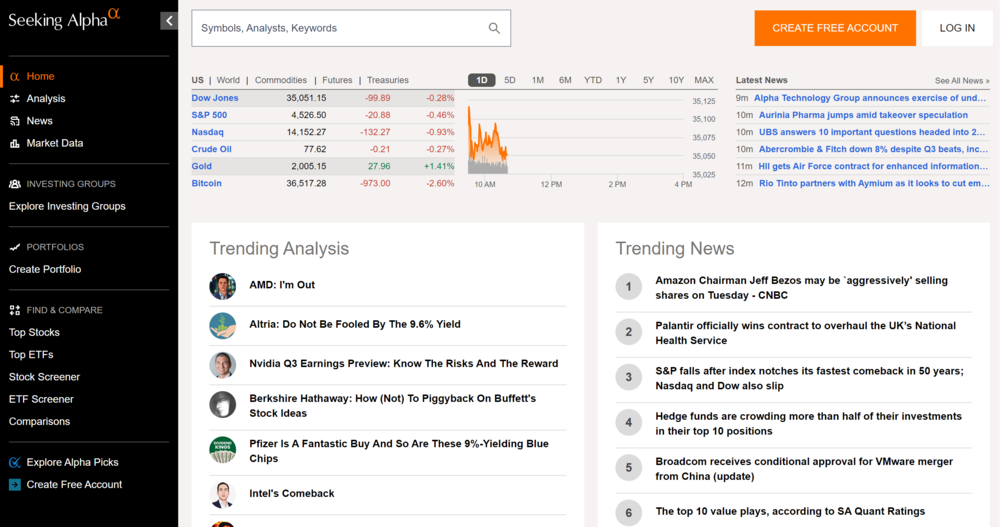

3. Seeking Alpha – Fundamental Stock Research Platform with Top Stocks List Based on Multiple Factors

Seeking Alpha is a well-known stock research platform that’s beloved by value and growth investors. The platform brings together in-depth fundamental research with opinion-driven analysis to help investors look at a stock from all sides.

One of the great things about Seeking Alpha is that it provides access to tons of valuation and performance metrics that most other research platforms don’t cover. While these can be overkill for beginner investors, they’re really powerful for investors who want to build their own valuation models.

Seeking Alpha is also unique in that it invites financial bloggers, analysts, hedge fund managers, and others to write opinion columns about every stock it covers. Each article is like its own stock tip, and there are typically dozens of articles for every stock. So, investors can get multiple perspectives on a company in order to make a trading decision.

For investors who want ready-made trade ideas, Seeking Alpha offers a top stocks list. This list usually has 50-100 stocks that Seeking Alpha rates as strong buys. The list is compiled using 3 factors: Wall Street analyst ratings, ratings from Seeking Alpha’s contributors, and stock ratings from Seeking Alpha’s own quantitative model. The result is a list of undervalued and high growth potential stocks that tend to outperform the market.

Seeking Alpha offers a limited free account that doesn’t include access to the top stocks list. Seeking Alpha Premium costs $239 per year.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

|---|---|---|---|

| Top stocks list | Yes | Yes | $239/year |

Pros:

- Extremely detailed valuation and fundamental analysis

- Opinion articles with multiple perspectives on each stock

- Multi-factor list of top-rated stocks

- Comprehensive stock screener

Cons:

- Opinion articles can be complex for beginner investors

4. Mindful Trader – Swing Trading Service That Requires Only Minutes Each Day to Copy Trades

Mindful Trader is a swing trading service that gives traders actionable trade ideas that they can simply copy. It’s a great service for traders who want to be active in the market, but don’t want to spend hours per day monitoring charts and looking for setups.

Mindful Trader’s picks are based on a 20-year backtested strategy that looks for highly specific momentum setups. There’s typically 3-4 new trades per week and positions are open for several days at a time. According to the platform’s backtest, the strategy has an annual return of 141%—although it’s important to remember this is not a guarantee of future performance.

Traders don’t need any prior experience to use Mindful Trader, so it’s a great platform for anyone in need of stock tips for beginners. It’s especially suitable for individuals who are looking to break into stock trading. The service also does a nice job of explaining the strategy that it uses, so traders can learn how to trade and build their own strategies from this service.

Mindful Trader costs $47 per month.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

|---|---|---|---|

| Trade alerts | No | No | $47/month |

Pros:

- Backtested swing trading strategy with 141% annualized average return

- 3-4 new stock trades per week

- Copy trades with only minutes of work each day

- No experience required

Cons:

- Only offers a single strategy to follow

- Doesn’t present any research on stocks

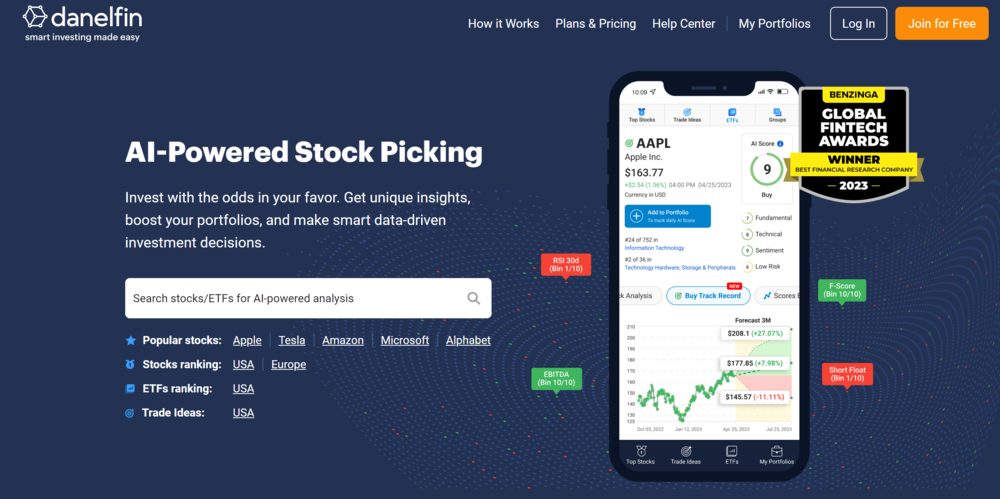

5. Danelfin – AI-powered Stock Rating Platform with Actionable Trade Ideas and Profit Targets

Danelfin uses AI to rate stocks based on fundamental and technical analysis, social sentiment analysis, and risk. Based on these factors, it calculates a 1-10 score for every stock and presents the best ideas to traders and investors.

Danelfin’s trade ideas lists are updated daily. Traders can find ideas for 1-month, 3-month, or 6-month timeframes and trade both long and short ideas. For each stock, the platform displays the expected profit target, the number of trade ideas on that stock that Danelfin has flagged before, and the win rate of those past trade ideas.

Danelfin is somewhat unique among stock tips services in that it covers international stocks along with US stocks. So, it’s especially helpful for traders who want to trade emerging or European markets.

The service offers a surprising amount for free, including access to the top 10 trade ideas each day. Access to all of Danelfin’s AI ratings and trade ideas starts at $17 per month.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

|---|---|---|---|

| Trade ideas list | Yes | Yes | $17/month |

Pros:

- AI-generated stock scores broken down into 4 factors

- Trade ideas for multiple time horizons

- Past win rate for trade ideas on each stock

- Covers international markets

Cons:

- Limited tools for conducting manual analysis

- No peer comparison for stocks

6. Gorilla Trades – Stock Picking Newsletter with Daily Short-term Trade Ideas

Gorilla Trades is a stock picking newsletter that delivers short-term swing trade alerts on a daily basis. This is one of the best stock tip services for active traders who want to rotate their capital frequently rather than hold onto several long-term investments.

Gorilla Trades trade ideas come complete with a price target and stop loss, enabling traders to easily automate trades and eliminate emotion from their decision-making. Trades come with annotated charts, enabling users to see the setup they’re trading. A system of confirmation based on trading volume prevents traders from chasing trades that may not be profitable.

The service focuses mainly on large-cap US stocks, although it also offers occasional penny stock tips. Gorilla Trades is transparent about its performance and traders can see all of the past picks to get an idea of how quickly the trade ideas move.

Gorilla Trades costs $499.95 per year.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

|---|---|---|---|

| Daily trade ideas | No | No | $499.95/year |

Pros:

- Daily swing trade ideas

- Ideas include price target, stop loss, and volume confirmation

- Annotated charts to explain trade ideas

- Requires very little time each day

Cons:

- No research on trades other than those being executed

7. Option Samurai – Options Scanning Platform with Pre-built Scans, Stock Scores, and More

Option Samurai is an options scanning platform that traders can use to find profitable options trades. The best part of this platform is the pre-built scans, which options traders can jump into immediately in order to find trade ideas.

There are dozens of pre-built scans, and Option Samurai makes it easy to find the right one based on strategy categories like bullish/bearish, option strategies, and risk. Of course, traders can also customize any of these scans to tailor Option Samurai to their strategy.

Option Samurai also offers stock ratings to help traders develop ideas. Ratings are automatically generated based on a combination of technical and fundamental parameters.

An unusual options order flow feed enables traders to monitor what hedge funds, institutional investors, and other whales are trading. This can be a way to get tipped off to upcoming market movements.

Option Samurai starts at $34 per month.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

|---|---|---|---|

| Pre-built options scans | Yes | No | $34/month |

Pros:

- Dozens of pre-built options trade scans

- Customizable scans for 24+ strategies

- Stock ratings

- Unusual options order flow feed

Cons:

- Doesn’t have a list of top options trade opportunities

8. Stansberry’s Investment Advisory – Investment Newsletter Offering One Long-term Stock Pick Per Month

Stanberry’s Investment Advisory is a long-running stock picking newsletter that delivers one new recommendation every month. The newsletter is designed for long-term investors who want to build a diversified portfolio of value and growth stocks.

Each new stock pick comes with a story about the industry and why it’s poised for success. Then the newsletter dives into a more detailed explanation of why one stock in particular is worth investors’ attention.

The Investment Advisory portfolio typically contains 20-30 stocks. New users may be able to buy some existing picks to start building a portfolio, but at one pick per month it can take a while to develop a rounded portfolio.

Following along with Stanberry’s Investment Advisory takes only a few minutes per month, so it’s a very minimal time commitment. The newsletter costs $199 per year.

| Stock Tips Format | Stock Scores? | Free Plan? | Pricing |

|---|---|---|---|

| Monthly stock recommendation | No | No | $199/year |

Pros:

- One new ready-to-buy stock pick per month

- Build a diversified long-term investment portfolio

- Very little time required to follow picks

Cons:

- Only presents research on the stock being recommended

What Are Stock Price Tips?

Stock tips include any information that traders and investors can use to make better decisions in the market. The goal of using a stock tips service is to find potentially profitable trades more quickly.

Stock price tips can come in several different forms including:

- Direct recommendations to buy a specific stock. This type of stock tip might include a price target and stop loss for a trade.

- Lists of top stocks. These lists serve as starting points for traders and investors to do their own research and plan out trades.

- Price predictions: Traders and investors can use price predictions to find stocks that are poised for significant gains, then plan their trades based on this information.

- Stock scores: Stock scores, whether delivered by a human analyst or an AI algorithm, can help traders and investors quickly find stocks that will potentially outperform the market.

Many of the best stock tips services offer research tools in addition to tips and picks. These research tools enable traders and investors to dig into recommended stocks to find out more about their potential. For example, investors can use valuation analysis to determine whether a recommended stock is undervalued and to determine a price target for their investment.

Notably, a lot of stock tips services now incorporate AI tools to help traders and investors make decisions. This is important since many of the top hedge fund managers use AI to pick stocks. So, everyday investors can use these services to get access to cutting-edge decision-making tools.

Can Stock Trading Tips Help Traders Profit?

The ultimate purpose of stock trading tips services is to help traders be more profitable than they would be on their own. The success of any service can generally be measured by whether it beats the market. Most traders underperform the market when trading on their own.

Stock tips help traders in 2 key ways. First, they reduce the time it takes to find profitable opportunities. This is important because traders only have so much time each day. If they can find more trade setups in less time, they have more chances to turn a profit and redeploy their capital.

Second, stock buying tips enhance the quality of trades that traders and investors pursue. Instead of trading a setup that has a 50% chance of success, traders can use stock tips to find setups that have a 70% chance of success.

The world’s top hedge funds rely on slight trading modifications that give them a market edge. So, using stock tips to get an edge can make a huge difference in an individual trader’s performance.

That said, there’s no guarantee that traders will make money when using a stock tips service. Traders still need to have a proven, resilient trading strategy. They also need to eliminate emotion from their strategy execution. According to one survey, 66% of traders have made emotional trading decisions that ended up costing them money.

How to Pick the Best Stock Tips Service

There are several important things that traders and investors need to consider when choosing a stock tips service. Here are the main things to think about.

Investing vs. Trading

Investing and trading have very different time frames and goals. Investors typically have time horizons of 12 months or more for stock investments and they want to build a diversified portfolio, not simply buy the highest-performing stocks with no regard for what may happen in a downturn.

Traders, on the other hand, have time horizons of hours to days, or in some cases weeks. They are focused on short-term profits and don’t need to consider diversification.

Some stock market tips are aimed at investors, while others are aimed at traders. When presented with a tip, think carefully about what that tip is based on. Is it short-term price action, or long-term fundamentals?

In addition, when choosing a stock tips service that offers actionable ideas, look closely at whether the predicted time frame for a stock to reach its price target is a few weeks or many months.

Tips Format

Traders and investors should also consider what form tips for investing in stocks are presented in. Some traders and investors may prefer a list of trade ideas that are ready to act on or stock trading signals that they can simply copy. Other traders and investors may prefer a list of top-rated stocks or ideas that they can filter through using the factors that matter most for their own strategy.

Investors in particular may like stock ratings, which can be used to compare peer stocks or decide between competing investment ideas. When presented with ratings, investors should look closely at what the ratings are based on and ensure that those factors are relevant to their portfolio strategy.

Additional Research Tools

Many platforms that provide tips for buying stocks also give traders and investors extra research tools that they can use to find and evaluate ideas.

For example, services like AltIndex that deliver price predictions also give investors in-depth alternative stock data to understand how companies are doing. Seeking Alpha provides a stock screener and detailed fundamental data for investors to use.

While these research tools aren’t required, they can play an important role in investors’ decision-making. They’re especially useful for services that provide stock buying tips on a wide range of stocks and leave it up to investors to decide which opportunities to pursue.

Performance Record

Services that deliver actionable trade or investment ideas usually track the performance of their recommendations. Traders and investors can review this performance to see if the service has consistently beaten the market.

Keep in mind that there’s more to performance than just the total return that a service has delivered. Investors should also look at the biggest losses a service has suffered to make sure they can stomach the risk involved.

Pricing

Investors need to consider pricing when choosing a stock tips service because it plays into their overall return. Ultimately, an investor should make more money with a stock tips service—after paying the service’s cost—than they would without the service.

In many cases, whether a service is worthwhile depends partly on how much capital a trader or investor has to deploy. If a trader only has $1,000, paying for a $400 tips service can really eat into their ability to trade. But if a trader has $10,000, then that $400 service represents a much smaller portion of their overall capital.

Conclusion

Stock tips services can help traders and investors find the best opportunities in the market. When used properly, they save time and boost profitability. They can make a big difference in traders’ edge and help investors find the best long-term investments to build a portfolio.

The best stock tips service to use right now is AltIndex. This platform uses AI to score thousands of stocks and predict their price in 3 months’ time. Traders and investors can quickly find the stocks with the greatest upside potential, plus confirm opportunities using AltIndex’s vast trove of alternative stock data. Get started with AltIndex for free to see the best stock tips today.

Visit AltIndexReferences

- https://www.bloomberg.com/news/articles/2023-07-17/ai-can-write-but-is-it-any-good-at-picking-stocks-quicktake

- https://www.cnbc.com/2020/09/18/stock-picking-has-a-terrible-track-record-and-its-getting-worse.html

- https://www.nytimes.com/2023/11/01/business/how-does-the-worlds-largest-hedge-fund-really-make-its-money.html

- https://www.prnewswire.com/news-releases/66-of-investors-regret-impulsive-or-emotional-investing-decisions-while-32-admit-trading-while-drunk-301351321.html

- https://www.fidelity.com/learning-center/trading-investing/trading/what-is-drawdown-video

FAQs

Where can I get the best stock tips?

AltIndex is the best platform to use for stock tips today. AltIndex uses AI to rate stocks on a scale from 0-100 and predict their 3-month price performance. Traders and investors can quickly find the best opportunities based on these predictions.

Are stock tips legal?

Stock trading tips from online recommendation services are completely legal. Stock tips are only illegal if they are insider tips, such as from someone who works at a company, that aren’t available to the public.

Are stock trading tips worth it?

Stock trading tips can help traders and investors make greater profits in the stock market. Tips can help traders find opportunities that have a greater likelihood of success. They can also reduce the amount of time that traders spend looking for setups, enabling them to make more trades each day.