It seems that we are not out of the woods just yet. With the Fed raising interest rates by 25 basis points and a hint of a pause, it seemed that investors could rest easy for a bit. Still, fear is suddenly back in the air as investors are reminded of the impact of high-interest rates in our current environment.

Yesterday banking shares were sold off again just following the seizure and sale of First Republic Bank to JP Morgan. Shares of the smaller regional lender PacWest Bankcorp just plunged 50.62% yesterday as PacWest Bank confirmed reports about considering “strategic options, ” including the company’s possible sale.

Are We Going To Expect Another Bank Collapse?

According to Pacwest’s statement, it planned to sell some assets to free up cash on its balance sheet. Still, investors fear PacWest’s fate could be another victim of the market’s ongoing state: high-interest rates, slow growth, and high inflation.

This may be due to regional banks that have run into trouble, seen heavy outflows of deposits, and need to raise capital. Many have large amounts of low-interest bonds and commercial real estate assets on their books and would record losses if they sold them on the open market, affecting the confidence in the banking industry.

In addition, another bank that also experienced extreme volatility was Western Alliance, which was down 38.45% when its trading was halted. Even though the Phoenix-based bank mentioned in their statement that even if they have plans of readjusting their balance sheet, they haven’t experienced any unusual withdrawals.

The bigger worry now is that bank failures can lead to doubts about healthy banks, creating a financial contagion that could impact the wider economy. As investors, it’s always important to be aware of the risks in the marketplace and the opportunities that arise.

Defensive Sectors That Shelter Portfolios From Downside Risk During Crisis

A quick look at history (the subprime mortgage crisis, global financial crisis, European debt crisis, etc. ) tells us that in uncertain times, investors would go on a more defensive approach in their investments. And this defensiveness can be an opportunity for any investor to follow the money and protect their portfolio.

Consumer Staples

These companies produce essential goods such as food, beverages, and household products that people continue to purchase even during economic downturns. When people go “back-to-basics,” this is generally the sector that comes to mind. Companies like Walgreens Boots Alliance belong in this sector.

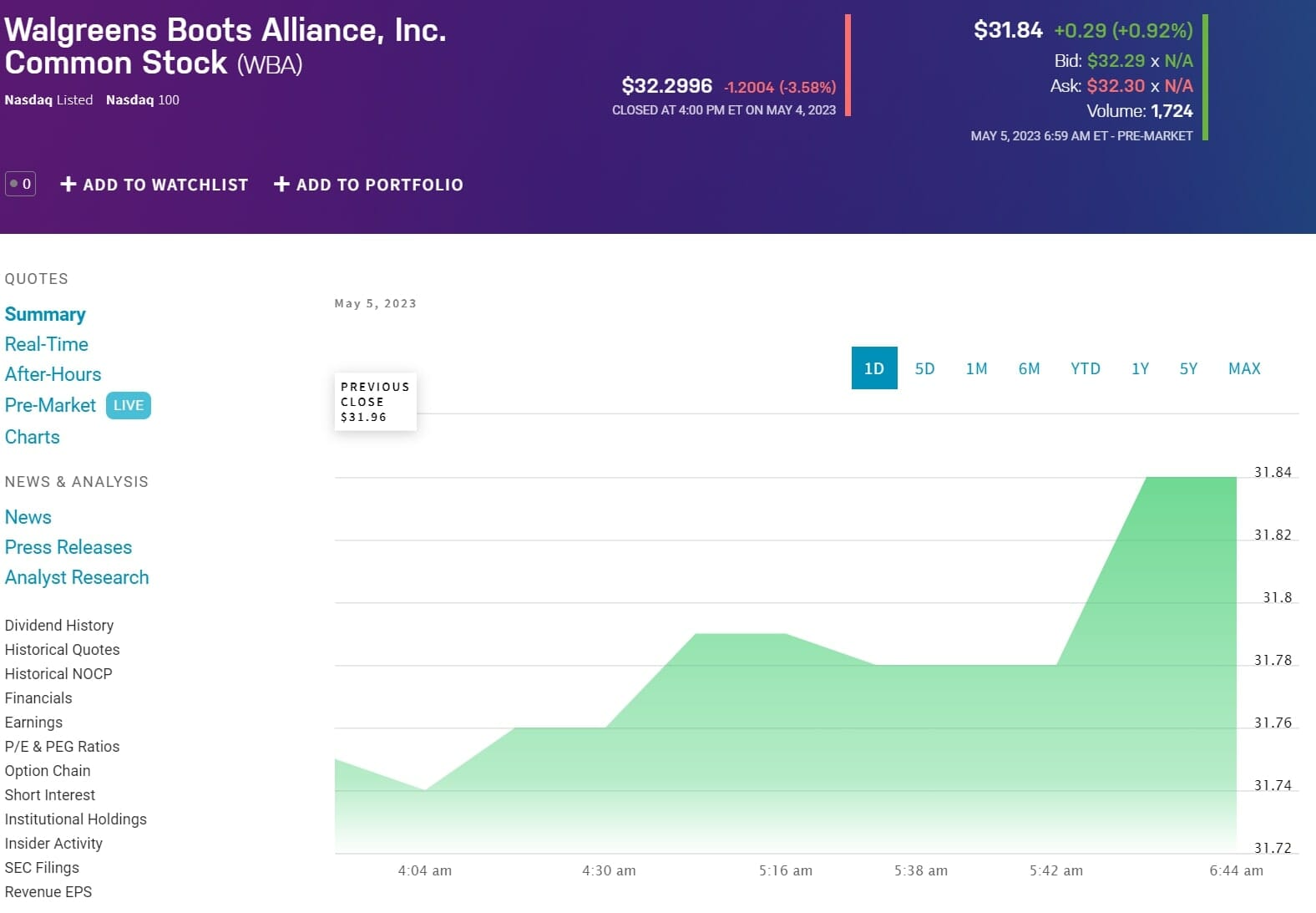

Walgreens Boots Alliance Inc. (WBA)

Walgreens Boots Alliance Inc (NASDAQ:WBA) is a consumer staples company that operates in healthcare, pharmacy, and retail. The company has a portfolio of consumer brands, including Walgreens and Boots.

Today, WBA offers products in three main segments: U.S. Retail Pharmacy, International, and U.S. Healthcare. The U.S. Retail Pharmacy segment operates retail drug stores and offers health and wellness services.

Its international segment operates pharmacy-led health and beauty retail businesses outside the United States. The U.S. Healthcare segment is a consumer-centric healthcare business that uses technology to engage consumers across their care journey.

Utilities

Companies that provide essential services such as electricity, gas, and water tend to be less volatile than other sectors and are seen by many as a relatively safe investment during economic uncertainty. This is where companies like Black Hills Corp. come into play as another defensive stance on the looming crisis.

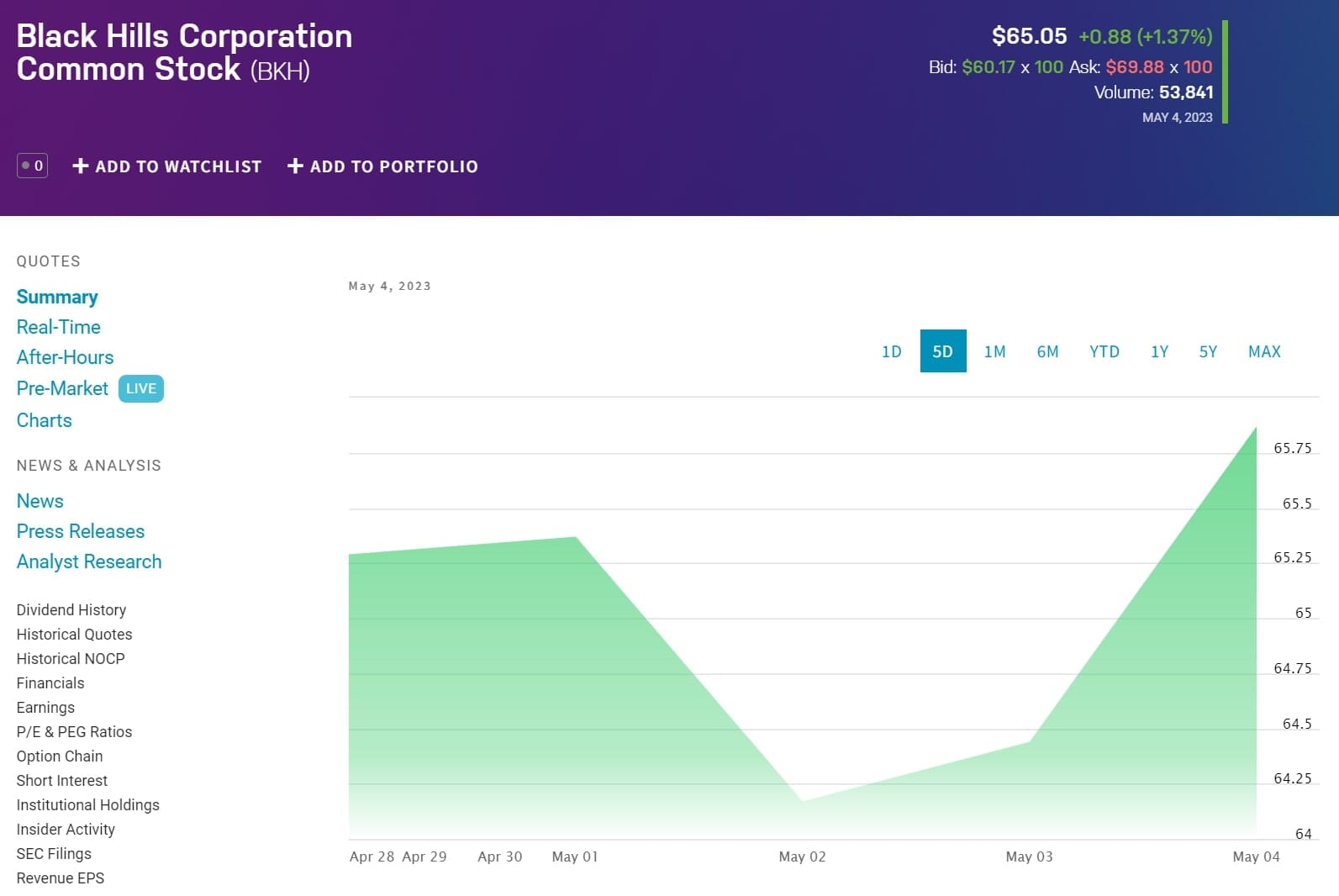

Black Hills Corp (BKH)

Black Hills Corp (NYSE:BKH) is a publicly traded electric and gas utility company headquartered in Rapid City, South Dakota. J. B. French started the firm in 1941. Today, the company operates in eight states: Arkansas, Colorado, Iowa, Montana, Nebraska, South Dakota, Wyoming, and Texas.

It serves a population of approximately 1.3 million people. The four business segments of this company are electric utilities, gas utilities (which provide heating and cooling), power generation, and mining.

The company’s 1.3 million customers divide into 1,083,000 natural gas and 216,000 electric users across different states.

Consumer Discretionary

While consumer discretionary companies can be affected by economic downturns, they tend to be more resilient than other sectors because people still purchase non-essential goods and services, to a lesser extent. That helps them weather crises.

Companies like McDonald’s offer stability and a proven history of being one of the known brands to outlive multiple economic crises.

McDonald’s Corp (MCD)

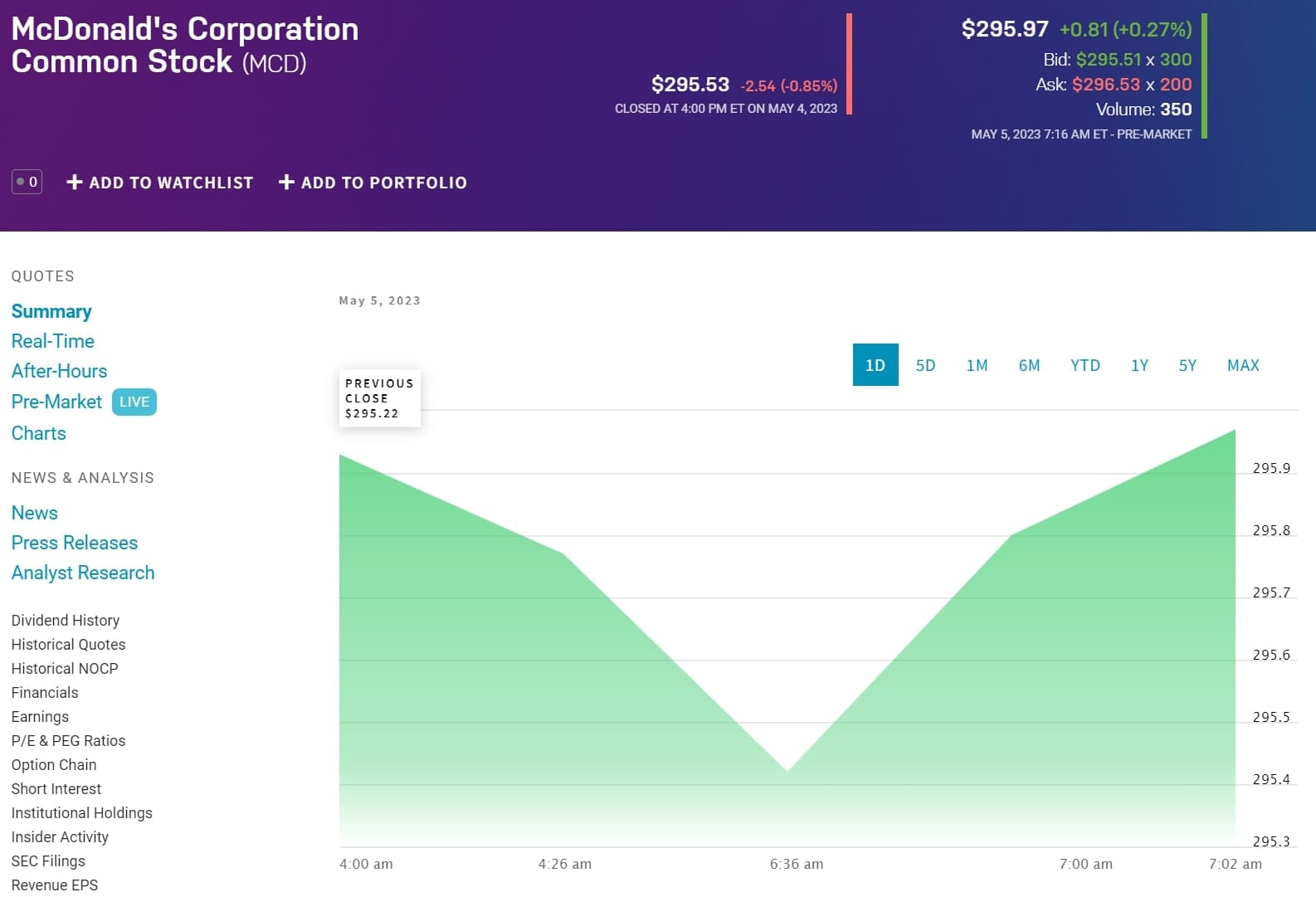

McDonald’s Corp (NYSE:MCD) is a multinational fast-food retailer serving over 63 million people daily. The company was founded in 1940 by Richard and Maurice McDonald. The company is headquartered in Chicago, Illinois, U.S. MCD employs about 150,000 employees.

The company operates in more than 100 countries and today sells various types of fast foods, including Big Mac, McDouble, Cheeseburger, Happy Meal, World Famous Fries, and Egg McMuffin.

McDonald’s operates a variety of eateries, including Drive-Thru, McDrive, McCafé, McExpress, and McDonald’s Next, all of which provide counter service, as well as drive-through and walk-through service with seats inside and occasionally outside.

MCD’s latest annual dividend yield is 2.06%, with a 5-year dividend growth rate of 47.78%. Moreover, it has continuously increased its dividends for 46 straight years and is a part of the elite Dividend Aristocrats.